Oracle Unusual Options Activity

Oracle Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Oracle.

有大量资金的鲸鱼对Oracle持明显的看好态度。

Looking at options history for Oracle (NYSE:ORCL) we detected 12 trades.

看看Oracle (NYSE:ORCL)的期权历史,我们发现了12次交易。

If we consider the specifics of each trade, it is accurate to state that 58% of the investors opened trades with bullish expectations and 33% with bearish.

如果我们考虑每一个交易的具体情况,准确地说,58%的投资者开设了看好期权,33%的投资者开设了看跌期权。

From the overall spotted trades, 4 are puts, for a total amount of $156,480 and 8, calls, for a total amount of $543,303.

从整体交易来看,卖出看跌期权4个,总额为156,480美元;买进看涨期权8个,总额为543,303美元。

Predicted Price Range

预测价格区间

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $110.0 to $175.0 for Oracle over the recent three months.

根据交易活动,大量投资者正在瞄准在过去3个月内Oracle的价格区间从110.0美元到175.0美元。

Insights into Volume & Open Interest

成交量和持仓量分析

In terms of liquidity and interest, the mean open interest for Oracle options trades today is 1296.25 with a total volume of 1,410.00.

就流动性和利益而言,Oracle期权交易今天的平均持仓量为1296.25,总成交量为1,410.00。

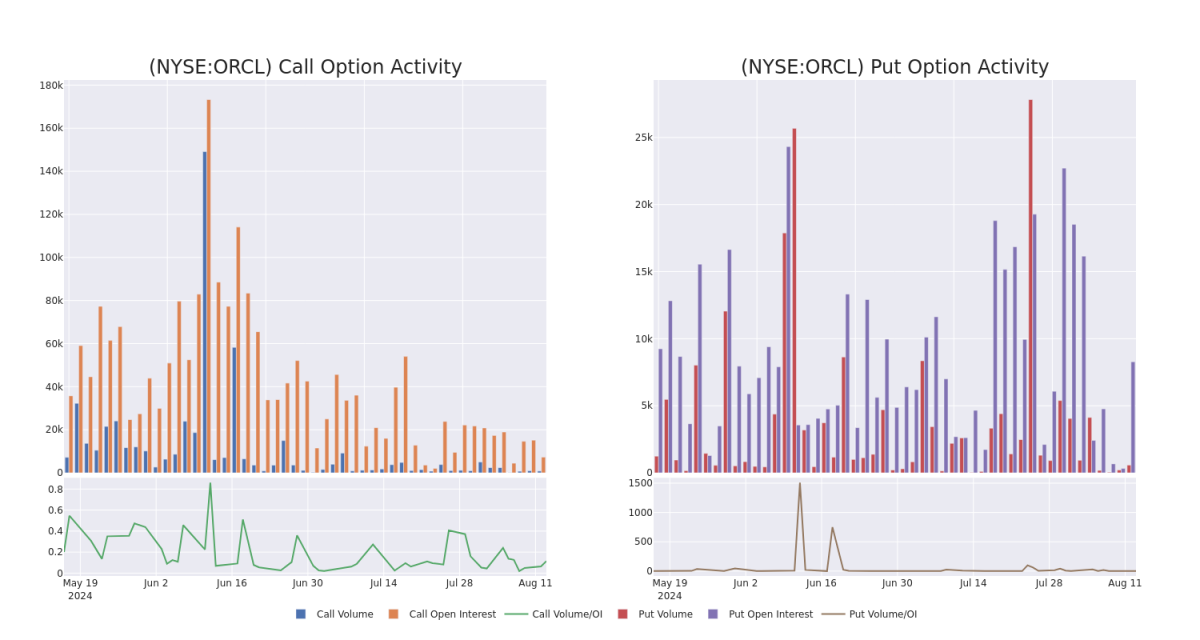

In the following chart, we are able to follow the development of volume and open interest of call and put options for Oracle's big money trades within a strike price range of $110.0 to $175.0 over the last 30 days.

在下面的图表中,我们可以跟踪到过去30天内Oracle大额交易的看涨和看跌期权的成交量和持仓量的发展。期权价格区间为110.0美元到175.0美元。

Oracle 30-Day Option Volume & Interest Snapshot

Oracle 30天期权成交量和利益快照

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | CALL | TRADE | BULLISH | 09/06/24 | $6.35 | $6.3 | $6.35 | $130.00 | $253.3K | 112 | 430 |

| ORCL | CALL | TRADE | BEARISH | 10/18/24 | $26.0 | $25.7 | $25.7 | $110.00 | $71.9K | 38 | 28 |

| ORCL | PUT | SWEEP | BULLISH | 09/20/24 | $3.25 | $3.15 | $3.2 | $125.00 | $52.4K | 3.1K | 291 |

| ORCL | CALL | SWEEP | BEARISH | 08/23/24 | $3.2 | $2.83 | $3.1 | $133.00 | $46.8K | 191 | 163 |

| ORCL | CALL | TRADE | BULLISH | 12/20/24 | $14.0 | $13.85 | $13.95 | $130.00 | $44.6K | 2.2K | 39 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | 看涨 | 交易 | 看好 | 09/06/24 | $ 6.35 | $6.3 | $ 6.35 | $130.00 | $253.3K | 112 | 430 |

| ORCL | 看涨 | 交易 | 看淡 | 10/18/24 | $26.0 | $25.7 | $25.7 | $110.00 | $71.9K | 38 | 28 |

| ORCL | 看跌 | SWEEP | 看好 | 09/20/24 | $3.25 | $3.15 | $3.2 | $125.00 | $52.4千美元 | 3.1K | 291 |

| ORCL | 看涨 | SWEEP | 看淡 | 08/23/24 | $3.2 | 2.83美元 | $3.1 | $133.00 | $46.8K | 191 | 163 |

| ORCL | 看涨 | 交易 | 看好 | 12/20/24 | $14.0 | $13.85 | $13.95 | $130.00 | 44.6千美元 | 2.2K | 39 |

About Oracle

关于Oracle

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has 430,000 customers in 175 countries, supported by its base of 136,000 employees.

Oracle向全球企业提供数据库技术和企业资源规划(ERP)软件。Oracle成立于1977年,是第一个商用SQL数据库管理系统的创始人。如今,Oracle在175个国家拥有430,000个客户,由136,000名员工支持。

In light of the recent options history for Oracle, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于Oracle最近的期权历史,现在适合专注于公司本身。我们旨在探索其当前的表现。

Oracle's Current Market Status

Oracle当前的市场状况

- With a trading volume of 2,531,093, the price of ORCL is up by 1.25%, reaching $134.24.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 27 days from now.

- 交易量为2,531,093,ORCL价格上涨1.25%,达到134.24美元。

- 目前的RSI值表明该股票目前处于超买和超卖之间的中立状态。

- 下一个财报将在27天后发布。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Oracle options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和回报潜力。精明的交易员通过不断学习、调整策略、监控多个指标并密切关注市场动向来管理这些风险。通过Benzinga Pro的实时提醒了解最新的Oracle期权交易情况。