Market Mover | S P Setia Shares Fall Over 10% After Releasing Its Quarterly Financial Results

Market Mover | S P Setia Shares Fall Over 10% After Releasing Its Quarterly Financial Results

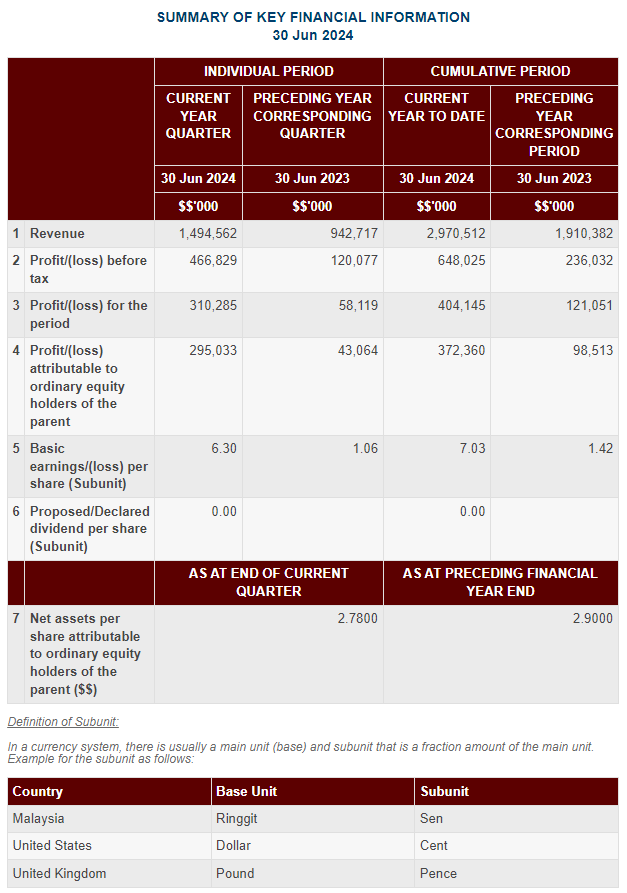

August 15, 2024 - $SPSETIA (8664.MY)$ shares fell 10.53% to RM1.36 on Thursday. The company released its 24Q2 financial results, reporting a net profit of RM310 million for the second quarter ended Jun 30, 2024.

2024年8月15日 - $SPSETIA (8664.MY)$ 公司发布了2024年第二季度财报,报告净利润为3,100万马来西亚令吉,截至2024年6月30日。

Key Highlights

主要亮点

Profit increased: Net profit after tax has increased to RM404 million in YTD Q2 2024 compared to RM121 million in the same period last year, benefitting from successful strategic land deals in Johor and Klang Valley, as well as completion of S P Setia’s 50% equity stake disposal in Taman Ikan Emas, Cheras partnership redevelopment project.

利润增加:截至2024年第二季度,税后净利润比去年同期增加到4,040万马来西亚令吉,受益于在柔佛和吉隆坡谋划成功的战略用地买卖,以及S P Setia在武吉加里曼丹Taman Ikan Emas项目的50%股权出售完成。

52% of FY2024 sales target achieved, launches phasing underway: With RM2.30 billion in sales driven by robust industrial segment’s performance in the Central region and favourable demand conditions in the Southern region, the remaining phases of launches are in the pipeline progressively throughout the rest of the year.

完成了2024财年销售目标的52%,中央地区强劲工业部门的表现和南部地区良好的需求状况推动了23亿马来西亚令吉的销售,其余的推出阶段将在今年剩下的时间内逐步推出。

Successful De-gearing strategies: From RM10.1 billion borrowings in Q4 2023, it has declined significantly by RM700 million within 6 months to RM9.4 billion as of Q2 2024. Net gearing ratio has consistently strengthened over the past few quarters to 0.41x per Q2 2024, compared to 0.49x in Q4 2023 due to the effectiveness of the Group’s debt management and capital allocation strategies.

成功减杠杆的策略:从2023年第四季度的101亿马来西亚令吉借款,到2024年第二季度已经显著下降了7000万马来西亚令吉,降至94亿马来西亚令吉。由于集团的债务管理和资本分配策略的有效性,净负债比率在过去几个季度持续加强,截至2024年第二季度为0.41倍,而2023年第四季度为0.49倍。

Steady progress of inventories clearance: Achieved RM244 million reduction of stocks compared to Q4 2023 level, representing ~15% clearance progressively taking place through a concerted effort throughout the Group.

存货清理稳步进展:与2023年第四季度相比,存货已经减少了2,440万马来西亚令吉,约占集团总存货的15%,通过集团的协调努力逐步清理。

Setia Brand refresh – “Shaping Spaces That Shape Us All": In its 50th year, in honouring decades of excellence, S P Setia celebrates its enduring legacy and unwavering commitment to quality and innovation in real estate development with new marketing campaigns aimed to enhance future sales.

Setia品牌更新 - “打造改变我们所有人空间”:在其50周年之际,S P Setia通过新的营销活动来庆祝其悠久的历史和对房地产开发质量和创新的恒久承诺,旨在增强未来的销售。

Related Links: Q2FY2024 Financial Results

相关链接:2024年第二季度财务结果

52% of FY2024 sales target achieved, launches phasing underway: With RM2.30 billion in sales driven by robust industrial segment’s performance in the Central region and favourable demand conditions in the Southern region, the remaining phases of launches are in the pipeline progressively throughout the rest of the year.

52% of FY2024 sales target achieved, launches phasing underway: With RM2.30 billion in sales driven by robust industrial segment’s performance in the Central region and favourable demand conditions in the Southern region, the remaining phases of launches are in the pipeline progressively throughout the rest of the year.