Market Whales and Their Recent Bets on NEM Options

Market Whales and Their Recent Bets on NEM Options

Financial giants have made a conspicuous bullish move on Newmont. Our analysis of options history for Newmont (NYSE:NEM) revealed 23 unusual trades.

金融巨头对纽曼矿业采取了引人注目的看涨姿态。我们对纽曼矿业的期权历史进行分析发现,有23笔飞凡交易。

Delving into the details, we found 47% of traders were bullish, while 43% showed bearish tendencies. Out of all the trades we spotted, 11 were puts, with a value of $612,695, and 12 were calls, valued at $1,529,913.

深入了解后,我们发现47%的交易者看好,而43%的交易者则显示出看淡倾向。我们发现的所有交易中,有11张看跌期权,价值为612,695美元,还有12张看涨期权,价值为1,529,913美元。

What's The Price Target?

目标价是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $35.0 to $57.5 for Newmont over the last 3 months.

考虑到这些合同的成交量和持仓量,似乎鲸鱼们在过去3个月里看好纽曼矿业的目标价区间从35.0美元到57.5美元。

Insights into Volume & Open Interest

成交量和持仓量分析

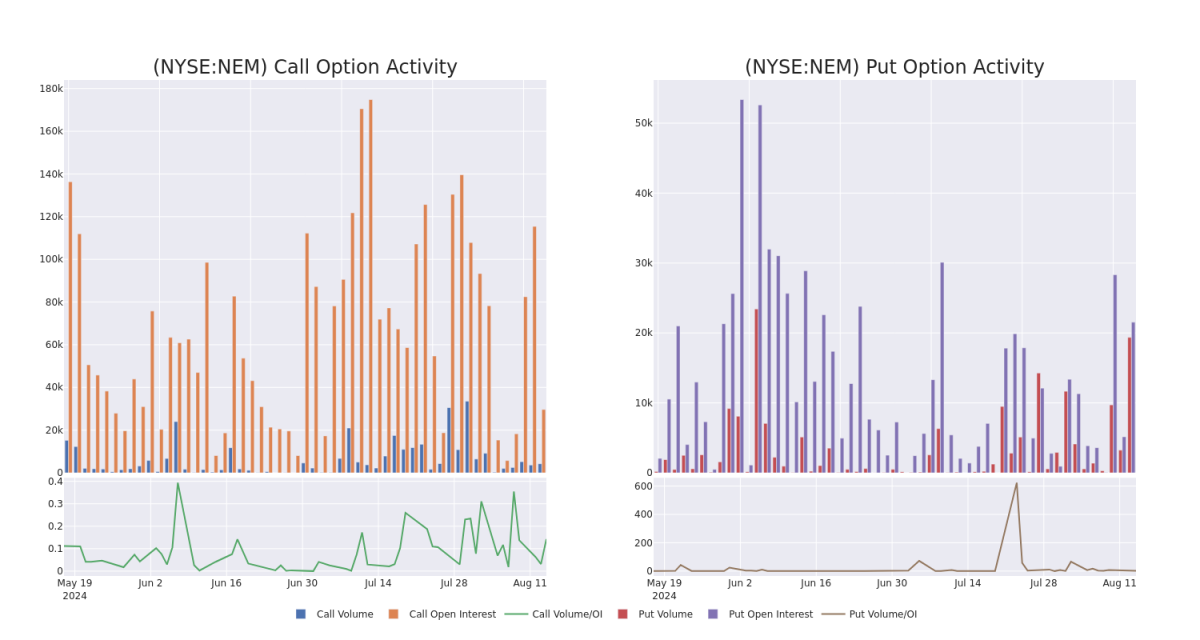

In today's trading context, the average open interest for options of Newmont stands at 5687.0, with a total volume reaching 23,592.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Newmont, situated within the strike price corridor from $35.0 to $57.5, throughout the last 30 days.

在今天的交易环境中,纽曼矿业期权的平均持仓量为5687.0,总成交量为23,592.00。附带的图表描述了纽曼矿业高价值交易中看涨和看跌期权的成交量和持仓量在过去30天内的走势,这些期权的行权价格区间为35.0美元到57.5美元。

Newmont Call and Put Volume: 30-Day Overview

纽曼矿业看涨和看跌期权成交量:30天总览

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NEM | CALL | SWEEP | NEUTRAL | 09/20/24 | $9.2 | $8.65 | $9.0 | $40.00 | $270.0K | 12.1K | 307 |

| NEM | CALL | SWEEP | BULLISH | 09/20/24 | $9.0 | $8.95 | $9.0 | $40.00 | $245.7K | 12.1K | 809 |

| NEM | CALL | SWEEP | NEUTRAL | 09/20/24 | $9.05 | $9.0 | $9.0 | $40.00 | $202.5K | 12.1K | 507 |

| NEM | CALL | SWEEP | BULLISH | 03/21/25 | $7.45 | $7.35 | $7.45 | $45.00 | $145.2K | 44 | 1 |

| NEM | CALL | SWEEP | BULLISH | 06/20/25 | $9.75 | $9.65 | $9.75 | $42.50 | $122.8K | 1.5K | 127 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 纽曼矿业 | 看涨 | SWEEP | 中立 | 09/20/24 | $9.2 | $ 8.65 | 9.0美元 | $40.00 | $270.0K | 12.1K | 307 |

| 纽曼矿业 | 看涨 | SWEEP | 看好 | 09/20/24 | 9.0美元 | $8.95 | 9.0美元 | $40.00 | $245.7K | 12.1K | 809 |

| 纽曼矿业 | 看涨 | SWEEP | 中立 | 09/20/24 | $9.05 | 9.0美元 | 9.0美元 | $40.00 | $202.5K | 12.1K | 507 |

| 纽曼矿业 | 看涨 | SWEEP | 看好 | 03/21/25 | $7.45 | $7.35 | $7.45 | $45.00 | $145.2K | 44 | 1 |

| 纽曼矿业 | 看涨 | SWEEP | 看好 | 06/20/25 | $9.75 | $9.65 | $9.75 | $42.50 | $122.8K | 1.5K | 127 |

About Newmont

关于纽曼矿业

Newmont is the world's largest gold miner. It bought Goldcorp in 2019, combined its Nevada mines in a joint venture with competitor Barrick later that year, and also purchased competitor Newcrest in November 2023. Its portfolio includes 17 wholly or majority owned mines and interests in two joint ventures in the Americas, Africa, Australia and Papua New Guinea. The company is expected to produce roughly 6.9 million ounces of gold in 2024. However, after buying Newcrest, Newmont is likely to sell a number of its higher cost, smaller mines accounting for 20% of forecast sales in 2024. Newmont also produces material amounts of copper, silver, zinc, and lead as byproducts. It had about two decades of gold reserves along with significant byproduct reserves at the end of December 2023.

纽曼矿业是世界上最大的黄金生产商。它在2019年收购了Goldcorp,在同年晚些时候与竞争对手Barrick公司合作组建了内华达州的一家合资企业,并于2023年11月收购了竞争对手Newcrest。其投资组合包括在美洲、非洲、澳大利亚和巴布亚新几内亚拥有全部或绝大多数权益的17个矿山和两个合资企业。预计该公司在2024年生产约690万盎司黄金。然而,在收购Newcrest之后,纽曼矿业可能会出售占2024年预测销售额20%的成本较高、规模较小的矿山。纽曼矿业还生产大量的铜、白银、锌和铅副产品。今年12月底,黄金储备和副产品储备还有约20年的时间。

Having examined the options trading patterns of Newmont, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在审查纽曼矿业的期权交易模式后,我们现在转向公司本身。这种转变使我们能够深入探讨其当前的市场地位和表现。

Where Is Newmont Standing Right Now?

纽曼矿业目前的地位如何?

- With a volume of 2,022,990, the price of NEM is down -0.73% at $48.66.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 71 days.

- 成交量为2,022,990,NEM的价格下跌了-0.73%,为48.66美元。

- RSI指标暗示该股票可能要超买了。

- 下次财报预计在71天内发布。

Expert Opinions on Newmont

关于纽曼矿业的专家意见

In the last month, 1 experts released ratings on this stock with an average target price of $57.0.

在过去一个月中,有1位专家对这只股票进行了评级,平均目标价为57.0美元。

- An analyst from BMO Capital persists with their Outperform rating on Newmont, maintaining a target price of $57.

- BMO Capital的一位分析师坚持其对纽曼矿业的跑赢市场评级,维持目标价为57美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Newmont with Benzinga Pro for real-time alerts.

期权交易涉及更大的风险,但也提供了更高的获利潜力。 懂得识别并控制风险的交易者通过持续的教育、策略性交易调整、利用各种因子,以及了解市场动态来降低风险。使用Benzinga Pro即可及时获得纽曼矿业的最新期权交易警报。

In today's trading context, the average open interest for options of Newmont stands at 5687.0, with a total volume reaching 23,592.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Newmont, situated within the strike price corridor from $35.0 to $57.5, throughout the last 30 days.

In today's trading context, the average open interest for options of Newmont stands at 5687.0, with a total volume reaching 23,592.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Newmont, situated within the strike price corridor from $35.0 to $57.5, throughout the last 30 days.