What the Options Market Tells Us About MercadoLibre

What the Options Market Tells Us About MercadoLibre

Deep-pocketed investors have adopted a bearish approach towards MercadoLibre (NASDAQ:MELI), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MELI usually suggests something big is about to happen.

资金雄厚的投资者对MercadoLibre(纳斯达克:mercadolibre)采取了看淡的策略,这是市场参与者不应忽视的。我们根据Benzinga公共期权记录的跟踪结果,今天揭示了这一重大的举动。这些投资者的身份尚不清楚,但MELI如此大规模的行动通常意味着即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 18 extraordinary options activities for MercadoLibre. This level of activity is out of the ordinary.

我们从观察到的现象中获得了这些信息,当贝辛格的期权筛选器突出了18个mercadoLibre的非凡期权活动。这种活跃程度是不同寻常的。

The general mood among these heavyweight investors is divided, with 16% leaning bullish and 33% bearish. Among these notable options, 8 are puts, totaling $331,390, and 10 are calls, amounting to $484,979.

这些重量级投资者的总体情绪分为两派,16%看涨,33%看淡。在这些值得注意的期权中,有8个看跌,总值为331,390美元,有10个看涨,总值为484,979美元。

Predicted Price Range

预测价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $1320.0 and $2200.0 for MercadoLibre, spanning the last three months.

在评估了成交量和持仓量之后,很明显,主要的市场推动者正在关注mercadoLibre在1320.0美元至2200.0美元之间的价格带,跨越了过去三个月。

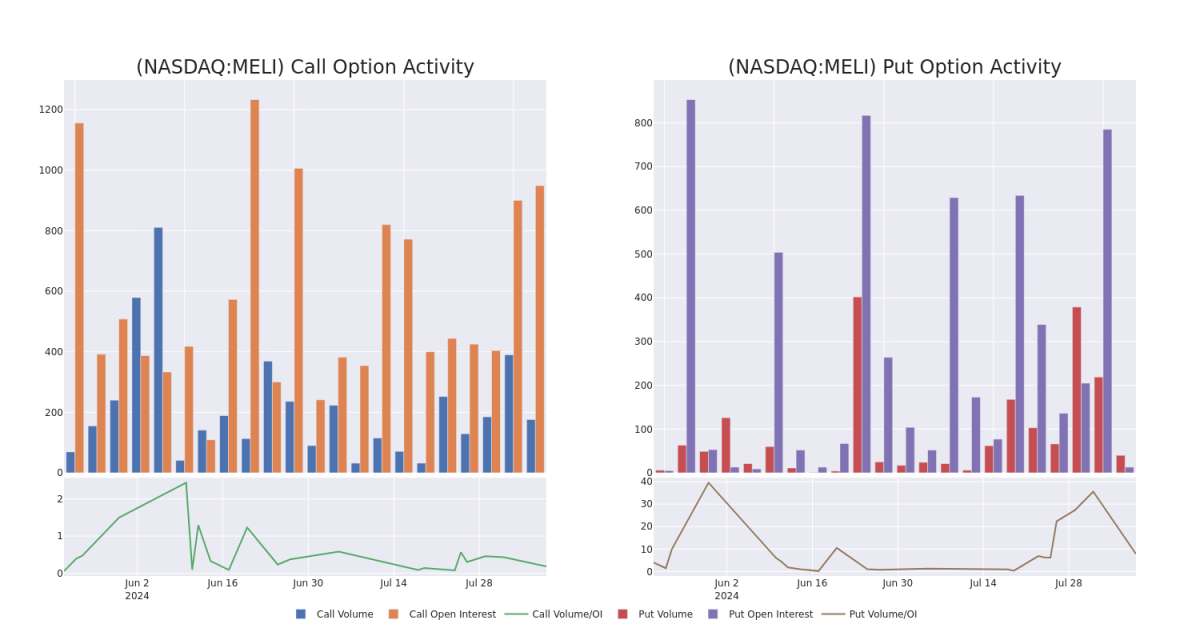

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

In today's trading context, the average open interest for options of MercadoLibre stands at 45.2, with a total volume reaching 52.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in MercadoLibre, situated within the strike price corridor from $1320.0 to $2200.0, throughout the last 30 days.

在今天的交易背景下,mercadoLibre期权的平均持仓量为45.2,总成交量达到52.00。以下图表描述了在过去30天内,mercadoLibre的高价值交易中,位于1320.0美元至2200.0美元的行权价格走廊内的看涨和看跌期权成交量和持仓量的变化。

MercadoLibre 30-Day Option Volume & Interest Snapshot

MercadoLibre 30天期权成交量和未平仓合约快照

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MELI | CALL | SWEEP | BULLISH | 08/16/24 | $159.5 | $153.0 | $153.0 | $1750.00 | $76.5K | 115 | 5 |

| MELI | PUT | TRADE | NEUTRAL | 06/20/25 | $169.0 | $156.4 | $163.0 | $1760.00 | $65.2K | 5 | 4 |

| MELI | CALL | TRADE | NEUTRAL | 12/20/24 | $128.3 | $119.4 | $123.9 | $2000.00 | $61.9K | 59 | 5 |

| MELI | CALL | TRADE | NEUTRAL | 12/20/24 | $617.8 | $604.8 | $610.19 | $1320.00 | $61.0K | 3 | 1 |

| MELI | PUT | SWEEP | NEUTRAL | 08/23/24 | $113.1 | $101.4 | $108.16 | $2000.00 | $53.9K | 0 | 5 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| mercadolibre | 看涨 | SWEEP | 看好 | 08/16/24 | $159.5 | $153.0 | $153.0 | $1750.00 | $76.5K | 115 | 5 |

| mercadolibre | 看跌 | 交易 | 中立 | 06/20/25 | $169.0 | $156.4 | $163.0 | $1760.00 | $65.2K | 5 | 4 |

| mercadolibre | 看涨 | 交易 | 中立 | 12/20/24 | $128.3 | $119.4 | $123.9 | $2000.00 | $61.9K | 59 | 5 |

| mercadolibre | 看涨 | 交易 | 中立 | 12/20/24 | $617.8 | $604.8 | $610.19 | $1320.00 | $61.0K | 3 | 1 |

| mercadolibre | 看跌 | SWEEP | 中立 | 08/23/24 | $113.1 | $101.4 | $108.16 | $2000.00 | $53.9千美元 | 0 | 5 |

About MercadoLibre

关于mercadolibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions as of the end of 2023. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

MercadoLibre是拉美地区最大的电子商务市场,截至2023年底,在其涵盖18个国家的商业网络或金融科技解决方案中,拥有超过2.18亿活跃用户和100万活跃卖家。该公司在其核心在线商店之外运营一系列互补业务,包括货运解决方案(Mercado Envios)、支付和融资业务(Mercado Pago和Mercado Credito)、广告(Mercado Clics)、分类广告和一站式电子商务解决方案(Mercado Shops)等。MercadoLibre从最终价值费用、广告版税、付款处理、插入费用、订阅费用以及来自消费者和小企业贷款的利息收入中获取收入。

MercadoLibre's Current Market Status

MercadoLibre的当前市场状况

- Trading volume stands at 165,144, with MELI's price down by -1.23%, positioned at $1892.72.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 77 days.

- 交易量为165,144,MELI的价格下跌了-1.23%,位于1892.72美元。

- RSI指标显示该股票可能接近超买。

- 77天后将公布收益报告。

Professional Analyst Ratings for MercadoLibre

MercadoLibre的专业分析师评级

In the last month, 4 experts released ratings on this stock with an average target price of $2251.25.

在上个月,有4位专家对该股票进行了评级,平均目标价为$2251.25。

- Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for MercadoLibre, targeting a price of $2400.

- Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on MercadoLibre with a target price of $2480.

- An analyst from BTIG has decided to maintain their Buy rating on MercadoLibre, which currently sits at a price target of $2025.

- An analyst from Barclays persists with their Overweight rating on MercadoLibre, maintaining a target price of $2100.

- JP 摩根的一位分析师维持持有评级,目标价为 2400 美元。

- 高盛的一位分析师在持续评估中保持对mercadoLibre的买入评级,目标价为2480美元。

- BTIG的一位分析师已决定维持对mercadoLibre的买入评级,目前的价格目标为2025美元。

- 巴克莱银行的一位分析师坚持对MercadoLibre的超重评级,维持目标价为$2100。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MercadoLibre with Benzinga Pro for real-time alerts.

交易期权涉及更高的风险,但也带来了更高的利润潜力。机智的交易者通过持续的教育、策略性的交易调整、利用各种因子以及保持对市场动态的关注来减少这些风险。使用Benzinga Pro获取MercadoLibre的最新期权交易以获取实时警报。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $1320.0 and $2200.0 for MercadoLibre, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $1320.0 and $2200.0 for MercadoLibre, spanning the last three months.