If you lose money when investing in U.S. Treasury bonds, this article will tell you how to speed up your unwinding and make a profit | moomoo research

If you lose money when investing in U.S. Treasury bonds, this article will tell you how to speed up your unwinding and make a profit | moomoo research

Preface

前言

In the current complex and volatile financial market environment, 20-year Treasury bond ETFs (such as TLT) have become the first choice for many investors. However, market volatility and changes in interest rate policies may cause ETF prices to fall, leaving investors in a dilemma. To meet this challenge, we propose two strategies to help investors get out of the trap and gain substantial returns in future market trends.

在当前复杂和动荡的金融市场环境下,20年期国债ETF(如TLT)已成为许多投资者的首选。然而,市场波动和利率政策的变化可能会导致ETF价格下跌,让投资者陷入困境。为应对这一挑战,我们提出了两种策略,帮助投资者走出困境,在未来市场趋势中获得实质性收益。

Strategy 1: Continue to hold TLT and use the Covered Call strategy

策略1:继续持有TLT并使用Covered Call策略

Strategy Overview:

策略概述:

1. Continue to hold: On the basis of holding TLT, do not rush to sell, and wait for the market to pick up by holding for a long time.

1. 继续持有:在持有TLT的基础上,不要急于出售,通过长时间持有等待市场反弹。

2. Sell call options (Covered Call): Sell higher-priced call options at the end of each month or before the Federal Reserve's interest rate meeting.

2. 卖出看涨期权(Covered Call):在每个月末或联邦储备利率会议之前出售高价的看涨期权。

Strategy Analysis:

策略分析:

- Market Expectations: With the expectation of the Federal Reserve's gradual interest rate cuts, the price of long-term bond ETFs is expected to gradually recover. Continuing to hold TLT can not only avoid selling at a low point, but also enjoy capital gains from future price increases.

- 市场预期:随着联邦储备逐渐降息的预期,长期债券ETF的价格预计会逐渐恢复。继续持有TLT不仅可以避免低点出售,还可以享受未来价格上涨的资本收益。

- Option fee income: By selling call options, investors can regularly receive option fee income. This income can make up for some of the losses during the holding period, and can even bring stable cash flow when the market is sideways. Let's take the option expiring on September 30 as an example. If it is stuck at $100 per share, we can make a covered call at this time. The call option expiring on September 30 with an exercise price of 100 yuan can receive $1 per share, which increases our holding income by about 2 months and slightly exceeds 1%, but the sacrificed income is the subsequent price increase under the rapid interest rate cut.

- 期权费收入:通过出售看涨期权,投资者可以定期获得期权费收入。这种收入可以弥补持有期间的部分亏损,并且在市场横盘时甚至可以带来稳定的现金流。我们以9月30日到期的期权为例。如果它卡在每股100美元,我们可以在此时进行看涨期权。以100元的行权价格到期的看涨期权可以获得每股1美元,这将增加我们的持有收入约2个月,略高于1%,但牺牲的是快速降息后的随后价格上涨的收益。

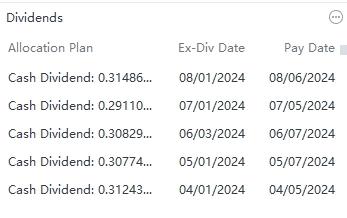

- Interest income: During the holding period of TLT, investors can also obtain regular interest income, further enhancing the overall income. Currently, the monthly dividend is just over $0.3 per share, which can continuously reduce the holding cost and collect rent.

- 利息收入:在持有TLT期间,投资者还可以获得定期的利息收入,进一步增强整体收益。目前,每股月度分红略高于0.3美元,可以持续降低持有成本和收租。

Operation details:

操作细节:

- Select contracts: Select call options that expire at the end of each month, and set the exercise price to a certain range above the current price (such as more than 10%. If it is too high, the option fee will be too low).

- 选择合同:选择每个月到期的看涨期权,并将行权价格设置为略高于当前价格的一定范围(如超过10%。如果过高,期权费将会太低)。

- Risk management: Do not sell call options that exceed the holding amount on hand, otherwise it will become naked short selling.

- 风险管理:不要出售超出手头持有量的看涨期权,否则将变成裸卖空。

Expected returns:

预期回报:

- Spread income: As the Fed gradually cuts interest rates, TLT prices are expected to gradually recover.

- 价差收入:随着联邦逐步降息,TLT价格预计将逐步恢复。

- Option fee income: Option fees obtained by selling call options every month.

- 期权费收入:每个月出售看涨期权获得的期权费。

- Interest income: TLT interest income during the holding period.

- 利息收入:TLT持有期间的利息收入。

A simple calculation shows that you can continue to earn more option fee income than simply holding TLT, which is equivalent to earning the time value of options and the money of option speculators, but will lose potential returns.

简单的计算表明,您可以继续赚取比简单持有TLT更多的期权费收入,这相当于赚取期权的时间价值和期权投机者的钱,但会失去潜在的回报。

Strategy 2: Sell Put strategy combined with cash management for those who still have money to buy at the bottom but want to wait

策略2:看跌期权+现金管理组合的出售策略,适用于还有钱可以在低点买入但想等待的人

Strategy Overview:

策略概述:

1. Sell Put strategy: When TLT prices are low, sell put options (Sell Put) to get more TLT at a lower price.

1. 卖出看跌期权策略:当TLt价格低时,卖出看跌期权(Sell Put)以更低的价格获得更多的TLT。

2. Cash management: Deposit the margin required for Sell Put in Futu's cash treasure to earn extra interest.

2、现金管理:将富途卖出看跌所需的保证金存入现金宝以获取额外的利息。

Strategy Analysis:

策略分析:

- Market Expectations: Sell Put strategy is suitable for use when the market is close to the bottom area. By selling put options, investors can buy TLT at a low price in the future and reduce the cost of holding positions.

-市场预期:卖出看跌策略适用于市场接近底部时使用。通过出售看跌期权,投资者可以低价购买TLt,并降低持仓成本。

- Option fee income: By selling put options, investors can receive option fee income regularly, which not only enhances cash flow, but can also be used to further cover positions. At the current price, assuming that investors are willing to buy at $93 per share, but the current price is not $93, they can sell $93 put options, at which time they can earn a premium of 0.97 yuan per share, and the funds will not be consumed too quickly in holding ETFs, and the funds can continue to collect interest in Cash Treasure.

-期权费用收入:通过出售看跌期权,投资者可以定期获得期权费用收入,这不仅增强了现金流,而且还可以用于进一步覆盖头寸。在当前价格下,假设投资者愿意以每股93美元的价格购买,但当前价格并非93美元,他们可以卖出93美元的看跌期权,此时他们可以赚取每股0.97元的权利金,资金不会在持有ETF时被迅速消耗,而是可以在现金宝中继续收集利息。

- Cash Treasure income: The margin is deposited in Futu's Cash Treasure, which can obtain additional interest income and ensure efficient use of funds.

-现金宝收入:保证金存入富途现金宝,可获得额外的利息收入,并确保资金的高效利用。

Operation details:

操作细节:

- Select contract: Select a put option with a strike price lower than the current market price to ensure that TLT is bought at a low price in the future.

-选择合约:选择行权价格低于当前市价的看跌期权,以确保在未来以低价购买TLt。

- Cash management: Deposit all or part of the margin required for Sell Put in Cash Treasure to earn additional interest.

-现金管理:将卖出看跌所需的全部或部分保证金存入现金宝以获取额外的利息。

- Risk management: Do not sell put options that exceed your ability to receive goods.

-风险管理:不要卖出超过接受的货物数量的看跌期权。

Expected income:

预期收益:

- Option fee income: Option fees obtained by selling put options.

-期权费用收入:通过出售看跌期权获得的期权费用。

- Cash Treasure Income: Interest income earned during the period when the margin is deposited in Cash Treasure.

-现金宝收入:存入现金宝的保证金期间所赚取的利息收入。

- TLT Interest Income: Interest income earned after buying more TLT in the future.

-TLt利息收入:购买更多TLt后所赚取的利息收入。

summary

总结

Whether it is the Covered Call of Strategy 1 or the Sell Put of Strategy 2, the core is to obtain multiple sources of income through option operations and cash management on the basis of holding TLT, so as to effectively get out of the trap. With the increasing expectations of the Federal Reserve's interest rate cut, both strategies are expected to help investors achieve higher comprehensive returns.

无论是策略1的被保险看涨还是策略2的卖出看跌,核心都是在持有TLt的基础上通过期权操作和现金管理获得多种收入来源,从而有效地摆脱陷阱。随着联邦储备降息预期的增加,这两种策略都有望帮助投资者实现更高的综合回报。

This will effectively improve the income of simply holding and collecting interest.

$iShares 20+ Year Treasury Bond ETF (TLT.US)$

这将有效地提高简单持有和收集利息的收入。

$20+年以上美国国债ETF-iShares (TLT.US)$

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only. Read more

免责声明:Moomoo Technologies Inc.仅提供此内容供信息和教育使用。 阅读更多