Here's How Much You Would Have Made Owning Eli Lilly Stock In The Last 10 Years

Here's How Much You Would Have Made Owning Eli Lilly Stock In The Last 10 Years

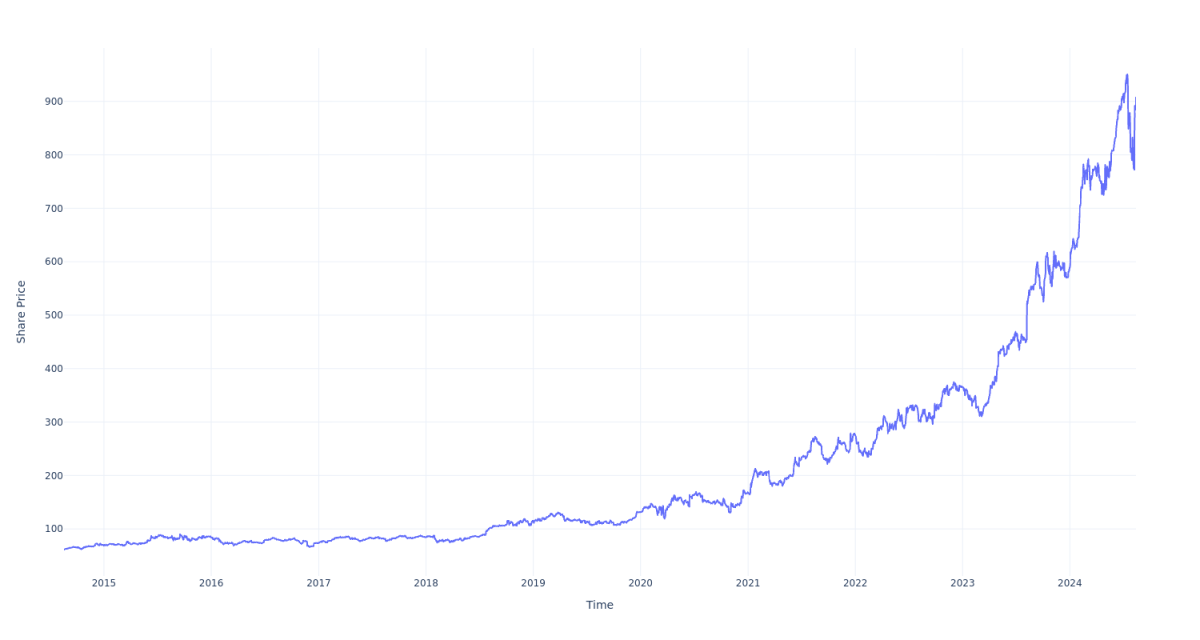

Eli Lilly (NYSE:LLY) has outperformed the market over the past 10 years by 20.19% on an annualized basis producing an average annual return of 30.74%. Currently, Eli Lilly has a market capitalization of $816.78 billion.

在过去的10年里,礼来公司(NYSE:LLY)的年化表现比市场优秀20.19%,平均年回报率为30.74%。目前,礼来公司的市值为8167.8亿美元。

Buying $100 In LLY: If an investor had bought $100 of LLY stock 10 years ago, it would be worth $1,478.57 today based on a price of $907.10 for LLY at the time of writing.

购买100美元的LLY股票:如果投资者10年前购买了100美元的LLY股票,根据当时LLY的价格907.10美元,今天价值1478.57美元。

Eli Lilly's Performance Over Last 10 Years

过去十年礼来的表现

Finally -- what's the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

最终,所有这些的意义是什么?从这篇文章中得出的核心见解是注意到复利对于一段时间内现金增长的巨大影响。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自动化内容引擎生成并由编辑审查。