This Is Why Kin Shing Holdings Limited's (HKG:1630) CEO Compensation Looks Appropriate

This Is Why Kin Shing Holdings Limited's (HKG:1630) CEO Compensation Looks Appropriate

Key Insights

主要见解

- Kin Shing Holdings to hold its Annual General Meeting on 16th of August

- Total pay for CEO Dik Cheung Chow includes HK$1.11m salary

- The total compensation is 50% less than the average for the industry

- Kin Shing Holdings' EPS declined by 51% over the past three years while total shareholder loss over the past three years was 76%

- 建盛控股将于8月16日举行其年度股东大会。

- CEO Dik Cheung Chow的总薪酬包括111万港元的年薪。

- 总补偿比行业平均水平低了50%。

- 建盛控股的每股收益在过去三年中下降了51%,而股东的总亏损在过去三年中达到了76%。

Performance at Kin Shing Holdings Limited (HKG:1630) has been rather uninspiring recently and shareholders may be wondering how CEO Dik Cheung Chow plans to fix this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 16th of August. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We think CEO compensation looks appropriate given the data we have put together.

建盛控股有限公司(HKG:1630)的业绩近期表现不佳,股东们可能想知道CEO Dik Cheung Chow打算如何解决这个问题。他们可以通过在即将到来的8月16日的股东大会上投票表决决议,比如执行薪酬。投票表决薪酬可能是影响管理层的有力方式,因为研究表明,正确的薪酬激励有助于提高公司业绩。我们认为根据我们整理的数据,CEO薪酬看起来是合适的。

Comparing Kin Shing Holdings Limited's CEO Compensation With The Industry

与行业相比,建盛控股的CEO薪酬

Our data indicates that Kin Shing Holdings Limited has a market capitalization of HK$38m, and total annual CEO compensation was reported as HK$1.1m for the year to March 2024. That's a modest increase of 4.0% on the prior year. We note that the salary portion, which stands at HK$1.11m constitutes the majority of total compensation received by the CEO.

我们的数据显示,建盛控股有限公司的市值为3800万港元,截至2024年3月的年度总CEO薪酬报告为110万港元。与上一年相比,这是一个适度的增长,增长了4.0%。我们注意到,薪水部分,即111万港元,占CEO总补偿的大部分。

In comparison with other companies in the Hong Kong Construction industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$2.3m. In other words, Kin Shing Holdings pays its CEO lower than the industry median.

与香港市值低于16亿港币的其他建筑行业公司相比,CEO总薪酬的报告中位数为230万元,也就是说,建盛控股支付给其CEO的薪酬低于行业中位数。

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$1.1m | HK$1.1m | 98% |

| Other | HK$18k | HK$18k | 2% |

| Total Compensation | HK$1.1m | HK$1.1m | 100% |

| 组成部分 | 2024 | 2023 | 比例(2024年) |

| 薪资 | 110万港元 | 110万港元 | 98% |

| 其他 | HK$18k | HK$18k | 2% |

| 总补偿 | 110万港元 | 110万港元 | 100% |

On an industry level, around 84% of total compensation represents salary and 16% is other remuneration. Kin Shing Holdings pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

在行业层面上,约84%的总薪酬是薪水,16%是其他报酬。建盛控股支付高薪,更注重薪酬的这一方面,与非薪酬支付相比。如果薪酬成为总薪酬的主导因素,这意味着CEO的薪酬倾向于不受变量因素的影响,而这通常与业绩挂钩。

Kin Shing Holdings Limited's Growth

建盛控股的发展

Over the last three years, Kin Shing Holdings Limited has shrunk its earnings per share by 51% per year. It achieved revenue growth of 162% over the last year.

在过去三年中,建盛控股的每股收益年均下降了51%,但在过去一年中实现了162%的营业收入增长。

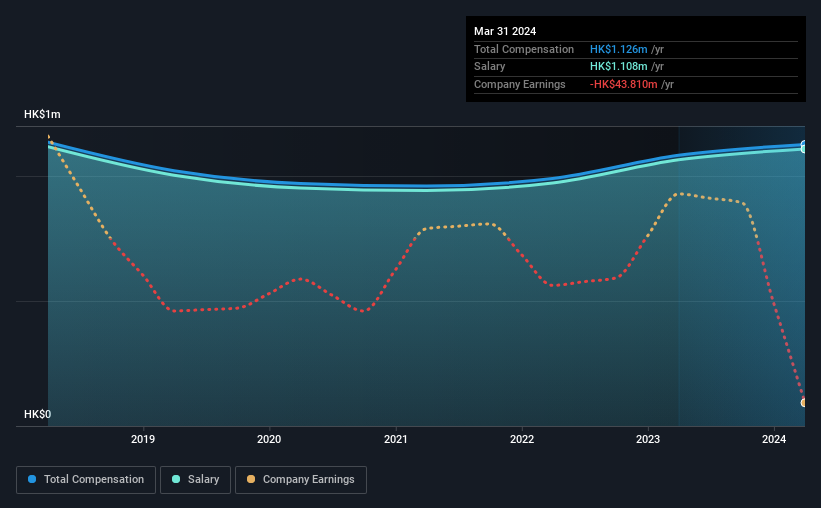

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

在过去三年中,EPS的下降可以说是令人担忧的。另一方面,强劲的营业收入增长表明该业务正在增长。总之,我们无法对业务绩效形成强烈的看法,但这是值得关注的。我们没有分析师的预测,但您可以通过查看更详细的历史收益,营业收入和现金流图表来更好地了解其增长情况。

Has Kin Shing Holdings Limited Been A Good Investment?

建盛控股是否是一个良好的投资?

With a total shareholder return of -76% over three years, Kin Shing Holdings Limited shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

在过去三年中,建盛控股股东的总回报率为-76%,大多数股东可能会感到失望。这表明给CEO过于慷慨的报酬可能是不明智的。

In Summary...

总之……

Kin Shing Holdings pays its CEO a majority of compensation through a salary. The fact that shareholders have earned a negative share price return is certainly disconcerting. The poor performance of the share price might have something to do with the lack of earnings growth. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board's judgement and decision-making is aligned with their expectations.

建盛控股通过薪水为其CEO支付了大部分的报酬。股东获得负的股价回报是令人不安的事实。股价表现的不佳可能与盈利增长不足有关。即将举行的股东大会将为股东提供机会,持股人可以提出自己的问题并评估该董事会的判断和决策是否符合他们的期望。

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for Kin Shing Holdings that investors should think about before committing capital to this stock.

虽然关注CEO薪酬很重要,但投资者也应考虑业务的其他方面。这就是为什么我们挖掘了一些有关建盛控股的警告迹象,投资者在向这只股票投资前应谨慎考虑这些因素。

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

当然,你可能会通过观察其他股票的不同涨跌幅来找到一笔不错的投资。所以,可以看一下这个有趣的公司的免费列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

On an industry level, around 84% of total compensation represents salary and 16% is other remuneration. Kin Shing Holdings pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

On an industry level, around 84% of total compensation represents salary and 16% is other remuneration. Kin Shing Holdings pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.