What the Options Market Tells Us About Moderna

What the Options Market Tells Us About Moderna

Deep-pocketed investors have adopted a bearish approach towards Moderna (NASDAQ:MRNA), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MRNA usually suggests something big is about to happen.

财力雄厚的投资者对Moderna(纳斯达克股票代码:MRNA)采取了看跌的态度,这是市场参与者不容忽视的。我们对本辛加公开期权记录的追踪今天揭示了这一重大举措。这些投资者的身份仍然未知,但是MRNA的如此重大变动通常表明即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 18 extraordinary options activities for Moderna. This level of activity is out of the ordinary.

我们今天从观察中收集了这些信息,当时Benzinga的期权扫描仪重点介绍了Moderna的18项非同寻常的期权活动。这种活动水平与众不同。

The general mood among these heavyweight investors is divided, with 22% leaning bullish and 66% bearish. Among these notable options, 9 are puts, totaling $474,376, and 9 are calls, amounting to $342,609.

这些重量级投资者的总体情绪存在分歧,22%的人倾向于看涨,66%的人倾向于看跌。在这些值得注意的期权中,有9个是看跌期权,总额为474,376美元,9个是看涨期权,总额为342,609美元。

Predicted Price Range

预测的价格区间

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $75.0 to $150.0 for Moderna over the recent three months.

根据交易活动,看来重要投资者的目标是在最近三个月中将Moderna的价格范围从75.0美元扩大到150.0美元。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

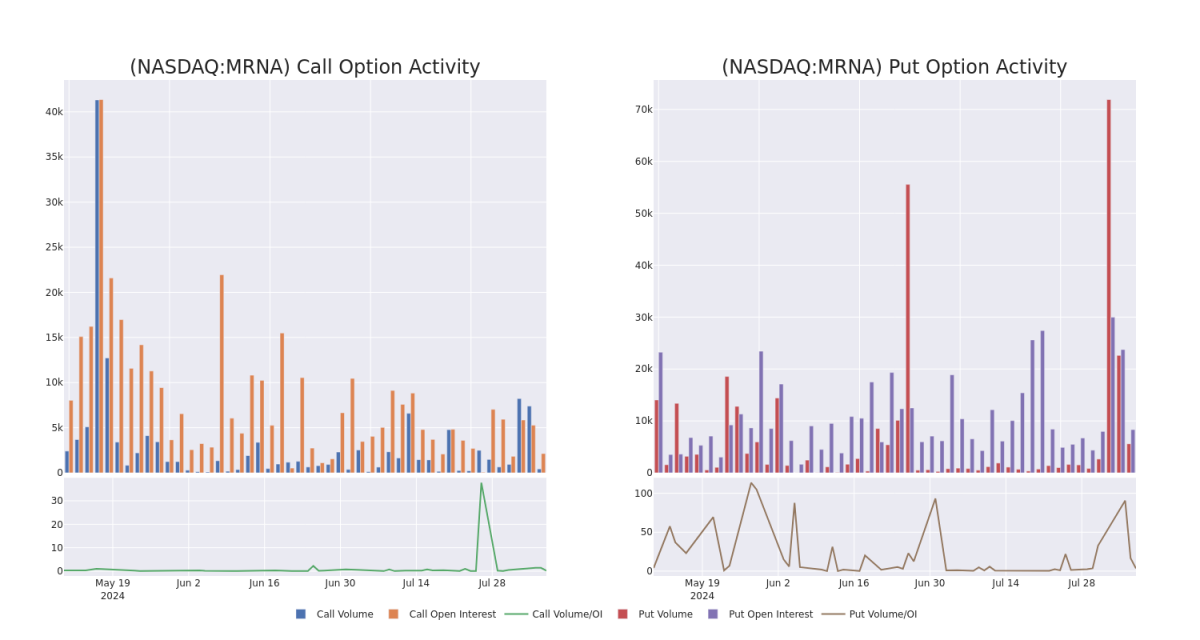

In today's trading context, the average open interest for options of Moderna stands at 871.33, with a total volume reaching 6,015.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Moderna, situated within the strike price corridor from $75.0 to $150.0, throughout the last 30 days.

在当今的交易背景下,Moderna期权的平均未平仓合约为871.33,总交易量达到6,015.00。随附的图表描绘了过去30天Moderna高价值交易的看涨和看跌期权交易量以及未平仓合约的变化,行使价走势从75.0美元到150.0美元不等。

Moderna Option Activity Analysis: Last 30 Days

Moderna 期权活动分析:过去 30 天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRNA | PUT | TRADE | BEARISH | 06/20/25 | $12.05 | $9.6 | $11.25 | $75.00 | $141.7K | 1.2K | 0 |

| MRNA | PUT | SWEEP | BEARISH | 09/20/24 | $10.35 | $10.25 | $10.25 | $90.00 | $94.7K | 2.3K | 86 |

| MRNA | CALL | SWEEP | BEARISH | 01/17/25 | $12.05 | $11.85 | $11.85 | $90.00 | $50.9K | 596 | 64 |

| MRNA | PUT | SWEEP | BULLISH | 08/16/24 | $1.08 | $0.9 | $0.9 | $78.00 | $44.5K | 1.9K | 500 |

| MRNA | CALL | TRADE | BEARISH | 06/20/25 | $14.0 | $13.0 | $13.0 | $100.00 | $44.2K | 109 | 36 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRNA | 放 | 贸易 | 粗鲁的 | 06/20/25 | 12.05 美元 | 9.6 美元 | 11.25 美元 | 75.00 美元 | 141.7 万美元 | 1.2K | 0 |

| MRNA | 放 | 扫 | 粗鲁的 | 09/20/24 | 10.35 美元 | 10.25 美元 | 10.25 美元 | 90.00 美元 | 94.7 万美元 | 2.3K | 86 |

| MRNA | 打电话 | 扫 | 粗鲁的 | 01/17/25 | 12.05 美元 | 11.85 美元 | 11.85 美元 | 90.00 美元 | 50.9 万美元 | 596 | 64 |

| MRNA | 放 | 扫 | 看涨 | 08/16/24 | 1.08 | 0.9 美元 | 0.9 美元 | 78.00 美元 | 44.5 万美元 | 1.9K | 500 |

| MRNA | 打电话 | 贸易 | 粗鲁的 | 06/20/25 | 14.0 美元 | 13.0 美元 | 13.0 美元 | 100.00 美元 | 44.2 万美元 | 109 | 36 |

About Moderna

关于 Moderna

Moderna is a commercial-stage biotech that was founded in 2010 and had its initial public offering in December 2018. The firm's mRNA technology was rapidly validated with its COVID-19 vaccine, which was authorized in the United States in December 2020. Moderna had 39 mRNA development candidates in clinical trials as of mid-2023. Programs span a wide range of therapeutic areas, including infectious disease, oncology, cardiovascular disease, and rare genetic diseases.

Moderna是一家商业阶段的生物技术公司,成立于2010年,并于2018年12月进行了首次公开募股。该公司的 mRNA 技术通过其 COVID-19 疫苗迅速得到验证,该疫苗于 2020 年 12 月在美国获得授权。截至2023年中期,Moderna在临床试验中有39个mRNA开发候选药物。项目涵盖广泛的治疗领域,包括传染病、肿瘤学、心血管疾病和罕见遗传病。

After a thorough review of the options trading surrounding Moderna, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对围绕Moderna的期权交易进行了全面审查之后,我们将对该公司进行更详细的审查。这包括评估其当前的市场状况和表现。

Current Position of Moderna

Moderna 的现状

- Currently trading with a volume of 1,421,559, the MRNA's price is up by 0.88%, now at $83.03.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 85 days.

- MRNA目前的交易量为1,421,559美元,价格上涨了0.88%,目前为83.03美元。

- RSI读数表明该股目前可能已超卖。

- 预计财报将在85天后发布。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Moderna options trades with real-time alerts from Benzinga Pro.

期权交易带来更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。通过Benzinga Pro的实时提醒,随时了解最新的Moderna期权交易。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $75.0 to $150.0 for Moderna over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $75.0 to $150.0 for Moderna over the recent three months.