S&P 500 Closes 2.3% Higher, Notches Best Session Since January 2023: Fed's Barkin Downplays Unemployment Concerns

S&P 500 Closes 2.3% Higher, Notches Best Session Since January 2023: Fed's Barkin Downplays Unemployment Concerns

Wall Street ended Thursday's session on a positive note, extending midday gains and breaking the recent trend of afternoon declines. Investor sentiment was bolstered by lower-than-expected initial jobless claims last week, alleviating fears of a more structural increase in unemployment potentially leading to a recession.

周四收盘时,华尔街以积极的姿态结束了今天的交易,延续了午间涨势,并打破了近期下午下跌的趋势。较上周初,初次申领失业救济金的人数低于预期,这缓解了人们对失业率可能出现结构性增长并导致经济衰退的担忧,投资者情绪得到了提振。

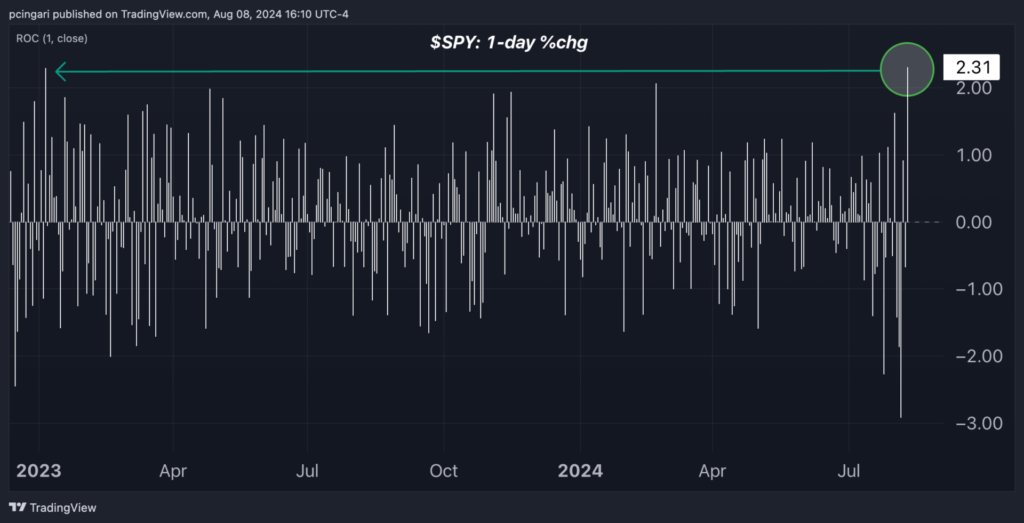

The S&P 500 index, as tracked by the SPDR S&P 500 ETF Trust (NYSE:SPY), closed Thursday's session up 2.3%, marking its best daily performance since January 2023.

标普500指数,由SPDR标普500ETF信托(纽约证券交易所: SPY)跟踪,周四收盘上涨2.3%,为自2023年1月以来最佳日绩效表现。

The tech-heavy Nasdaq 100 index, tracked by the Invesco QQQ Trust (NASDAQ:QQQ), closed 3.1% higher, marking its best daily performance since February 2023. Despite this rise, the Nasdaq 100 remains 5% below last Thursday's opening levels but has rallied 5.7% from Monday's lows.

以科技为重心的nasdaq 100指数,由纳斯达克100ETF-Invesco QQQ Trust(NASDAQ:QQQ)跟踪,收盘上涨3.1%,创下自2023年2月以来的最佳日绩效表现。尽管出现上涨,纳斯达克100仍低于上周四的开盘水平5%,但已从周一的低位反弹5.7%。

Within tech stocks, Arm Holdings plc (NASDAQ:ARM) and Marvell Technologies Inc. (NASDAQ:MRVL) were the day's top performers, up 10.6% and 8.9%, respectively.

在科技股中,Arm Holdings plc(NASDAQ:ARM)和Marvell Technologies Inc.(NASDAQ:MRVL)是当天的最佳表现者,分别上涨10.6%和8.9%。

Strong gains were also observed in both blue-chip stocks, with the Dow Jones Industrial Average up 1.8%, and small caps, with the iShares Russell 2000 ETF (NYSE:IWM) up 2.4%.

在蓝筹股和小盘股上也观察到了强劲的涨势,道琼斯工业平均指数上涨1.8%,而iShares Russell 2000 ETF(纽约证券交易所:IWM)上涨2.4%。

Chart: S&P 500 Marks Best Session In 19 Months

图:标普500标记了19个月内最佳交易日

Fed's Barkin Pushes Back Against Labor Market Crisis

Fed的Barkin反击劳动市场危机

Richmond Fed President Tom Barkin, a voting member of the Federal Open Market Committee in 2024, provided key insights during a National Association for Business Economics (NABE) call on Thursday.

美联储联邦公开市场委员会(FOMC)2024年投票成员、 Richmond Fed主席Tom Barkin在周四全国商业经济学家协会(NABE)会议上提供了关键见解。

Barkin highlighted while companies are slowing their hiring, they are simultaneously not engaging in significant layoffs.

Barkin强调,虽然公司正在放缓招聘,但同时不会进行重大裁员。

This cautious approach by businesses is reflected in the jobless claims data, which indicate that layoffs are not increasing. Many employers are hesitant to lay off workers remembering the difficulties they faced in hiring two years ago.

企业采取的这种谨慎态度反映在失业救济金数据中,这表明裁员并未增加。许多雇主不愿解雇员工,记得两年前雇人困难。

Barkin described the economy as "gently moving into a normalizing state," which he believes will allow for a steady and deliberate normalization of interest rates.

Barkin将经济形容为“缓慢地进入正常化状态”,他认为这将允许利率稳步、审慎地正常化。

The Richmond Fed President observed that spending patterns are changing. Consumers are still spending but are becoming more selective. Businesses that have raised prices significantly are noticing a more discerning customer base.

Richmond Fed主席观察到,支出模式正在发生变化。消费者仍在消费,但变得更加挑剔。涨价显著的企业注意到消费者更有分辨能力。

"Consumers are still spending, but they're choosing," Barkin said, indicating a shift towards more value-based purchasing decisions.

Barkin表示:“消费者仍在消费,但他们在选择。”这表明购买决策正在从物价到价值的转变。

"While inflation is down, prices are still high and I think there are indicators of a choosier customer. And that's the solution to high prices."

Barkin说:“尽管通货膨胀下降了,但价格仍然很高,我认为有挑剔的客户表现出了指标。这是高价格的解决方案。”

According to Barkin, inflation is still higher than desired. "The inflation numbers, if you look at those six months of the year, I would categorize them as too disappointing."

根据Barkin的说法,通货膨胀仍然高于预期水平。 “通货膨胀率,如果看看那半年年南北,我会将其归为太令人失望了。”

He stressed that while there has been progress, the rate of inflation needs to decline further to align with the Federal Reserve's targets. Barkin also cautioned about medium-term inflationary pressures. Potential conflicts in the Middle East could impact oil prices, and limited housing supply remains a concern.

他强调,虽然已经取得了一定进展,但通货膨胀率需要进一步下降,以与美联储的目标相一致。Barkin还对中东地区存在的潜在冲突和住房供应不足问题提出了警告,称这可能会影响油价。

Barkin highlighted the importance of monitoring the labor market and inflation data closely in the coming weeks, before making a decision on whether to cut rates in September.

Barkin强调,需要在未来的几周密切监测劳动力市场和通货膨胀数据,然后决定是否在9月份降息。

Read Now:

立即阅读:

- Mortgage Rates Fall To Lowest Level In Over A Year, Ease Pressure On Homebuyers: 'Good News For Home Price Appreciation'

- 房贷利率降至一年多以来的最低水平,减轻了购房者的压力:“对于房价的升值来说是个好消息”

Within tech stocks,

Within tech stocks,