Downstream Business Continues to Increase Contribution to GAR's Financial Performance in the First Half of 2024

Downstream Business Continues to Increase Contribution to GAR's Financial Performance in the First Half of 2024

- EBITDA margin remained robust at almost 10% despite lower plantation output

- Downstream business makes strong contribution to consolidated performance

- Underlying profit impacted by increased financial expenses due to high interest rates

- 尽管种植业的产量降低,EBITDA利润率仍然强劲保持在近10%左右

- 下游业务对公司综合业绩作出了强大的贡献

- 由于高利率冲击,基础利润受到影响

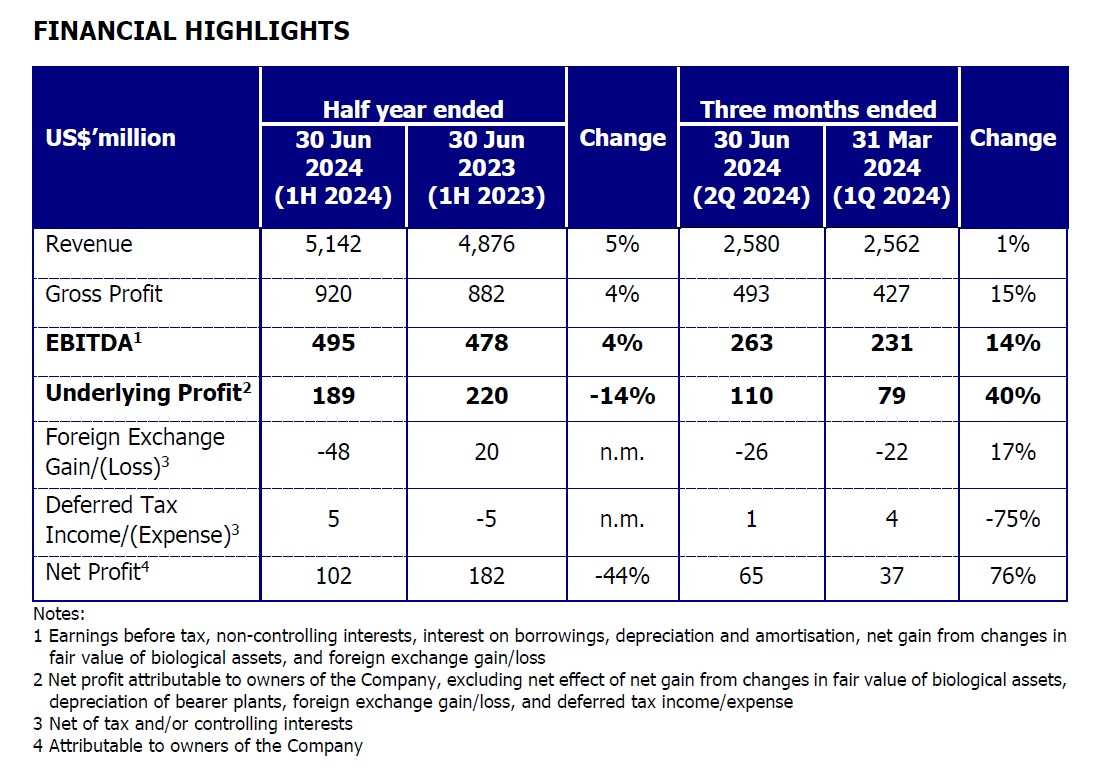

Singapore, 13 August 2024: Golden Agri-Resources Ltd ("GAR" or the "Company") continued to deliver resilient results during the first half of 2024, expanding its sales volume despite slightly softer CPO prices to grow the Company's revenue by 5% year on year to US$5.14 billion.

新加坡,2024年8月13日:金光集团有限公司(“GAR”或“公司”)在2024上半年持续提供强劲的业绩,尽管尽管棕榈油价格略有下跌,但扩大了销售规模,公司营业收入同比增长5%,达到54.14亿美元。

EBITDA stood at US$495 million, preserving a margin of almost 10%. Underlying profit and net profit for this period fell year on year to US$189 million and US$102 million respectively, primarily due to higher financial expenses and unrealised foreign exchange loss. However, financial performance has improved quarter on quarter in 2024 as a result of increased plantation output.

EBITDA达到4950万美元,利润率近10%。然而,本期基础利润和净利润同比下滑至1.89亿美元和1.02亿美元,主要是由于高额的财务开支和未实现的汇率损失所致。但是,由于种植业产量的增加,2024年的财务业绩已经逐季得到了改善。

With its prudent financial management, GAR's balance sheet remained healthy, reflected by a low gearing ratio of 0.61 times and net debt to EBITDA of 0.53 times as of 30 June 2024.

由于稳健的财务管理,GAR的资产负债表保持良好,截至2024年6月,净债务/ EBITDA比率为0.53倍,负债率仅为0.61倍。

On the results, Mr. Franky O. Widjaja, GAR Chairman and Chief Executive Officer commented: "GAR has achieved resilient results during the first six months of 2024. We are committed to further enhancing profitability through creating additional value across our integrated business model. Our key priorities include intensifying long-term yield, improving cost efficiency, and developing more value-added products. This strategic approach will ensure GAR continues to deliver value amidst the dynamic industry environment."

在业绩方面,GAR董事长兼首席执行官Franky O. Widjaja先生评论道:“在2024年前六个月,GAR取得了强劲的业绩。我们致力于通过跨足整合业务模式,进一步提高盈利能力。我们的重点工作包括加强长期收益、提高成本效益和开发更多的增值产品。这种战略方法将确保GAR在不断变化的行业环境下继续提供价值。”

Mr. Widjaja added: "The supply of palm oil and other vegetable oils is highly susceptible to extreme weather conditions and we are now seeing the impact of El Niño conditions from 2023 on Indonesia's palm oil production. Escalating geopolitical tensions are also disrupting global logistics and the world's economic stability. Hence, despite the industry's robust fundamentals, we are carefully monitoring the development of these factors as they could influence our business operations and impact CPO price trends."

Widjaja先生补充道:“棕榈油和其他植物油的供应非常容易受到极端天气条件的影响,而我们现在正在看到2023年厄尔尼诺条件对印度尼西亚的棕榈油产量产生影响。不断升级的地缘政治紧张局势也正在破坏全球物流和世界经济的稳定。因此,尽管该行业的基本面强劲,但我们仍在谨慎监视这些因素的发展,因为它们可能影响我们的业务运营并影响CPO价格走势。”

SEGMENTAL PERFORMANCE

板块业绩

Plantations and palm oil mills

种植园和榨油厂

At the end of June 2024, GAR's total planted area was almost 534,000 hectares, of which 92% was mature. Plasma plantations made up 116,000 hectares of this total area. GAR accelerated its replanting activity to reach 10,800 hectares in the first half of 2024, up by 66% from the same period last year. As a result, the average age of the Company's nucleus area remained at 15.5 years. This replanting effort is part of GAR's yield intensification programme, rejuvenating its existing plantations to achieve long-term production growth.

截至2024年6月,GAR的种植园总面积接近534,000公顷,其中92%成熟。等离子种植园占该总面积的116,000公顷。GAR加速了翻新工作,上半年完成了10,800公顷的翻新,同比增长了66%。因此,公司核心区的平均年龄保持在15.5岁左右。这项重新种植工作是GAR的收益增长计划的一部分。

GAR harvested around 4 million tonnes of fresh fruit bunches (FFB) in the first half of 2024, down from 4.4 million tonnes in the same period last year. Adverse weather caused by El Niño conditions that peaked in the third quarter of 2023 was the major driver of this decline, along with preparation of old estates for replanting. Palm product output for this period was 1.21 million tonnes, 9% lower than the same period last year.

GAR在2024年上半年收割了约400万吨的新鲜油果,低于去年同期的440万吨。恶劣的天气状况,加上准备重新种植的老园区,是这一下降的主要原因。本期的棕榈制品产量为121万吨,比去年同期下降9%。

Nevertheless, EBITDA for the first half of 2024 was sustained at US$213 million with a resilient margin of 23.4%. Strategic procurement decisions helped the Company to lower production costs and take advantage of declining fertiliser prices to offset reduced plantation output.

尽管种植业的产量降低,但2024年上半年的EBITDA利润率仍然保持在2,1300万美元,利润率强劲达到23.4%。战略采购决策有助于降低生产成本,并利用肥料价格下降抵消减少的种植业产量。

Palm, laurics and others

Palm, 派神板块其他

GAR's downstream segment consists of the processing and global merchandising of palm and oilseed-based products comprising bulk and branded products, oleochemicals, sugar and other vegetable oils. Expanding value-added downstream products is a core part of GAR's growth strategy.

GAR的下游业务包括加工和全球商品化棕榈油和油籽产品,包括散装和品牌产品,油脂化学制品,糖和其他植物油。扩大增值下游产品是GAR增长战略的核心部分。

Downstream sales volume expanded strongly by 11% to 5.7 million tonnes in the first half of 2024, generating a revenue of US$5.09 billion. This segment successfully delivered EBITDA of US$282 million with a robust margin of 5.5%, contributing 57% of the Company's consolidated EBITDA.

下游销售量在2024年上半年强劲增长11%,达到570万吨,创造了50.9亿美元的收入。下游板块成功交付了2,8200万美元的EBITDA,强劲的利润率达到5.5%,是公司综合利润的57%。

ONGOING SUSTAINABILITY INITIATIVES

持续的可持续发展项目

GAR's focus on enhancing and expanding sustainability initiatives aims to meet the growing demand for sustainable products while navigating regulatory changes to future-proof the business.

GAR着力增强和扩大可持续性项目,旨在满足可持续产品的日益增长的需求,同时应对未来业务的监管变化。

Through investments into Traceability to the Plantation (TTP), satellite monitoring and information systems, GAR has built a strong foundation for compliance with the EU Deforestation Regulation (EUDR). The Company is actively engaging regulators, stakeholders and customers to ensure readiness when the regulation comes into force in 2025.

通过对种植地至加工流程的追根溯源、卫星监测和信息系统投资,GAR为与欧盟森林砍伐条例(EUDR)的合规性打下了坚实的基础。公司正在积极与监管机构、利益相关者和客户合作,以确保该条例于2025年生效时做好准备。

GAR has also extended its commitment to supply chain traceability to include its global supply chain and non-palm commodities. The Company has achieved full TTM for soy, sugar, and coconut as well as 50% TTM for sunflower oil. GAR will continue to leverage its traceability experience to extend oversight and enhance sustainable practices among its non-palm suppliers.

GAR还将其供应链追溯承诺扩展到全球供应链和非棕榈商品。公司已在大豆、糖、椰子等产品上实现了全面的溯源承诺,向向日葵油提供了50%的溯源承诺。GAR将继续利用其追溯经验扩大监督范围,并增强其非棕榈供应商的可持续业务做法。

For media enquiries, please contact:

communications@sinarmas-agri.com

媒体查询请联系:

通信-半导体@sinarmas-agri.com

On the results,

On the results,