Stock Of The Day: Amazon Stock Eyes Refilling A Gap

Stock Of The Day: Amazon Stock Eyes Refilling A Gap

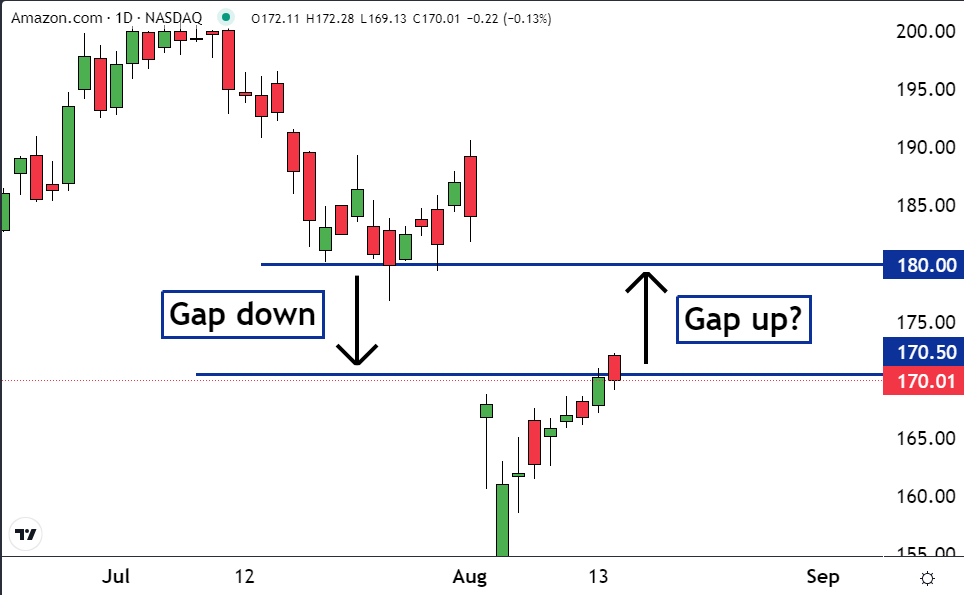

The old Wall Street saying "gaps refill" is true. It means that if a stock moves quickly, or "gaps," through price levels going one way, and then eventually reverses and gets back to those same levels going the other way, it could move quickly or gap back through them in the opposite direction.

旧金山股市的名言“跳空回补”是确切的。这意味着,如果一支股票快速上涨,或“跳空”,穿过价格水平,然后最终反转并回到那些相同的价格水平,它可能会迅速或反向跳回这些水平。

Amazon.com Inc. (NASDAQ:AMZN) may be about to refill a gap. This would mean a move higher. That's why it is our Stock of the Day.

亚马逊公司(纳斯达克:AMZN)可能即将回补缺口。这将意味着股价上涨。这就是为什么它是我们的当日股票推荐。

If a market is moving higher, there aren't enough sell orders to fill all the buy orders. Because of this, those who wish to buy are forced to pay successively higher prices. This is the only way they can get sellers interested and draw them into the market.

如果市场上涨,卖出订单不足以填补所有买入订单。因此,愿意购买的人被迫付出越来越高的价格。这是他们吸引卖家进入市场的唯一方法。

But when a stock reaches a resistance level the dynamics change.

但是当一只股票到达支撑位时,市场形势会发生变化。

Resistance in a financial market is a large group of traders and investors who are looking to sell at, or close to, the same price. At resistance levels, there are more than enough sell orders to fill every buy order.

金融市场中的支撑位是一大批希望在或接近相同价格卖出的交易者和投资者。在支撑位水平,有足够的卖出订单来填满每一个买入订单。

Because of this, market rallies tend to pause or halt when they reach resistance.

因此,当市场上涨到达支撑位时,市场上涨趋势往往会暂停或停止。

Read Also: Nvidia's Rebound Rally Adds Billions To Market Value, Analysts Eye AI Growth: Report

另外一篇文章:英伟达的反弹行情为市值增加数十亿美元,分析师瞄准人工智能业务增长:报告

One of the main reasons why resistance forms in a market is because of buyer's remorse or regret. This happens when people buy and then watch the price drop lower.

市场上形成阻力的主要原因之一是买方后悔或遗憾。当人们购买后看价格下跌时,就会发生这种情况。

When this happens, some of the people who bought decided they made a mistake. They want to exit their positions, but they don't want to lose any money.

当发生这种情况时,一些购买者决定他们犯了错误。他们想退出自己的持仓,但又不想亏本出售。

As a result, if the stock eventually rallies back up to their buy price they place sell orders. And if there are enough of these orders it will create resistance. This is why price levels that had been support frequently convert into resistance.

因此,如果股票最终上涨到他们的买入价格,他们会放置卖出订单。如果有足够的这些订单,它将形成支撑位。这就是为什么价格水平经常转换成阻力位。

If a stock closes at one price and then opens the next day at a price that is much lower, it will appear as a blank space or a 'gap' on a chart. This is what happened with Amazon between Aug. 1 and Aug. 2.

如果一支股票在一个价格收盘,然后第二天以一个远低于该价格的价格开盘,它将出现为空白空间或图表中的“缺口”。这就是亚马逊在8月1日和8月2日之间发生的事情。

The shares closed on Aug. 1 at $187.04 and opened on Aug. 2 at $166.75.

股票在8月1日收盘价为187.04美元,在8月2日开盘价为166.75美元。

There was no trading between these two prices. And if there was no trading, there can't be anyone who bought who came to regret their decision to do so when the price moved lower.

这两个价格之间没有交易。如果没有交易,当价格下降时,没有人会后悔自己的购买决定。

So, now that Amazon is back in between these two prices, it may move rapidly upwards. Buyers may need to be aggressive and push the price higher if they want to acquire shares.

因此,现在亚马逊回到这两个价格之间,它可能会迅速向上移动。如果买方想要获得股票,他们可能需要采取积极措施,推高股价。

The gap may be about to refill.

缺口可能即将回补。

Photo: Shutterstock

Photo: shutterstock