Super Micro Computer, SMCI, Generates a Power Inflow Signal That Rises by Over 3%. TradePulse Power Inflow Alert. Stock Rises After the Signal and Closes Higher. The TradePulse Power Inflow Signal Was Triggered at 10:02 Am ET.

Super Micro Computer, SMCI, Generates a Power Inflow Signal That Rises by Over 3%. TradePulse Power Inflow Alert. Stock Rises After the Signal and Closes Higher. The TradePulse Power Inflow Signal Was Triggered at 10:02 Am ET.

Super Micro Computer, (NASTAQ:SMCI) experienced a Power Inflow, a crucial event for investors who use order flow analytics in their investment strategies. This Power Inflow marks a shift from a net selling or distribution phase to a net buying or accumulation environment, illustrating a significant inflow that exceeds outflow. Such a change is commonly viewed as a sign of heightened investor confidence and a short-term uptrend in the stock.

超微电脑(NASTAQ: SMCI)经历了一次流入事件,这对于那些在投资策略中使用订单流分析的投资者来说是至关重要的。这次流入标志着从净卖出或分销阶段转向了净买入或积累环境,说明了一次显著的流入,超过了流出。这种变化通常被视为投资者信心提高和股票短期上涨趋势的迹象。

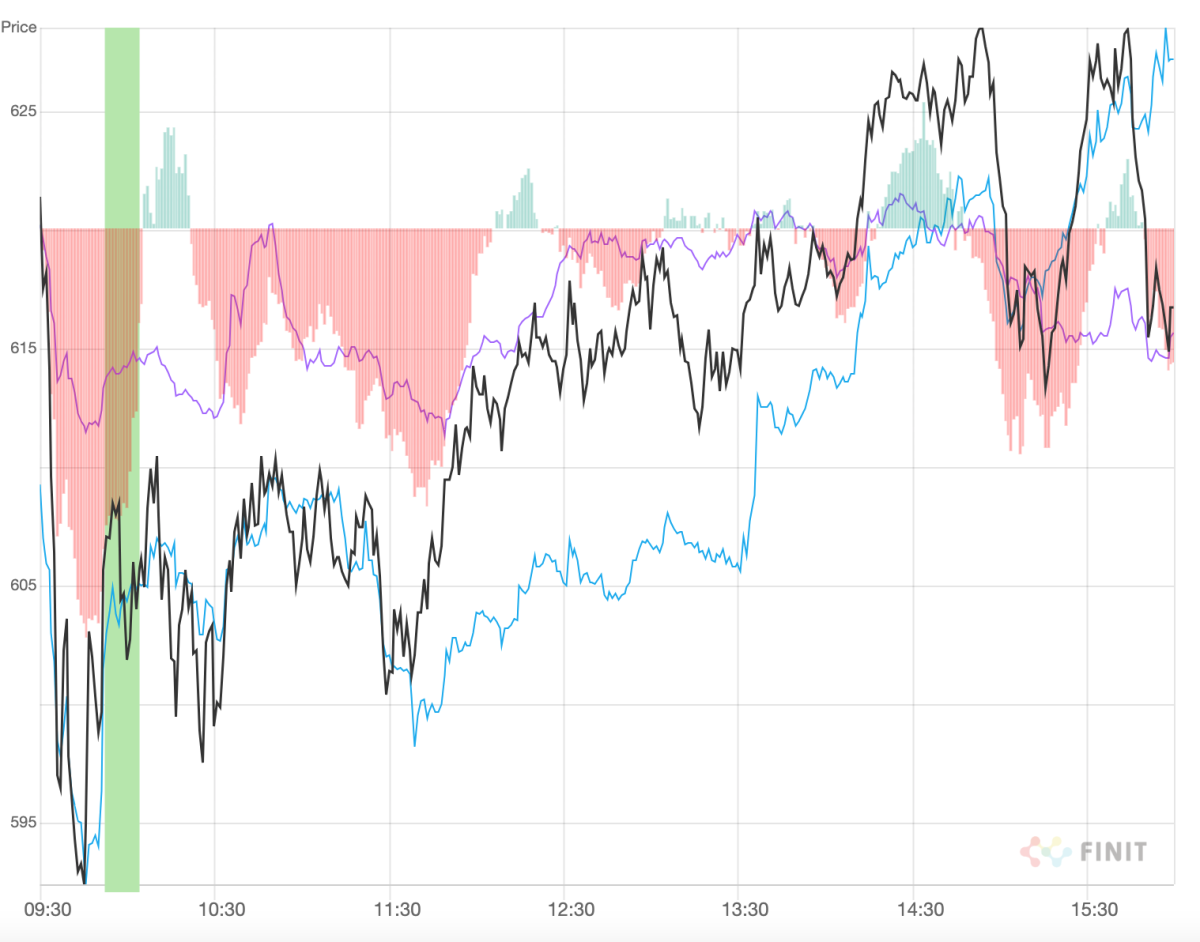

At 10:02 AM ET on August 6th, Super Micro Computer (SMCI) recorded a Power Inflow at a trading price of USD $606. This occurrence is essential for investors who base their trading decisions on order flow analytics. The Power Inflow indicates the potential start of an uptrend in Super Micro Computor Inc.'s stock, presenting an opportunity for investors aiming to profit from anticipated price rises. Bullish stakeholders diligently seek to confirm sustained positive momentum in SMCI stock price, and this development is viewed as a favorable sign.

在8月6日上午10:02(东部时间),超微电脑(SMCI)以606美元的交易价格记录了一次流入事件。对于那些基于订单流分析进行交易决策的投资者来说,这种流入事件意味着超微电脑公司股票潜在上涨趋势的开端,为那些希望从预期价格上涨中获利的投资者提供了机会。看好的股东们会努力确认SMCI股价的持续正向动量,而这一进展被视为一个有利的迹象。

Power Inflow signal description:

流入信号描述:

Order flow analytics, or transaction/market flow analysis, involves a comprehensive analysis of order volumes from both retail and institutional traders. This method scrutinizes the flow of buy and sell orders, paying close attention to factors such as: order size, timing, and other relevant characteristics that form patterns to generate actionable insights and improve trading decisions. This approach is particularly appreciated for its effectiveness in identifying bullish signals among proactive traders.

订单流分析或交易/市场流分析包括对来自零售和机构交易者的订单量进行全面分析。该方法审核买入和卖出订单的流动,密切关注诸如订单大小、时机和其他相关特征等因素,形成图案以生成可操作的见解并改善交易决策。这种方法尤其因其在主动交易者中识别看涨信号的有效性而受到赞赏。

Generally manifesting within the first two hours of market opening, a Power Inflow serves as an indicator of the likely trend for the stock throughout the day.

通常在市场开盘的头两个小时内显示,大量资金流入标志着当天股票可能的趋势。

Incorporating order flow analytics into their trading strategies helps market participants to more precisely evaluate market dynamics, uncover trading opportunities, and potentially enhance their trading outcomes. However, the importance of implementing strong risk management strategies cannot be emphasized enough. Effective risk management is vital for safeguarding capital and minimizing potential losses, thereby fostering a more disciplined approach to navigating market uncertainties and enhancing the prospects for long-term trading success.

将订单流分析纳入其交易策略,可以帮助市场参与者更精确地评估市场动态,发现交易机会,可能提高其交易结果。然而,实施强有力的风险管理策略的重要性不言而喻。有效的风险管理对于保护资本和尽量减少潜在损失至关重要,从而培养更加严谨的应对市场不确定性的方法,并增强长期交易成功的前景。

Market News and Data are brought to you by Benzinga APIs and include firms, like Finit USA, responsible for parts of the data within this article.

市场新闻和数据由Benzinga APIs带给您,包括像Finit USA这样的公司,它负责本文中部分数据的处理。

2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2024年Benzinga.com保留版权所有,Benzinga.com不提供投资建议。

After Market Close UPDATE:

收盘后更新:

The price at the time of the Power Inflow was $606. The returns on the High price ($628.10) and Close price ($614.91) after the Power Inflow are respectively 3.64% and 1.47% The result underlines the importance of a trading plan that includes Profit Targets and Stop Losses that reflect your risk appetite. This daily return annualizes significantly higher returns per year than the indexes if you can replicate this on a daily basis.

当流入事件发生时,股票价格为606美元。流入事件后高价(628.10美元)和收盘价(614.91美元)的回报率分别为3.64%和1.47%。该结果强调了交易计划的重要性,其中包括反映您风险偏好的利润目标和止损。如果您能每天复制这一结果,则该日回报年化率显着高于指数。

Past Performance is Not Indicative of Future Results

过往表现并不代表未来结果

Order flow analytics, or transaction/market flow analysis, involves a comprehensive analysis of order volumes from both retail and institutional traders. This method scrutinizes the flow of buy and sell orders, paying close attention to factors such as: order size, timing, and other relevant characteristics that form patterns to generate actionable insights and improve trading decisions. This approach is particularly appreciated for its effectiveness in identifying bullish signals among proactive traders.

Order flow analytics, or transaction/market flow analysis, involves a comprehensive analysis of order volumes from both retail and institutional traders. This method scrutinizes the flow of buy and sell orders, paying close attention to factors such as: order size, timing, and other relevant characteristics that form patterns to generate actionable insights and improve trading decisions. This approach is particularly appreciated for its effectiveness in identifying bullish signals among proactive traders.