Market Mover | Walmart Shares Jump 6% After Q2 Earnings Result

Market Mover | Walmart Shares Jump 6% After Q2 Earnings Result

August 15, 2024 - $Walmart (WMT.US)$ shares jumped 6.58% to $73.18 in pre-market trading on Thursday. The company today announced second quarter results with strong growth in revenue and operating income.

2024年8月15日 - $沃尔玛 (WMT.US)$ 周四美股盘前,沃尔玛股票上涨6.58%至73.18美元。该公司今天宣布了第二季度的业绩结果,营业收入和营业利润强劲增长。

Q2 Highlights

第二季度亮点

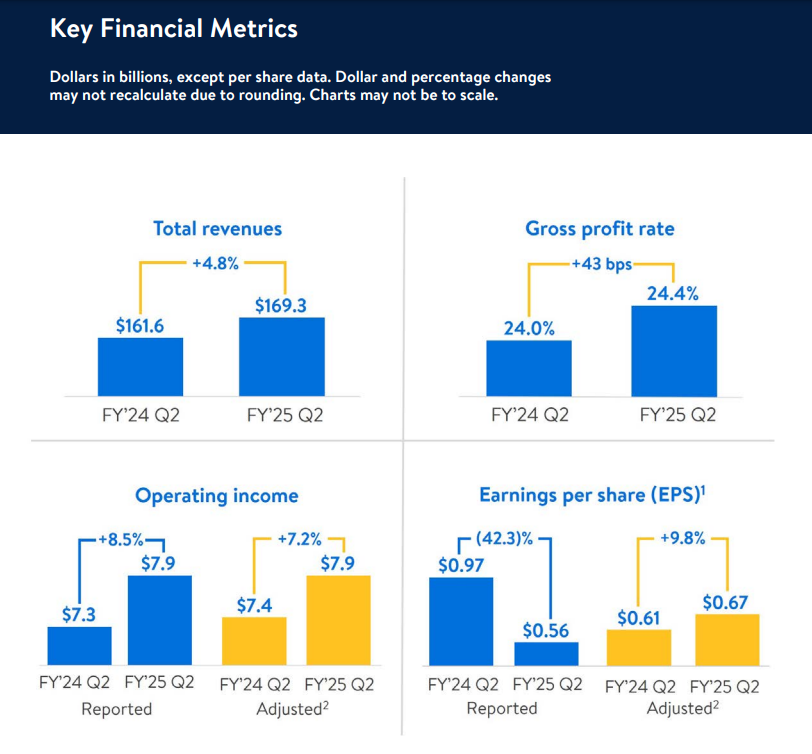

Consolidated revenue of $169.3 billion, up 4.8%announces second quarter results with strong growth in revenue and operating income.

Consolidated gross margin rate up 43 bps, led by Walmart U.S. and Walmart International.

Consolidated operating income up $0.6 billion, or 8.5%; adjusted operating income up 7.2%, due to higher gross margins and growth in membership income; also benefited from reduced eCommerce losses.

ROA at 6.4%, ROI at 15.1%, up 230 bps.

Global eCommerce sales grew 21%, led by storefulfilled pickup & delivery and marketplace.

Global advertising business grew 26%, including 30% for Walmart Connect in the U.S.

Adjusted EPS of $0.67 excludes the effect, net of tax, from a net loss of $0.11 on equity and other investments.

营业收入达1693亿美元,同比增长4.8%,并宣布了第二季度的业绩结果,营收和营业利润均有强劲增长。

毛利率上涨43个基点,主要得益于沃尔玛美国和沃尔玛国际。

营业利润上涨6亿美元,增长8.5%;调整后的营业利润增长7.2%,受益于较高的毛利率和会员服务收入增长,同时减少了电子商务亏损。

ROA为6.4%,ROI为15.1%,增长了230个基点。

全球电子商务销售增长21%,主要得益于门店自提和送货,以及市场营销。

全球广告业务增长26%,其中包括美国沃尔玛连锁店增长30%。

调整后的每股收益为0.67美元,不包括股权和其他投资净损失的影响。

Guidance

指导

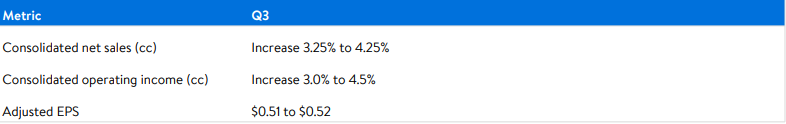

Q3: The Company’s fiscal third quarter guidance is based on the following FY24 Q3 figures: Net Sales: $159.4 billion, operating income: $6.2 billion, and adjusted EPS1 : $0.51. Guidance contemplates the impact of timing of festive events in the Company’s international segment and the timing of planned expenses.

Q3:该公司的财政第三季度指导是基于以下FY24 Q3数字:净销售额:1594亿美元,营业利润:62亿美元,调整后的EPS1:0.51美元。该指导考虑了公司国际业务中节日活动时间和计划支出的影响。

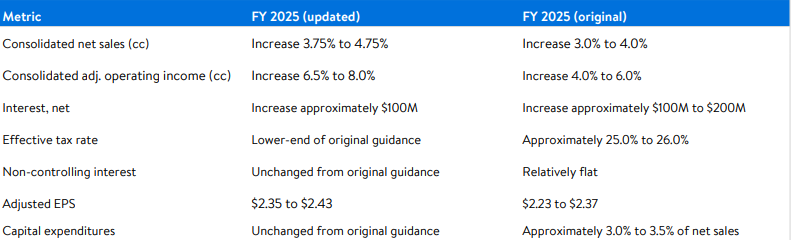

Fiscal Year 2025: The Company’s fiscal year guidance is based on the following FY24 figures: Net sales: $642.6 billion, adjusted operating income1 : $27.1 billion, and adjusted EPS1 : $2.22. The Company’s full year guidance assumes a generally stable consumer and continued pressure from its mix of products and formats globally.

2025财年:该公司的财年指导是基于以下FY24数字:净销售额:6426亿美元,调整后的营业利润1:271亿美元,调整后的EPS1:2.22美元。该公司的全年指导假定消费者总体稳定,并继续承受来自其全球产品和格式的压力。

Related Reading: Press Release

相关阅读:新闻发布