Decoding Constellation Energy's Options Activity: What's the Big Picture?

Decoding Constellation Energy's Options Activity: What's the Big Picture?

Whales with a lot of money to spend have taken a noticeably bullish stance on Constellation Energy.

资金充沛的鲸鱼在Constellation Energy方面采取了明显看好的立场。

Looking at options history for Constellation Energy (NASDAQ:CEG) we detected 8 trades.

查看Constellation Energy(纳斯达克:CEG)期权历史记录,我们检测到8次交易。

If we consider the specifics of each trade, it is accurate to state that 62% of the investors opened trades with bullish expectations and 25% with bearish.

如果我们考虑每一笔交易的具体情况,可以准确地说有62%的投资者持看好预期开仓,25%的投资者持看淡预期开仓。

From the overall spotted trades, 5 are puts, for a total amount of $367,290 and 3, calls, for a total amount of $136,970.

从所有发现的交易中,5次为看跌期权,总金额为367,290美元,而3次为看涨期权,总金额为136,970美元。

Expected Price Movements

预期价格波动

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $155.0 to $220.0 for Constellation Energy over the last 3 months.

考虑这些合同的成交量和未平仓合约数量,显示过去3个月鲸鱼一直将Constellation Energy的目标价区间定为155.0至220.0美元。

Volume & Open Interest Trends

成交量和未平仓量趋势

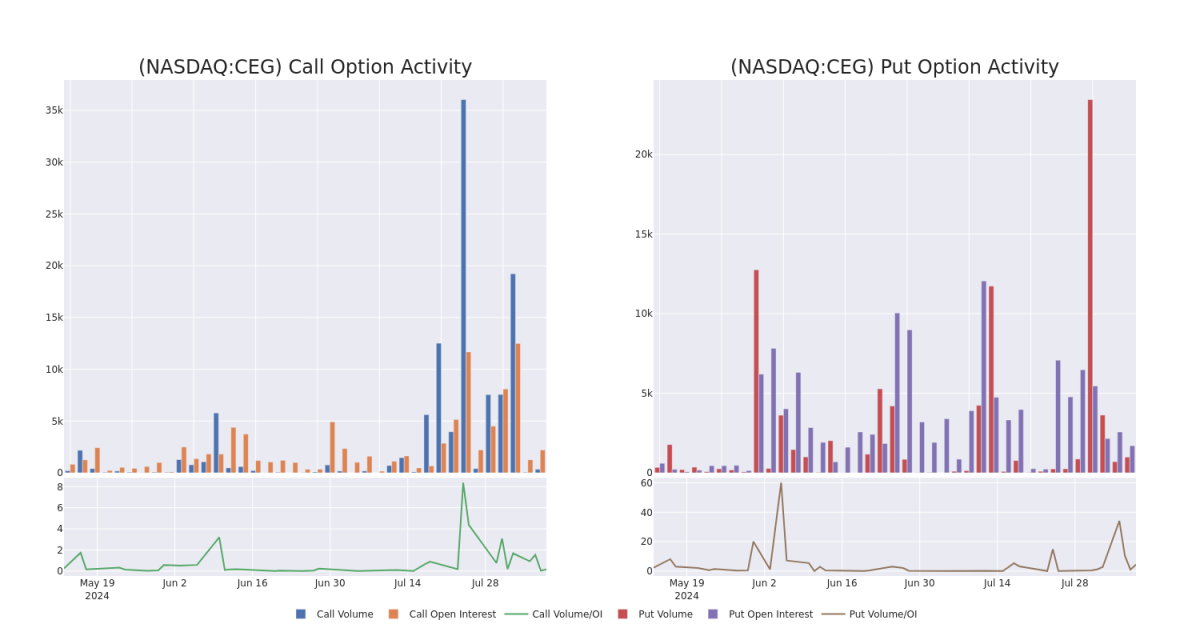

In today's trading context, the average open interest for options of Constellation Energy stands at 780.4, with a total volume reaching 1,312.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Constellation Energy, situated within the strike price corridor from $155.0 to $220.0, throughout the last 30 days.

在当今的交易环境中,Constellation Energy期权的平均未平仓合约数量为780.4,总成交量达到1,312.00。附带的图表描述了过去30天内Constellation Energy高价值交易的看跌和看涨期权成交量和未平仓合约的变化,这些交易位于155.0至220.0美元的行权价格走廊内。

Constellation Energy Call and Put Volume: 30-Day Overview

Constellation Energy看涨和看跌期权的成交量概述:30天。

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | PUT | TRADE | BULLISH | 11/15/24 | $9.4 | $8.9 | $8.9 | $155.00 | $120.1K | 221 | 555 |

| CEG | PUT | SWEEP | BEARISH | 11/15/24 | $8.8 | $8.6 | $8.8 | $155.00 | $107.3K | 221 | 183 |

| CEG | CALL | SWEEP | BULLISH | 08/16/24 | $3.6 | $3.5 | $3.6 | $190.00 | $72.0K | 1.3K | 260 |

| CEG | PUT | SWEEP | NEUTRAL | 11/15/24 | $8.8 | $8.7 | $8.8 | $155.00 | $65.1K | 221 | 181 |

| CEG | PUT | TRADE | BULLISH | 11/15/24 | $9.1 | $8.8 | $8.8 | $155.00 | $49.2K | 221 | 51 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | 看跌 | 交易 | 看好 | 11/15/24 | 9.4美元 | $8.9 | $8.9 | $155.00 | $120.1K | 221 | 555 |

| CEG | 看跌 | SWEEP | 看淡 | 11/15/24 | $ 8.8 | $8.6美元 | $ 8.8 | $155.00 | $107.3K | 221 | 183 |

| CEG | 看涨 | SWEEP | 看好 | 08/16/24 | $3.6 | $3.5 | $3.6 | $190.00 | $72.0K | 1.3K | 260 |

| CEG | 看跌 | SWEEP | 中立 | 11/15/24 | $ 8.8 | $8.7 | $ 8.8 | $155.00 | $65.1K | 221 | 181 |

| CEG | 看跌 | 交易 | 看好 | 11/15/24 | $9.1 | $ 8.8 | $ 8.8 | $155.00 | $49.2千 | 221 | 51 |

About Constellation Energy

Constellation Energy

Constellation Energy Corp offers energy solutions. It provides clean energy and sustainable solutions to homes, businesses, the public sector, community aggregations, and a range of wholesale customers (such as municipalities, cooperatives, and other strategics). The company offers comprehensive energy solutions and a variety of pricing options for electric, natural gas, and renewable energy products for companies of any size.

Constellation Energy Corp提供能源解决方案。它为家庭、企业、公共部门、社区集合体和各种批发客户(如市政当局、合作社和其他战略客户)提供清洁能源和可持续解决方案。公司为各种规模的企业提供综合能源解决方案和各种定价选项,包括电力、天然气和可再生能源产品。

Having examined the options trading patterns of Constellation Energy, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在检查了Constellation Energy的期权交易模式后,我们的注意力现在直接转向该公司。这个转变使我们深入了解其现在的市场位置和表现。

Current Position of Constellation Energy

Constellation Energy的当前位置

- With a trading volume of 3,143,933, the price of CEG is up by 4.1%, reaching $187.03.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 88 days from now.

- 在交易量为3,143,933时,CEG的价格上涨了4.1%,达到了187.03美元。

- 目前的RSI值表明该股票目前处于超买和超卖之间的中立状态。

- 下一次盈利报告将在88天后发布。

Professional Analyst Ratings for Constellation Energy

Constellation Energy的专业分析师评级

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $217.66666666666666.

在过去30天中,共有3位专业分析师对该股票给出了他们的看法,设定了平均价格目标为217.66666666666666美元。

- In a cautious move, an analyst from Barclays downgraded its rating to Overweight, setting a price target of $211.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Constellation Energy, targeting a price of $212.

- Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Constellation Energy with a target price of $230.

- 巴克莱银行的一位分析师在谨慎的行动中将其评级下调为增持,并制定了211美元的价格目标。

- 艾佛里公司的一位分析师继续持有对Constellation Energy的跑赢大盘评级,目标价为212美元。

- 瑞士银行的一位分析师保持对Constellation Energy的买入评级,目标价为230美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Constellation Energy options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在回报。精明的交易员通过不断教育自己,调整策略,监控多个指标,并密切关注市场变动来管理这些风险。通过Benzinga Pro及时获得Constellation Energy期权交易的最新信息。