NextEra Energy's Options: A Look at What the Big Money Is Thinking

NextEra Energy's Options: A Look at What the Big Money Is Thinking

Whales with a lot of money to spend have taken a noticeably bullish stance on NextEra Energy.

有很多钱的鲸鱼对新纪元能源采取明显的看涨态度。

Looking at options history for NextEra Energy (NYSE:NEE) we detected 13 trades.

查看新纪元能源(NYSE:NEE)期权的历史,我们发现了13次交易。

If we consider the specifics of each trade, it is accurate to state that 61% of the investors opened trades with bullish expectations and 38% with bearish.

如果我们考虑每一项交易的具体情况,那么可以准确地说有61%的投资者持有看涨期望,38%则持有看淡期望。

From the overall spotted trades, 4 are puts, for a total amount of $176,267 and 9, calls, for a total amount of $442,807.

从总共发现的交易中,有4个看跌期权,总金额为176,267美元和9个看涨期权,总金额为442,807美元。

Predicted Price Range

预测价格区间

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $82.5 for NextEra Energy over the last 3 months.

考虑到这些合同的成交量和未平仓合约数,看起来鲸鱼们在过去3个月内一直在瞄准新纪元能源在70.0到82.5美元区间内的目标价。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for NextEra Energy's options for a given strike price.

这些数据可以帮助您追踪给定执行价格的新纪元能源期权的流动性和关注度。

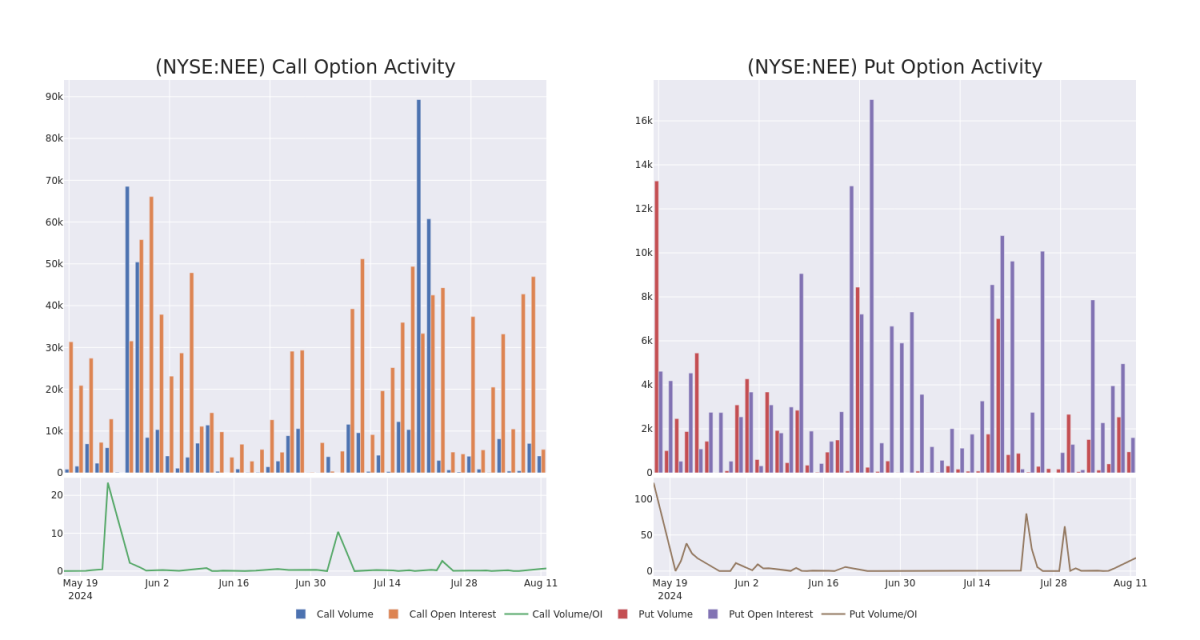

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of NextEra Energy's whale activity within a strike price range from $70.0 to $82.5 in the last 30 days.

下面,我们可以观察最近30天内所有新纪元能源鲸鱼活动中看涨期权和看跌期权的成交量和未平仓合约数的变化。

NextEra Energy Option Volume And Open Interest Over Last 30 Days

NextEra能源期权成交量和持仓量过去30天的发展情况

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NEE | CALL | SWEEP | BULLISH | 10/18/24 | $8.95 | $8.85 | $8.95 | $70.00 | $87.7K | 1.2K | 99 |

| NEE | PUT | SWEEP | BEARISH | 10/18/24 | $3.8 | $3.75 | $3.8 | $77.50 | $66.8K | 1.5K | 309 |

| NEE | CALL | SWEEP | BULLISH | 10/18/24 | $3.75 | $3.65 | $3.7 | $77.50 | $59.9K | 2.7K | 1.0K |

| NEE | CALL | SWEEP | BULLISH | 10/18/24 | $3.75 | $3.65 | $3.75 | $77.50 | $58.1K | 2.7K | 907 |

| NEE | PUT | SWEEP | BEARISH | 03/21/25 | $7.9 | $7.8 | $7.9 | $80.00 | $55.3K | 13 | 70 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NEE | 看涨 | SWEEP | 看好 | 10/18/24 | $8.95 | $8.85 | $8.95 | 70.00美元 | $87.7K | 1.2K | 99 |

| NEE | 看跌 | SWEEP | 看淡 | 10/18/24 | $3.8 | $3.75 | $3.8 | $77.50 | $66.8K | 1.5K | 309 |

| NEE | 看涨 | SWEEP | 看好 | 10/18/24 | $3.75 | $3.65 | $3.7 | $77.50 | $59.9千美元 | 2.7K | 1.0K |

| NEE | 看涨 | SWEEP | 看好 | 10/18/24 | $3.75 | $3.65 | $3.75 | $77.50 | $58.1K | 2.7K | 907 |

| NEE | 看跌 | SWEEP | 看淡 | 03/21/25 | $7.9 | $7.8 | $7.9 | $80.00 | $55.3K | 13 | 70 |

About NextEra Energy

关于新纪元能源

NextEra Energy's regulated utility, Florida Power & Light, is the largest rate-regulated utility in Florida. The utility distributes power to nearly 6 million customer accounts in Florida and owns 34 gigawatts of generation. FP&L contributes roughly 70% of NextEra's consolidated operating earnings. NextEra Energy Resources, the renewable energy segment, generates and sells power throughout the United States and Canada with more than 34 GW of generation capacity, including natural gas, nuclear, wind, and solar.

新纪元能源的管制公用事业企业 Florida Power & Light 是佛罗里达州最大的管制公用事业企业。该公用事业向佛罗里达州近 600 万户客户提供电力,并拥有 34 吉瓦的发电量。Florida Power & Light 大约贡献了新纪元整个企业的约 70% 经营收益。新纪元能源部门则通过拥有超过 34 吉瓦的发电能力在美国和加拿大各地生成和销售电力,包括天然气、核能、风能和太阳能。

Where Is NextEra Energy Standing Right Now?

NextEra能源现在处于什么位置?

- With a trading volume of 1,483,077, the price of NEE is down by -0.23%, reaching $77.28.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 71 days from now.

- NEE的交易量为1,483,077,价格下跌了-0.23%,达到77.28美元。

- 当前RSI值表明该股票可能接近超买状态。

- 下一个财报将于71天后发布。

Expert Opinions on NextEra Energy

对NextEra能源的专家意见

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $84.0.

过去30天中,共有3位专业分析师对这支股票发表了他们的看法,设定了平均目标价为84.0美元。

- Maintaining their stance, an analyst from BMO Capital continues to hold a Outperform rating for NextEra Energy, targeting a price of $83.

- An analyst from Barclays persists with their Equal-Weight rating on NextEra Energy, maintaining a target price of $75.

- An analyst from JP Morgan persists with their Overweight rating on NextEra Energy, maintaining a target price of $94.

- BMO Capital的一位分析师继续维持看好新纪元能源的评级,目标价为83美元。

- 巴克莱银行的一位分析师坚持对新纪元能源给出“等权重”评级,维持目标价为 $ 75。

- JP Morgan的一位分析师继续坚持给新纪元能源超配的评级,并保持94美元的目标价。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest NextEra Energy options trades with real-time alerts from Benzinga Pro.

期权交易涉及较高的风险和潜在收益。精明的交易者通过不断学习、调整策略、监控多种因子并密切关注市场动向来管理这些风险。通过Benzinga Pro实时警报了解最新的NextEra Energy期权交易。