Check Out What Whales Are Doing With PYPL

Check Out What Whales Are Doing With PYPL

Whales with a lot of money to spend have taken a noticeably bearish stance on PayPal Holdings.

富裕的鲸鱼开始看淡paypal控股。

Looking at options history for PayPal Holdings (NASDAQ:PYPL) we detected 24 trades.

查看paypal控股(纳斯达克:PYPL)期权历史,我们发现了24笔交易。

If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 58% with bearish.

如果考虑每个交易的具体情况,可以准确地说,37%的投资者带着看好的期望打开了交易,而58%则是持看淡的态度。

From the overall spotted trades, 5 are puts, for a total amount of $234,676 and 19, calls, for a total amount of $6,182,906.

从整体交易中,总共有5个看跌期权,共计$234,676,19个看涨期权,共计$6,182,906。

What's The Price Target?

目标价是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $60.0 to $100.0 for PayPal Holdings over the recent three months.

基于交易活动,看起来主要的投资者正在针对paypal控股在最近三个月内的价格区间从60.0美元到100.0美元。

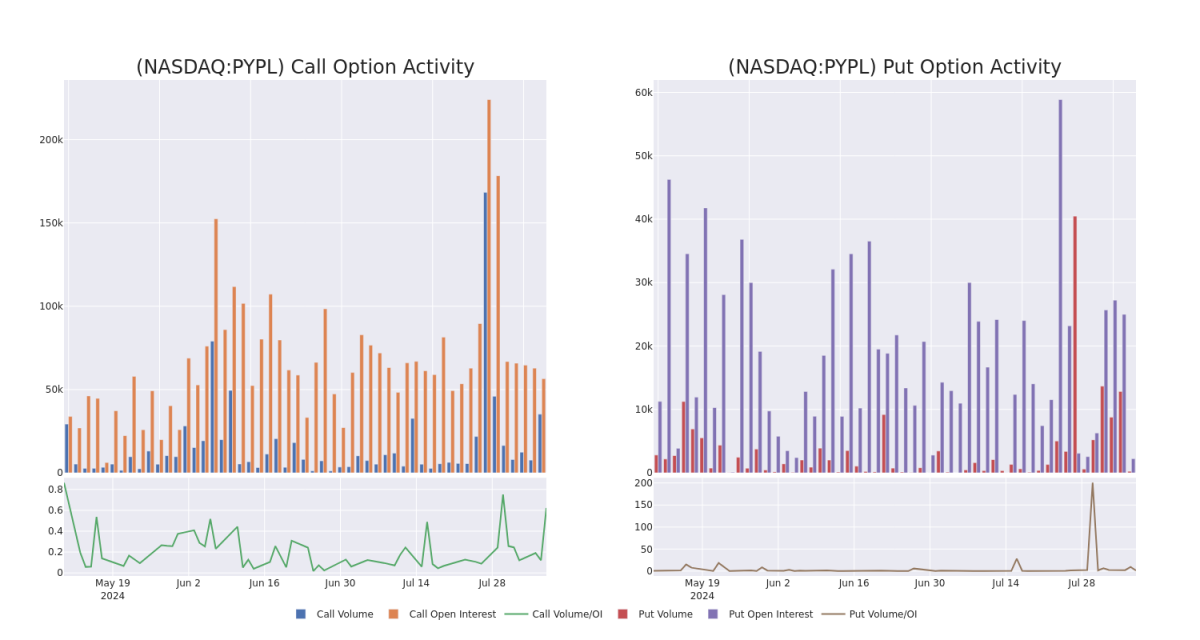

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in PayPal Holdings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to PayPal Holdings's substantial trades, within a strike price spectrum from $60.0 to $100.0 over the preceding 30 days.

评估成交量和未平仓合约是期权交易的战略步骤。这些指标揭示了定价指数处paypal控股期权的流动性和投资者兴趣。下面的数据显示了在60.0美元到100.0美元之间的看涨期权和看跌期权的成交量和未平仓合约的波动,与paypal控股的巨额交易相对应,过去30天内。

PayPal Holdings 30-Day Option Volume & Interest Snapshot

PayPal Holdings 30天期权成交量及持仓快照

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | CALL | TRADE | BULLISH | 12/18/26 | $17.75 | $17.05 | $18.0 | $65.00 | $5.2M | 868 | 2.9K |

| PYPL | CALL | TRADE | BULLISH | 01/17/25 | $3.65 | $3.55 | $3.65 | $72.50 | $91.2K | 7.1K | 500 |

| PYPL | CALL | TRADE | BULLISH | 01/17/25 | $3.65 | $3.55 | $3.65 | $72.50 | $91.2K | 7.1K | 250 |

| PYPL | CALL | SWEEP | BEARISH | 12/18/26 | $17.6 | $17.5 | $17.55 | $65.00 | $84.2K | 868 | 3.3K |

| PYPL | PUT | SWEEP | BEARISH | 12/18/26 | $11.25 | $9.65 | $10.95 | $62.50 | $79.2K | 627 | 92 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | 看涨 | 交易 | 看好 | 12/18/26 | $17.75 | $17.05 | $18.0 | $65.00 | $5.2M | 868 | 2.9K |

| PYPL | 看涨 | 交易 | 看好 | 01/17/25 | $3.65 | $3.55 | $3.65 | $72.50 | $91.2K | 7.1K | 500 |

| PYPL | 看涨 | 交易 | 看好 | 01/17/25 | $3.65 | $3.55 | $3.65 | $72.50 | $91.2K | 7.1K | 250 |

| PYPL | 看涨 | SWEEP | 看淡 | 12/18/26 | $17.6 | $17.5 | $17.55 | $65.00 | $84.2K | 868 | 3.3K |

| PYPL | 看跌 | SWEEP | 看淡 | 12/18/26 | $11.25 | $9.65 | $10.95 | $62.50 | $79.2千美元 | 627 | 92 |

About PayPal Holdings

关于paypal控股

PayPal was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform.

paypal控股于2015年从ebay分拆出来,为商家和消费者提供电子支付解决方案,重点放在在线交易方面。该公司在2023年末拥有4.26亿活跃账户。该公司还拥有Venmo,这是一个人对人的支付平台。

Following our analysis of the options activities associated with PayPal Holdings, we pivot to a closer look at the company's own performance.

在分析paypal控股的期权活动后,我们转向更近距离地审视该公司的表现。

Current Position of PayPal Holdings

paypal控股目前的位置

- With a volume of 3,211,323, the price of PYPL is up 2.87% at $64.55.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 84 days.

- 随着3211323的成交量,PYPL的价格上涨了2.87%,达到64.55美元。

- RSI指标暗示该股票可能要超买了。

- 下一轮收益预计在84天后发布。

What The Experts Say On PayPal Holdings

专家对paypal控股的看法

5 market experts have recently issued ratings for this stock, with a consensus target price of $81.2.

5位市场专家最近对该股票发行了评级,共识目标价为81.2美元。

- An analyst from Macquarie has decided to maintain their Outperform rating on PayPal Holdings, which currently sits at a price target of $90.

- Consistent in their evaluation, an analyst from Keefe, Bruyette & Woods keeps a Outperform rating on PayPal Holdings with a target price of $78.

- An analyst from Wells Fargo persists with their Equal-Weight rating on PayPal Holdings, maintaining a target price of $70.

- Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on PayPal Holdings with a target price of $85.

- Maintaining their stance, an analyst from Susquehanna continues to hold a Positive rating for PayPal Holdings, targeting a price of $83.

- 摩根士丹利的一位分析师决定维持对PayPal控股的超越市场预期(Outperform)的评级,目前该股的目标价为90.0美元。

- 一位来自Keefe, Bruyette & Woods的分析师一直持续看好paypal控股,其目标价为78.0美元。

- 一位来自富国银行的分析师坚持维持他们对paypal控股的中性评级(Equal-Weight),目标价维持在70.0美元。

- 巴克莱银行的一位分析师在其评级中继续看好paypal控股,目标价为85.0美元。

- Susquehanna的分析师保持对paypal控股的积极评价,目标价格为83.0美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest PayPal Holdings options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在回报。精明的交易者通过不断地自我教育、调整策略、监控多个因子以及密切关注市场动向来管理这些风险。通过Benzinga Pro的实时提醒了解最新的paypal控股期权交易动态。