Eli Lilly Unusual Options Activity For August 15

Eli Lilly Unusual Options Activity For August 15

High-rolling investors have positioned themselves bearish on Eli Lilly (NYSE:LLY), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in LLY often signals that someone has privileged information.

高额投资者已经将自己的看淡头寸摆好在了Eli Lilly (纽交所:LLY)上,这对零售交易者很重要。这项活动是通过Benzinga跟踪公开的期权数据发现的。这些投资者的身份尚不确定,但LLY的如此重大举动通常意味着某人有特权信息。

Today, Benzinga's options scanner spotted 39 options trades for Eli Lilly. This is not a typical pattern.

今日,Benzinga的期权扫描仪发现了39笔Eli Lilly的期权交易。这不是一个典型的模式。

The sentiment among these major traders is split, with 38% bullish and 53% bearish. Among all the options we identified, there was one put, amounting to $42,000, and 38 calls, totaling $5,455,963.

这些主要交易者的情绪是分裂的,38%的人看好,53%的人看淡。在所有我们发现的期权中,有1笔看跌期权,金额为42,000美元,以及38笔看涨期权,总额为$5,455,963。

Expected Price Movements

预期价格波动

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $690.0 to $940.0 for Eli Lilly over the last 3 months.

考虑到这些合同的成交量和持仓量,过去3个月内鲸鱼们一直在瞄准Eli Lilly的价格区间在690.0美元到940.0美元之间。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

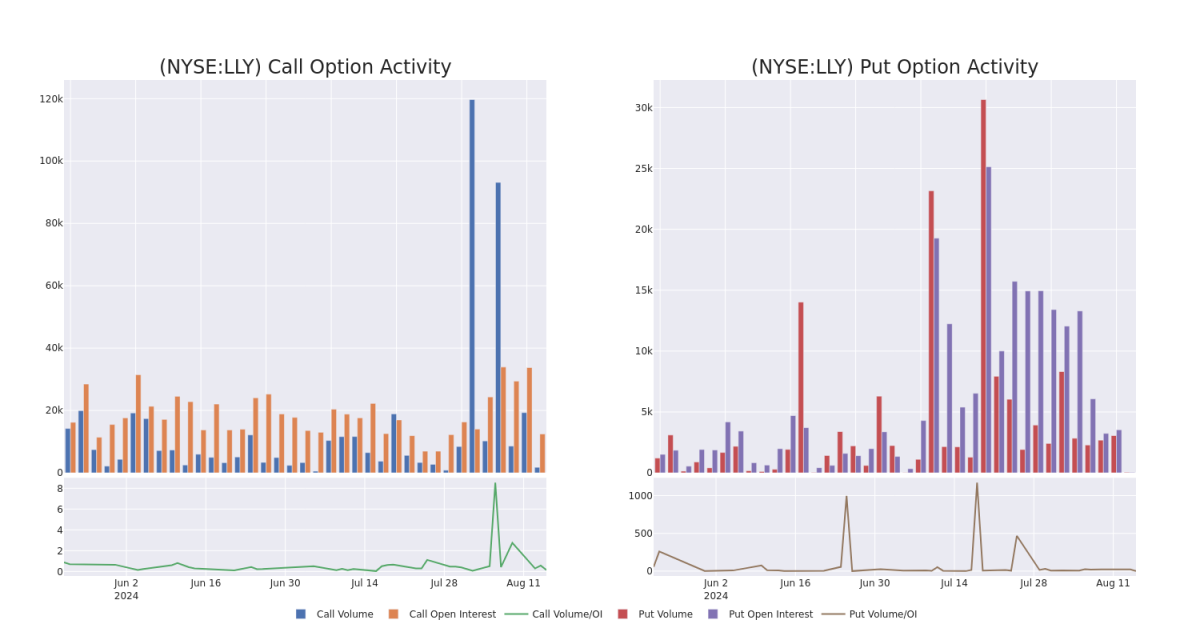

In terms of liquidity and interest, the mean open interest for Eli Lilly options trades today is 480.38 with a total volume of 1,812.00.

就流动性和兴趣而言,Eli Lilly期权的平均持仓量是480.38,总成交量为1,812.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Eli Lilly's big money trades within a strike price range of $690.0 to $940.0 over the last 30 days.

在下图中,我们可以跟随Eli Lilly大资金交易的看涨和看跌期权的成交量和持仓量的发展,这些期权的执行价格范围为690.0美元到940.0美元,持续时间为30天。

Eli Lilly Option Volume And Open Interest Over Last 30 Days

Eli Lilly过去30天的期权成交量和未平仓合约量

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LLY | CALL | SWEEP | BULLISH | 11/15/24 | $236.95 | $234.3 | $237.0 | $700.00 | $2.3M | 756 | 100 |

| LLY | CALL | SWEEP | BULLISH | 09/20/24 | $135.8 | $134.05 | $135.8 | $800.00 | $611.9K | 1.3K | 45 |

| LLY | CALL | SWEEP | BEARISH | 12/19/25 | $183.55 | $176.1 | $176.3 | $900.00 | $125.0K | 498 | 91 |

| LLY | CALL | SWEEP | BEARISH | 12/19/25 | $181.75 | $173.0 | $174.05 | $900.00 | $123.3K | 498 | 1 |

| LLY | CALL | SWEEP | BEARISH | 12/19/25 | $179.7 | $173.05 | $174.05 | $900.00 | $123.0K | 498 | 31 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LLY | 看涨 | SWEEP | 看好 | 11/15/24 | $236.95 | $234.3 | $237.0 | $700.00 | $2.3M | 756 | 100 |

| LLY | 看涨 | SWEEP | 看好 | 09/20/24 | $135.8 | $134.05 | $135.8 | $800.00 | $611.9K | 1.3K | 45 |

| LLY | 看涨 | SWEEP | 看淡 | 2025年12月19日 | $183.55 | $176.1 | $176.3 | $900.00 | $125.0K | 498 | 91 |

| LLY | 看涨 | SWEEP | 看淡 | 2025年12月19日 | $181.75 | $173.0 | $174.05 | $900.00 | $123.3K | 498 | 1 |

| LLY | 看涨 | SWEEP | 看淡 | 2025年12月19日 | $179.7 | $173.05 | $174.05 | $900.00 | $123.0K | 498 | 31 |

About Eli Lilly

关于Eli Lilly

Eli Lilly is a drug firm with a focus on neuroscience, cardiometabolic, cancer, and immunology. Lilly's key products include Verzenio for cancer; Mounjaro, Zepbound, Jardiance, Trulicity, Humalog, and Humulin for cardiometabolic; and Taltz and Olumiant for immunology.

Eli Lilly是一家专注于神经科学,心脏代谢,癌症和免疫学的药物公司。Lilly的主要产品包括用于治疗癌症的Verzenio;用于心脏代谢的Mounjaro,Zepbound,Jardiance,Trulicity,Humalog和Humulin;以及用于免疫学的Taltz和Olumiant。

Current Position of Eli Lilly

Eli Lilly的当前位置

- Currently trading with a volume of 610,194, the LLY's price is down by -0.69%, now at $924.0.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 77 days.

- 目前交易量为610,194,LLY的股价下跌了-0.69%,现在为$924.0。

- RSI读数表明该股目前可能接近超买水平。

- 预期的收益发布还有77天。

What The Experts Say On Eli Lilly

关于Eli Lilly,专家们的看法是什么?

In the last month, 5 experts released ratings on this stock with an average target price of $1017.0.

上个月,5位专家发布了对该股票的评级,平均目标价为1017美元。

- An analyst from B of A Securities persists with their Buy rating on Eli Lilly, maintaining a target price of $1125.

- An analyst from Deutsche Bank upgraded its action to Buy with a price target of $1025.

- An analyst from Berenberg has decided to maintain their Buy rating on Eli Lilly, which currently sits at a price target of $1050.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $885.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Eli Lilly, targeting a price of $1000.

- 来自b of A Securities的分析师坚持对Eli Lilly的买入评级,维持目标价在1125美元。

- 德意志银行的分析师将其评级上调至买入,目标价为1025美元。

- 来自Berenberg的分析师决定维持对Eli Lilly的买入评级,目前的价格目标为1050美元。

- 来自Cantor Fitzgerald的分析师将其评级下调为Overweight,调整价格目标至885美元。

- Wells Fargo的分析师继续持有Eli Lilly的增持评级,目标价为1000美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Eli Lilly options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在回报。精明的交易者通过不断学习、调整策略、监控多个指标以及密切关注市场动向来管理这些风险。通过来自Benzinga Pro的实时警报,了解最新的Eli Lilly期权交易信息。