Barrick Gold Unusual Options Activity

Barrick Gold Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Barrick Gold.

拥有大量资金的鲸鱼对巴里克黄金持明显看好态度。

Looking at options history for Barrick Gold (NYSE:GOLD) we detected 8 trades.

查看巴里克黄金(纽交所:黄金)期权历史记录,我们检测到8次交易。

If we consider the specifics of each trade, it is accurate to state that 62% of the investors opened trades with bullish expectations and 25% with bearish.

如果我们考虑每一笔交易的具体情况,可以准确地说有62%的投资者持看好预期开仓,25%的投资者持看淡预期开仓。

From the overall spotted trades, 2 are puts, for a total amount of $243,711 and 6, calls, for a total amount of $502,530.

从整个交易中,有2个看跌期权,总金额为$243,711,还有6个看涨期权,总金额为$502,530。

What's The Price Target?

目标价是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $17.0 to $27.0 for Barrick Gold during the past quarter.

分析这些合约的成交量和持仓量,似乎大牌手在过去的一个季度中一直关注巴里克黄金在$17.0到$27.0之间的价格窗口。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

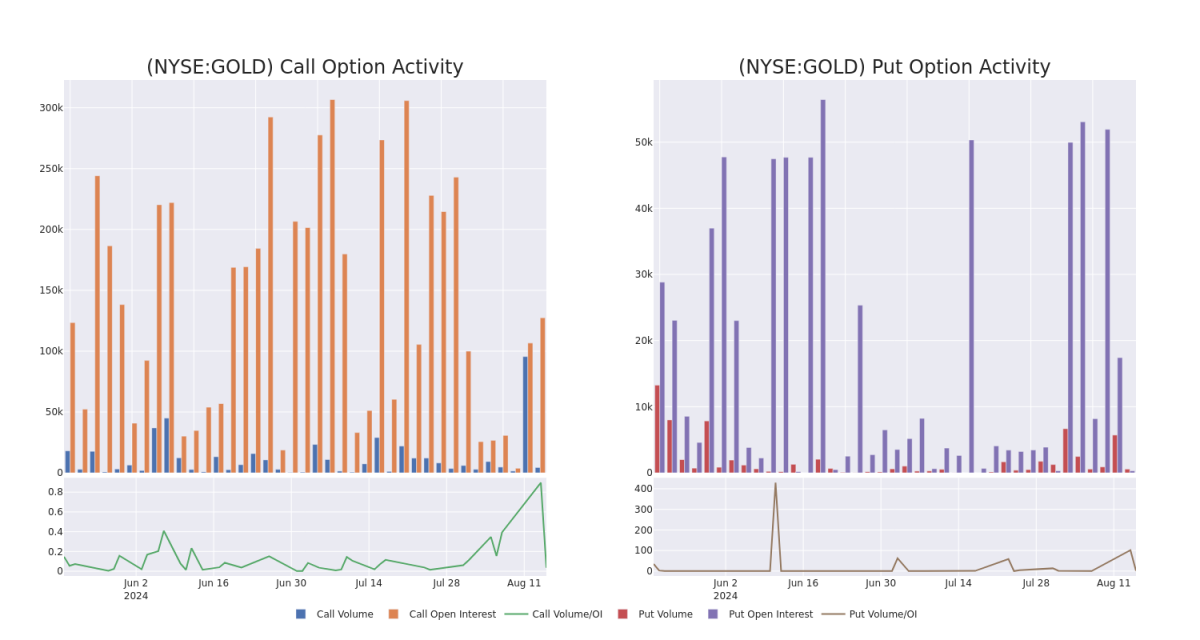

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Barrick Gold's options for a given strike price.

这些数据可以帮助您跟踪特定行权价下巴里克黄金期权的流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Barrick Gold's whale activity within a strike price range from $17.0 to $27.0 in the last 30 days.

下面,我们可以观察过去30天内巴里克黄金所有鲸鱼活动关于$17.0到$27.0行权价范围内看涨期权、看跌期权的成交量和持仓量的演变。

Barrick Gold 30-Day Option Volume & Interest Snapshot

巴里克黄金30天期权成交量和持仓量快照

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GOLD | PUT | SWEEP | BEARISH | 06/20/25 | $8.15 | $8.05 | $8.15 | $27.00 | $214.3K | 303 | 264 |

| GOLD | CALL | TRADE | NEUTRAL | 09/20/24 | $0.42 | $0.4 | $0.41 | $20.00 | $205.0K | 43.1K | 669 |

| GOLD | CALL | TRADE | BULLISH | 01/17/25 | $3.05 | $2.97 | $3.02 | $17.00 | $90.6K | 63.2K | 637 |

| GOLD | CALL | SWEEP | BULLISH | 01/16/26 | $1.65 | $1.53 | $1.66 | $25.00 | $66.3K | 8.6K | 1.2K |

| GOLD | CALL | SWEEP | BULLISH | 08/16/24 | $1.2 | $1.17 | $1.2 | $18.00 | $63.8K | 12.4K | 767 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 黄金 | 看跌 | SWEEP | 看淡 | 06/20/25 | $8.15 | $8.05 | $8.15 | 27.00美元 | $214.3K | 303 | 264 |

| 黄金 | 看涨 | 交易 | 中立 | 09/20/24 | $0.42 | $0.4 | $0.41 | $20.00 | 205,000美元 | 43.1K | 669 |

| 黄金 | 看涨 | 交易 | 看好 | 01/17/25 | $3.05 | $2.97 | $3.02 | $17.00 | $90.6千 | 63.2K | 637 |

| 黄金 | 看涨 | SWEEP | 看好 | 01/16/26 | $1.65 | $1.53 | $1.66 | $25.00 | 成交量66.3K | 8,600 | 1.2K |

| 黄金 | 看涨 | SWEEP | 看好 | 08/16/24 | $1.2 | $1.17 | $1.2 | $18.00 | $63.8K应该是指成交量为63,800股。 | 12.4K | 767 |

About Barrick Gold

关于巴里克黄金

Based in Toronto, Barrick Gold is one of the world's largest gold miners. In 2023, the firm produced nearly 4.1 million attributable ounces of gold and about 420 million pounds of copper. At year-end 2023, Barrick had about two decades of gold reserves along with significant copper reserves. After buying Randgold in 2019 and combining its Nevada mines in a joint venture with competitor Newmont later that year, it operates mines in 19 countries in the Americas, Africa, the Middle East, and Asia. The company also has growing copper exposure. Its potential Reko Diq project in Pakistan, if developed, could double copper production by the end of the decade.

巴里克黄金总部位于多伦多,是世界上最大的黄金矿商之一。2023年,该公司生产了近410万盎司黄金和约4.2亿磅铜。到2023年年底,巴里克黄金拥有约20年的黄金储备以及大量铜储备。在2019年收购Randgold后,合并其内华达州矿山与竞争对手纽曼创业公司的合资企业,该公司在美洲、非洲、中东和亚洲的19个国家开采矿山。该公司还有不断增长的铜业务。如果开发成功,其位于巴基斯坦的Reko Diq项目可能会使铜产量到本十年末翻倍。

In light of the recent options history for Barrick Gold, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考虑到巴里克黄金的最近期权历史,现在适合关注这家公司本身。我们旨在探究巴里克黄金的当前表现。

Barrick Gold's Current Market Status

巴里克黄金当前市场状况

- With a volume of 9,500,923, the price of GOLD is up 0.47% at $19.25.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 77 days.

- 黄金成交量为9,500,923,价格上涨0.47%,报19.25美元。

- RSI指标暗示该股票可能要超买了。

- 下一次盈利预计在77天内发布。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。