What the Options Market Tells Us About AppLovin

What the Options Market Tells Us About AppLovin

Whales with a lot of money to spend have taken a noticeably bullish stance on AppLovin.

资金充裕的鲸鱼已经明显看好AppLovin。

Looking at options history for AppLovin (NASDAQ:APP) we detected 8 trades.

我们查看了AppLovin (纳斯达克:APP) 的期权历史,发现了8笔交易。

If we consider the specifics of each trade, it is accurate to state that 62% of the investors opened trades with bullish expectations and 25% with bearish.

如果我们考虑每一笔交易的具体情况,可以准确地说有62%的投资者持看好预期开仓,25%的投资者持看淡预期开仓。

From the overall spotted trades, 3 are puts, for a total amount of $85,177 and 5, calls, for a total amount of $163,100.

从整体交易中发现,3笔是看跌期权,总金额为$85,177,5笔是看涨期权,总金额为$163,100。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $66.0 to $75.0 for AppLovin over the recent three months.

基于交易活动,看起来显著的投资者正在看好AppLovin近三个月的价格区间在$66.0到$75.0之间。

Volume & Open Interest Trends

成交量和未平仓量趋势

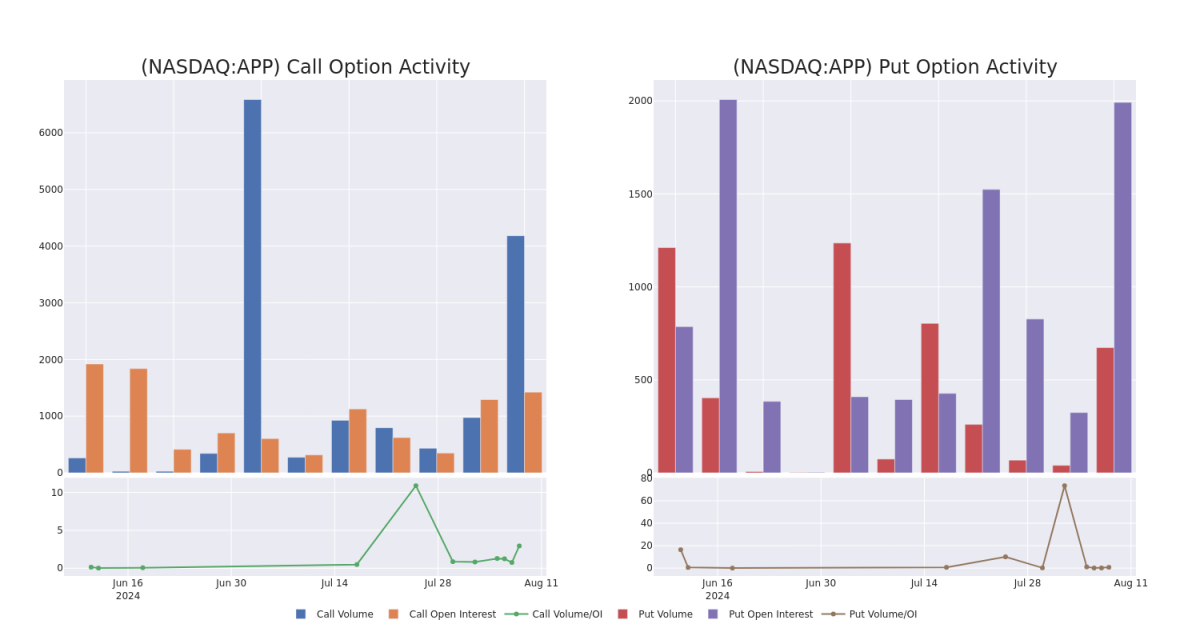

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in AppLovin's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to AppLovin's substantial trades, within a strike price spectrum from $66.0 to $75.0 over the preceding 30 days.

评估成交量和持仓量是期权交易的策略性步骤。这些指标揭示了AppLovin期权在特定执行价格上的流动性和投资者兴趣。下面的数据可视化了在过去30天内,$66.0到$75.0执行价格范围内,与AppLovin交易相关的看涨和看跌期权的成交量和持仓量波动。

AppLovin Option Volume And Open Interest Over Last 30 Days

AppLovin在过去30天内的期权成交量和未平仓合约数

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APP | CALL | SWEEP | BEARISH | 10/18/24 | $5.9 | $5.8 | $5.8 | $70.00 | $56.2K | 180 | 124 |

| APP | PUT | TRADE | BULLISH | 11/15/24 | $12.7 | $12.4 | $12.4 | $75.00 | $29.7K | 290 | 0 |

| APP | CALL | SWEEP | BULLISH | 08/16/24 | $0.8 | $0.65 | $0.75 | $75.00 | $28.8K | 1.0K | 711 |

| APP | PUT | SWEEP | BEARISH | 08/16/24 | $2.45 | $2.4 | $2.45 | $67.00 | $28.1K | 557 | 128 |

| APP | PUT | SWEEP | BULLISH | 08/09/24 | $1.0 | $0.85 | $0.88 | $66.00 | $27.2K | 1.1K | 545 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 应用程序 | 看涨 | SWEEP | 看淡 | 10/18/24 | $5.9 | $5.8 | $5.8 | 70.00美元 | $56.2K | 180 | 124 |

| 应用程序 | 看跌 | 交易 | 看好 | 11/15/24 | $12.7 | $12.4 | $12.4 | $75.00 | $29.7K | 290 | 0 |

| 应用程序 | 看涨 | SWEEP | 看好 | 08/16/24 | $0.8 | $0.65 | 0.75美元 | $75.00 | 28.8千美元 | 1.0K | 711 |

| 应用程序 | 看跌 | SWEEP | 看淡 | 08/16/24 | $2.45 | $2.4 | $2.45 | $67.00 | $28.1K | 557 | 128 |

| 应用程序 | 看跌 | SWEEP | 看好 | 08/09/24 | $1.0 | $0.85 | $0.88 | $66.00 | $27.2K | 1.1千 | 545 |

About AppLovin

关于AppLovin

AppLovin Corp is a mobile app technology company. It focuses on growing the mobile app ecosystem by enabling the success of mobile app developers. The company's software solutions provide tools for mobile app developers to grow their businesses by automating and optimizing the marketing and monetization of their applications.

AppLovin Corp是一家移动应用程序技术公司,专注于通过支持移动应用程序开发人员的成功来增长移动应用程序生态系统。该公司的软件解决方案为移动应用程序开发人员提供工具,通过自动化和优化其应用程序的营销和货币化来增长他们的业务。

Where Is AppLovin Standing Right Now?

AppLovin现在的状态如何?

- Currently trading with a volume of 4,013,751, the APP's price is up by 5.42%, now at $70.83.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 90 days.

- 现在的交易量是4,013,751,APP的价格上涨了5.42%,目前为$70.83。

- RSI读数表明该股票目前处于中立状态,处于超买和超卖之间。

- 预计90天内发布收益报告。

What The Experts Say On AppLovin

关于AppLovin,专家的看法

In the last month, 3 experts released ratings on this stock with an average target price of $98.33333333333333.

在过去一个月中,有3位专家对这支股票进行了评级,平均目标价为$98.33333333333333。

- An analyst from Wedbush persists with their Outperform rating on AppLovin, maintaining a target price of $90.

- An analyst from Oppenheimer has revised its rating downward to Outperform, adjusting the price target to $105.

- An analyst from Wedbush has revised its rating downward to Outperform, adjusting the price target to $100.

- Wedbush的一位分析师坚持对AppLovin的跑赢大盘评级,保持目标价为$90。

- Oppenheimer的一位分析师调低了评级至跑赢大盘,将价格目标设定为$105。

- Wedbush的一位分析师调低了评级至跑赢大盘,将价格目标设定为$100。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for AppLovin with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但同时也提供了更高的利润潜力。精明的交易者通过持续教育,策略性的交易调整,利用各种因子和关注市场动态来减轻这些风险。通过Benzinga Pro获取AppLovin的最新期权交易,以获得实时警报。

From the overall spotted trades, 3 are puts, for a total amount of $85,177 and 5, calls, for a total amount of $163,100.

From the overall spotted trades, 3 are puts, for a total amount of $85,177 and 5, calls, for a total amount of $163,100.