Apollo Global Management Options Trading: A Deep Dive Into Market Sentiment

Apollo Global Management Options Trading: A Deep Dive Into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bearish stance on Apollo Global Management.

拥有大量资金的鲸鱼明显对阿波罗全球管理持悲观态度。

Looking at options history for Apollo Global Management (NYSE:APO) we detected 9 trades.

查看阿波罗全球管理 (纽交所:APO) 期权历史,我们发现了9笔交易。

If we consider the specifics of each trade, it is accurate to state that 22% of the investors opened trades with bullish expectations and 77% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,22%的投资者持有看涨的预期,77%的看跌。

From the overall spotted trades, 2 are puts, for a total amount of $112,000 and 7, calls, for a total amount of $2,145,340.

从总交易中,看跌期权有2笔,总金额为112,000美元,看涨期权有7笔,总金额为2,145,340美元。

Projected Price Targets

预计价格目标

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $92.5 to $120.0 for Apollo Global Management over the last 3 months.

考虑到这些合同的成交量和持仓量,过去3个月鲸鱼一直以92.5美元至120.0美元的价格区间为目标。

Insights into Volume & Open Interest

成交量和持仓量分析

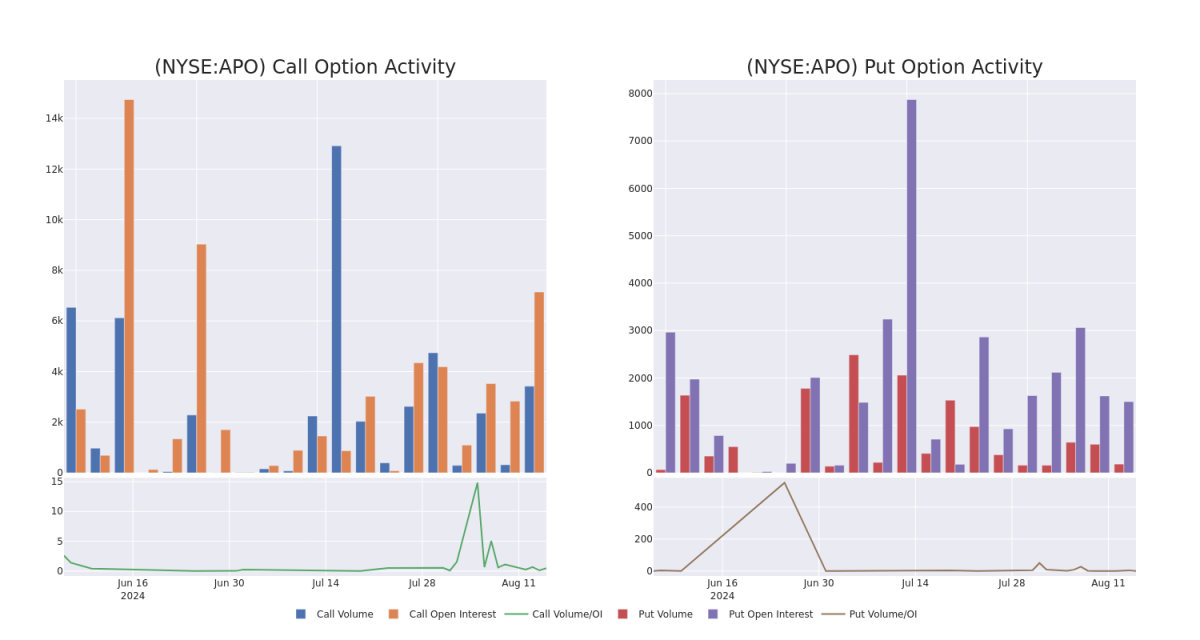

In terms of liquidity and interest, the mean open interest for Apollo Global Management options trades today is 1234.57 with a total volume of 3,605.00.

在流动性和利息方面,阿波罗全球管理期权的平均持仓量为1234.57,总成交量为3,605.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Apollo Global Management's big money trades within a strike price range of $92.5 to $120.0 over the last 30 days.

在下面的图表中,我们可以跟踪阿波罗全球管理在过去30天内坐庄的看涨和看跌期权在92.5美元至120.0美元的执行价格区间内的成交量和持仓量的发展。

Apollo Global Management Option Volume And Open Interest Over Last 30 Days

阿波罗全球管理期权成交量和持仓量在过去30天内的变化

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APO | CALL | TRADE | BEARISH | 01/17/25 | $7.1 | $6.9 | $6.91 | $115.00 | $1.0M | 1.2K | 1.7K |

| APO | CALL | TRADE | BEARISH | 09/20/24 | $7.4 | $7.1 | $7.2 | $105.00 | $864.0K | 2.8K | 1.2K |

| APO | CALL | TRADE | BEARISH | 01/17/25 | $12.4 | $12.3 | $12.3 | $105.00 | $123.0K | 1.8K | 104 |

| APO | PUT | SWEEP | BEARISH | 08/16/24 | $11.2 | $11.1 | $11.2 | $120.00 | $56.0K | 1.5K | 117 |

| APO | PUT | SWEEP | BEARISH | 08/16/24 | $11.2 | $11.1 | $11.2 | $120.00 | $56.0K | 1.5K | 67 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 阿波罗全球管理 | 看涨 | 交易 | 看淡 | 01/17/25 | $7.1 | $6.9 | $6.91 | $115.00 | $1.0M | 1.2K | 1.7K |

| 阿波罗全球管理 | 看涨 | 交易 | 看淡 | 09/20/24 | $7.4 | $7.1 | $7.2 | $105.00 | $864.0K | 2.8K | 1.2K |

| 阿波罗全球管理 | 看涨 | 交易 | 看淡 | 01/17/25 | $12.4 | $12.3 | $12.3 | $105.00 | $123.0K | 1.8K | 104 |

| 阿波罗全球管理 | 看跌 | SWEEP | 看淡 | 08/16/24 | $11.2 | 11.1美元 | $11.2 | $120.00 | $56.0K | 1.5K | 117 |

| 阿波罗全球管理 | 看跌 | SWEEP | 看淡 | 08/16/24 | $11.2 | 11.1美元 | $11.2 | $120.00 | $56.0K | 1.5K | 67 |

About Apollo Global Management

关于阿波罗全球管理

Apollo Global Management Inc is an alternative investment manager. It serves various sectors such as chemicals, manufacturing and industrial, natural resources, consumer and retail, consumer services, business services, financial services, leisure, and media and telecom and technology. The company operates in three business segments that are Asset Management, Retirement Services, and Principal Investing. It generates maximum revenue from the Retirement Services segment.

阿波罗全球管理公司是一家替代性投资管理公司。它服务于各种领域,如化学品、制造业和工业、自然资源、消费与零售、消费服务、商业服务、金融服务、休闲、媒体和电信以及科技。该公司经营着三个业务部门,分别是资产管理、养老服务和主要投资。它的营业收入主要来自养老服务部分。

In light of the recent options history for Apollo Global Management, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于阿波罗全球管理最近的期权历史,现在应该将注意力集中在该公司本身上。我们的目标是探讨它的当前表现。

Where Is Apollo Global Management Standing Right Now?

阿波罗全球管理现在处于什么地位?

- With a volume of 2,275,719, the price of APO is up 4.39% at $110.63.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 76 days.

- 阿波罗全球管理股票的成交量为2,275,719,价格上涨4.39%,达到110.63美元。

- RSI指标暗示该标的股票目前处于超买和超卖的中立区间。

- 下一次盈利预计将在76天内公布。

What Analysts Are Saying About Apollo Global Management

分析师对阿波罗全球管理的看法

In the last month, 4 experts released ratings on this stock with an average target price of $126.0.

在过去一个月中,有4位专家对这支股票进行了评级,平均目标价为126.0美元。

- An analyst from B of A Securities upgraded its action to Buy with a price target of $123.

- Consistent in their evaluation, an analyst from Deutsche Bank keeps a Buy rating on Apollo Global Management with a target price of $124.

- An analyst from Barclays persists with their Overweight rating on Apollo Global Management, maintaining a target price of $128.

- Consistent in their evaluation, an analyst from Deutsche Bank keeps a Buy rating on Apollo Global Management with a target price of $129.

- 来自美银证券的一位分析师将其行动升级为买入,目标价为123美元。

- 在评估方面保持一致,德意志银行的一位分析师对阿波罗全球管理持有买入评级,并保持目标价为124美元。

- 在评估方面保持一致,巴克莱银行的一位分析师继续维持其对阿波罗全球管理的超配评级,并保持目标价为128美元。

- 在评估方面保持一致,德意志银行的一位分析师对阿波罗全球管理持有买入评级,并保持目标价为129美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Apollo Global Management with Benzinga Pro for real-time alerts.

交易期权涉及的风险更大,但也提供了更高利润的可能性。精明的交易员通过持续的教育,战略性的交易调整,利用各种因子,以及关注市场动态来降低这些风险。通过Benzinga Pro保持最新的阿波罗全球管理期权交易,以获取实时的警报通知。