Yantai Shuangta Food (SZSE:002481) Seems To Use Debt Quite Sensibly

Yantai Shuangta Food (SZSE:002481) Seems To Use Debt Quite Sensibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Yantai Shuangta Food Co., Ltd. (SZSE:002481) does carry debt. But the more important question is: how much risk is that debt creating?

霍华德马克斯先生说得好:与其担心股价波动不如担心永久性损失带来的风险,这也是每个实际投资者都会担心的。因此,当您考虑一只股票的风险时,有必要考虑其负债,因为过高的负债可能会使公司陷入困境。值得注意的是,瑞康医药股份有限公司(SZSE:002481)确实存在负债。但更重要的问题是:这些负债产生了多大的风险?

When Is Debt A Problem?

什么时候负债才是一个问题?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

一般来说,只有当一家公司无法通过筹集资本或使用自己的现金流轻松偿还债务时,债务才会成为真正的问题。如果情况变得非常糟糕,债权人可以接管企业。然而,一个更常见(但仍然令人痛苦的)情况是:它必须以低价募集新的股本,从而永久性稀释股东权益。当然,债务的好处在于它通常代表着廉价资本,尤其是当它替代那些能够以高回报率再投资的公司的稀释时。当我们考虑债务水平时,我们首先考虑现金和债务水平的综合影响。

How Much Debt Does Yantai Shuangta Food Carry?

瑞康医药承担了多少负债?

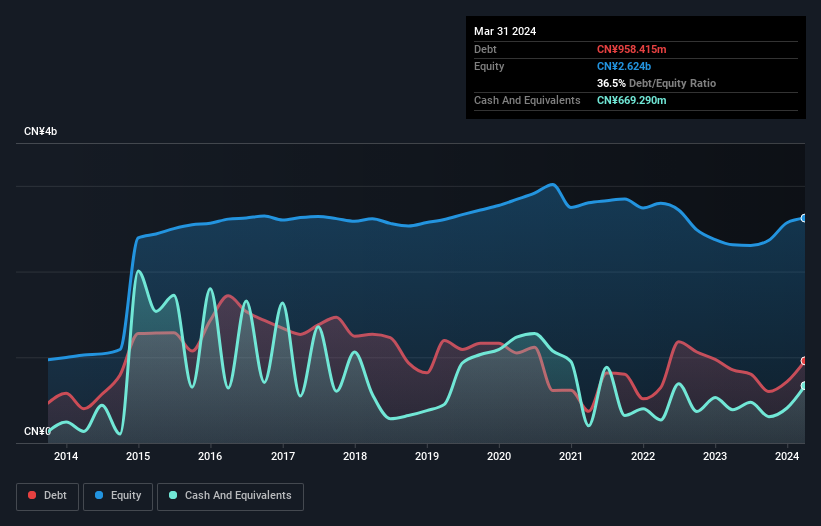

You can click the graphic below for the historical numbers, but it shows that as of March 2024 Yantai Shuangta Food had CN¥958.4m of debt, an increase on CN¥853.1m, over one year. However, because it has a cash reserve of CN¥669.3m, its net debt is less, at about CN¥289.1m.

您可以单击下面的图表查看历史数据,但它显示,截至2024年3月,瑞康医药负债95840万人民币,较去年增加了85310万人民币。但是,由于其现金储备为66930万人民币,因此其净负债少于28910万人民币。

How Strong Is Yantai Shuangta Food's Balance Sheet?

瑞康医药的资产负债表有多强?

According to the last reported balance sheet, Yantai Shuangta Food had liabilities of CN¥1.26b due within 12 months, and liabilities of CN¥218.6m due beyond 12 months. On the other hand, it had cash of CN¥669.3m and CN¥315.0m worth of receivables due within a year. So it has liabilities totalling CN¥494.3m more than its cash and near-term receivables, combined.

根据上次披露的资产负债表,瑞康医药有126亿人民币的负债需在12个月内偿还,21860万人民币的负债需在12个月以上偿还。另一方面,它有66930万人民币现金和31500万人民币的应收账款需在一年内到期。因此,其负债总额比其现金和近期应收账款的总和多了49430万人民币。

Of course, Yantai Shuangta Food has a market capitalization of CN¥5.16b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

当然,瑞康医药的市值为51.6亿人民币,因此这些负债可能是可以被管理的。但是,我们确实认为值得关注其资产负债表的强度,因为它可能会随着时间的推移而发生变化。

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Service Corporation International的债务是其EBITDA的3.5倍,而其EBIT可覆盖其利息开支的3.7倍。综合考虑,虽然我们不希望看到债务水平上升,但我们认为它可以应对当前的杠杆。好消息是,Service Corporation International在过去12个月中将其EBIT提高了2.9%,从而逐渐降低了其相对于收益的债务水平。毫无疑问,我们从资产负债表中获得了有关债务的大部分内容。但是,相对于资产负债表,更重要的是未来收益,这将决定Service Corporation International维持健康资产负债表的能力。如果您关注未来,您可以查看此免费报告,其中有分析师的利润预测。

Yantai Shuangta Food's net debt is only 0.87 times its EBITDA. And its EBIT easily covers its interest expense, being 47.0 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. It was also good to see that despite losing money on the EBIT line last year, Yantai Shuangta Food turned things around in the last 12 months, delivering and EBIT of CN¥178m. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Yantai Shuangta Food will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

瑞康医药的净负债只有其EBITDA的0.87倍。而其EBIT轻松覆盖了利息支出,规模为其47倍。因此,您可以认为其受到负债的威胁不比大象受到老鼠的威胁更多。去年,虽然瑞康医药在EBIT线上亏损了,但在过去12个月中,成功扭亏为盈并实现了1.78亿元人民币的EBIT。当您分析债务时,资产负债表显然是要重点关注的区域。但是,您不能将债务完全孤立地看待,因为瑞康医药需要收益来偿还债务。因此,如果您想了解更多有关其收益的信息,可以查看其长期收益趋势图表。

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the most recent year, Yantai Shuangta Food recorded free cash flow worth 66% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

最后,一家企业需要自由现金流来偿还债务;会计利润并不足以摆脱负债。因此,核实多少利息和税费备付资金(Ebit)由自由现金流支持是值得的。在最近的一年中,瑞康医药记录的自由现金流价值相当于其EBIT的66%,这是比较正常的,因为自由现金流不包括利息和税收。这笔实打实的现金意味着它可以在需要时减少其债务。

Our View

我们的观点

The good news is that Yantai Shuangta Food's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! When we consider the range of factors above, it looks like Yantai Shuangta Food is pretty sensible with its use of debt. While that brings some risk, it can also enhance returns for shareholders. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Yantai Shuangta Food (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

好消息是,瑞康医药用其EBIT轻松覆盖了其利息支出,这让我们像毛绒绒的小狗一样喜极而泣。好消息并不止于此,它的EBIT转为自由现金流的能力也支持了这一印象!当我们考虑上述因素的范围时,看起来瑞康医药在利用债务方面相当明智。虽然这带来了一些风险,但也可能增加股东的回报。毫无疑问,我们从资产负债表中获得了很多关于债务的信息。但是,并非所有投资风险都存在于资产负债表中。例如,我们发现了2项瑞康医药的警示信号(1项让我们有点不舒服!),在在投资此处前,您应该知晓这些警示信号。

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

当然,如果您是那种喜欢购买没有债务负担的股票的投资者,那么不要犹豫,立即发现我们独家的净现金增长股票列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

According to the last reported balance sheet, Yantai Shuangta Food had liabilities of CN¥1.26b due within 12 months, and liabilities of CN¥218.6m due beyond 12 months. On the other hand, it had cash of CN¥669.3m and CN¥315.0m worth of receivables due within a year. So it has liabilities totalling CN¥494.3m more than its cash and near-term receivables, combined.

According to the last reported balance sheet, Yantai Shuangta Food had liabilities of CN¥1.26b due within 12 months, and liabilities of CN¥218.6m due beyond 12 months. On the other hand, it had cash of CN¥669.3m and CN¥315.0m worth of receivables due within a year. So it has liabilities totalling CN¥494.3m more than its cash and near-term receivables, combined.