ARM Holdings's Options Frenzy: What You Need to Know

ARM Holdings's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bullish move on ARM Holdings. Our analysis of options history for ARM Holdings (NASDAQ:ARM) revealed 96 unusual trades.

金融巨头在ARM控股股票上做出了明显的看好的举动。我们对ARM控股(纳斯达克:ARM)期权历史进行的分析发现,存在96次不寻常的交易。

Delving into the details, we found 57% of traders were bullish, while 32% showed bearish tendencies. Out of all the trades we spotted, 31 were puts, with a value of $2,264,926, and 65 were calls, valued at $10,748,961.

深入剖析后,我们发现57%的交易者看好该股,32%呈现出看淡趋势。在我们发现的所有交易中,卖出看跌期权31个,总价值为$2,264,926,买入看涨期权65个,总价值为$10,748,961。

Expected Price Movements

预期价格波动

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $80.0 to $260.0 for ARM Holdings over the last 3 months.

考虑到这些合约的成交量和未平仓合约量,似乎鲸鱼们在过去的3个月中一直将ARm控股的价格区间定位在$80.0至$260.0之间。

Volume & Open Interest Trends

成交量和未平仓量趋势

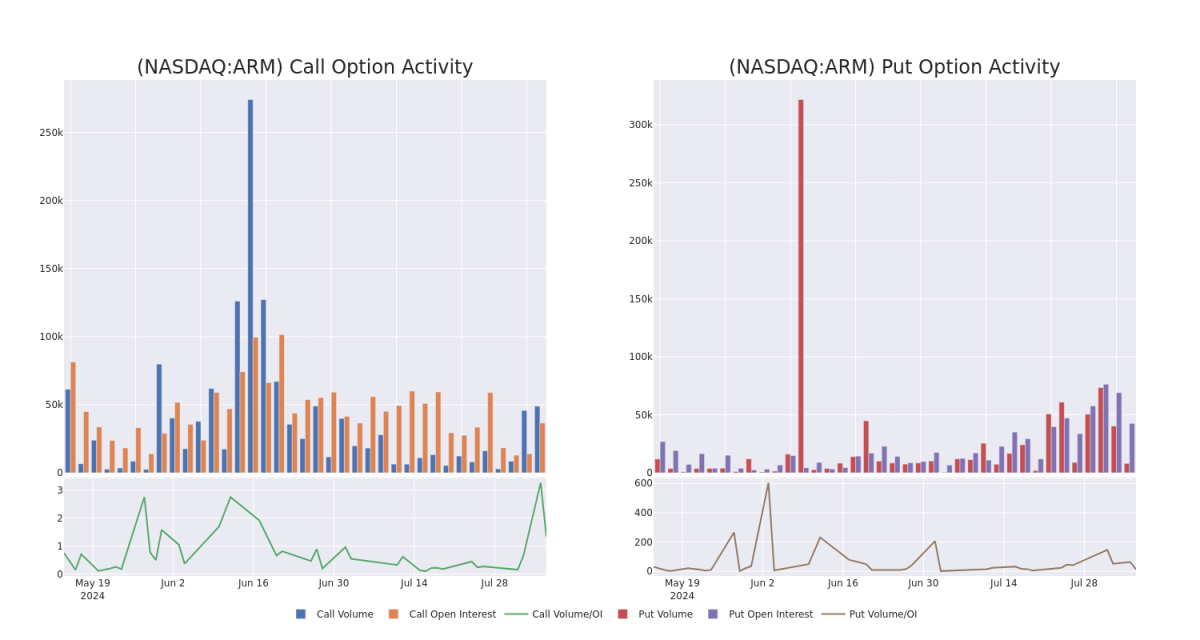

In today's trading context, the average open interest for options of ARM Holdings stands at 1615.02, with a total volume reaching 57,064.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in ARM Holdings, situated within the strike price corridor from $80.0 to $260.0, throughout the last 30 days.

在今天的交易背景下,ARm控股期权的平均未平仓合约为1615.02,总成交量达到了57,064.00。下图描述了在过去30天中,位于$80.0至$260.0的高价值交易的看涨和看跌期权成交量和未平仓合约的进展情况。

ARM Holdings Call and Put Volume: 30-Day Overview

ARM Holdings看涨期权和看跌期权成交量:30天概述

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ARM | CALL | SWEEP | BEARISH | 12/18/26 | $50.85 | $50.5 | $50.8 | $115.00 | $878.8K | 1.6K | 1.8K |

| ARM | CALL | SWEEP | BEARISH | 12/18/26 | $50.85 | $50.8 | $50.8 | $115.00 | $665.4K | 1.6K | 1.9K |

| ARM | CALL | SWEEP | BULLISH | 01/17/25 | $20.0 | $19.75 | $20.0 | $120.00 | $499.0K | 1.5K | 2.5K |

| ARM | CALL | SWEEP | NEUTRAL | 12/18/26 | $50.8 | $49.0 | $50.8 | $115.00 | $182.8K | 1.6K | 1.8K |

| ARM | CALL | TRADE | NEUTRAL | 01/17/25 | $20.0 | $19.8 | $19.9 | $120.00 | $99.4K | 1.5K | 2.6K |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ARM | 看涨 | SWEEP | 看淡 | 12/18/26 | $50.85 | $50.5 | $50.8 | $115.00 | $878.8K | 1.6K | 1.8K |

| ARM | 看涨 | SWEEP | 看淡 | 12/18/26 | $50.85 | $50.8 | $50.8 | $115.00 | $665.4K | 1.6K | 1.9K |

| ARM | 看涨 | SWEEP | 看好 | 01/17/25 | $20.0 | $19.75 | $20.0 | $120.00 | $499.0K | 1.5K | 2.5千 |

| ARM | 看涨 | SWEEP | 中立 | 12/18/26 | $50.8 | $49.0 | $50.8 | $115.00 | $182.8K | 1.6K | 1.8K |

| ARM | 看涨 | 交易 | 中立 | 01/17/25 | $20.0 | 19.8美元 | $19.9 | $120.00 | $99.4K | 1.5K | 2.6K |

About ARM Holdings

关于ARM控股

Arm Holdings is the IP owner and developer of the ARM architecture (ARM stands for Acorn RISC Machine), which is used in 99% of the world's smartphone CPU cores, and it also has high market share in other battery-powered devices like wearables, tablets, or sensors. Arm licenses its architecture for a fee, offering different types of licenses depending on the flexibility the customer needs. Customers like Apple or Qualcomm buy architectural licenses, which allows them to modify the architecture and add or delete instructions to tailor the chips to their specific needs. Other clients directly buy off-the-shelf designs from Arm. Off-the-shelf and architectural customers pay a royalty fee per chip shipped.

Arm Holdings是ARM体系结构(IP)的所有者和开发者,该体系结构在全球99%的智能手机CPU核心中使用,在其他电池供电设备(如可穿戴设备、平板电脑或传感器)中也占有很高的市场份额。Arm根据用户的需求提供不同类型的许可证,客户如苹果或高通购买体系结构许可证,这使他们可以修改体系结构并添加/删除指令以使芯片更符合其特定需求。其他客户直接从Arm购买现成的设计。现成的和架构客户每出货一颗芯片,就会支付一定的版税。

In light of the recent options history for ARM Holdings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考虑到ARm Holdings的最近期权历史,现在应该关注该公司本身。我们旨在探讨其当前表现。

Where Is ARM Holdings Standing Right Now?

ARM控股现在处于什么地位?

- With a volume of 8,637,481, the price of ARM is up 3.62% at $114.45.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 101 days.

- 随着成交量为8,637,481,ARm的股价上涨了3.62%,至$114.45。

- RSI指标表明该基础股票可能被超卖。

- 下一个盈利预计将在101天内发布。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。