Brent Oil Price Analysis: Anticipating A Correction

Brent Oil Price Analysis: Anticipating A Correction

By RoboForex Analytical Department

由RoboForex分析部门提供

Brent crude oil's price increased to 76.88 USD per barrel on Wednesday, continuing to rise for the second consecutive session. This rebound helps mitigate previous losses, which were part of a broader market risk aversion phase.

布伦特原油价格于周三上涨至每桶76.88美元,在连续第二个交易日上涨。这种反弹有助于缓解以前的损失,这是整个市场风险厌恶阶段的一部分。

Current Market Dynamics

当前市场动态

Investor concerns about energy supply disruptions are heightening due to political developments in Hamas and ongoing unrest affecting Libya's Sharara oil field. These factors contribute to apprehensions about potential threats to oil supply from the Middle East.

由于哈马斯政治动态和利比亚Sharara油田的持续动荡,投资者对能源供应中断的担忧日益加剧。这些因素增加了对来自中东石油供应潜在威胁的担忧。

Additionally, the latest data from the American Petroleum Institute (API) indicated a modest rise in US oil inventories, less than market forecasts, which had anticipated a more considerable increase. This was the first inventory build in five weeks, adding a layer of complexity to market dynamics.

此外,美国石油协会(API)最新数据显示美国石油库存略微上升,低于市场预期,市场预计会有更大幅度的上涨。这是五个星期以来第一次库存增加,为市场动态增加了一层复杂性。

Technical Analysis Of Brent

布伦特的技术面分析

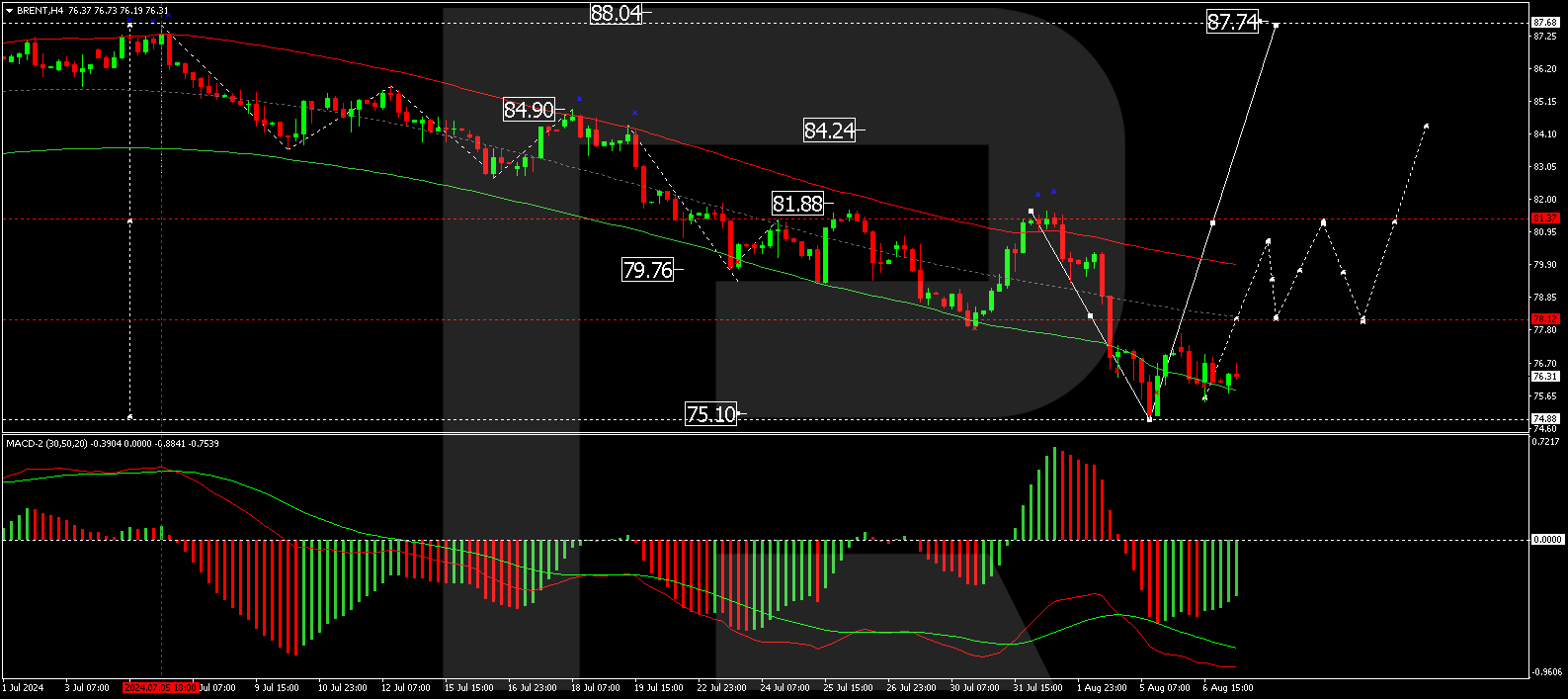

The H4 chart suggests that Brent is progressing towards the 78.12 USD level. After reaching this target, a pullback to 76.33 USD could occur, potentially setting the stage for another upward movement towards 79.85 USD and extending to 81.37 USD. The MACD indicator supports this bullish scenario, with the signal line positioned for upward momentum from current lows.

H4图表显示布伦特正朝着78.12美元的目标前进。达到这个目标后,可能会回撤到76.33美元,可能会为另一次上涨奠定基础,达到79.85美元并延伸到81.37美元。 MACD指标支持这种看涨的情况,信号线定位在目前低点的上涨动量处。

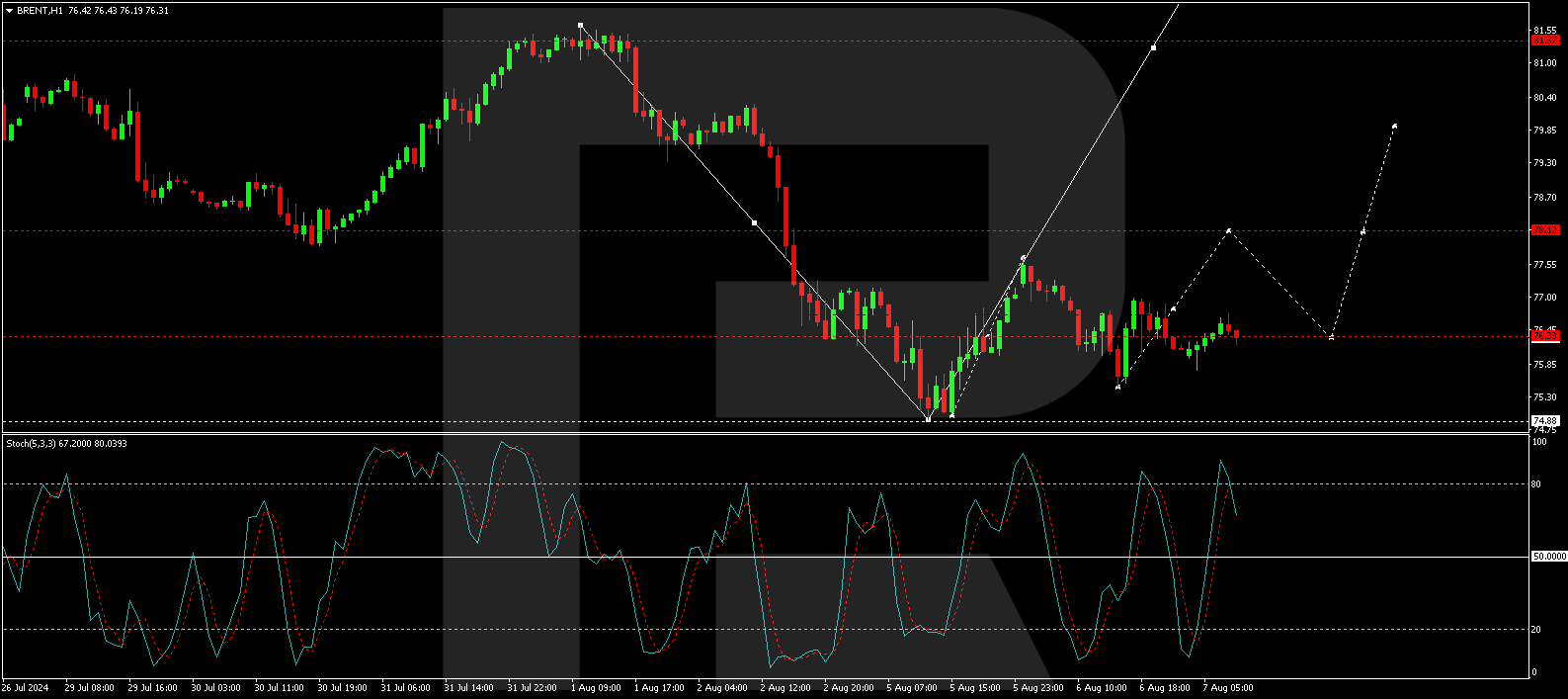

On the H1 chart, Brent has established a consolidation range of around 76.33 USD. An upward breakout towards 78.12 USD is anticipated. Once this target is achieved, a retracement to 76.33 USD might follow. The Stochastic oscillator is poised near the 80 level, suggesting an impending downturn, which aligns with the expected corrective phase following the initial rise.

在H1图表上,布伦特已经建立了一个76.33美元左右的区间。预计向上突破78.12美元。一旦达到这个目标,可能会回调至76.33美元。随着初始上涨后预期的纠正阶段,随着随机震荡器接近80水平,预示着即将出现下行趋势。

Market Outlook

市场前景

Investors should monitor further geopolitical developments and additional inventory reports, which could significantly influence oil price movements. The upcoming Federal Reserve communications and economic indicators will also be crucial in shaping market sentiment, especially concerning the potential for economic slowdowns, which could impact oil demand.

投资者应当密切监视地缘政治的发展和额外的库存报告,这些报告可能会显著影响油价的走势。即将到来的美联储通讯和经济指标也将是塑造市场情绪的关键,尤其是关于经济放缓的潜在影响,这可能会影响石油需求。

Disclaimer

免责声明

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

本分析仅代表作者个人观点,不得视为交易建议。RoboForex不承担基于本文所含交易建议和评论所产生的任何交易结果的责任。

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

本文来自非报酬的外部投稿人。它不代表Benzinga的报道,并且没有因为内容或准确性而被编辑。

Additionally, the latest data from the American Petroleum Institute (API) indicated a modest rise in US oil inventories, less than market forecasts, which had anticipated a more considerable increase. This was the first inventory build in five weeks, adding a layer of complexity to market dynamics.

Additionally, the latest data from the American Petroleum Institute (API) indicated a modest rise in US oil inventories, less than market forecasts, which had anticipated a more considerable increase. This was the first inventory build in five weeks, adding a layer of complexity to market dynamics.