Phoenix New Media Reports Second Quarter 2024 Unaudited Financial Results

Phoenix New Media Reports Second Quarter 2024 Unaudited Financial Results

Live Conference Call to be Held at 9:30 PM U.S. Eastern Time on August 13, 2024

电话会议将于美国东部时间2024年8月13日晚上 9:30 举行

BEIJING, China, August 14, 2024 — Phoenix New Media Limited (NYSE: FENG) ("Phoenix New Media", "ifeng" or the "Company"), a leading new media company in China, today announced its unaudited financial results for the second quarter ended June 30, 2024.

中国北京,2024年8月14日——中国领先的新媒体公司凤凰新媒体有限公司(纽约证券交易所代码:FENG)(“凤凰新媒体”、“ifeng” 或 “公司”)今天公布了截至2024年6月30日的第二季度未经审计的财务业绩。

Mr. Yusheng Sun, CEO of Phoenix New Media, stated, "During the second quarter of 2024, we continued to establish ourselves as a leading new media outlet. We focused on strengthening our team's professional capabilities, producing quality content, refining our products, and optimizing user experience. Simultaneously, we kept exploring new commercial opportunities, creating new marketing solutions, attracting new clients, and exploring additional advertising revenue streams. We are committed to further improving our operational efficiency and monetization capabilities to strengthen our position."

凤凰新媒体首席执行官孙宇生表示:“在2024年第二季度,我们继续将自己确立为领先的新媒体的地位。我们专注于增强团队的专业能力、制作高质量的内容、完善我们的产品和优化用户体验。同时,我们一直在探索新的商业机会,创建新的营销解决方案,吸引新客户并探索额外的广告收入来源。我们致力于进一步提高我们的运营效率和盈利能力,以巩固我们的地位。”

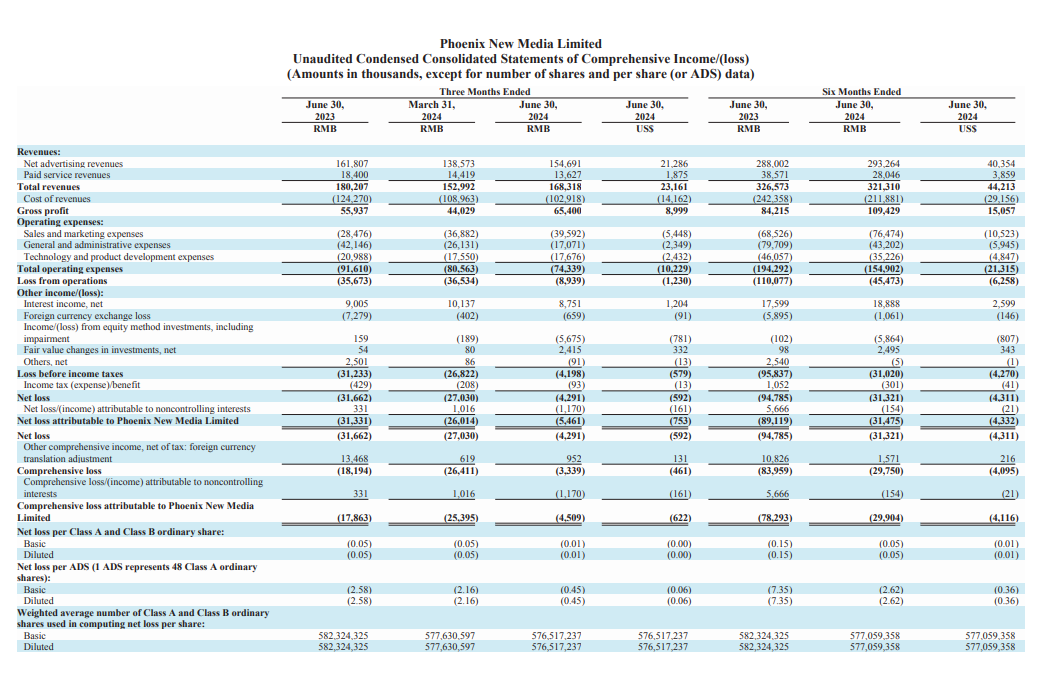

Second Quarter 2024 Financial Results

2024 年第二季度财务业绩

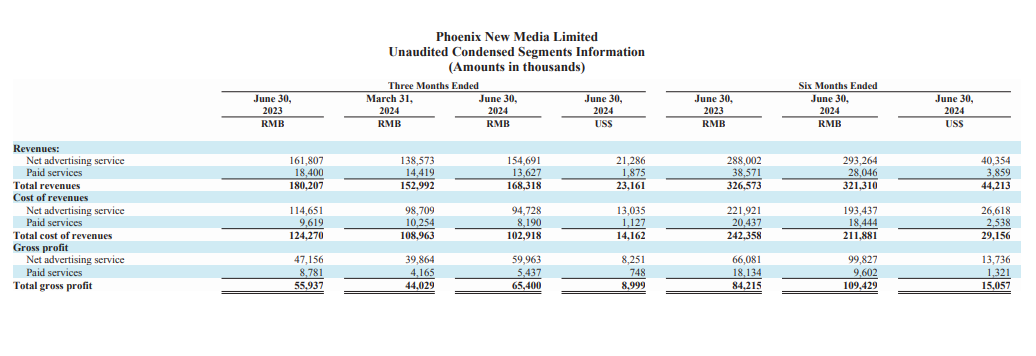

REVENUES

Total revenues in the second quarter of 2024 decreased by 6.6% to RMB168.3 million (US$23.2 million) from RMB180.2 million in the same period of 2023, primarily due to the year-over-year decline in both the Company's net advertising revenues and paid services revenues.

收入

2024年第二季度的总收入从2023年同期的人民币1802万元下降了6.6%,至人民币16830万元(合2320万美元),这主要是由于公司的净广告收入和付费服务收入同比下降。

Net advertising revenues in the second quarter of 2024 decreased by 4.4% to RMB154.7 million (US$21.3 million) from RMB161.8 million in the same period of 2023, mainly due to the reduction in advertising spending of advertisers from certain industries and the intensified industry-wide competition.

Paid services revenues in the second quarter of 2024 decreased by 26.1% to RMB13.6 million (US$1.9 million) from RMB18.4 million in the same period of 2023. Paid services revenues comprise (i) revenues from paid contents, mainly including digital reading, audio books, and paid videos, and (ii) revenues from E-commerce and others. Revenues from paid contents in the second quarter of 2024 decreased by 20.3% to RMB5.9 million (US$0.8 million) from RMB7.4 million in the same period of 2023, mainly due to the decrease in the content spending of certain customers in the second quarter of 2024. Revenues from E-commerce and others in the second quarter of 2024 decreased by 30.0% to RMB7.7 million (US$1.1 million) from RMB11.0 million in the same period of 2023, as the Company scaled down its E-commerce business in 2023.

2024年第二季度的净广告收入从2023年同期的人民币16180万元下降了4.4%,至人民币15470万元(合2,130万美元),这主要是由于某些行业广告商的广告支出减少以及全行业竞争的加剧。

2024年第二季度的付费服务收入从2023年同期的人民币18.4万元下降了26.1%,至人民币13.6万元(合190万美元)。付费服务收入包括(i)来自付费内容的收入,主要包括数字阅读、有声读物和付费视频,以及(ii)来自电子商务和其他方面的收入。2024年第二季度的付费内容收入从2023年同期的人民币74万元下降了20.3%,至人民币590万元(80万美元),这主要是由于某些客户的内容支出在2024年第二季度有所减少。由于该公司在2023年缩减了电子商务业务,2024年第二季度的电子商务和其他收入从2023年同期的人民币1100万元下降了30.0%,至人民币770万元(合110万美元)。

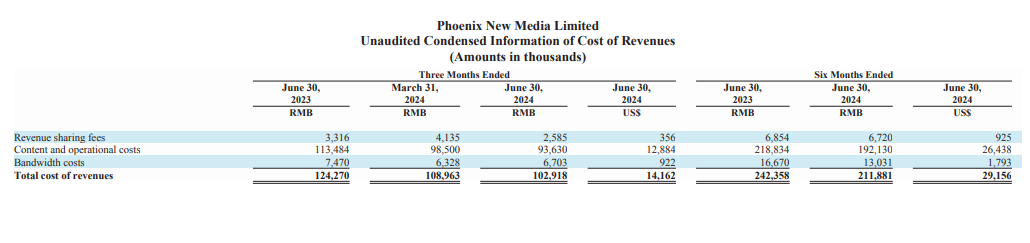

COST OF REVENUES AND GROSS PROFIT

Cost of revenues in the second quarter of 2024 decreased by 17.2% to RMB102.9 million (US$14.2 million) from RMB124.3 million in the same period of 2023, as a result of the Company's strict cost control measures.

Gross profit in the second quarter of 2024 increased by 17.0% to RMB65.4 million (US$9.0 million) from RMB55.9 million in the same period of 2023. Gross margin in the second quarter of 2024 was 38.9%, as compared to 31.0% in the same period of 2023.

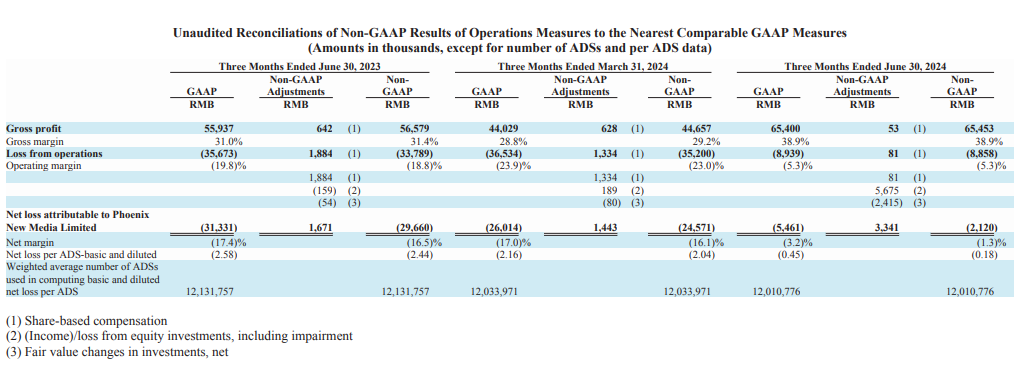

To supplement the financial measures presented in accordance with the United States Generally Accepted Accounting Principles ("GAAP"), the Company has presented certain non-GAAP financial measures in this press release, which excluded the impact of certain reconciling items as stated in the "Use of Non-GAAP Financial Measures" section below. The related reconciliations to GAAP financial measures are presented in the accompanying "Unaudited Reconciliations of Non-GAAP Results of Operation Measures to the Nearest Comparable GAAP Measures."

Non-GAAP gross margin in the second quarter of 2024, which excluded share-based compensation, increased to 38.9% from 31.4% in the same period of 2023.

收入成本和毛利润

由于公司严格的成本控制措施,2024年第二季度的收入成本从2023年同期的人民币12430万元下降了17.2%,至人民币10.290万元(合1,420万美元)。

2024年第二季度的毛利从2023年同期的人民币5590万元增长了17.0%,至人民币654万元(合900万美元)。2024年第二季度的毛利率为38.9%,而2023年同期为31.0%。

为了补充根据美国公认会计原则(“GAAP”)提出的财务指标,公司在本新闻稿中提出了某些非公认会计准则财务指标,其中排除了下文 “使用非公认会计准则财务指标” 部分所述的某些对账项目的影响。与GAAP财务指标的相关对账见随附的 “非公认会计准则经营业绩指标与最接近的可比GAAP指标的未经审计的对账”。

2024年第二季度的非公认会计准则毛利率(不包括基于股份的薪酬)从2023年同期的31.4%增至38.9%。

OPERATING EXPENSES AND LOSS FROM OPERATIONS

Total operating expenses in the second quarter of 2024 decreased by 18.9% to RMB74.3 million (US$10.2 million) from RMB91.6 million in the same period of 2023, primarily attributable to the decrease in allowance for expected credit losses as the Company reversed some allowance for expected credit losses in the second quarter of 2024 due to the collection of some long-aged accounts receivables and the decrease in certain operating expenses as a result of the Company's strict cost control measures.

Loss from operations in the second quarter of 2024 was RMB8.9 million (US$1.2 million), compared to loss from operations of RMB35.7 million in the same period of 2023. Operating margin in the second quarter of 2024 was negative 5.3%, compared to negative 19.8% in the same period of 2023.

Non-GAAP loss from operations in the second quarter of 2024, which excluded share-based compensation, was RMB8.9 million (US$1.2 million), compared to non-GAAP loss from operations of RMB33.8 million in the same period of 2023. Non-GAAP operating margin in the second quarter of 2024, which excluded share-based compensation, was negative 5.3%, compared to negative 18.8% in the same period of 2023.

OTHER INCOME OR LOSS

Other income or loss reflects net interest income, foreign currency exchange gain or loss, income or loss from equity investments, including impairment, fair value changes in investments, net, and others, net. Total net other income in the second quarter of 2024 was RMB4.7 million (US$0.6 million), compared to total net other income of RMB4.4 million in the same period of 2023, which mainly consisted of the following items:

运营费用和运营损失

2024年第二季度的总运营支出从2023年同期的人民币91.6万元下降了18.9%,至人民币7430万元(合1,020万美元),这主要是由于公司撤销了2024年第二季度因收取部分长期应收账款以及公司严格的成本控制措施导致某些运营费用减少而导致的预期信贷损失备抵减少。

2024年第二季度的运营亏损为人民币890万元(合120万美元),而2023年同期的运营亏损为人民币3570万元。2024年第二季度的营业利润率为负5.3%,而2023年同期为负19.8%。

2024年第二季度的非公认会计准则运营亏损(不包括基于股份的薪酬)为人民币890万元(合120万美元),而2023年同期的非公认会计准则运营亏损为人民币3380万元。2024年第二季度的非公认会计准则营业利润率(不包括基于股份的薪酬)为负5.3%,而2023年同期为负18.8%。

其他收入或损失

其他收入或亏损反映净利息收入、外币汇兑损益、股权投资的收入或亏损,包括减值、投资公允价值变动、净额和其他净额。2024年第二季度的其他净收入总额为人民币470万元(合60万美元),而2023年同期的其他净收入总额为人民币440万元,主要包括以下项目:

Net interest income in the second quarter of 2024 was RMB8.8 million (US1.2 million), compared to RMB9.0 million in the same period of 2023.

Foreign currency exchange loss in the second quarter of 2024 was RMB0.7 million (US$0.1 million), compared to a foreign currency exchange loss of RMB7.3 million in the same period of 2023.

Loss from equity method investments,including impairment, was RMB5.7 million (US$0.8 million) in the second quarter of 2024, compared to income from equity method investments, including impairment, of RMB0.2 million in the same period of 2023, which were mainly attributable to the changes in estimated fair value of the underlying investments held by the Company through limited partnerships accounted for under the equity method.

Fair value changes in investments, net in the second quarter of 2024 was a gain of RMB2.4 million (US$0.3 million), compared to a gain of RMB0.1 million in the same period of 2023, which were mainly attributable to the changes in estimated fair value of the underlying investments held by the Company through a private equity fund accounted using NAV as a practical expedient under ASC 820.

Others, net, in the second quarter of 2024 was almost nil, compared to a gain of RMB2.5 million in the same period of 2023. Others, net primarily consists of some non-operating gain or loss.

2024年第二季度的净利息收入为人民币880万元(合120万美元),而2023年同期为900万元人民币。

2024年第二季度的外币汇兑损失为人民币70万元(合10万美元),而2023年同期的外币汇兑损失为人民币73万元。

2024年第二季度,包括减值在内的权益法投资亏损为人民币570万元(合80万美元),而2023年同期权益法投资的收益(包括减值)为人民币2万元,这主要归因于公司通过有限合伙企业持有的标的投资在权益法下核算的估计公允价值的变化。

投资的公允价值变动,2024年第二季度的净收益为人民币240万元(合30万美元),而2023年同期的收益为人民币1.0万元,这主要归因于公司通过私募股权基金持有的标的投资的估计公允价值的变化,根据ASC 820将资产净值作为实际权宜之计。

2024年第二季度的其他净收益几乎为零,而2023年同期的收益为250万元人民币。其他净收益主要包括一些非营业收益或亏损。

NET LOSS ATTRIBUTABLE TO PHOENIX NEW MEDIA LIMITED

Net loss attributable to Phoenix New Media Limited in the second quarter of 2024 was RMB5.5 million (US$0.8 million), compared to net loss attributable to Phoenix New Media Limited of RMB31.3 million in the same period of 2023. Net margin in the second quarter of 2024 was negative 3.2%, compared to negative 17.4% in the same period of 2023. Net loss per basic and diluted ordinary share in the second quarter of 2024 was RMB0.01 (US$0.00), compared to net loss per basic and diluted ordinary share of RMB0.05 in the same period of 2023.

Non-GAAP net loss attributable to Phoenix New Media Limited, which excluded share-based compensation, income or loss from equity investments, including impairment, and fair value changes in investments, net, was RMB2.1 million (US$0.3 million) in the second quarter of 2024, compared to non-GAAP net loss attributable to Phoenix New Media Limited of RMB29.7 million in the same period of 2023. Non-GAAP net margin in the second quarter of 2024 was negative 1.3%, compared to negative 16.5% in the same period of 2023. Non-GAAP net loss per basic and diluted ADS in the second quarter of 2024 was RMB0.18 (US$0.02), compared to non-GAAP net loss per basic and diluted ADS of RMB2.44 in the same period of 2023. "ADS(s)" refers to the Company's American Depositary Share(s), each representing 48 Class A ordinary shares of the Company.

In the second quarter of 2024, the Company's weighted average number of ADSs used in the computation of basic and diluted net loss per ADS was 12,010,776. As of June 30, 2024, the Company had a total of 576,517,237 ordinary shares outstanding, or the equivalent of 12,010,776 ADSs.

归属于凤凰新媒体有限公司的净亏损

2024年第二季度归属于凤凰新媒体有限公司的净亏损为人民币550万元(80万美元),而2023年同期归属于凤凰新媒体有限公司的净亏损为人民币3130万元。2024年第二季度的净利润率为负3.2%,而2023年同期为负17.4%。2024年第二季度每股基本股和摊薄普通股净亏损为人民币0.01元(0.00美元),而2023年同期每股基本股和摊薄普通股净亏损为人民币0.05元。

归属于凤凰新媒体有限公司的非公认会计准则净亏损在2024年第二季度为人民币210万元(30万美元),其中不包括股权投资的基于股份的薪酬、收入或亏损,包括减值和投资公允价值变动,净亏损为人民币210万元(30万美元),而2023年同期归属于凤凰新媒体有限公司的非公认会计准则净亏损为人民币2970万元。2024年第二季度的非公认会计准则净利润率为负1.3%,而2023年同期为负16.5%。2024年第二季度,每股基本和摊薄后ADS的非公认会计准则净亏损为人民币0.18元(0.02美元),而2023年同期每股基本和摊薄后ADS的非公认会计准则净亏损为人民币2.44元。“ADS(s)” 是指公司的美国存托股份,每股代表公司的48股A类普通股。

在2024年第二季度,该公司在计算每份ADS的基本和摊薄净亏损时使用的加权平均ADS数量为12,010,776份。截至2024年6月30日,该公司共有576,517,237股普通股已发行普通股,相当于12,010,776股美国存托凭证。

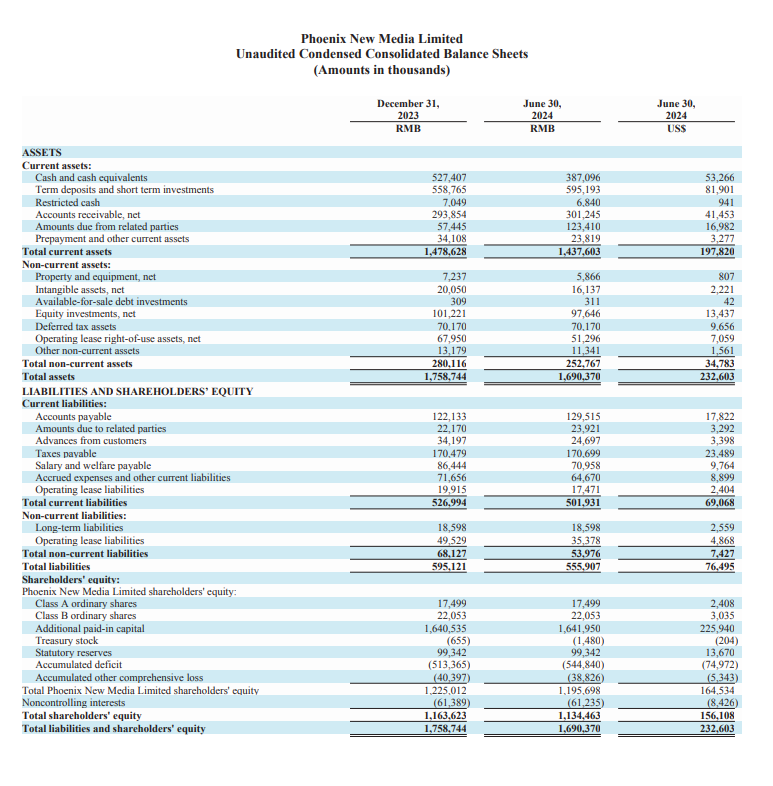

CERTAIN BALANCE SHEET ITEMS

某些资产负债表项目

As of June 30, 2024, the Company's cash and cash equivalents, term deposits and short term investments and restricted cash were RMB989.1 million (US$136.1 million).

截至2024年6月30日,该公司的现金及现金等价物、定期存款和短期投资以及限制性现金为人民币98.910万元(1.361亿美元)。

Business Outlook

For the third quarter of 2024, the Company expects its total revenues to be between RMB151.6 million and RMB166.6 million; net advertising revenues are expected to be between RMB142.3 million and RMB152.3 million; and paid services revenues are expected to be between RMB9.3 million and RMB14.3 million.

All of the above forecasts reflect the current and preliminary view of the Company's management, which are subject to changes and substantial uncertainty, particularly in view of the uncertainty of macroeconomic environment.

Conference Call Information

The Company will hold a conference call at 9:30 p.m. U.S. Eastern Time on August 13, 2024 (August 14, 2024 at 9:30 a.m. Beijing/Hong Kong time) to discuss its second quarter 2024 unaudited financial results and operating performance.

To participate in the call, please register in advance of the conference by clicking here. Upon registering, each participant will receive the participant dial-in numbers and a unique access PIN, which will be used to join the conference call. Please dial in 10 minutes before the call is scheduled to begin.

A live and archived webcast of the conference call will also be available at the Company's investor relations website at

商业展望

该公司预计,2024年第三季度的总收入将在人民币15160万元至人民币16660万元之间;净广告收入预计将在人民币14230万元至15230万元人民币之间;付费服务收入预计将在人民币930万元至1430万元人民币之间。

上述所有预测都反映了公司管理层当前和初步的观点,这些观点可能会发生变化和很大的不确定性,特别是考虑到宏观经济环境的不确定性。

电话会议信息

公司将在美国东部时间2024年8月13日晚上 9:30(北京/香港时间2024年8月14日上午9点30分)举行电话会议,讨论其2024年第二季度未经审计的财务业绩和经营业绩。

要参加电话会议,请点击此处在会议之前注册。注册后,每位参与者将收到参与者的拨入号码和唯一的访问密码,该密码将用于加入电话会议。请在预定通话开始前 10 分钟拨号。

电话会议的网络直播和存档网络直播也将在公司的投资者关系网站上公布

Use of Non-GAAP Financial Measures

To supplement the consolidated financial statements presented in accordance with the United States Generally Accepted Accounting Principles ("GAAP"), Phoenix New Media Limited uses non-GAAP gross profit, non-GAAP gross margin, non-GAAP income or loss from operations, non-GAAP operating margin, non-GAAP net income or loss attributable to Phoenix New Media Limited, non-GAAP net margin and non-GAAP net income or loss per basic and diluted ADS, each of which is a non-GAAP financial measure. Non-GAAP gross profit is gross profit excluding share-based compensation. Non-GAAP gross margin is non-GAAP gross profit divided by total revenues. Non-GAAP income or loss from operations is income or loss from operations excluding share-based compensation. Non-GAAP operating margin is non-GAAP income or loss from operations divided by total revenues. Non-GAAP net income or loss attributable to Phoenix New Media Limited is net income or loss attributable to Phoenix New Media Limited excluding share-based compensation, income or loss from equity investments, including impairment and fair value changes in investments, net. Non-GAAP net margin is non-GAAP net income or loss attributable to Phoenix New Media Limited divided by total revenues. Non-GAAP net income or loss per basic and diluted ADS is non-GAAP net income or loss attributable to Phoenix New Media Limited divided by weighted average number of basic and diluted ADSs. The Company believes that separate analysis and exclusion of the aforementioned non-GAAP to GAAP reconciling items add clarity to the constituent parts of its performance. The Company reviews these non-GAAP financial measures together with the related GAAP financial measures to obtain a better understanding of its operating performance. It uses these non-GAAP financial measures for planning, forecasting and measuring results against the forecast. The Company believes that using these non-GAAP financial measures to evaluate its business allows both management and investors to assess the Company's performance against its competitors and ultimately monitor its capacity to generate returns for investors. The Company also believes that these non-GAAP financial measures are useful supplemental information for investors and analysts to assess its operating performance without the effect of items like share-based compensation, income or loss from equity investments, including impairment, and fair value changes in investments, net, which have been and will continue to be significant recurring items. However, the use of these non-GAAP financial measures has material limitations as an analytical tool. One of the limitations of using these non-GAAP financial measures is that they do not include all items that impact the Company's gross profit, income or loss from operations and net income or loss attributable to Phoenix New Media Limited for the period. In addition, because these non-GAAP financial measures are not calculated in the same manner by all companies, they may not be comparable to other similarly titled measures used by other companies. In light of the foregoing limitations, you should not consider these non-GAAP financial measures in isolation from, or as an alternative to, the financial measures prepared in accordance with GAAP.

使用非公认会计准则财务指标

为了补充根据美国公认会计原则(“GAAP”)列报的合并财务报表,菲尼克斯新媒体有限公司使用非公认会计准则毛利、非公认会计准则毛利率、非公认会计准则运营收入或亏损、非公认会计准则营业利润率、归属于菲尼克斯新媒体有限公司的非公认会计准则净收益或亏损、非公认会计准则净利润率以及每份基本和摊薄后的ADS的非公认会计准则净收益或亏损,均为非公认会计准则财务指标。非公认会计准则毛利是毛利,不包括基于股份的薪酬。非公认会计准则毛利率是非公认会计准则毛利除以总收入。非公认会计准则运营收入或亏损是指不包括股份薪酬在内的运营收入或亏损。非公认会计准则营业利润率是非公认会计准则的运营收入或亏损除以总收入。归属于凤凰新媒体有限公司的非公认会计准则净收益或亏损是归属于凤凰新媒体有限公司的净收益或亏损,不包括基于股份的薪酬、股权投资的收益或亏损,包括投资的减值和公允价值变动。非公认会计准则净利润率是归属于菲尼克斯新媒体有限公司的非公认会计准则净收益或亏损除以总收入。每股基本广告和摊薄后ADS的非公认会计准则净收益或亏损是归属于菲尼克斯新媒体有限公司的非公认会计准则净收益或亏损除以基本和摊薄后的ADS的加权平均数。该公司认为,将上述非公认会计准则与公认会计准则的对账项目进行单独分析和排除,可以明确其业绩的组成部分。公司审查这些非公认会计准则财务指标以及相关的GAAP财务指标,以更好地了解其经营业绩。它使用这些非公认会计准则财务指标来规划、预测和衡量预测结果。该公司认为,使用这些非公认会计准则财务指标来评估其业务,可以让管理层和投资者评估公司相对于竞争对手的表现,并最终监控其为投资者创造回报的能力。该公司还认为,这些非公认会计准则财务指标是有用的补充信息,可供投资者和分析师评估其经营业绩,而不会受到股票薪酬、包括减值在内的股权投资收益或亏损(包括减值)和投资公允价值变动等项目的影响,这些项目一直是并将继续是重要的经常性项目。但是,使用这些非公认会计准则财务指标作为分析工具存在重大局限性。使用这些非公认会计准则财务指标的局限性之一是,它们不包括所有影响公司在此期间的毛利、运营收入或亏损以及归属于菲尼克斯新媒体有限公司的净收益或亏损的项目。此外,由于并非所有公司都以相同的方式计算这些非公认会计准则财务指标,因此它们可能无法与其他公司使用的其他类似标题的指标进行比较。鉴于上述限制,您不应将这些非公认会计准则财务指标与根据公认会计原则编制的财务指标分开考虑,或将其作为其替代方案。

Exchange Rate

This announcement contains translations of certain RMB amounts into U.S. dollars ("USD") at specified rates solely for the convenience of the readers. Unless otherwise stated, all translations from RMB to USD were made at the rate of RMB7.2672 to US$1.00, the noon buying rate in effect on June 28, 2024 in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or USD amounts referred could be converted into USD or RMB, as the case may be, at any particular rate or at all. For analytical presentations, all percentages are calculated using the numbers presented in the financial information contained in this earnings release.

About Phoenix New Media Limited

Phoenix New Media Limited (NYSE: FENG) is a leading new media company providing premium content on an integrated Internet platform, including PC and mobile, in China. Having originated from a leading global Chinese language TV network based in Hong Kong, Phoenix TV, the Company enables consumers to access professional news and other quality information and share user-generated content on the Internet through their PCs and mobile devices. Phoenix New Media's platform includes its PC channel, consisting of ifeng.com website, which comprises interest-based verticals and interactive services; its mobile channel, consisting of mobile news applications, mobile video application, digital reading applications and mobile Internet website; and its operations with the telecom operators that provides mobile value-added services.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar statements. Among other things, the business outlook and quotations from management in this announcement, as well as Phoenix New Media's strategic and operational plans, contain forward-looking statements. Phoenix New Media may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission ("SEC") on Forms 20-F and 6-K, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Phoenix New Media's beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: the Company's goals and strategies; the Company's future business development, financial condition and results of operations; the expected growth of online and mobile advertising, online video and mobile paid services markets in China; the Company's reliance on online and mobile advertising for a majority of its total revenues; the Company's expectations regarding demand for and market acceptance of its services; the Company's expectations regarding maintaining and strengthening its relationships with advertisers, partners and customers; the Company's investment plans and strategies; fluctuations in the Company's quarterly operating results; the Company's plans to enhance its user experience, infrastructure and services offerings; competition in its industry in China; and relevant government policies and regulations relating to the Company. Further information regarding these and other risks is included in the Company's filings with the SEC, including its registration statement on Form F-1, as amended, and its annual reports on Form 20-F. All information provided in this press release and in the attachments is as of the date of this press release, and Phoenix New Media does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries please contact:

Phoenix New Media Limited

Muzi Guo

Email: investorrelations@ifeng.com

汇率

本公告仅为方便读者而将某些人民币金额按指定汇率折算成美元(“美元”)。除非另有说明,否则从人民币兑美元的所有汇率均按人民币7.2672元兑1美元的汇率进行,这是美联储委员会发布的H.10统计数据中2024年6月28日生效的午盘买入汇率。本公司未就所提及的人民币或美元金额可视情况以任何特定汇率或根本兑换成美元或人民币作出任何陈述。对于分析报告,所有百分比均使用本财报中包含的财务信息中提供的数字计算。

关于凤凰新媒体有限公司

菲尼克斯新媒体有限公司(纽约证券交易所代码:FENG)是一家领先的新媒体公司,在包括个人电脑和移动设备在内的综合互联网平台上提供优质内容。该公司起源于总部位于香港的全球领先中文电视网络凤凰卫视,使消费者能够通过个人电脑和移动设备在互联网上获得专业新闻和其他质量信息,并共享用户生成的内容。菲尼克斯新媒体的平台包括其PC频道,包括ifeng.com网站,其中包括基于兴趣的垂直行业和互动服务;其移动频道,包括移动新闻应用程序、移动视频应用程序、数字阅读应用程序和移动互联网网站;以及与提供移动增值服务的电信运营商的业务。

安全港声明

本公告包含前瞻性陈述。这些声明是根据1995年《美国私人证券诉讼改革法》的 “安全港” 条款作出的。这些前瞻性陈述可以通过 “将”、“期望”、“预期”、“未来”、“打算”、“计划”、“相信”、“估计” 等术语和类似陈述来识别。除其他外,本公告中的业务展望和管理层的报价以及菲尼克斯新媒体的战略和运营计划都包含前瞻性陈述。Phoenix New Media还可能在其向美国证券交易委员会(“SEC”)提交的20-F和6-k表格的定期报告、向股东提交的年度报告、新闻稿和其他书面材料以及其高管、董事或员工向第三方所做的口头陈述中作出书面或口头前瞻性陈述。非历史事实的陈述,包括有关菲尼克斯新媒体信念和期望的陈述,均为前瞻性陈述。前瞻性陈述涉及固有的风险和不确定性。许多因素可能导致实际业绩与任何前瞻性陈述中包含的业绩存在重大差异,包括但不限于以下因素:公司的目标和战略;公司未来的业务发展、财务状况和经营业绩;中国在线和移动广告、在线视频和移动付费服务市场的预期增长;公司对在线和移动广告的大部分总收入的依赖;公司对需求和市场接受度的预期的其服务;公司对维持和加强与广告商、合作伙伴和客户关系的期望;公司的投资计划和战略;公司季度经营业绩的波动;公司改善用户体验、基础设施和服务产品的计划;中国行业的竞争;以及与公司相关的政府政策法规。有关这些风险和其他风险的更多信息包含在公司向美国证券交易委员会提交的文件中,包括经修订的F-1表格注册声明以及20-F表格的年度报告。本新闻稿和附件中提供的所有信息均截至本新闻稿发布之日,除非适用法律要求,否则菲尼克斯新媒体不承担任何更新任何前瞻性陈述的义务。

投资者和媒体垂询,请联系:

菲尼克斯新媒体有限公司

郭木子

电子邮件:investorrelations@ifeng.com

Click the tables to enlarge

点击表格放大