Investors Might Be Losing Patience for Crinetics Pharmaceuticals' (NASDAQ:CRNX) Increasing Losses, as Stock Sheds 4.3% Over the Past Week

Investors Might Be Losing Patience for Crinetics Pharmaceuticals' (NASDAQ:CRNX) Increasing Losses, as Stock Sheds 4.3% Over the Past Week

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right stock, you can make a lot more than 100%. Take, for example Crinetics Pharmaceuticals, Inc. (NASDAQ:CRNX). Its share price is already up an impressive 188% in the last twelve months. On the other hand, we note it's down 9.8% in about a month. We note that the broader market is down 4.9% in the last month, and this may have impacted Crinetics Pharmaceuticals' share price. And shareholders have also done well over the long term, with an increase of 114% in the last three years.

投资存在风险,公司可能会破产。但如果你能选择正确的股票,你可以获得超过100%的收益。例如,Crinetics Pharmaceuticals,Inc.(NASDAQ:CRNX)的股价在最近12个月里已经上涨了惊人的188%。然而,我们注意到在一个月左右的时间里,股价下跌了9.8%。我们注意到,在过去一个月里,整个市场下跌了4.9%,这可能影响了Crinetics Pharmaceuticals的股价。此外,股东们在长期内也赚得不错,过去三年里增长了114%。

Since the long term performance has been good but there's been a recent pullback of 4.3%, let's check if the fundamentals match the share price.

由于长期表现良好,但最近有所回落,下跌了4.3%,让我们检查基本面是否符合股价。

With just US$1,385,000 worth of revenue in twelve months, we don't think the market considers Crinetics Pharmaceuticals to have proven its business plan. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Crinetics Pharmaceuticals has the funding to invent a new product before too long.

在过去的12个月中,Crinetics Pharmaceuticals的营业收入仅有138.5万美元,我们认为市场并没有认为Crinetics Pharmaceuticals已证明其商业计划。因此,投资者们似乎更加关注可能发生的事情,而不是当前的收入(或缺乏收入)。Crinetics Pharmaceuticals有可能有些股东认为该公司有资金在不久的将来发明新产品。

Companies that lack both meaningful revenue and profits are usually considered high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Of course, if you time it right, high risk investments like this can really pay off, as Crinetics Pharmaceuticals investors might know.

通常被认为缺乏实质性营业收入和利润的公司具有高风险,通常有很大的机会需要更多的资金来进行业务发展,他们需要依靠资本市场来筹集股权资金。因此,股票价格本身影响着股票的价值(因为它决定了资本成本)。虽然像这样的一些公司后来会实现计划,为股东赚取可观的收益,但很多公司都以痛苦的亏损和最终退市告终。当然,如果你恰好把握好了时机,像Crinetics Pharmaceuticals的投资者们可能真的可以获得高风险投资所带来的收益。

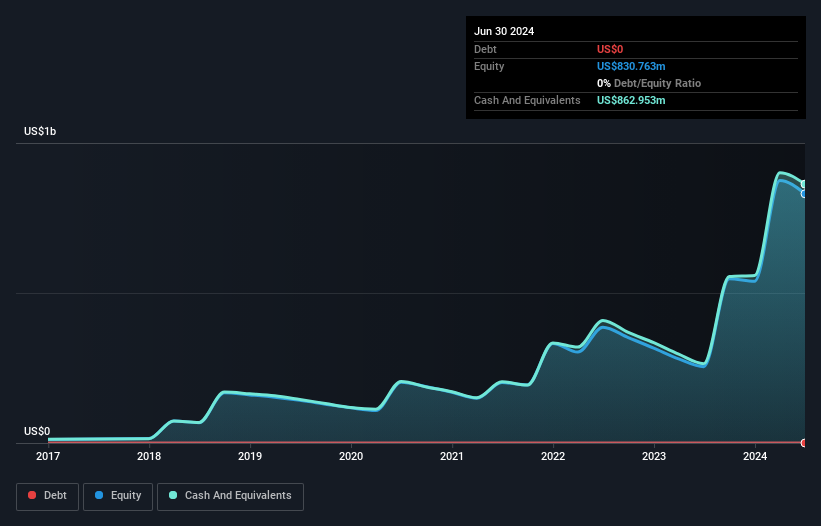

Crinetics Pharmaceuticals has plenty of cash in the bank, with cash in excess of all liabilities sitting at US$758m, when it last reported (June 2024). This gives management the flexibility to drive business growth, without worrying too much about cash reserves. And with the share price up 75% in the last year , the market is focussed on that blue sky potential. You can click on the image below to see (in greater detail) how Crinetics Pharmaceuticals' cash levels have changed over time.

Crinetics Pharmaceuticals在银行有充足的现金,上次报告时,超过所有负债的现金达到7,580万美元(2024年6月)。这为管理层提供了驱动业务增长的灵活性,不必过多担心现金储备。随着过去一年该股票价格上涨了75%,市场关注的是这一蓝天潜力。你可以点击下面的图片查看Crinetics Pharmaceuticals的现金水平如何随时间变化(详细)。

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. However you can take a look at whether insiders have been buying up shares. It's often positive if so, assuming the buying is sustained and meaningful. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

投资一家连营收都没有的公司可能存在极高的风险,它的价值不易确定。但你可以查看内部人员是否一直在买卖股票,这通常是积极的,如果购买是持续和有意义的话。幸运的是,我们有一份内部人员买卖股票的图表,供你免费查看。

A Different Perspective

不同的观点

It's nice to see that Crinetics Pharmaceuticals shareholders have received a total shareholder return of 188% over the last year. That's better than the annualised return of 21% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Crinetics Pharmaceuticals you should be aware of.

值得高兴的是,Crinetics Pharmaceuticals的股东在过去一年内获得了总股东回报率达188%。这比在半个十年里年化回报率21%还要好,这意味着公司最近的表现更好。鉴于股票价格势头依然强劲,重点关注该股票可能是值得的,以免失去机会。事实上,我认为长期观察股票价格作为业务表现的代理是很有意思的,但要真正获得洞察力,我们需要考虑其他信息。比如:我们已经发现Crinetics Pharmaceuticals有3个警告信号,你应该注意到。

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

当然,您可能在其他地方找到一家出色的企业进行投资。因此,请查看我们预计将实现盈利增长的公司的免费列表。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

请注意,本文所引述的市场回报反映了目前在美国交易所上市的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。