A Closer Look at American Tower's Options Market Dynamics

A Closer Look at American Tower's Options Market Dynamics

Benzinga's options scanner has just identified more than 12 option transactions on American Tower (NYSE:AMT), with a cumulative value of $799,652. Concurrently, our algorithms picked up 9 puts, worth a total of 705,932.

Benzinga的期权扫描仪刚刚在美国铁塔(纽约证券交易所代码:AMT)上发现了超过12笔期权交易,累计价值为799,652美元。同时,我们的算法获得了9个看跌期权,总价值705,932个。

Predicted Price Range

预测的价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $200.0 and $220.0 for American Tower, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场走势者正在关注过去三个月中美国铁塔200美元至220.0美元之间的价格区间。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

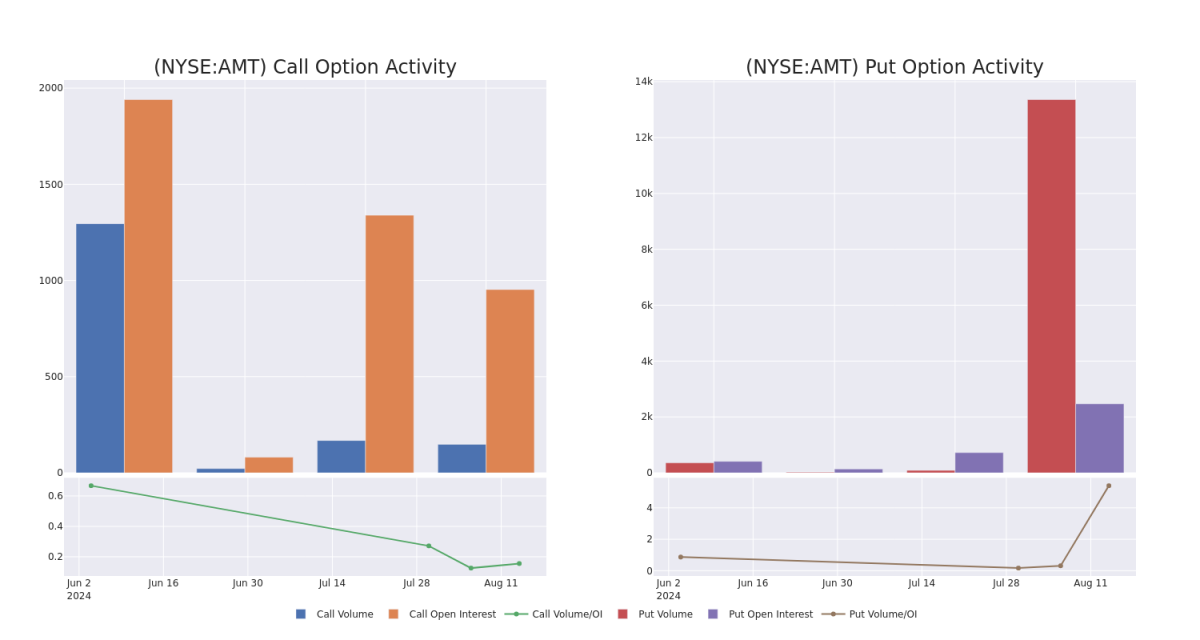

In terms of liquidity and interest, the mean open interest for American Tower options trades today is 855.5 with a total volume of 13,506.00.

就流动性和利息而言,今天美国铁塔期权交易的平均未平仓合约为855.5,总交易量为13,506.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for American Tower's big money trades within a strike price range of $200.0 to $220.0 over the last 30 days.

在下图中,我们可以跟踪过去30天内美国铁塔大额资金交易的看涨和看跌期权交易量和未平仓合约的变化,其行使价区间为200.0美元至220.0美元。

American Tower Call and Put Volume: 30-Day Overview

美国铁塔看涨和看跌交易量:30天概述

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMT | PUT | SWEEP | BULLISH | 09/20/24 | $4.6 | $4.0 | $4.1 | $220.00 | $289.7K | 2.4K | 1.0K |

| AMT | PUT | SWEEP | BULLISH | 09/20/24 | $4.8 | $4.2 | $4.2 | $220.00 | $135.3K | 2.4K | 320 |

| AMT | CALL | TRADE | BULLISH | 08/16/24 | $14.2 | $13.7 | $14.2 | $210.00 | $93.7K | 579 | 88 |

| AMT | PUT | TRADE | BULLISH | 09/20/24 | $4.5 | $4.2 | $4.2 | $220.00 | $44.5K | 2.4K | 2.0K |

| AMT | PUT | TRADE | BULLISH | 09/20/24 | $4.3 | $4.0 | $4.0 | $220.00 | $42.4K | 2.4K | 1.9K |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMT | 放 | 扫 | 看涨 | 09/20/24 | 4.6 美元 | 4.0 美元 | 4.1 美元 | 220.00 美元 | 289.7 万美元 | 2.4K | 1.0K |

| AMT | 放 | 扫 | 看涨 | 09/20/24 | 4.8 美元 | 4.2 美元 | 4.2 美元 | 220.00 美元 | 135.3 万美元 | 2.4K | 320 |

| AMT | 打电话 | 贸易 | 看涨 | 08/16/24 | 14.2 美元 | 13.7 美元 | 14.2 美元 | 210.00 美元 | 93.7 万美元 | 579 | 88 |

| AMT | 放 | 贸易 | 看涨 | 09/20/24 | 4.5 美元 | 4.2 美元 | 4.2 美元 | 220.00 美元 | 44.5 万美元 | 2.4K | 2.0K |

| AMT | 放 | 贸易 | 看涨 | 09/20/24 | 4.3 美元 | 4.0 美元 | 4.0 美元 | 220.00 美元 | 42.4 万美元 | 2.4K | 1.9K |

About American Tower

关于美国铁塔

American Tower owns and operates more than 220,000 cell towers throughout the us, Asia, Latin America, Europe, and Africa. It also owns and/or operates 28 data centers in 10 us markets after acquiring CoreSite. On its towers, the company has a very concentrated customer base, with most revenue in each market being generated by just the top few mobile carriers. The company operates more than 40,000 towers in the us, which accounted for almost half of the company's total revenue in 2023. Outside the us, American Tower operates over 75,000 towers in India, almost 50,000 towers in Latin America (dominated by Brazil), 30,000 towers in Europe, and nearly 25,000 towers in Africa. American Tower operates as a REIT.

美国铁塔在美国、亚洲、拉丁美洲、欧洲和非洲拥有并运营超过22万座手机信号塔。在收购CoreSite后,它还在美国10个市场拥有和/或运营28个数据中心。该公司的客户群非常集中,每个市场的大部分收入仅由排名前几的移动运营商产生。该公司在美国运营着40,000多座塔楼,占公司2023年总收入的近一半。在美国以外,美国铁塔在印度运营着超过75,000座塔楼,在拉丁美洲(以巴西为主)运营近5万座塔楼,在欧洲运营3万座塔楼,在非洲运营近25,000座塔楼。美国铁塔以房地产投资信托基金的形式运营。

In light of the recent options history for American Tower, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于美国铁塔最近的期权历史,现在应该将重点放在公司本身上。我们的目标是探索其目前的表现。

Present Market Standing of American Tower

美国铁塔目前的市场地位

- Currently trading with a volume of 2,289,241, the AMT's price is up by 0.23%, now at $223.18.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 71 days.

- AMT目前的交易量为2,289,241美元,价格上涨了0.23%,目前为223.18美元。

- RSI读数表明,该股目前可能接近超买。

- 预计收益将在71天后发布。

What The Experts Say On American Tower

专家对美国塔的看法

5 market experts have recently issued ratings for this stock, with a consensus target price of $243.6.

5位市场专家最近发布了该股的评级,共识目标价为243.6美元。

- Consistent in their evaluation, an analyst from BMO Capital keeps a Outperform rating on American Tower with a target price of $246.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for American Tower, targeting a price of $245.

- An analyst from JP Morgan has decided to maintain their Overweight rating on American Tower, which currently sits at a price target of $240.

- An analyst from TD Cowen persists with their Buy rating on American Tower, maintaining a target price of $239.

- Maintaining their stance, an analyst from Scotiabank continues to hold a Sector Outperform rating for American Tower, targeting a price of $248.

- BMO Capital的一位分析师在评估中保持了对美国铁塔跑赢大盘的评级,目标价为246美元。

- 富国银行的一位分析师保持立场,继续对美国铁塔进行增持评级,目标价格为245美元。

- 摩根大通的一位分析师已决定维持对美国铁塔的增持评级,目前的目标股价为240美元。

- 道明考恩的一位分析师坚持对美国铁塔的买入评级,维持239美元的目标价。

- 丰业银行的一位分析师维持其立场,继续维持美国铁塔的行业跑赢大盘评级,目标股价为248美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest American Tower options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时警报,随时了解最新的美国铁塔期权交易。