Looking At Valero Energy's Recent Unusual Options Activity

Looking At Valero Energy's Recent Unusual Options Activity

Investors with a lot of money to spend have taken a bearish stance on Valero Energy (NYSE:VLO).

那些有大量资金的投资人对瓦莱罗能源(纽交所:VLO)持看淡态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录中发现,今天这些头寸已经出现了。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with VLO, it often means somebody knows something is about to happen.

无论这些投资者是机构还是富有的个人,我们都不知道。但当这么大的事情发生在VLO上时,通常意味着某些人知道即将发生的事情。

Today, Benzinga's options scanner spotted 8 options trades for Valero Energy.

今天,Benzinga的期权扫描器发现了8个瓦莱罗能源的期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 37% bullish and 62%, bearish.

这些大额交易的整体情绪在37%看好和62%看淡之间分化。

Out of all of the options we uncovered, there was 1 put, for a total amount of $27,636, and 7, calls, for a total amount of $315,322.

在我们发现的所有期权中,共有1个看跌期权,总金额为$27,636,7个看涨期权,总金额为$315,322。

Expected Price Movements

预期价格波动

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $115.0 and $150.0 for Valero Energy, spanning the last three months.

在评估了成交量和持仓量后,显然主要市场推手正在专注于以$115.0到$150.0为价格区间的瓦莱罗能源,跨度为过去三个月。

Insights into Volume & Open Interest

成交量和持仓量分析

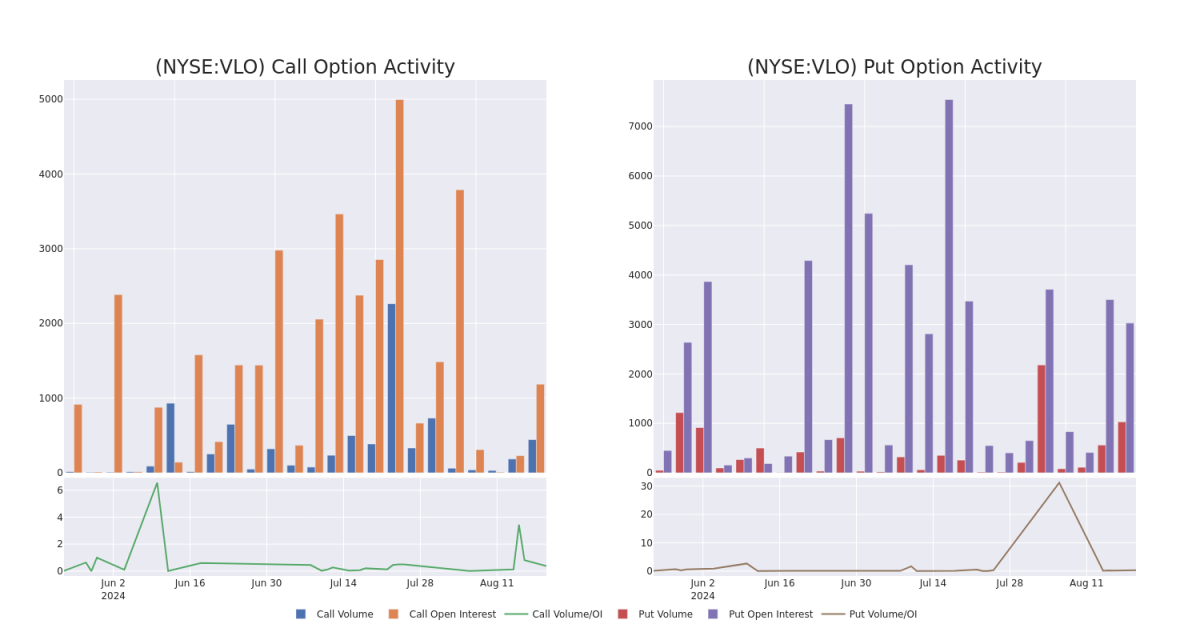

In today's trading context, the average open interest for options of Valero Energy stands at 601.71, with a total volume reaching 1,474.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Valero Energy, situated within the strike price corridor from $115.0 to $150.0, throughout the last 30 days.

在今天的交易背景下,瓦莱罗能源期权的平均持仓量为601.71,总成交量为1,474.00。随附的图表勾画了高价值交易的看涨和看跌期权成交量和持仓量的进展,在罢工价格走廊内,从$115.0到$150.0,贯穿过去30天。

Valero Energy Option Activity Analysis: Last 30 Days

瓦莱罗能源期权活动分析:最近30天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VLO | CALL | TRADE | BEARISH | 08/23/24 | $2.98 | $2.9 | $2.9 | $140.00 | $53.6K | 1 | 227 |

| VLO | CALL | TRADE | BEARISH | 12/20/24 | $10.25 | $10.2 | $10.2 | $145.00 | $50.9K | 542 | 19 |

| VLO | CALL | TRADE | BULLISH | 12/19/25 | $20.45 | $20.2 | $20.45 | $150.00 | $49.0K | 43 | 24 |

| VLO | CALL | SWEEP | BEARISH | 12/20/24 | $7.65 | $7.55 | $7.6 | $150.00 | $47.1K | 553 | 68 |

| VLO | CALL | SWEEP | BULLISH | 12/19/25 | $18.95 | $18.5 | $18.87 | $150.00 | $45.1K | 43 | 60 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VLO | 看涨 | 交易 | 看淡 | 08/23/24 | $2.98 | $2.9 | $2.9 | $140.00 | $53.6K | 1 | 227 |

| VLO | 看涨 | 交易 | 看淡 | 12/20/24 | $10.25 | $10.2 | $10.2 | $145.00 | $50.9K | 542 | 19 |

| VLO | 看涨 | 交易 | 看好 | 2025年12月19日 | $20.45 | $20.2 | $20.45 | $150.00 | $49.0千 | 43 | 24 |

| VLO | 看涨 | SWEEP | 看淡 | 12/20/24 | $7.65 | $7.55 | $7.6 | $150.00 | $47.1K | 553 | 68 |

| VLO | 看涨 | SWEEP | 看好 | 2025年12月19日 | $18.95 | $18.5 | $18.87 | $150.00 | $45.1K | 43 | 60 |

About Valero Energy

关于瓦莱罗能源

Valero Energy is one of the largest independent refiners in the United States. It operates 15 refineries, with a total throughput capacity of 3.2 million barrels a day in the US, Canada, and the United Kingdom. Valero also owns 12 ethanol plants with capacity of 1.6 billion gallons a year and holds a 50% stake in Diamond Green Diesel, which has the capacity to produce 1.2 billion gallons per year of renewable diesel.

瓦莱罗能源是美国最大的独立精炼公司之一。在美国、加拿大和英国经营15个炼油厂,总通过能力达到320万桶/日。瓦莱罗还拥有12个乙醇工厂,年产能达16亿加仑,并持有Diamond Green Diesel的50%股权,Diamond Green Diesel的可再生柴油产能为12亿加仑/年。

Having examined the options trading patterns of Valero Energy, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在审查了瓦莱罗能源的期权交易模式之后,我们现在的关注点直接转向公司。这一转变使我们能够深入挖掘其当前的市场地位和业绩。

Current Position of Valero Energy

瓦莱罗能源目前的持仓情况

- With a trading volume of 1,946,774, the price of VLO is up by 0.01%, reaching $148.23.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 65 days from now.

- VLO的交易量为1,946,774,价格上涨了0.01%,达到了148.23美元。

- 目前的RSI值表明该股票目前处于超买和超卖之间的中立状态。

- 下一次收益报告将于65天后发布。

Expert Opinions on Valero Energy

关于瓦莱罗能源的专家意见

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $165.0.

过去一个月,有1位行业分析师分享了对该股票的见解,提出了平均目标价165.0美元。

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Equal-Weight rating for Valero Energy, targeting a price of $165.

- 维持他们的立场,威尔斯·富戈(Wells Fargo)的一位分析师继续持有瓦莱罗能源的等重评级,目标价为165美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Valero Energy with Benzinga Pro for real-time alerts.

交易期权会涉及更大的风险,但也提供了更高的盈利潜力。聪明的交易者通过持续的教育,战略性交易调整,利用各种因子,并保持对市场动态的关注来减轻这些风险。使用Benzinga Pro获取瓦莱罗能源的最新期权交易,以获得实时警报。