Decoding PayPal Holdings's Options Activity: What's the Big Picture?

Decoding PayPal Holdings's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bearish move on PayPal Holdings. Our analysis of options history for PayPal Holdings (NASDAQ:PYPL) revealed 20 unusual trades.

金融巨头对PayPal控股公司采取了明显的看跌举动。我们对PayPal控股公司(纳斯达克股票代码:PYPL)期权历史的分析显示了20笔不寻常的交易。

Delving into the details, we found 40% of traders were bullish, while 55% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $172,243, and 17 were calls, valued at $6,173,877.

深入研究细节,我们发现40%的交易者看涨,而55%的交易者表现出看跌倾向。在我们发现的所有交易中,有3笔是看跌期权,价值为172,243美元,17笔是看涨期权,价值6,173,877美元。

Predicted Price Range

预测的价格区间

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $62.5 to $70.0 for PayPal Holdings over the recent three months.

根据交易活动,看来主要投资者的目标是在最近三个月中将PayPal Holdings的价格区间从62.5美元扩大到70.0美元。

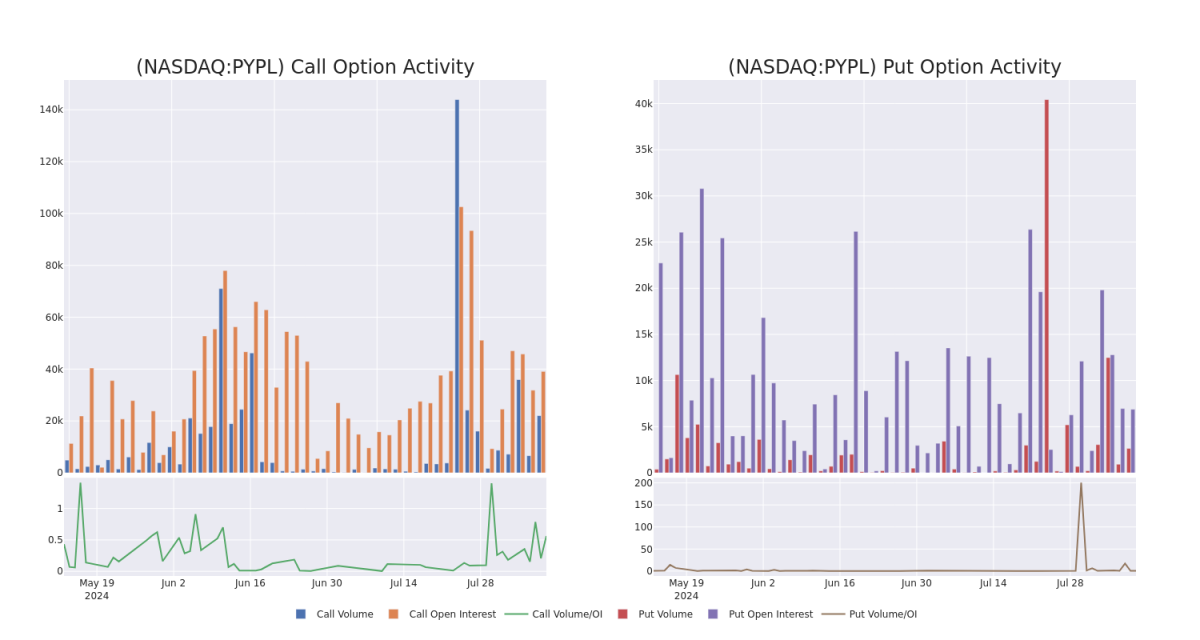

Volume & Open Interest Trends

交易量和未平仓合约趋势

In today's trading context, the average open interest for options of PayPal Holdings stands at 4598.8, with a total volume reaching 24,687.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in PayPal Holdings, situated within the strike price corridor from $62.5 to $70.0, throughout the last 30 days.

在当今的交易背景下,PayPal控股期权的平均未平仓合约为4598.8,总交易量达到24,687.00。随附的图表描绘了过去30天PayPal Holdings高价值交易的看涨和看跌期权交易量以及未平仓合约的变化,行使价走势从62.5美元到70.0美元不等。

PayPal Holdings Option Activity Analysis: Last 30 Days

PayPal Holdings 期权活动分析:过去 30 天

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | CALL | TRADE | BULLISH | 12/18/26 | $18.25 | $17.7 | $18.4 | $65.00 | $5.2M | 6.8K | 25 |

| PYPL | CALL | TRADE | BEARISH | 12/18/26 | $17.85 | $17.75 | $17.75 | $65.00 | $243.1K | 6.8K | 3.3K |

| PYPL | PUT | SWEEP | BULLISH | 03/21/25 | $6.7 | $6.7 | $6.7 | $65.00 | $90.4K | 2.1K | 335 |

| PYPL | CALL | TRADE | BULLISH | 12/18/26 | $17.75 | $16.5 | $17.7 | $65.00 | $88.5K | 6.8K | 3.0K |

| PYPL | CALL | TRADE | BULLISH | 10/18/24 | $5.55 | $5.5 | $5.55 | $62.50 | $49.9K | 3.0K | 25 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | 打电话 | 贸易 | 看涨 | 12/18/26 | 18.25 美元 | 17.7 美元 | 18.4 美元 | 65.00 美元 | 520 万美元 | 6.8K | 25 |

| PYPL | 打电话 | 贸易 | 粗鲁的 | 12/18/26 | 17.85 美元 | 17.75 美元 | 17.75 美元 | 65.00 美元 | 243.1 万美元 | 6.8K | 3.3K |

| PYPL | 放 | 扫 | 看涨 | 03/21/25 | 6.7 美元 | 6.7 美元 | 6.7 美元 | 65.00 美元 | 90.4 万美元 | 2.1K | 335 |

| PYPL | 打电话 | 贸易 | 看涨 | 12/18/26 | 17.75 美元 | 16.5 美元 | 17.7 美元 | 65.00 美元 | 88.5 万美元 | 6.8K | 3.0K |

| PYPL | 打电话 | 贸易 | 看涨 | 10/18/24 | 5.55 美元 | 5.5 美元 | 5.55 美元 | 62.50 美元 | 49.9 万美元 | 3.0K | 25 |

About PayPal Holdings

关于 PayPal 控股

PayPal was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform.

PayPal于2015年从eBay分拆出来,为商家和消费者提供电子支付解决方案,重点是在线交易。截至2023年底,该公司拥有4.26亿个活跃账户。该公司还拥有人对人支付平台Venmo。

In light of the recent options history for PayPal Holdings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于PayPal Holdings最近的期权历史,现在应该将重点放在公司本身上。我们的目标是探索其目前的表现。

Where Is PayPal Holdings Standing Right Now?

PayPal Holdings现在处于什么位置?

- With a trading volume of 1,612,421, the price of PYPL is up by 1.3%, reaching $65.12.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 82 days from now.

- PYPL的交易量为1,612,421美元,价格上涨了1.3%,达到65.12美元。

- 当前的RSI值表明该股可能已接近超买。

- 下一份收益报告定于即日起82天后发布。

Professional Analyst Ratings for PayPal Holdings

PayPal控股的专业分析师评级

In the last month, 5 experts released ratings on this stock with an average target price of $82.8.

上个月,5位专家发布了该股的评级,平均目标价为82.8美元。

- An analyst from Susquehanna has decided to maintain their Positive rating on PayPal Holdings, which currently sits at a price target of $83.

- Consistent in their evaluation, an analyst from Monness, Crespi, Hardt keeps a Buy rating on PayPal Holdings with a target price of $95.

- Consistent in their evaluation, an analyst from Canaccord Genuity keeps a Buy rating on PayPal Holdings with a target price of $80.

- Consistent in their evaluation, an analyst from BMO Capital keeps a Market Perform rating on PayPal Holdings with a target price of $72.

- Reflecting concerns, an analyst from RBC Capital lowers its rating to Outperform with a new price target of $84.

- 萨斯奎哈纳的一位分析师决定维持对PayPal Holdings的正面评级,目前该公司的目标股价为83美元。

- 来自克雷斯皮蒙尼斯的一位分析师哈特在评估中保持了对PayPal Holdings的买入评级,目标价为95美元。

- Canaccord Genuity的一位分析师在评估中保持了对PayPal Holdings的买入评级,目标价为80美元。

- BMO Capital的一位分析师在评估中保持了对PayPal Holdings的市场表现评级,目标价格为72美元。

- 加拿大皇家银行资本的一位分析师将其评级下调至跑赢大盘,新的目标股价为84美元,这反映了人们的担忧。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest PayPal Holdings options trades with real-time alerts from Benzinga Pro.

期权交易带来更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。通过Benzinga Pro的实时提醒,随时了解最新的PayPal Holdings期权交易。