Largest IPO in Seven Years: 99 Speed Mart Opens Subscription on August 15th

Largest IPO in Seven Years: 99 Speed Mart Opens Subscription on August 15th

August 15th – $99SMART (5326.MY)$ is set to launch an initial public offering (IPO), with the subscription period running from August 15th to August 23rd. The IPO is priced at RM1.65 per share, according to the official prospectus. The listing is scheduled for September 9th.

8月15日- $99SMART (5326.MY)$ 将要进行首次公开招股(IPO),认购期从8月15日至8月23日。根据官方招股说明,IPO的价格为1.65马币每股。上市日期定于9月9日。

This IPO involves the issuance of up to 1,428 million ordinary shares, which includes an offer for sale of up to 1,028 million existing shares, referred to as 'Offer Shares'. Additionally, there is a public issue of 400 million new shares, known as 'Issue Shares'. Out of these shares, the company plans an institutional offering of up to 1,218 million shares to selected Malaysian investors at a price determined by bookbuilding, and a retail offering of 210 million shares to the company's directors, employees, contributors, and the public at a specified retail price.

本次IPO涉及发行多达142800万股普通股,其中包括高达102800万股现有股份的出售,称为“发售股份”。此外,还有40000万股新股的公开发行,称为“发行股份”。其中,公司计划向马来西亚的特定投资者发行多达121800万股的机构认购,价格由集资确定,以及向公司的董事、雇员、贡献者和公众以特定的零售价格发行21000万股的零售认购。

Corporate Profile

Corporate Profile

公司概况

The company is principally an investment holding company with four wholly-owned subsidiaries. Through two of these subsidiaries, it operates the well-known "99 Speedmart" chain of mini-market outlets involved in the retailing of Fast-Moving Consumer Goods (FMCG) across Malaysia. The remaining two wholly-owned subsidiaries, namely Yiwu J-Jade Trading and Yiwu SM Import and Export, were recently incorporated in China for the purposes of investment holding and procuring merchandise for sale in their outlets, respectively. According to the IMR Report, the company is the largest mini-market player and a leading grocery retailer in Malaysia, holding a market share of 37.9% and 11.1% in 2022, respectively, based on the Group's revenue for the FYE 2022.

该公司主要是一个投资控股公司,拥有四家全资子公司。其中两家子公司通过运营著名的“99 Speedmart”连锁迷你市场零售快动消费品(FMCG)在马来西亚广泛开展业务。另外两家全资子公司,分别是义乌杰诚贸易和义乌顺脉进出口,最近在中国成立,其一个用于投资控股,另一个则用于采购销售在其店面的商品。根据 IMR 报告,该公司是马来西亚最大的迷你市场参与者和领先的杂货零售商,在 2022财年基于集团营业收入,占有 37.9% 和 11.1% 的市场份额。

Their outlets serve approximately 940,000 customers per day based on the number of sales transactions recorded in the FYE 2022, with an average sales transaction value per outlet per day of RM23.59. Their growth strategy revolves around implementing their expansion plan. From the FYE 2020 to FYE 2022, they opened an average of 230 new outlets per year (net of closures). As of the Last Practical Date (LPD), they operate 2,542 outlets across Malaysia. The Group maintains a rapid expansion trajectory, aiming to open approximately 250 outlets annually, with an immediate objective to reach a total of about 3,000 operating outlets nationwide by the end of 2025.

根据2022财年记录的销售交易次数显示,他们的店铺每天大约服务940,000名顾客,每个店铺每天的平均销售交易额为RM23.59。他们的增长策略围绕着实施扩张计划展开。自2020财年至2022财年,他们每年平均开设230家新店(扣除关闭店铺)。截至最近实际日期(LPD),他们在马来西亚运营着2,542家店铺。该集团保持着快速的扩张轨迹,旨在每年开设约250家店铺,并有一个立即的目标,即到2025年底在全国范围内达到总共约3,000家营运店铺。

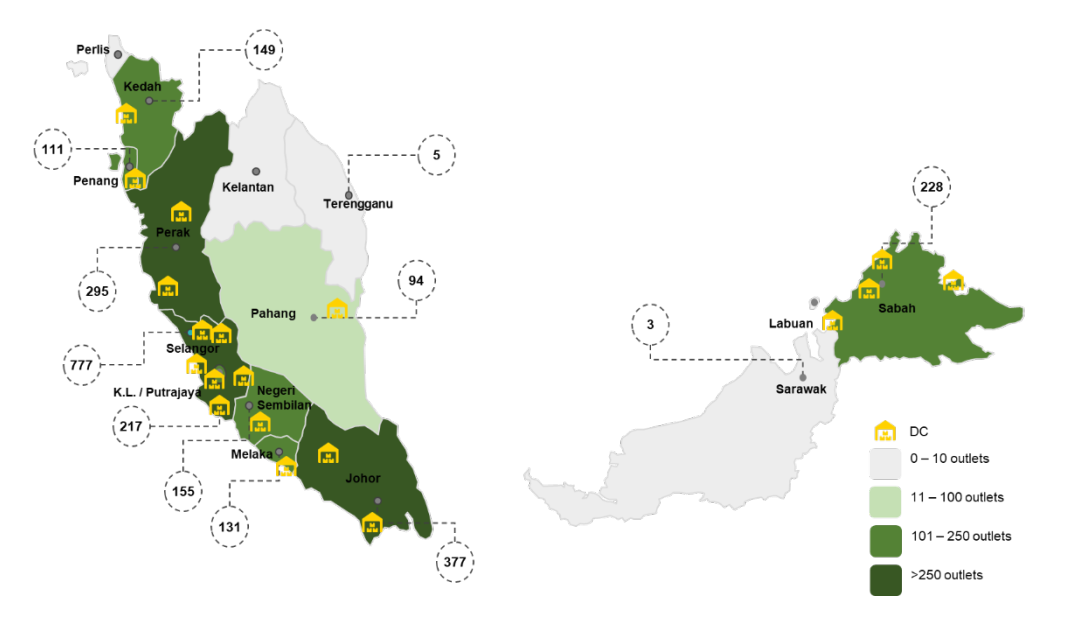

The map referenced illustrates the geographical distribution of their outlets and Distribution Centers (DCs) as of the LPD, categorized by state:

该公司的财务业绩持续改善,营业收入从2021财政年度的78.4亿令吉增加到2023财政年度的92.1亿令吉。这意味着在这三年时间内,复合年增长率(CAGR)约为8.41%。毛利润(GP)也有显著增长,从7,5600万令吉增加到8,4145万令吉,表示收益增长强劲。

Financial Overview

Financial Overview

财务总览

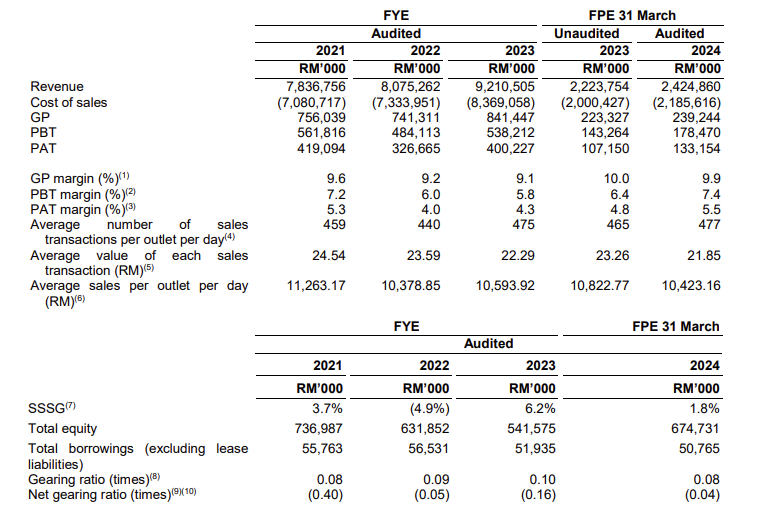

The company's financial performance has consistently improved, with revenue rising from RM7.84 billion in FYE 2021 to RM9.21 billion in FYE 2023. This equates to a compound annual growth rate (CAGR) of approximately 8.41% over the three-year period. Gross Profit (GP) has also seen a notable increase, climbing from RM756 million to RM841.45 million, representing a CAGR of about 5.50%, indicating a robust expansion in profitability.

在2024年的财政期结束时,该公司的财务业绩继续反映出其坚实的财务进展和增长。这一时期的营业收入为24.2亿令吉,毛利润为2,3924万令吉,税前利润为1,7847万令吉,利润后税为1,3315万令吉。

Profit Before Tax (PBT) has remained relatively stable, slightly declining from RM561.82 million in FYE 2021 to RM538.21 million in FYE 2023. Similarly, Profit After Tax (PAT) attributable to the owners of the Company has experienced a slight decrease from RM419.09 million to RM400.23 million.

SSSG,即同店销售增长,是零售中用于衡量经营已开业一定时间(通常一年或更长时间)的连锁店的销售增长的关键绩效指标。它是通过将当期这些店铺的销售额与前期这些店铺的销售额进行比较来计算的,排除新开或关闭店铺的影响。

For the financial period end (FPE) 2024, the company's financial performance continues to reflect its solid financial progress and growth. Revenue for this period is at RM2.42 billion, with Gross Profit (GP) at RM239.24 million. Profit Before Tax (PBT) is RM178.47 million, and Profit After Tax (PAT) is RM133.15 million.

根据招股说明书中的数据,SSSG从2021财政年度的3.7%稳步增加到2023财政年度的6.2%,表明现有店铺销售在稳步增长。这是企业长期发展的积极标志,它表明公司通过提高店铺效率和优化运营,实现增长,而不仅仅依靠开新店来增加销售。

According to the data in the Prospectus, SSSG has shown a steady increase from 3.7% in FYE 2021 to 6.2% in FPE 2023, indicating a consistent growth in sales for existing stores. This is a positive sign for the long-term development of the business as it demonstrates the company's ability to achieve growth through improving individual store efficiency and optimizing operations rather than solely relying on opening new stores to increase sales.

根据招股书的数据,从2021财年的3.7%到2023财年的6.2%,SSSG呈现稳步增长,表明现有店铺的销售额持续增长。这是业务长期发展的一个积极表现,它展示了公司通过提高个体店铺的效率和优化运营能力来实现增长,而不仅仅依靠开设新店铺来增加销售额的能力。

SSSG, or Same Store Sales Growth, is a key performance indicator used in retail to measure the growth of sales for stores that have been open for a certain period of time, typically one year or more. It is calculated by comparing the sales of these stores in the current period to the sales of the same stores in the previous period, excluding the impact of newly opened or closed stores.

马来西亚的杂货零售业经历了扩张,从2018年的693亿令吉增长到2022年的727亿令吉,复合年增长率为1.2%。值得注意的是,与前一年相比,2022年增长率高达19.2%。

Industry Overview

Industry Overview

行业概述

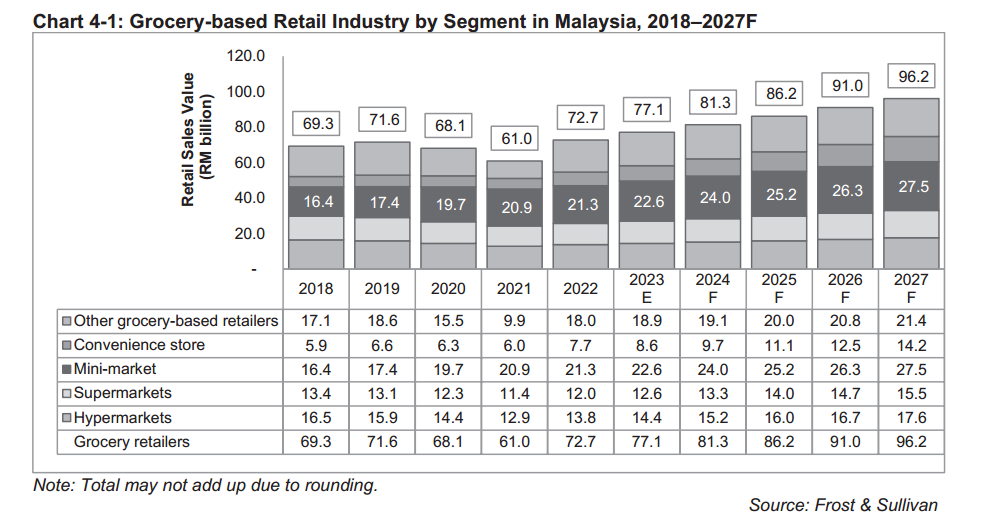

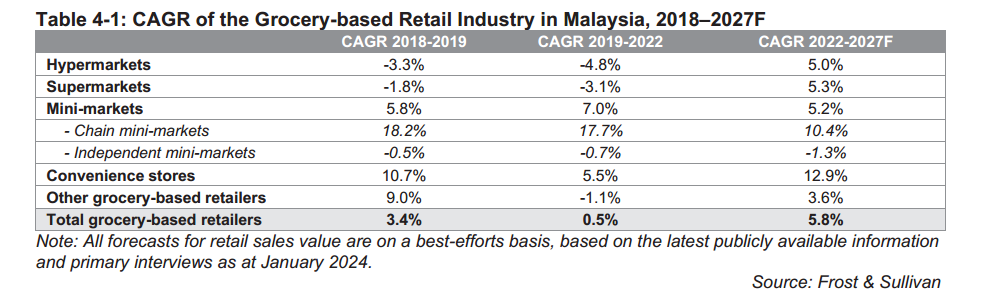

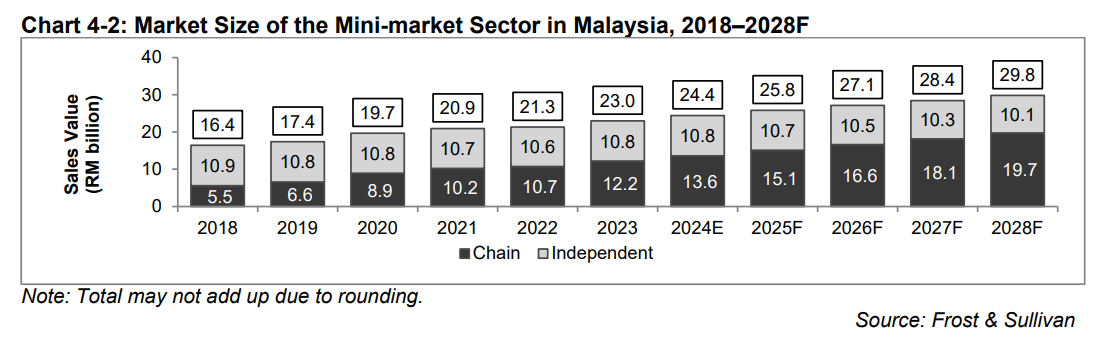

The grocery-based retail industry in Malaysia has experienced expansion, as evidenced by the rise in sales value from RM69.3 billion in 2018 to RM72.7 billion in 2022, at a CAGR of 1.2%. Notably, there has been a substantial growth rate of 19.2% in 2022 compared to the previous year.

迷你市场行业的增长也预计将由连锁零售商拓展推动,这些连锁零售商正在推动杂货采购体验的现代化。现代化的杂货店为消费者提供舒适的购物体验。

Moving forward, the grocery-based retail industry in Malaysia is projected to continue growing from 2022 to 2027. This growth will be driven by population growth and a resilient economic outlook, which lead to higher income and expenditure by households. These are key factors supporting the growth of the grocery-based retail industry. However, the grocery-based retail industry may face challenges due to inflationary pressures, which can lead to consumers becoming more price sensitive.

未来,马来西亚以食品杂货为基础的零售行业预计将从2022年持续增长到2027年。这种增长将受到人口增长和坚韧的经济前景的推动,带动家庭收入和支出的增加。这些都是支持零售行业增长的关键因素。然而,食品杂货零售业可能面临通货膨胀的压力,这可能导致消费者变得更加价格敏感。

In 2022, grocery-based retailers held a significant share of the total store-based retail sales in Malaysia, accounting for 30.3%. Within the grocery-based retail sector, mini-markets have emerged as a rapidly expanding industry segment in terms of market share, larger than other grocery segments, capturing a growing market share of 29.3% in 2022, compared to 23.7% in 2018.

2022年,基于杂货的零售商在马来西亚的零售销售总额中占据了重要份额,达到了30.3%。在基于杂货的零售业板块中,迷你市场已成为市场份额迅速扩张的行业板块,比其他杂货板块更大,2022年市场份额上升至29.3%,而2018年仅为23.7%。

The growth of the mini-markets industry is also expected to be driven by the expansion of chain retailers which are contributing to the modernisation of the grocery purchasing experience. Modern grocery stores provide consumers a comfortable shopping experience.

小型超市行业的增长也预计将受到连锁零售商的推动,这些连锁零售商正在推进杂货采购体验的现代化。现代化的杂货店为消费者提供舒适的购物体验。

Utilisation of proceeds

Utilisation of proceeds

募集所得资金的利用

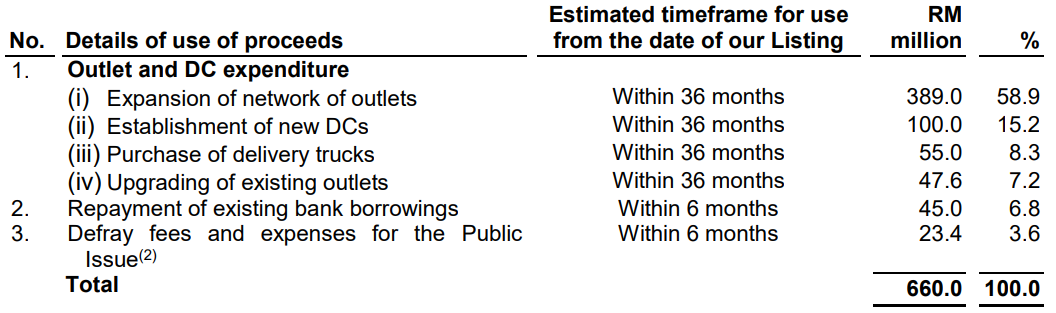

Based on the IPO Price of RM1.65, the total gross proceeds of RM660.0 million from the public issue will be used by the company in the following manner:

按照每股1.65令吉的发行价,从公开发售中获得的总共6600万令吉将由公司按照以下方式使用:

Outlet and DC expenditure: The company intends to allocate approximately RM591.6 million, which represents 89.6% of its budget, to expand the outlet network, upgrade equipment in existing outlets, and invest in enhancing logistics capabilities. These investments aim to sustain and improve efficiency in supporting their expanding network and product range.

Repayment of existing bank borrowings: As of the LPD, the Group's existing bank borrowings totaled approximately RM51.5 million. The company intends to use RM45 million, which is about 6.8% of the total gross proceeds from their Public Issue, to repay 14 term loan facilities with Alliance Bank Berhad, CIMB Bank Berhad, Hong Leong Bank Berhad, and RHB Bank Berhad.

Establishment of a COE for software solutions: The company estimate that approximately RM23.4 million, which is about 3.6% of the total gross proceeds, will be utilized for their listing expenses.

销售点和配送中心支出:公司打算分配约59160万令吉,即其预算的89.6%,用于扩大销售点网络、升级现有销售点设备,以及投资于提高物流能力。这些投资旨在维持和提高其扩展网络和产品范围的效率。

现有银行借款的偿还:截至上市日,集团现有银行借款总额约为RM5150万。公司打算使用RM4500万,即来自公开募股总募集款项的约6.8%,偿还联合银行有限公司,联昌银行有限公司,香格里拉银行有限公司和RHB银行有限公司的14个期限贷款。

建立软件解决方案中心:公司估计将用约2340万令吉,即总募集资金的约3.6%,用于上市支出之用。