Gold Nears Record Highs Amid Geopolitical Uncertainty And Fed Speculations

Gold Nears Record Highs Amid Geopolitical Uncertainty And Fed Speculations

By RoboForex Analytical Department

由RoboForex分析部门提供

The price of gold continues its impressive ascent, balancing around $2500 per troy ounce early this week, hovering near record peaks. The primary catalyst driving this rally is the intensified demand for safe-haven assets amid ongoing geopolitical tensions.

黄金价格持续上升,本周早期每盎司约2500美元平衡,靠近创纪录的高点。推动这一涨势的主要因素是由于持续的地缘政治紧张局势导致的对避险资产需求增强。

The spotlight remains on the Middle East conflict, with U.S. Secretary of State Antony Blinken slated to participate in ceasefire talks between Israel and Gaza. However, the fluctuating news from the region casts doubt on the success of these negotiations, thereby boosting gold's appeal as a secure investment.

中东冲突仍然备受关注,美国国务卿布林肯计划参加以色列和加沙的停火谈判。但是,该地区动荡不定的消息使这些谈判成功的前景存在疑虑,从而提高了黄金作为安全投资的吸引力。

Further supporting gold's rally are the market expectations surrounding the U.S. Federal Reserve's upcoming actions. Despite robust economic indicators, inflation is inching closer to the Fed's target, prompting speculation of forthcoming interest rate reductions. Investors are currently anticipating a 25 basis point cut in September, with potential for additional cuts at the year's remaining meetings, summing up to 75-100 basis points.

支持黄金涨势的进一步因素是市场对美联储即将采取的行动的预期。尽管经济多个指标强劲,通胀正在逐渐接近美联储的目标,引发了即将降息的猜测。投资者目前预计9月将会有25个基点的降息,并有可能在今年剩余的会议上进行额外的降息,总计达到75-100个基点。

This week is pivotal for gold investors, with the Federal Reserve set to release the minutes from its latest meeting and a scheduled speech by Fed Chairman Jerome Powell. These events are expected to clarify the Fed's stance on monetary policy, influencing XAU/USD's price forecast trajectory.

本周对于黄金投资者具有重要意义,美联储将公布最新会议纪要,并安排美联储主席鲍威尔的讲话。预计这些事件将澄清美联储在货币政策上的立场,影响黄金/美元价格预测轨迹。

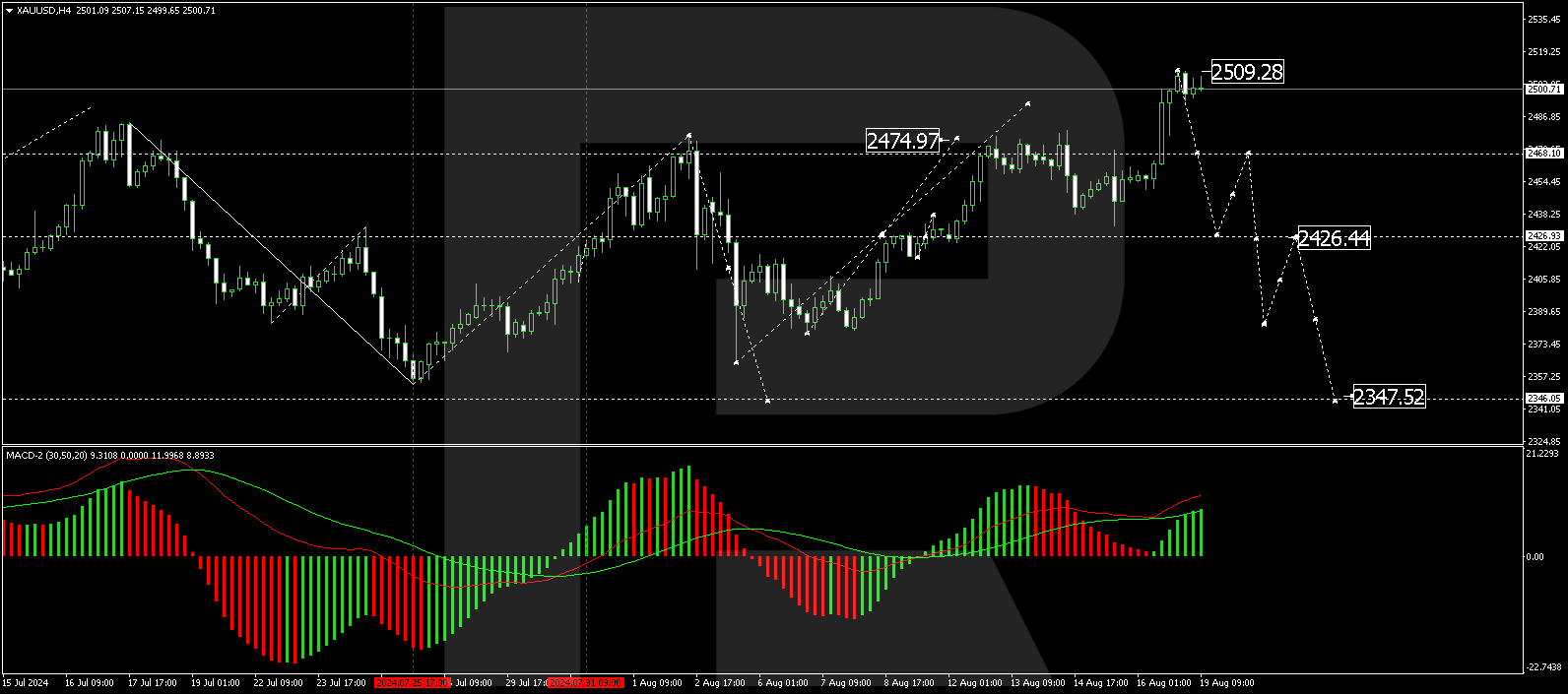

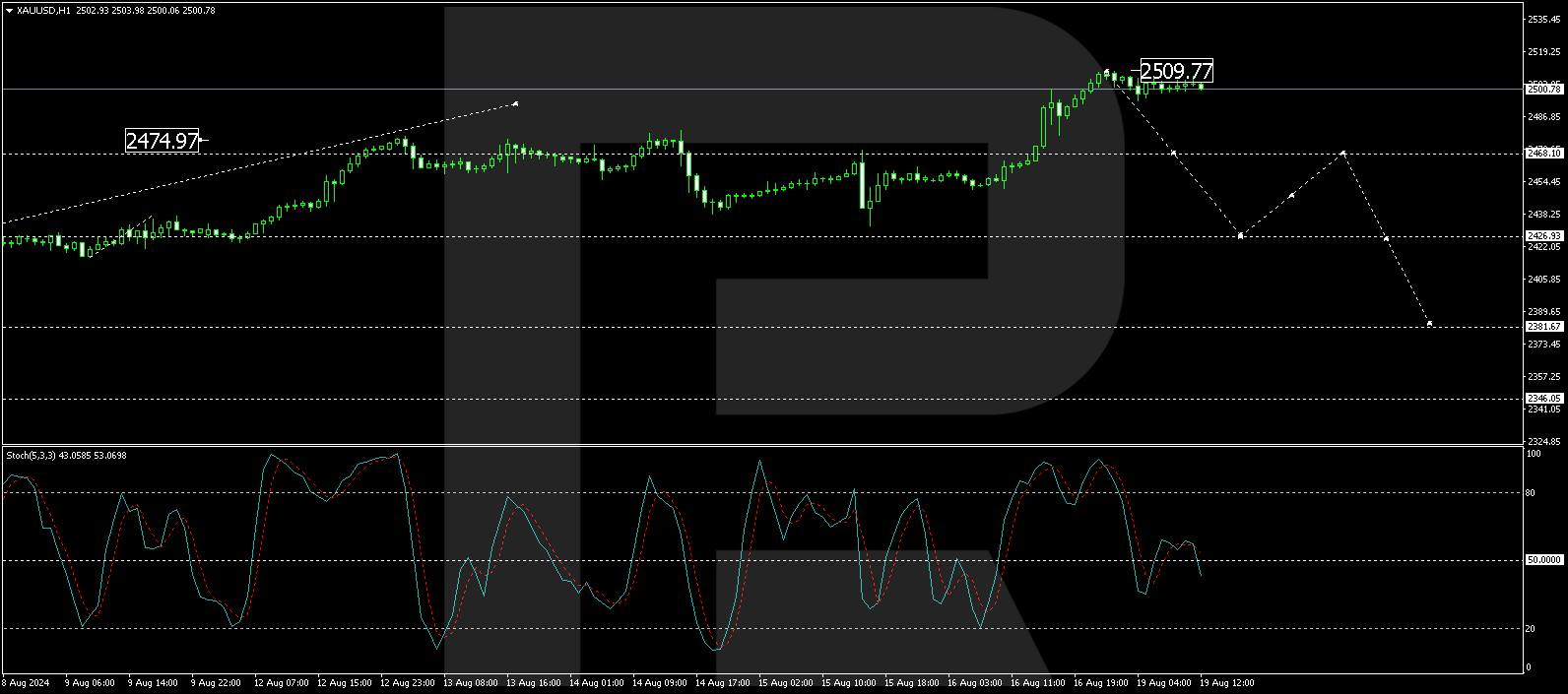

Technical Analysis Of XAU/USD

黄金/美元的技术面分析

Gold has completed a growth structure reaching $2509.00 on the H4 chart. Currently, a consolidation pattern is forming below this peak, with expectations leaning towards a downward breakout initiating a decline towards $2426.44, potentially extending down to $2347.55. This bearish outlook is technically supported by the MACD indicator, where the signal line is set for a downward trajectory from above the zero level.

黄金在H4图表上形成了达到2509.00美元的增长结构。目前,在此高峰下形成了一种整理模式,预计会向下突破,导致下降至2426.44美元,并有可能进一步下跌至2347.55美元。这种看跌的前景在技术上受到MACD指标的支持,信号线从零以上向下趋势。

On the H1 chart, gold has achieved the upper boundary of its latest growth wave at $2509.77, followed by a formation of a tight consolidation range. Anticipations are set for a downward movement, targeting a decline to $2468.00 with a further potential to reach $2426.90. This bearish perspective aligns with the Stochastic oscillator's signal line, which is poised to drop from below 80 to 20, suggesting a potential selloff in the near term.

在H1图表上,黄金已经达到最新的增长波的上限,在2509.77美元处形成了一种紧密的整理区间。预期它会向下运动,目标下降至2468.00美元,并有可能进一步下跌至2426.90美元。这种看跌的观点与随机振荡器的信号线相一致,该信号线已准备从80以下降至20,表明近期可能会有出售的风险。

As geopolitical events unfold and the Federal Reserve's monetary policy becomes clearer, gold's price dynamics are expected to remain a focal point for investors seeking stability in uncertain times.

随着地缘政治事件的发展和美联储货币政策的明朗化,黄金价格的动态预计仍将是寻求不确定时期稳定性的投资者的焦点。

Disclaimer

免责声明

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

本分析仅代表作者个人观点,不得视为交易建议。RoboForex不承担基于本文所含交易建议和评论所产生的任何交易结果的责任。

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

本文来自非报酬的外部投稿人。它不代表Benzinga的报道,并且没有因为内容或准确性而被编辑。