Behind the Scenes of Exxon Mobil's Latest Options Trends

Behind the Scenes of Exxon Mobil's Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bearish stance on Exxon Mobil.

有很多钱可以花的鲸鱼对埃克森美孚采取了明显的看跌立场。

Looking at options history for Exxon Mobil (NYSE:XOM) we detected 27 trades.

查看埃克森美孚(纽约证券交易所代码:XOM)的期权历史记录,我们发现了27笔交易。

If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 55% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,37%的投资者以看涨的预期开盘,55%的投资者持看跌预期。

From the overall spotted trades, 13 are puts, for a total amount of $585,261 and 14, calls, for a total amount of $959,525.

在所有已发现的交易中,有13笔是看跌期权,总额为585,261美元,14笔是看涨期权,总额为959,525美元。

What's The Price Target?

目标价格是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $130.0 for Exxon Mobil during the past quarter.

分析这些合约的交易量和未平仓合约,大型企业似乎一直在关注埃克森美孚在过去一个季度的价格范围从50.0美元到130.0美元不等。

Volume & Open Interest Development

交易量和未平仓合约的发展

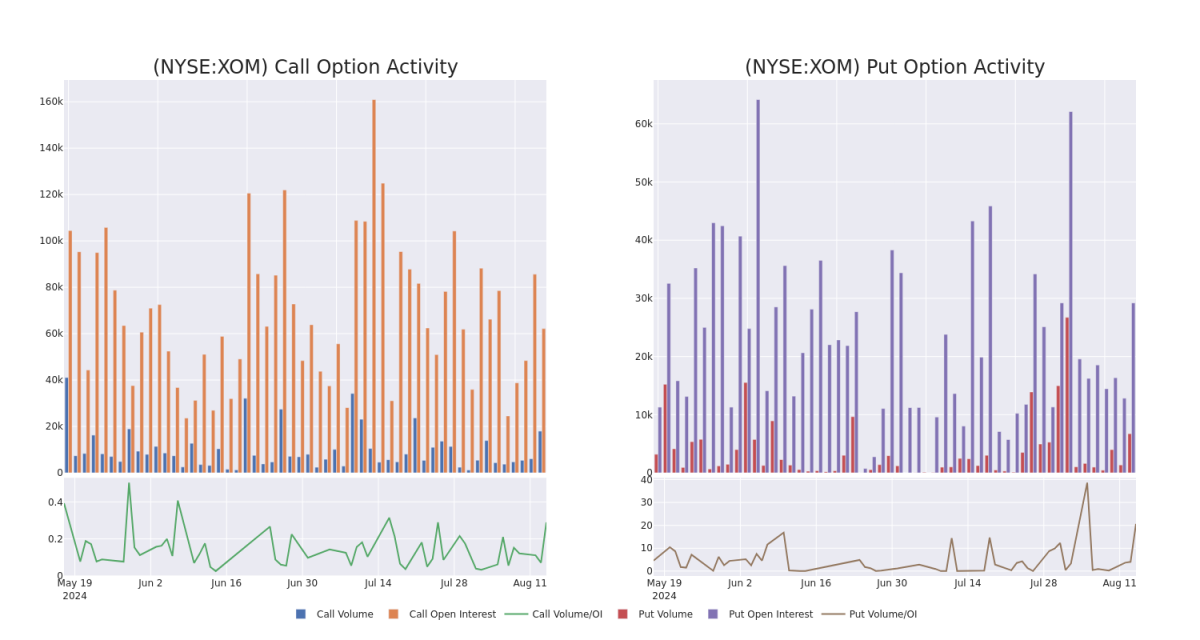

In today's trading context, the average open interest for options of Exxon Mobil stands at 3972.39, with a total volume reaching 24,707.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Exxon Mobil, situated within the strike price corridor from $50.0 to $130.0, throughout the last 30 days.

在今天的交易背景下,埃克森美孚期权的平均未平仓合约为3972.39,总交易量达到24,707.00。随附的图表描绘了过去30天埃克森美孚高价值交易的看涨和看跌期权交易量以及未平仓合约的变化,这些交易位于行使价走势从50.0美元到130.0美元之间。

Exxon Mobil Option Activity Analysis: Last 30 Days

埃克森美孚期权活动分析:过去 30 天

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| XOM | CALL | SWEEP | BEARISH | 12/20/24 | $5.6 | $5.5 | $5.5 | $120.00 | $275.0K | 7.3K | 505 |

| XOM | CALL | SWEEP | BULLISH | 11/15/24 | $3.15 | $3.15 | $3.15 | $125.00 | $128.2K | 28 | 440 |

| XOM | CALL | SWEEP | BULLISH | 08/16/24 | $2.23 | $2.09 | $2.23 | $117.00 | $84.0K | 2.5K | 694 |

| XOM | PUT | SWEEP | BULLISH | 01/17/25 | $3.6 | $3.5 | $3.5 | $110.00 | $72.8K | 14.0K | 236 |

| XOM | PUT | SWEEP | BULLISH | 08/16/24 | $0.76 | $0.71 | $0.71 | $118.00 | $63.9K | 2.2K | 1.7K |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| XOM | 打电话 | 扫 | 粗鲁的 | 12/20/24 | 5.6 美元 | 5.5 美元 | 5.5 美元 | 120.00 美元 | 275.0 万美元 | 7.3K | 505 |

| XOM | 打电话 | 扫 | 看涨 | 11/15/24 | 3.15 美元 | 3.15 美元 | 3.15 美元 | 125.00 美元 | 128.2 万美元 | 28 | 440 |

| XOM | 打电话 | 扫 | 看涨 | 08/16/24 | 2.23 美元 | 2.09 美元 | 2.23 美元 | 117.00 美元 | 84.0 万美元 | 2.5K | 694 |

| XOM | 放 | 扫 | 看涨 | 01/17/25 | 3.6 美元 | 3.5 美元 | 3.5 美元 | 110.00 美元 | 72.8 万美元 | 14.0K | 236 |

| XOM | 放 | 扫 | 看涨 | 08/16/24 | 0.76 美元 | 0.71 美元 | 0.71 美元 | 118.00 美元 | 63.9 万美元 | 2.2K | 1.7K |

About Exxon Mobil

关于埃克森美孚

ExxonMobil is an integrated oil and gas company that explores for, produces, and refines oil around the world. In 2023, it produced 2.4 million barrels of liquids and 7.7 billion cubic feet of natural gas per day. At the end of 2023, reserves were 16.9 billion barrels of oil equivalent, 66% of which were liquids. The company is one the world's largest refiners with a total global refining capacity of 4.5 million barrels of oil per day and is one of the world's largest manufacturers of commodity and specialty chemicals.

埃克森美孚是一家综合石油和天然气公司,在全球范围内勘探、生产和提炼石油。2023 年,它每天生产 240 万桶液体和 77 亿立方英尺的天然气。到2023年底,储量为169亿桶石油当量,其中66%是液体。该公司是全球最大的炼油厂之一,全球炼油总产能为每天450万桶石油,也是世界上最大的大宗商品和特种化学品制造商之一。

Having examined the options trading patterns of Exxon Mobil, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了埃克森美孚的期权交易模式之后,我们的注意力现在直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Present Market Standing of Exxon Mobil

埃克森美孚目前的市场地位

- With a trading volume of 9,197,916, the price of XOM is up by 0.88%, reaching $118.9.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 72 days from now.

- xOM的交易量为9,197,916美元,上涨了0.88%,达到118.9美元。

- 当前的RSI值表明该股可能已接近超买。

- 下一份收益报告定于72天后发布。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。