A Closer Look at Shopify's Options Market Dynamics

A Closer Look at Shopify's Options Market Dynamics

Deep-pocketed investors have adopted a bearish approach towards Shopify (NYSE:SHOP), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SHOP usually suggests something big is about to happen.

财力雄厚的投资者对Shopify(纽约证券交易所代码:SHOP)采取了看跌的态度,这是市场参与者不容忽视的。我们对本辛加公开期权记录的追踪今天揭示了这一重大举措。这些投资者的身份仍然未知,但是SHOP的如此实质性的变动通常表明大事即将发生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 26 extraordinary options activities for Shopify. This level of activity is out of the ordinary.

我们今天从观察中收集了这些信息,当时Benzinga的期权扫描仪重点介绍了Shopify的26项非同寻常的期权活动。这种活动水平与众不同。

The general mood among these heavyweight investors is divided, with 38% leaning bullish and 57% bearish. Among these notable options, 7 are puts, totaling $298,235, and 19 are calls, amounting to $1,074,437.

这些重量级投资者的总体情绪存在分歧,38%的人倾向于看涨,57%的人倾向于看跌。在这些值得注意的期权中,有7个是看跌期权,总额为298,235美元,19个是看涨期权,总额为1,074,437美元。

Expected Price Movements

预期的价格走势

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $45.0 to $85.0 for Shopify during the past quarter.

分析这些合约的交易量和未平仓合约,大型企业似乎一直在关注Shopify在过去一个季度的价格范围从45.0美元到85.0美元不等。

Volume & Open Interest Development

交易量和未平仓合约的发展

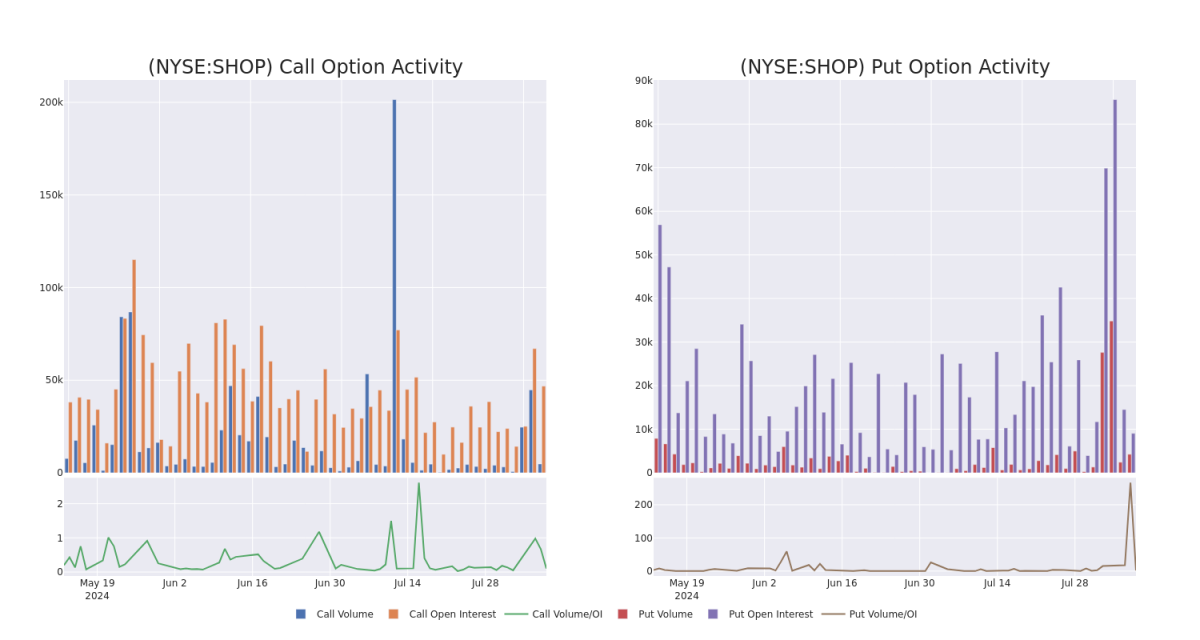

In today's trading context, the average open interest for options of Shopify stands at 2427.78, with a total volume reaching 9,029.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Shopify, situated within the strike price corridor from $45.0 to $85.0, throughout the last 30 days.

在当今的交易背景下,Shopify期权的平均未平仓合约为2427.78,总交易量达到9,029.00。随附的图表描绘了过去30天Shopify高价值交易的看涨和看跌期权交易量以及未平仓合约的变化,行使价走势从45.0美元到85.0美元不等。

Shopify Option Activity Analysis: Last 30 Days

Shopify 期权活动分析:过去 30 天

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SHOP | CALL | TRADE | BEARISH | 03/21/25 | $6.6 | $6.3 | $6.4 | $80.00 | $317.4K | 916 | 563 |

| SHOP | CALL | TRADE | BULLISH | 01/17/25 | $11.65 | $11.55 | $11.65 | $60.00 | $116.5K | 4.4K | 100 |

| SHOP | PUT | SWEEP | BEARISH | 01/17/25 | $2.96 | $2.94 | $2.94 | $55.00 | $89.1K | 4.3K | 2.0K |

| SHOP | CALL | TRADE | BEARISH | 08/16/24 | $0.6 | $0.55 | $0.55 | $70.00 | $56.4K | 10.8K | 2.0K |

| SHOP | CALL | SWEEP | BULLISH | 09/20/24 | $22.5 | $22.35 | $22.5 | $45.00 | $56.2K | 280 | 30 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 商店 | 打电话 | 贸易 | 粗鲁的 | 03/21/25 | 6.6 美元 | 6.3 美元 | 6.4 美元 | 80.00 美元 | 317.4 万美元 | 916 | 563 |

| 商店 | 打电话 | 贸易 | 看涨 | 01/17/25 | 11.65 美元 | 11.55 美元 | 11.65 美元 | 60.00 美元 | 116.5 万美元 | 4.4K | 100 |

| 商店 | 放 | 扫 | 粗鲁的 | 01/17/25 | 2.96 美元 | 2.94 美元 | 2.94 美元 | 55.00 美元 | 89.1 万美元 | 4.3K | 2.0K |

| 商店 | 打电话 | 贸易 | 粗鲁的 | 08/16/24 | 0.6 美元 | 0.55 美元 | 0.55 美元 | 70.00 美元 | 56.4 万美元 | 10.8K | 2.0K |

| 商店 | 打电话 | 扫 | 看涨 | 09/20/24 | 22.5 美元 | 22.35 美元 | 22.5 美元 | 45.00 美元 | 56.2 万美元 | 280 | 30 |

About Shopify

关于 Shopi

Shopify offers an e-commerce platform primarily to small and medium-size businesses. The firm has two segments. The subscription solutions segment allows Shopify merchants to conduct e-commerce on a variety of platforms, including the company's website, physical stores, pop-up stores, kiosks, social networks (Facebook), and Amazon. The merchant solutions segment offers add-on products for the platform that facilitate e-commerce and include Shopify Payments, Shopify Shipping, and Shopify Capital.

Shopify 主要为中小型企业提供电子商务平台。该公司有两个部门。订阅解决方案部门允许 Shopify 商家在各种平台上进行电子商务,包括公司的网站、实体店、快闪店、自助服务亭、社交网络 (Facebook) 和亚马逊。商家解决方案部门为该平台提供促进电子商务的附加产品,包括Shopify Payments、Shopify Shipping和Shopify Capital。

In light of the recent options history for Shopify, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于Shopify最近的期权历史,现在应该将重点放在公司本身上。我们的目标是探索其目前的表现。

Where Is Shopify Standing Right Now?

Shopify 现在的立场在哪里?

- Trading volume stands at 15,068,570, with SHOP's price up by 7.28%, positioned at $68.54.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 84 days.

- 交易量为15,068,570美元,其中SHOP的价格上涨了7.28%,为68.54美元。

- RSI指标显示该股可能接近超买。

- 预计将在84天内公布财报。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $45.0 to $85.0 for Shopify during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $45.0 to $85.0 for Shopify during the past quarter.