Smart Money Is Betting Big In Micron Technology Options

Smart Money Is Betting Big In Micron Technology Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Micron Technology.

有很多资金可以使用的庄家对美光科技采取了明显看好的态度。

Looking at options history for Micron Technology (NASDAQ:MU) we detected 65 trades.

查看美光科技(纳斯达克:MU)期权历史记录,我们发现了65笔交易。

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 43% with bearish.

如果我们考虑每笔交易的具体情况,则可以准确地说明44%的投资者带着看涨的预期开展交易,43%的投资者则带着看淡的预期。

From the overall spotted trades, 31 are puts, for a total amount of $2,131,828 and 34, calls, for a total amount of $2,306,452.

从所有被发现的交易中,31项为认沽权证,总金额为2,131,828美元;34项为认购权证,总金额为2,306,452美元。

What's The Price Target?

目标价是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $40.0 to $150.0 for Micron Technology during the past quarter.

分析这些合约的成交量和持仓量,似乎在过去一个季度中,大型投资者一直在关注美光科技在40至150美元的价格区间内。

Insights into Volume & Open Interest

成交量和持仓量分析

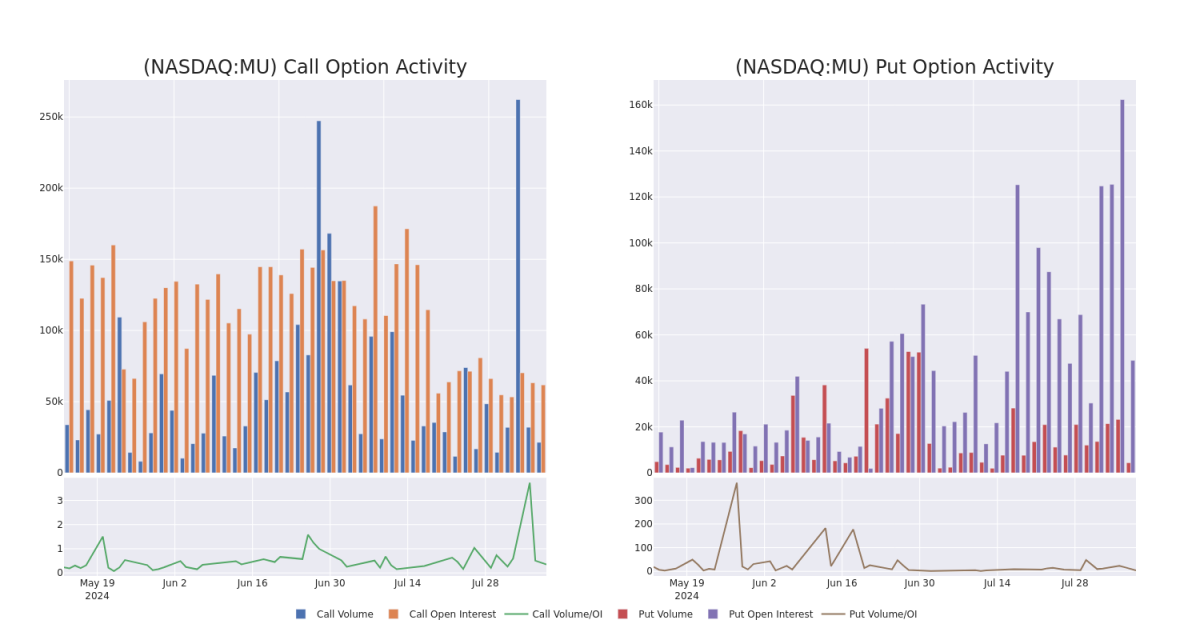

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Micron Technology's options for a given strike price.

这些数据可以帮助您跟踪给定行权价的美光科技期权的流动性和利率。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Micron Technology's whale activity within a strike price range from $40.0 to $150.0 in the last 30 days.

下面,我们可以观察到美光科技的整个鲸鱼活动的认购和认沽的成交量和持仓量的演变,分别在40美元至150美元的行权价格范围内,持续30天。

Micron Technology Option Activity Analysis: Last 30 Days

美光科技期权活动分析:过去30天

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MU | CALL | SWEEP | BEARISH | 09/20/24 | $9.05 | $8.95 | $8.99 | $90.00 | $448.7K | 5.0K | 630 |

| MU | PUT | TRADE | BEARISH | 01/17/25 | $2.13 | $2.08 | $2.13 | $62.50 | $362.1K | 3.3K | 1.7K |

| MU | PUT | SWEEP | BEARISH | 01/16/26 | $25.15 | $24.8 | $25.15 | $105.00 | $196.1K | 1.2K | 91 |

| MU | PUT | SWEEP | NEUTRAL | 10/18/24 | $6.9 | $6.85 | $6.85 | $90.00 | $137.0K | 2.3K | 213 |

| MU | CALL | SWEEP | BEARISH | 08/30/24 | $5.5 | $5.35 | $5.45 | $93.00 | $130.8K | 23 | 378 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 美光 | 看涨 | SWEEP | 看淡 | 09/20/24 | $9.05 | $8.95 | $8.99 | $90.00 | $448.7K | 5.0K | 630 |

| 美光 | 看跌 | 交易 | 看淡 | 01/17/25 | $2.13 | $2.08 | $2.13 | $62.50 | $362.1K | 3.3K | 1.7K |

| 美光 | 看跌 | SWEEP | 看淡 | 01/16/26 | $25.15 | $24.8 | $25.15 | $105.00 | $196.1K | 1.2K | 91 |

| 美光 | 看跌 | SWEEP | 中立 | 10/18/24 | $6.9 | $6.85 | $6.85 | $90.00 | $137.0K | 2.3K | 213 |

| 美光 | 看涨 | SWEEP | 看淡 | 08/30/2024 | $5.5 | $5.35 | $5.45 | 93.00美元 | $130.8K | 23 | 378 |

About Micron Technology

关于美光科技

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

美光科技是世界上最大的半导体公司之一,专门从事存储芯片。其主要营业收入来自动态随机存取存储器(DRAM),它还少量接触与或非(NAND)闪存芯片。美光科技服务于全球用户,将芯片销售到数据中心、移动电话、消费电子、工业和汽车应用中。该公司具有垂直一体化优势。

Having examined the options trading patterns of Micron Technology, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在分析了美光科技的期权交易模式后,我们现在将直接转向该公司。这种转变可以让我们深入了解其现在的市场地位和表现

Micron Technology's Current Market Status

美光科技当前市场状态

- Trading volume stands at 15,218,341, with MU's price up by 1.4%, positioned at $93.36.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 47 days.

- 成交量为15,218,341,MU的价格上涨了1.4%,位于93.36美元。

- RSI指标显示该股票可能已被超卖。

- 财报公布还有47天。

Professional Analyst Ratings for Micron Technology

美光科技的专业分析师评级

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $145.0.

在过去的30天中,共有1位专业分析师对该股票发表了自己的看法,并确定了平均目标价格为145.0美元。

- Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on Micron Technology with a target price of $145.

- 一位来自Keybanc的分析师对美光科技给出了一致的评价,保持了看涨评级,并设定了145美元的目标价。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。