Nu Holdings Unusual Options Activity

Nu Holdings Unusual Options Activity

Financial giants have made a conspicuous bullish move on Nu Holdings. Our analysis of options history for Nu Holdings (NYSE:NU) revealed 8 unusual trades.

金融巨头们对Nu控股采取了明显的看好态度。我们对Nu控股(纽交所代码:NU)期权历史进行分析后发现,出现了8个飞凡交易。

Delving into the details, we found 62% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $192,844, and 2 were calls, valued at $57,476.

具体分析表明,62%的交易者持看涨看好态度,25%表现出看淡态度。我们找到的所有交易中,有6个看跌交易,价值为$192,844,有2个看涨交易,价值为$57,476。

Projected Price Targets

预计价格目标

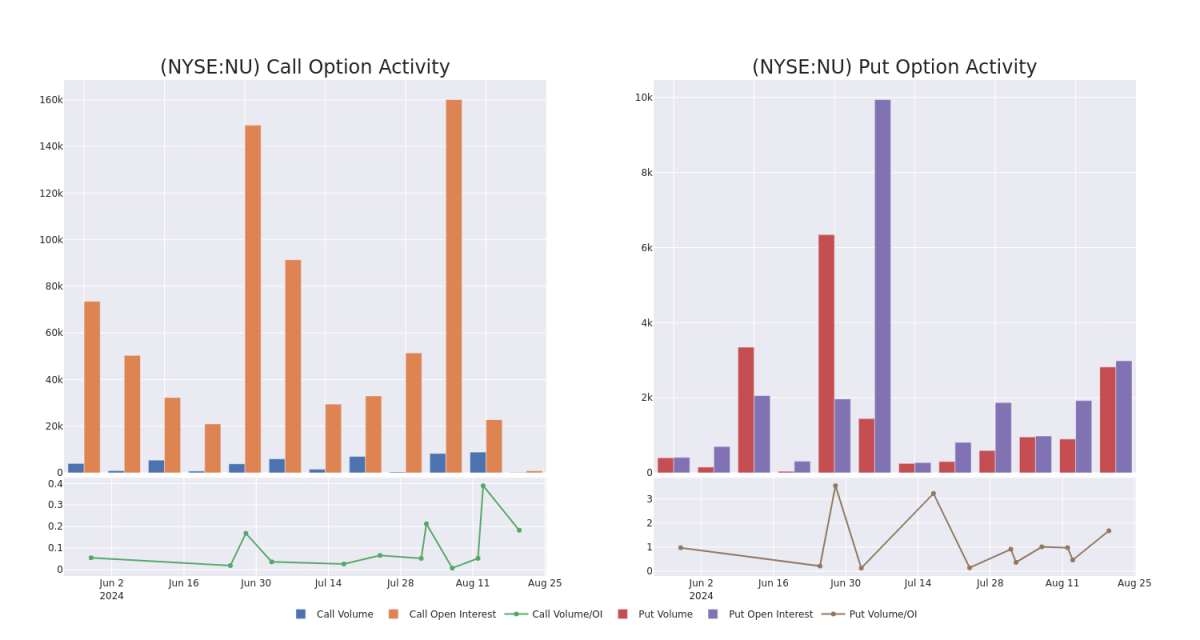

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $12.5 and $15.0 for Nu Holdings, spanning the last three months.

通过评估成交量和持仓量,明显的是主要的市场参与者正聚焦Nu控股在$12.5和$15.0之间的区间,这个区间跨度为最近的三个月。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

In terms of liquidity and interest, the mean open interest for Nu Holdings options trades today is 1280.33 with a total volume of 2,978.00.

从流动性和兴趣角度来看,Nu控股期权交易今天的平均持仓量为1280.33,成交总量为2,978.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Nu Holdings's big money trades within a strike price range of $12.5 to $15.0 over the last 30 days.

以下图表可以追踪Nu控股大额交易中看涨看跌期权的成交量和持仓量的发展,这些交易在30天内的执行价格范围为$12.5到$15.0。

Nu Holdings Option Activity Analysis: Last 30 Days

Nu控股期权行为分析:最近30天

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NU | PUT | TRADE | BULLISH | 01/16/26 | $2.9 | $2.6 | $2.6 | $15.00 | $52.0K | 2.1K | 342 |

| NU | PUT | SWEEP | NEUTRAL | 01/17/25 | $1.58 | $1.56 | $1.57 | $15.00 | $34.6K | 858 | 501 |

| NU | CALL | SWEEP | BEARISH | 08/23/24 | $1.98 | $1.94 | $1.94 | $12.50 | $30.0K | 859 | 157 |

| NU | CALL | SWEEP | BEARISH | 08/23/24 | $1.98 | $1.93 | $1.93 | $12.50 | $27.4K | 859 | 157 |

| NU | PUT | TRADE | BULLISH | 01/16/26 | $3.85 | $2.7 | $2.7 | $15.00 | $27.0K | 2.1K | 789 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NU | 看跌 | 交易 | 看好 | 01/16/26 | $2.9 | $2.6 | $2.6 | 15.00美元 | $52000 | 2.1K | 342 |

| NU | 看跌 | SWEEP | 中立 | 01/17/25 | $1.58 | 1.56美元 | $1.57 | 15.00美元 | $34.6K | 858 | 501 |

| NU | 看涨 | SWEEP | 看淡 | 08/23/24 | $1.98 | $1.94每股 | $1.94每股 | 该公司股价收盘价为10.54美元。 | $30.0K | 859 | 157 |

| NU | 看涨 | SWEEP | 看淡 | 08/23/24 | $1.98 | $1.93 | $1.93 | 该公司股价收盘价为10.54美元。 | $27.4K | 859 | 157 |

| NU | 看跌 | 交易 | 看好 | 01/16/26 | $3.85 | $2.7 | $2.7 | 15.00美元 | $27.0K | 2.1K | 789 |

About Nu Holdings

关于Nu控股

Nu Holdings Ltd is engaged in providing digital banking services. It offers several financial services such as Credit cards, Personal Account, Investments, Personal Loans, Insurance, Mobile payments, Business Accounts, and Rewards. The company earns the majority of its revenue in Brazil.

Nu Holdings有限公司从事数字银行服务。它提供多种金融服务,如信用卡、个人账户、投资、个人贷款、保险、移动支付、商务账户和奖励。该公司的大部分收入来自巴西。

Having examined the options trading patterns of Nu Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了Nu控股期权交易模式之后,我们的注意力现在直接转向公司。这个转变让我们能够深入了解该公司的市场定位和表现。

Present Market Standing of Nu Holdings

Nu控股目前的市场地位

- With a volume of 4,258,303, the price of NU is down -0.62% at $14.36.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 84 days.

- 以4,258,303的成交量,NU的价格为$14.36,下跌了-0.62%。

- RSI指标暗示该股票可能要超买了。

- 下一轮收益预计在84天后发布。

What Analysts Are Saying About Nu Holdings

关于Nu控股的分析师观点

5 market experts have recently issued ratings for this stock, with a consensus target price of $15.2.

5位市场专家最近对这只股票发布了评级,其中共识目标价为$15.2。

- In a cautious move, an analyst from UBS downgraded its rating to Neutral, setting a price target of $13.

- Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Nu Holdings with a target price of $17.

- Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on Nu Holdings with a target price of $16.

- An analyst from JP Morgan has decided to maintain their Neutral rating on Nu Holdings, which currently sits at a price target of $15.

- Reflecting concerns, an analyst from JP Morgan lowers its rating to Neutral with a new price target of $14.

- UBS的一位分析师谨慎地将其评级转为中立,设定了$13的目标价。

- 巴克莱银行的一位分析师在对Nu控股进行持续评估后,保持看好的态度,目标价为$17。

- Susquehanna的一位分析师在对Nu控股进行持续评估后,保持看好的态度,目标价为$16。

- JP摩根的一位分析师决定维持其对Nu控股持中立的评级,目前的目标价为$15。

- 反映对其的担忧,JP摩根的一位分析师将其评级下调为中立,并设定了新的目标价$14。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Nu Holdings options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在回报。精明的交易者通过不断地学习、调整策略、监控多个因素和密切关注市场动态来管理这些风险。通过来自Benzinga Pro的实时警报了解最新的Nu控股期权交易。

In terms of liquidity and interest, the mean open interest for Nu Holdings options trades today is 1280.33 with a total volume of 2,978.00.

In terms of liquidity and interest, the mean open interest for Nu Holdings options trades today is 1280.33 with a total volume of 2,978.00.