McKesson's Options Frenzy: What You Need to Know

McKesson's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bearish move on McKesson. Our analysis of options history for McKesson (NYSE:MCK) revealed 41 unusual trades.

金融巨头对麦克森采取了明显的看跌举动。我们对麦克森(纽约证券交易所代码:MCK)期权历史的分析显示了41笔不寻常的交易。

Delving into the details, we found 17% of traders were bullish, while 60% showed bearish tendencies. Out of all the trades we spotted, 33 were puts, with a value of $3,204,542, and 8 were calls, valued at $380,924.

深入研究细节,我们发现17%的交易者看涨,而60%的交易者表现出看跌的趋势。在我们发现的所有交易中,33笔是看跌期权,价值为3,204,542美元,8笔是看涨期权,价值380,924美元。

Predicted Price Range

预测的价格区间

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $270.0 to $690.0 for McKesson over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将麦克森的价格定在270.0美元至690.0美元之间。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

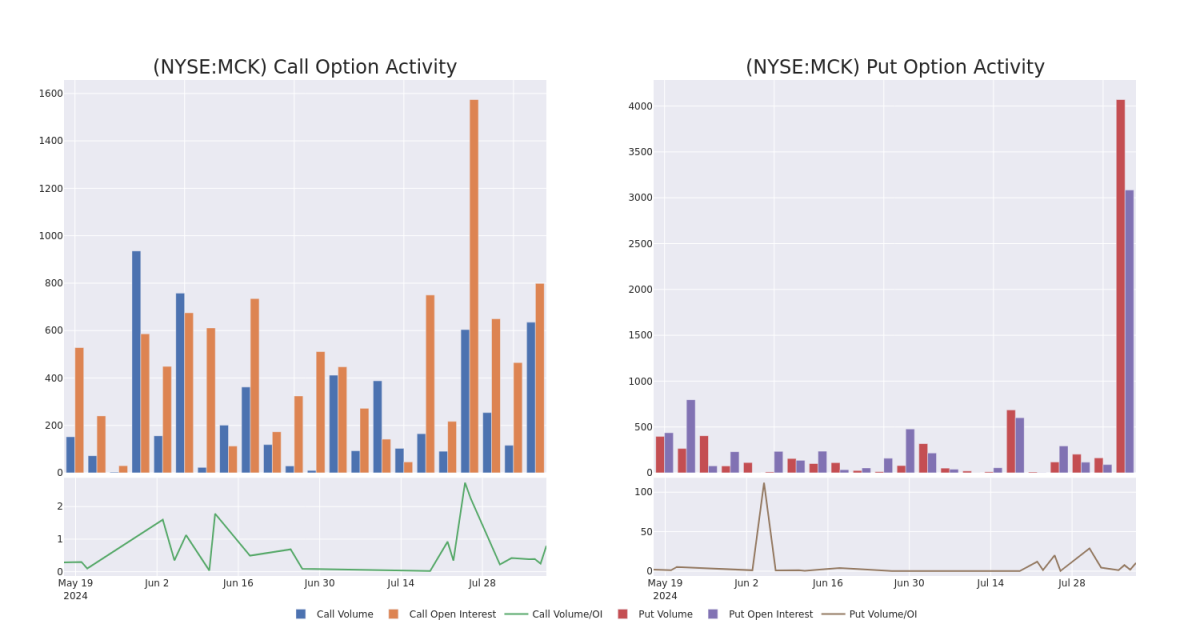

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in McKesson's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to McKesson's substantial trades, within a strike price spectrum from $270.0 to $690.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了指定行使价下麦克森期权的流动性和投资者对麦克森期权的兴趣。即将发布的数据可视化了与麦克森的大量交易相关的看涨期权和看跌期权的交易量和未平仓合约的波动,在过去30天内,行使价范围从270.0美元到690.0美元不等。

McKesson Option Activity Analysis: Last 30 Days

麦克森期权活动分析:过去 30 天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MCK | PUT | SWEEP | NEUTRAL | 08/09/24 | $79.9 | $75.0 | $77.12 | $630.00 | $382.0K | 117 | 117 |

| MCK | PUT | TRADE | BEARISH | 08/09/24 | $76.5 | $69.0 | $75.0 | $635.00 | $375.0K | 100 | 100 |

| MCK | PUT | SWEEP | BEARISH | 08/16/24 | $14.9 | $14.8 | $14.9 | $570.00 | $224.9K | 1.0K | 104 |

| MCK | PUT | SWEEP | BEARISH | 11/15/24 | $36.7 | $33.9 | $35.6 | $570.00 | $195.8K | 595 | 229 |

| MCK | PUT | SWEEP | NEUTRAL | 11/15/24 | $36.6 | $36.0 | $36.6 | $570.00 | $153.7K | 595 | 284 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MCK | 放 | 扫 | 中立 | 08/09/24 | 79.9 美元 | 75.0 美元 | 77.12 美元 | 630.00 美元 | 382.0 万美元 | 117 | 117 |

| MCK | 放 | 贸易 | 粗鲁的 | 08/09/24 | 76.5 美元 | 69.0 美元 | 75.0 美元 | 635.00 美元 | 375.0 万美元 | 100 | 100 |

| MCK | 放 | 扫 | 粗鲁的 | 08/16/24 | 14.9 美元 | 14.8 美元 | 14.9 美元 | 570.00 美元 | 224.9 万美元 | 1.0K | 104 |

| MCK | 放 | 扫 | 粗鲁的 | 11/15/24 | 36.7 美元 | 33.9 美元 | 35.6 美元 | 570.00 美元 | 19.58 万美元 | 595 | 229 |

| MCK | 放 | 扫 | 中立 | 11/15/24 | 36.6 美元 | 36.0 美元 | 36.6 美元 | 570.00 美元 | 153.7 万美元 | 595 | 284 |

About McKesson

关于麦克森

McKesson Corp is one of three leading pharmaceutical wholesalers in the us engaged in sourcing and distributing branded, generic, and specialty pharmaceutical products to pharmacies (retail chains, independent, and mail order), hospitals networks, and healthcare providers. Along with Cencora and Cardinal Health, the three account for over 90% of the us pharmaceutical wholesale industry. Outside the us market, McKesson engages in pharmaceutical wholesale and distribution in Canada. Additionally, the company supplies medical-surgical products and equipment to healthcare facilities and provides a variety of technology solutions for pharmacies.

McKesson Corp 是美国三家领先的药品批发商之一,从事向药房(零售连锁店、独立和邮购)、医院网络和医疗保健提供商采购和分销品牌、仿制药和特种药品。与Cencora和Cardinal Health一起,这三家公司占美国药品批发行业的90%以上。在美国市场以外,McKesson在加拿大从事药品批发和分销。此外,该公司向医疗机构提供医疗外科产品和设备,并为药房提供各种技术解决方案。

Following our analysis of the options activities associated with McKesson, we pivot to a closer look at the company's own performance.

在分析了与麦克森相关的期权活动之后,我们将转向仔细研究公司自身的表现。

McKesson's Current Market Status

麦克森的当前市场状况

- Currently trading with a volume of 3,264,678, the MCK's price is down by -7.39%, now at $571.85.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 83 days.

- MCK目前的交易量为3,264,678美元,价格下跌了-7.39%,目前为571.85美元。

- RSI读数表明,该股目前可能已接近超卖。

- 预计财报将在83天后发布。

What Analysts Are Saying About McKesson

分析师对麦克森的看法

In the last month, 4 experts released ratings on this stock with an average target price of $646.75.

上个月,4位专家发布了该股的评级,平均目标价为646.75美元。

- An analyst from Barclays has decided to maintain their Overweight rating on McKesson, which currently sits at a price target of $616.

- Maintaining their stance, an analyst from Baird continues to hold a Outperform rating for McKesson, targeting a price of $671.

- Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on McKesson with a target price of $670.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on McKesson with a target price of $630.

- 巴克莱银行的一位分析师已决定维持对麦克森的增持评级,目前的目标股价为616美元。

- 贝尔德的一位分析师保持立场,继续对麦克森维持跑赢大盘的评级,目标股价为671美元。

- 花旗集团的一位分析师在评估中保持对麦克森的买入评级,目标价为670美元。

- 根据他们的评估,Evercore ISI集团的一位分析师维持麦克森的跑赢大盘评级,目标价为630美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in McKesson's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to McKesson's substantial trades, within a strike price spectrum from $270.0 to $690.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in McKesson's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to McKesson's substantial trades, within a strike price spectrum from $270.0 to $690.0 over the preceding 30 days.