Don't Buy Hongkong Land Holdings Limited (SGX:H78) For Its Next Dividend Without Doing These Checks

Don't Buy Hongkong Land Holdings Limited (SGX:H78) For Its Next Dividend Without Doing These Checks

Hongkong Land Holdings Limited (SGX:H78) stock is about to trade ex-dividend in three days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. This means that investors who purchase Hongkong Land Holdings' shares on or after the 22nd of August will not receive the dividend, which will be paid on the 16th of October.

香港置地有限公司(SGX:H78)的股票将于三天后开始除息交易。股息除息日是记录日前一天,即股东需要出现在公司的名册上才能获得股息的日子,而这一天通常与交易日相差一天。因此,任何股票买卖所需时间至少需要两个工作日。这意味着在8月22日或之后购买香港置地的股权者将无法获得于10月16日支付的分红。

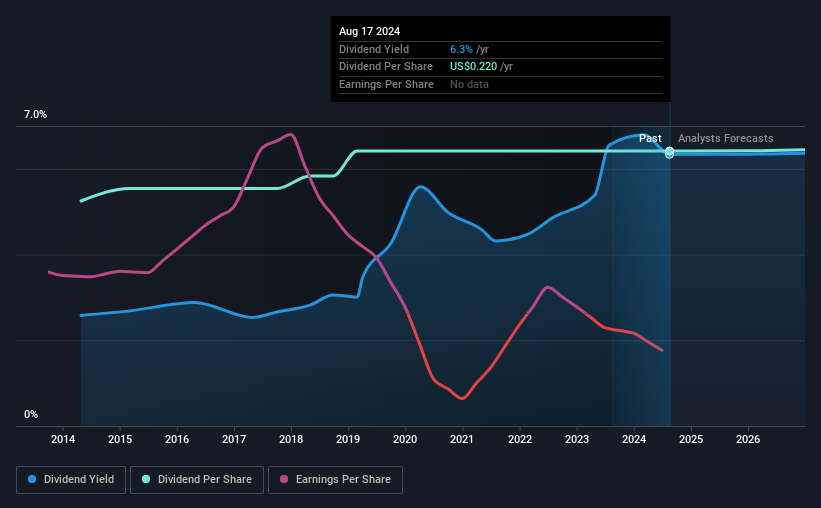

The company's next dividend payment will be US$0.06 per share. Last year, in total, the company distributed US$0.22 to shareholders. Looking at the last 12 months of distributions, Hongkong Land Holdings has a trailing yield of approximately 6.3% on its current stock price of US$3.47. If you buy this business for its dividend, you should have an idea of whether Hongkong Land Holdings's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

该公司下一个股息支付将为每股0.06美元。去年,该公司总共向股东派息0.22美元。根据过去12个月的分红派息计算,香港置地有限公司的股价当前为3.47美元,回报率约为6.3%。如果你出于分红考虑购买此业务,则应了解香港置地有限公司的分红是否可靠和可持续。因此,我们需要检查派息是否得到覆盖,以及收益是否正在增长。

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Hongkong Land Holdings paid a dividend last year despite being unprofitable. This might be a one-off event, but it's not a sustainable state of affairs in the long run. Considering the lack of profitability, we also need to check if the company generated enough cash flow to cover the dividend payment. If Hongkong Land Holdings didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. Dividends consumed 71% of the company's free cash flow last year, which is within a normal range for most dividend-paying organisations.

分红通常是用公司的收入支付的,因此,如果公司支付的派息超过了其盈利,那么其股息通常面临更高的风险被削减。即使去年扭亏为盈,香港置地仍然支付了股息。这可能是一次性事件,但从长远来看,这是不可持续的状态。考虑到公司缺乏盈利能力,我们还需要检查该公司是否产生足够的现金流来支付股息。如果香港置地公司没有产生足够的现金来支付股息,那么它必须从银行账户中或通过借款来支付股息,但这两种方式都是在长期内不可持续的。去年,分红占公司的自由现金流的71%,这是大多数分红机构所在区间的正常范围。

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

点击此处查看公司的支付比率以及未来分红的分析师预期。

Have Earnings And Dividends Been Growing?

收益和股息一直在增长吗?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Hongkong Land Holdings reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

盈利平稳的股票仍然可能成为有吸引力的分红支付者,但是在分红的可持续性方面需要更为保守的方法,要求有更大的安全保障。如果业务陷入困境并减少分红,公司的价值可能会急剧下跌。香港置地去年报告了亏损,而总体趋势表明其收益近年来也在下降,这使我们怀疑其股息是否面临风险。

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, 10 years ago, Hongkong Land Holdings has lifted its dividend by approximately 2.0% a year on average.

大多数投资者评估公司分红前景的主要方法是检查分红增长的历史速度。自我们的数据开始以来,即10年前,香港置地有限公司的股息平均每年增长约2.0%。

Remember, you can always get a snapshot of Hongkong Land Holdings's financial health, by checking our visualisation of its financial health, here.

请记住,您可以通过查看我们的财务状况可视化,来获取香港置地有限公司财务状况的快照。

To Sum It Up

总结一下

From a dividend perspective, should investors buy or avoid Hongkong Land Holdings? We're a bit uncomfortable with it paying a dividend while being loss-making. However, we note that the dividend was covered by cash flow. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Hongkong Land Holdings.

从股息角度考虑,投资者应该购买还是避免香港置地有限公司呢?虽然香港置地的亏损导致分红有些令人不安,但我们注意到分红由现金流覆盖。从股息角度看,我们倾向于回避香港置地有限公司。

Although, if you're still interested in Hongkong Land Holdings and want to know more, you'll find it very useful to know what risks this stock faces. In terms of investment risks, we've identified 1 warning sign with Hongkong Land Holdings and understanding them should be part of your investment process.

尽管如此,如果您仍对香港置地有限公司感兴趣并想了解更多信息,那么知道这家公司面临哪些风险将非常有用。在投资风险方面,我们鉴定了香港置地有限公司的1个警告信号,并且了解它们应该成为您投资过程的一部分。

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

一般来说,我们不建议仅仅购买第一个股息股票。下面是一个经过策划的有趣的、股息表现良好的股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.