ASML Holding's Options Frenzy: What You Need to Know

ASML Holding's Options Frenzy: What You Need to Know

Investors with a lot of money to spend have taken a bearish stance on ASML Holding (NASDAQ:ASML).

有大量投资资金的投资者对ASML Holding(纳斯达克:ASML)持看淡态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ASML, it often means somebody knows something is about to happen.

无论这些投资者是机构还是富人,我们都不知道。但是当ASML出现这种大事情时,通常意味着有人知道即将发生的事情。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 60 uncommon options trades for ASML Holding.

今日,Benzinga的期权扫描器发现阿斯麦有60 笔不寻常的期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 36% bullish and 43%, bearish.

这些大额买卖的整体情绪分为36%的看涨和43%的看跌。

Out of all of the special options we uncovered, 26 are puts, for a total amount of $1,697,046, and 34 are calls, for a total amount of $2,510,777.

在我们发现的所有特殊期权中,有26个看跌期权,总金额为1,697,046美元,34个看涨期权,总金额为2,510,777美元。

What's The Price Target?

目标价是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $620.0 to $1120.0 for ASML Holding over the recent three months.

基于交易活动,看来这些重要投资者在最近三个月内瞄准阿斯麦的价格区间从620.0美元到1120.0美元。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

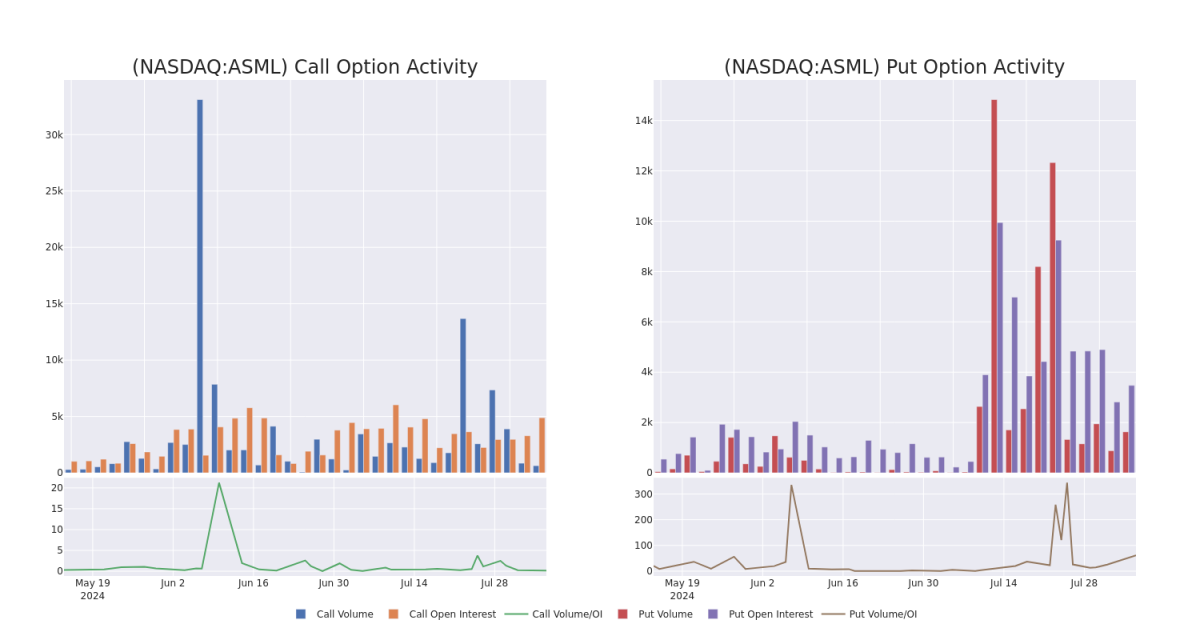

In today's trading context, the average open interest for options of ASML Holding stands at 115.35, with a total volume reaching 1,914.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in ASML Holding, situated within the strike price corridor from $620.0 to $1120.0, throughout the last 30 days.

在当今的交易环境中,阿斯麦的期权平均持仓量为115.35,总成交量为1,914.00。下面的图表描述了阿斯麦高价值交易的看涨和看跌期权成交量和持仓量的进展情况,这些期权交易位于620.0美元到1120.0美元的行权价格走廊中,在过去的30天内。

ASML Holding Call and Put Volume: 30-Day Overview

阿斯麦看涨和看跌期权成交量:30天总览。

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ASML | CALL | TRADE | BULLISH | 01/17/25 | $279.1 | $275.6 | $279.1 | $620.00 | $418.6K | 68 | 15 |

| ASML | PUT | TRADE | BULLISH | 02/21/25 | $61.2 | $59.1 | $59.5 | $800.00 | $297.5K | 48 | 51 |

| ASML | CALL | TRADE | BULLISH | 12/20/24 | $197.1 | $193.9 | $197.1 | $710.00 | $295.6K | 0 | 15 |

| ASML | CALL | SWEEP | NEUTRAL | 09/06/24 | $75.2 | $72.9 | $72.9 | $825.00 | $255.1K | 1 | 35 |

| ASML | CALL | TRADE | BEARISH | 08/30/24 | $60.6 | $55.0 | $56.8 | $840.00 | $136.3K | 5 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 阿斯麦 | 看涨 | 交易 | 看好 | 01/17/25 | $279.1 | $275.6 | $279.1 | 示例7 | $418.6K | 68 | 15 |

| 阿斯麦 | 看跌 | 交易 | 看好 | 02/21/25 | $61.2 | $59.1 | $59.5 | $800.00 | $297.5K | 48 | 51 |

| 阿斯麦 | 看涨 | 交易 | 看好 | 12/20/24 | $197.1 | $193.9 | $197.1 | $710.00 | $295.6K | 0 | 15 |

| 阿斯麦 | 看涨 | SWEEP | 中立 | 09/06/24 | $75.2 | $72.9 | $72.9 | $825.00 | $255.1K | 1 | 35 |

| 阿斯麦 | 看涨 | 交易 | 看淡 | 08/30/2024 | $60.6 | $55.0 | $56.8 | $840.00 | $136.3K | 5 | 0 |

About ASML Holding

关于阿斯麦控股

ASML is the leader in photolithography systems used in the manufacturing of semiconductors. Photolithography is the process in which a light source is used to expose circuit patterns from a photo mask onto a semiconductor wafer. The latest technological advances in this segment allow chipmakers to continually increase the number of transistors on the same area of silicon, with lithography historically representing a high portion of the cost of making cutting-edge chips. ASML outsources the manufacturing of most of its parts, acting like an assembler. ASML's main clients are TSMC, Samsung, and Intel.

ASML是半导体制造中使用的光刻系统领先者。光刻是一种利用光源将掩膜版上的电路图案显影到半导体晶片上的过程。该领域的最新技术进步使芯片厂商能够不断增加相同面积硅片上的晶体管数量,而光刻历史上占了制造前沿芯片成本的很高比例。ASML将大部分零件制造外包,充当装配工的角色。ASML的主要客户是TSMC,三星和英特尔。

Following our analysis of the options activities associated with ASML Holding, we pivot to a closer look at the company's own performance.

在分析与阿斯麦控股相关的期权活动之后,我们转向更深入地了解该公司的表现。

Where Is ASML Holding Standing Right Now?

阿斯麦目前处于何种地位?

- Trading volume stands at 605,089, with ASML's price up by 3.05%, positioned at $868.7.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 70 days.

- 交易量为605,089,阿斯麦的价格上涨3.05%,位于868.7美元。

- RSI指标显示该股票可能正接近超卖。

- 预计在70天内公布收益情况。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ASML Holding with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也有更高利润的潜力。精明的交易者通过持续的教育、策略性的交易调整、利用各种因子以及关注市场动态来减轻这些风险。使用Benzinga Pro即时警报,及时了解阿斯麦控股的最新期权交易。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ASML, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ASML, it often means somebody knows something is about to happen.