Check Out What Whales Are Doing With CVNA

Check Out What Whales Are Doing With CVNA

Whales with a lot of money to spend have taken a noticeably bullish stance on Carvana.

资金雄厚的鲸鱼已经明显地看好了Carvana。

Looking at options history for Carvana (NYSE:CVNA) we detected 26 trades.

查看 Carvana (纽交所:CVNA) 的期权交易历史, 我们发现了26笔交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 34% with bearish.

如果我们考虑到每个交易的具体情况,准确地说,50%的投资者持看好态度开仓,34%的投资者持看淡态度开仓。

From the overall spotted trades, 11 are puts, for a total amount of $776,441 and 15, calls, for a total amount of $1,126,926.

从所有被察觉到的交易中,有11个看跌期权交易,交易总额为776441美元,有15个看涨期权交易,交易总额为1126926美元。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $75.0 to $200.0 for Carvana over the recent three months.

根据交易活动来看,重要投资者似乎是在过去三个月内为了 Carvana 的股价区间,选择了从 $75.0 到 $200.0 的价格区间。

Volume & Open Interest Trends

成交量和未平仓量趋势

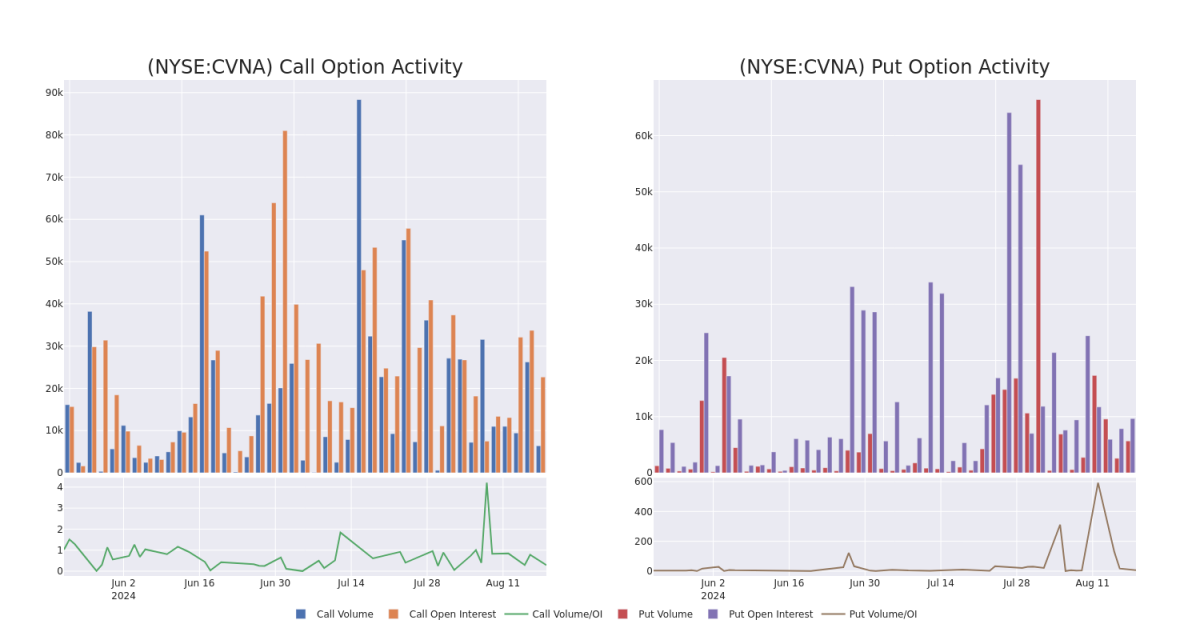

In terms of liquidity and interest, the mean open interest for Carvana options trades today is 1539.86 with a total volume of 12,069.00.

以流动性和兴趣度来看,Carvana 期权交易今日的平均持仓量为1539.86手,并且成交总量为12069.00手。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Carvana's big money trades within a strike price range of $75.0 to $200.0 over the last 30 days.

在下面的图表中,我们可以看到过去30天内,$75 至 $200 的行权价格段内,Carvana 大宗交易的看跌和看涨期权成交量和持仓量的变化趋势。

Carvana Call and Put Volume: 30-Day Overview

Carvana看涨期权和看跌期权成交量:30天概览

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVNA | CALL | SWEEP | BEARISH | 08/30/24 | $4.65 | $3.8 | $3.98 | $160.00 | $201.3K | 3.2K | 509 |

| CVNA | CALL | TRADE | BEARISH | 08/30/24 | $5.2 | $5.05 | $5.1 | $155.00 | $175.9K | 3.0K | 1.4K |

| CVNA | PUT | SWEEP | NEUTRAL | 10/18/24 | $15.4 | $14.55 | $14.55 | $155.00 | $145.5K | 427 | 0 |

| CVNA | CALL | SWEEP | BULLISH | 08/30/24 | $2.95 | $2.94 | $2.95 | $162.50 | $144.5K | 557 | 12 |

| CVNA | CALL | TRADE | BEARISH | 06/20/25 | $28.75 | $27.1 | $27.1 | $200.00 | $135.5K | 269 | 50 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| carvana | 看涨 | SWEEP | 看淡 | 08/30/2024 | $4.65 | $3.8 | $3.98 | $160.00 | $201.3K | 3.2K | 509 |

| carvana | 看涨 | 交易 | 看淡 | 08/30/2024 | $5.2 | $5.05 | $5.1 | $155.00 | $175.9K | 3.0K | 1.4千 |

| carvana | 看跌 | SWEEP | 中立 | 10/18/24 | $15.4 | $14.55 | $14.55 | $155.00 | $145.5K | 427 | 0 |

| carvana | 看涨 | SWEEP | 看好 | 08/30/2024 | $2.95应翻译为$2.95 | 2.94美元 | $2.95应翻译为$2.95 | $162.50 | $144.5K | 557 | 12 |

| carvana | 看涨 | 交易 | 看淡 | 06/20/25 | $28.75 | $27.1 | $27.1 | 。 | $135.5K | 269 | 50 |

About Carvana

关于Carvana

Carvana Co is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues. The other sales and revenues include sales of loans originated and sold in securitization transactions or to financing partners, commissions received on VSCs and sales of GAP waiver coverage. The foundation of the business is retail vehicle unit sales. This drives the majority of the revenue and allows the company to capture additional revenue streams associated with financing, VSCs, auto insurance and GAP waiver coverage, as well as trade-in vehicles.

Carvana Co是一家用于购买和销售二手车的电子商务平台。公司的营业收入来自二手车销售、批发车辆销售和其他销售和收入。其他销售和收入包括在证券化交易中发起并出售的贷款销售以及向融资合作伙伴的销售、收到的VSC佣金以及GAP豁免保险的销售。业务的基石是零售车辆销售。这推动了大部分收入,并允许公司捕获与融资、VSC、汽车保险、GAP豁免保险以及以旧车换新车的相关收入流相关的额外收入。

Following our analysis of the options activities associated with Carvana, we pivot to a closer look at the company's own performance.

在分析与Carvana相关的期权活动之后,我们转向更仔细地审视该公司的业绩。

Where Is Carvana Standing Right Now?

Carvana现在的处境如何?

- With a trading volume of 924,340, the price of CVNA is up by 0.04%, reaching $156.0.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 73 days from now.

- CVNA 的价格涨了0.04%,交易量为924,340手,现价为 $156.0。

- 当前RSI值表明该股票可能接近超买状态。

- 下一个财报公告将于73天后发布。

What Analysts Are Saying About Carvana

关于 Carvana 的分析师看法

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $152.0.

在过去一个月中,5个行业分析师纷纷对这支股票发表看法,提出了平均目标价 $152.0。

- An analyst from Morgan Stanley has decided to maintain their Underweight rating on Carvana, which currently sits at a price target of $110.

- An analyst from DA Davidson persists with their Neutral rating on Carvana, maintaining a target price of $155.

- Reflecting concerns, an analyst from Wedbush lowers its rating to Neutral with a new price target of $120.

- An analyst from Needham has decided to maintain their Buy rating on Carvana, which currently sits at a price target of $200.

- An analyst from Wells Fargo upgraded its action to Overweight with a price target of $175.

- 摩根士丹利的一位分析师决定维持他们对 Carvana 的减持评级,目标价为 $110。

- DA Davidson 的一位分析师仍然持有他们对 Carvana 的中立评级,目标价为$155。

- 反映担忧,Wedbush的一位分析师将评级下调至中立,并确定了新的目标价为 $120。

- Needham的一位分析师决定维持他们对 Carvana 的买入评级,目标价为 $200。

- 富国银行的一位分析师将动作上调至增持,目标价为$175。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

From the overall spotted trades, 11 are puts, for a total amount of $776,441 and 15, calls, for a total amount of $1,126,926.

From the overall spotted trades, 11 are puts, for a total amount of $776,441 and 15, calls, for a total amount of $1,126,926.