Aon Unveils D&O Risk Analyzer to Advance the Management of Executive Officer Risks

Aon Unveils D&O Risk Analyzer to Advance the Management of Executive Officer Risks

– Tool enables risk managers and brokers to assess corporate executive risks and tailor more impactful insurance programs

– Joins Aon's Property Risk and Casualty Risk analyzers in a growing suite of analytics tools for clients

— 该工具使风险经理和经纪人能够评估企业高管风险并量身定制更具影响力的保险计划

— 加入怡安的财产风险和意外伤害风险分析工具,为客户提供越来越多的分析工具

DUBLIN, Aug. 19, 2024 /PRNewswireExternal site Opens in a new tab/ -- Aon plcExternal site Opens in a new tab (NYSE: AON), a leading global professional services firm, today unveiled its Directors and Officers (D&O) Risk Analyzer, a digital application that allows risk managers of U.S.-listed public companies to make data-driven, technology-enabled decisions to mitigate executive risks facing their directors, officers and businesses. The tool is the latest release in a suite of new offerings that use data and analytics to deliver differentiated insights that help clients make better decisions in an evolving risk landscape.

都柏林,2024年8月19日 /PRNewswireExternal网站在新选项卡中打开/--全球领先的专业服务公司怡安PLCExternal网站在新标签页中打开(纽约证券交易所代码:AON)今天推出了其董事和高级管理人员(D&O)风险分析器,这是一款数字应用程序,允许美国上市公司的风险经理做出数据驱动、以技术为依据的决策,以降低其董事、高级管理人员和企业面临的行政风险。该工具是一系列新产品中的最新版本,这些产品使用数据和分析来提供差异化的见解,帮助客户在不断变化的风险环境中做出更好的决策。

External site Opens in a new tab

外部网站在新选项卡中打开

"Rising litigation and defense costs, equity market volatility and shifting regulatory frameworks have added complexity for corporate officer risks," said Timothy Fletcher, CEO of Aon's financial services group. "It is more important than ever for risk managers to assess D&O liability and the role of insurance in protecting public officers and board directors. Our D&O Risk Analyzer, together with Aon's brokers, provide a holistic analysis of the D&O risk landscape, helping clients make better decisions."

怡安金融服务集团首席执行官蒂莫西·弗莱彻表示:“诉讼和辩护成本的上涨、股市的波动以及监管框架的变化增加了公司高管风险的复杂性。”“风险经理评估董事和董事责任以及保险在保护公职人员和董事会董事方面的作用比以往任何时候都更加重要。我们的D&O风险分析器与怡安的经纪人一起,对D&O风险格局进行全面分析,帮助客户做出更好的决策。”

Aon's D&O Risk Analyzer provides clients and brokers quick access to:

怡安的D&O风险分析器使客户和经纪人可以快速访问:

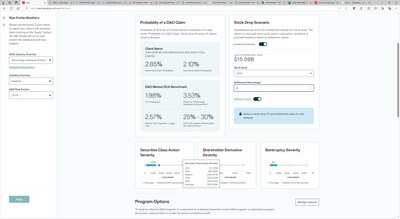

Real-time analytics, which help clients quantify the likelihood and magnitude of potential D&O losses with data-driven insights on risk retention, risk transfer and maximizing the value of insurance. The risk models can be adjusted in real time based on new client information to provide revised insights on view of risk.

Risk exposure and loss models, which provide a better understanding of exposure to adverse events, from small to catastrophic impact. Brokers and clients can explore the factors driving D&O litigation and exposure (including stock volatility, liquidity issues, disputed mergers and acquisitions and regulatory matters).

Stock price drop analysis, which measures how varying stock drops for clients may result in theoretical D&O loss based on historical settlement data.

Total cost of risk (TCOR) visualizations of all client's potential insurance options, which help clients explore actionable options to determine value, optimize limits and design the best potential insurance programs in the market, enabling not only better decisions but also the ability to best communicate those decisions.

实时分析,通过有关风险保留、风险转移和最大化保险价值的数据驱动见解,帮助客户量化潜在的D&O损失的可能性和规模。可以根据新的客户信息实时调整风险模型,以提供有关风险观的修订见解。

风险暴露和损失模型,可以更好地了解从小到灾难性的不良事件的暴露程度。经纪人和客户可以探索推动D&O诉讼和风险敞口的因素(包括股票波动、流动性问题、有争议的并购和监管事宜)。

股价下跌分析,该分析根据历史结算数据,衡量客户股票下跌的变化可能导致理论上的D&O损失。

所有客户潜在保险选项的总风险成本(TCOR)可视化,帮助客户探索可行的选择,以确定价值,优化限额并设计市场上最佳的潜在保险计划,不仅可以做出更好的决策,还可以更好地传达这些决策。

These features enable real-time loss forecasting to iterate and quantify D&O risk exposures and loss scenarios, allowing discussions between risk managers and brokers about the extent of potential risk, elevating the focus beyond expected loss and empowering risk managers to better covey risk retention and risk transfer options to the C-suite.

这些功能使实时损失预测能够迭代和量化D&O风险敞口和损失情景,从而允许风险经理和经纪人讨论潜在风险的程度,将重点转移到预期损失之外,并使风险经理能够更好地向高管提供风险保留和风险转移选项。

Empowering Clients with Actionable Insights

为客户提供切实可行的见解

The launch of Aon's D&O Risk Analyzer follows the 2024 debuts of the firm's Property Risk Analyzer and Casualty Risk Analyzer, which provide exposure visualizations and model potential losses to help Aon clients make informed decisions about their risk and insurance options. Aon will unveil additional risk analyzer tools in the coming months to provide data-driven insights on key risks. All Aon analytics tools are designed by Aon's Risk Capital and Human Capital capabilities in collaboration with Aon Business Services to provide Aon clients with actionable insights that allow for greater control over their insurance program structure.

怡安的D&O风险分析器是在该公司2024年首次推出财产风险分析器和意外伤害风险分析器之后推出的,该分析器提供风险敞口可视化并模拟潜在损失,以帮助怡安客户就其风险和保险选择做出明智的决策。怡安将在未来几个月内推出其他风险分析工具,以提供有关关键风险的数据驱动见解。所有怡安分析工具均由怡安的风险资本和人力资本部门与怡安商业服务合作设计,旨在为怡安客户提供切实可行的见解,从而更好地控制其保险计划结构。

"Aon's D&O Risk Analyzer exemplifies our firm's commitment to serve clients as they make data-informed decisions," said Joe Peiser, global CEO of Commercial Risk Solutions for Aon. "As the risk landscape grows more complex, we will continue to provide actionable analytics solutions that enable our clients to confidently assess risks and insurance offerings."

怡安商业风险解决方案全球首席执行官乔·派瑟表示:“怡安的D&O风险分析器体现了我们公司承诺在客户做出基于数据的决策时为他们提供服务。”“随着风险格局变得越来越复杂,我们将继续提供切实可行的分析解决方案,使我们的客户能够自信地评估风险和保险产品。”

About Aon

Aon plc External site Opens in a new tab(NYSE: AON) exists to shape decisions for the better — to protect and enrich the lives of people around the world. Through actionable analytic insight, globally integrated Risk Capital and Human Capital expertise, and locally relevant solutions, our colleagues provide clients in over 120 countries with the clarity and confidence to make better risk and people decisions that protect and grow their businesses.

关于怡安

怡安集团外部网站在新选项卡中打开(纽约证券交易所代码:AON)的存在是为了更好地制定决策——保护和丰富世界各地人们的生活。通过切实可行的分析见解、全球综合的风险资本和人力资本专业知识以及本地相关解决方案,我们的同事为120多个国家的客户提供了清晰和信心,使他们能够做出更好的风险和人员决策,从而保护和发展他们的业务。

Follow Aon on LinkedInExternal site Opens in a new tab, XExternal site Opens in a new tab, Facebook External site Opens in a new taband InstagramExternal site Opens in a new tab. Stay up-to-date by visiting Aon's newsroom Opens in a new tab and sign up for news alerts here Opens in a new tab.

在 LinkedInExternal 网站上关注怡安在新选项卡中打开,x外部网站在新选项卡中打开,Facebook外部网站在新选项卡中打开和Instagram外部网站在新选项卡中打开。访问怡安的新闻室随时了解最新信息在新选项卡中打开并在此处注册新闻提醒在新选项卡中打开.

Media Contact

mediainquiries@aon.com Opens in a new tab

Toll-free (U.S., Canada and Puerto Rico): +1 833 751 8114

International: +1 312 381 3024

媒体联系人

mediainquiries@aon.com 在新选项卡中打开

免费电话(美国、加拿大和波多黎各):+1 833 751 8114

国际:+1 312 381 3024

External site Opens in a new tab

外部网站在新选项卡中打开

SOURCE Aon plc

来源 Aon plc