Google Parent Alphabet Is A Top Large-Cap Pick For 2024 By This Analyst: Here's Why

Google Parent Alphabet Is A Top Large-Cap Pick For 2024 By This Analyst: Here's Why

Needham analyst Laura Martin reiterated Alphabet Inc (NASDAQ:GOOGL) Google with a Buy and a $210 price target.

Needham分析师Laura Martin重申Alphabet Inc(纳斯达克:GOOGL)Google的买入评级,目标价为210美元。

GOOGL is Martin's top large-cap stock pick for 2024, backed by a more robust macro backdrop, record political ad spending, data advantages, and Generative artificial intelligence integrations.

GOOGL是Martin 2024年的首选大市值股票,支持更强劲的宏观背景、创纪录的政治广告支出、数据优势和生成式人工智能融合。

The analyst highlighted Google's compelling long-term position, backed by the company's global ad revenue and digital market moat. Martin also highlighted YouTube as a rapid subscription revenue growth driver. The analyst expects Google's proprietary large language models (LLMs), with thousands of small and medium-sized businesses developing apps on these platforms, to be its primary upside value driver over the next 3-5 years.

分析师强调了Google的引人注目的长期地位,支持公司的全球广告营收和数字市场壕沟。Martin还强调了YouTube作为快速的订阅收入增长驱动因素。分析师预计,Google拥有数千家中小型企业在这些平台上开发应用程序的专有大语言模型(LLMs),将成为未来3-5年其主要上行驱动力。

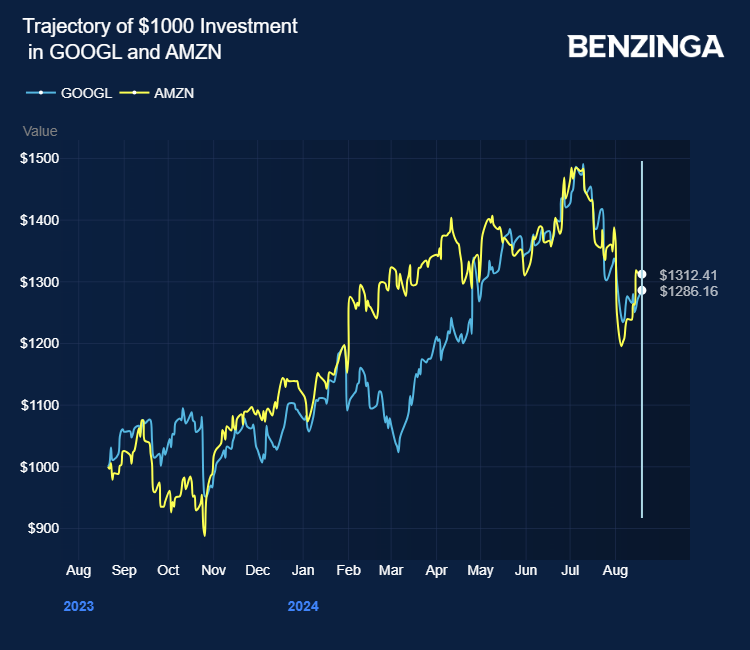

Martin listed critical takeaways from her conversation with the CEO of a GenAI infrastructure company that flagged Google and Amazon.Com Inc (NASDAQ:AMZN) as the most likely winners of the current arms race to build out GenAI tools, features, and capabilities. Companies have invested $1.3 trillion over the past 12 years to build the public cloud. Amazon and Microsoft Corp (NASDAQ:MSFT) took six years to achieve profitability from their cloud business. GenAI is much bigger; the analyst highlighted the CEO's view.

马丁列出了她与一家GenAI基础架构公司首席执行官交流中的关键要点,该公司将Google和亚马逊公司(纳斯达克:AMZN)列为目前最有可能获胜的构建GenAI工具、特性和能力的军备竞赛的获胜者。在过去的12年中,公司已经投资了13万亿美元来构建公共云。亚马逊和微软公司(纳斯达克:MSFT)用了六年时间才从其云业务中实现盈利。GenAI要大得多;分析师强调了首席执行官的看法。

The CEO projects $5 trillion—$6 trillion in total capital expenditure required for new data center infrastructure to support GenAI. He expects hyperscalers to spend $250 billion in 2024 on GenAI infrastructure projects, five times higher than the $50 billion annually they spent six years ago to build their cloud infrastructures.

首席执行官预计需要总计5-6万亿美元的资本支出来支持新的数据中心基础架构来支持GenAI。他预计,超大规模云服务提供商在2024年将在GenAI基础设施项目上投资2500亿美元,比六年前建立其云基础设施时每年500亿美元的投资额增长了五倍。

Martin noted the CEO's view that GenAI has already generated over $100 billion in revenue after 18 months. He expects GenAI business demands in 2024 to exceed GenAI capacity by 2x.

马丁指出首席执行官的看法,GenAI在18个月内已经创造了超过1000亿美元的收入。他预计,到2024年GenAI业务需求将超过GenAI容量的2倍。

Martin projected fiscal 2024 revenue and EPS of $346.40 billion and $7.62.

马丁预计2024财年的营业收入和每股收益分别为3464亿美元和7.62美元。

Price Action: GOOGL shares traded higher by 1.37% at $165.19 at last check Monday.

股价表现:截至上周一最后交易,GOOGL股价上涨1.37%,报165.19美元。

Photo via Shutterstock

图片来自shutterstock。

Martin listed critical takeaways from her conversation with the CEO of a GenAI infrastructure company that flagged Google and

Martin listed critical takeaways from her conversation with the CEO of a GenAI infrastructure company that flagged Google and