Behind the Scenes of AppLovin's Latest Options Trends

Behind the Scenes of AppLovin's Latest Options Trends

Financial giants have made a conspicuous bearish move on AppLovin. Our analysis of options history for AppLovin (NASDAQ:APP) revealed 11 unusual trades.

金融巨头在AppLovin上采取了明显的看淡策略。我们对AppLovin(纳斯达克:APP)期权历史进行了分析,发现了11笔异常交易。

Delving into the details, we found 18% of traders were bullish, while 63% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $57,200, and 9 were calls, valued at $2,315,850.

深入研究后,我们发现18%的交易员看好,而63%表现出看淡倾向。我们发现的所有交易中,有2笔看跌期权,价值57,200美元,而有9笔看涨期权,价值2,315,850美元。

Predicted Price Range

预测价格区间

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $65.0 to $115.0 for AppLovin over the recent three months.

根据交易活动,显然重要投资者们对AppLovin的价位区间瞄准在65.0美元至115.0美元之间,这种趋势持续了近三个月。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

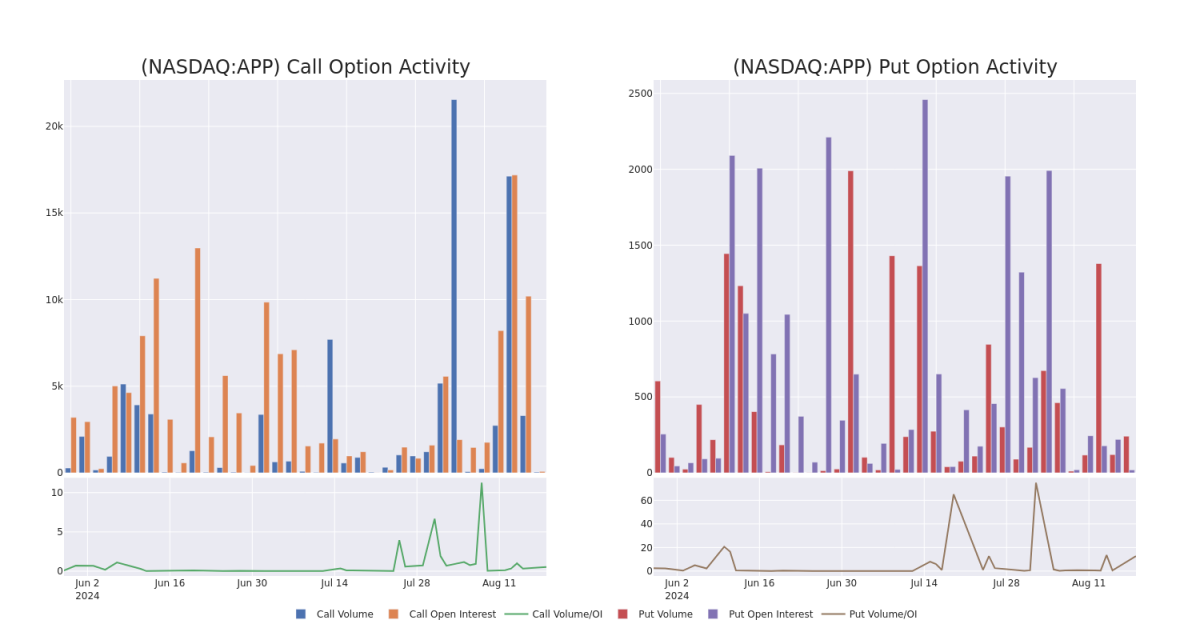

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for AppLovin's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across AppLovin's significant trades, within a strike price range of $65.0 to $115.0, over the past month.

通过分析成交量和持仓量,可以提供关键的股票研究洞察。这些信息对于评估AppLovin在特定行权价格下的期权流动性和利益水平非常重要。以下是AppLovin重要交易的成交量和持仓量趋势的快照,涵盖了过去一个月内65.0美元至115.0美元的行权价区间内的看涨期权和看跌期权。

AppLovin Option Volume And Open Interest Over Last 30 Days

AppLovin在过去30天内的期权成交量和未平仓合约数

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APP | CALL | SWEEP | BEARISH | 03/21/25 | $14.6 | $14.1 | $14.1 | $92.50 | $611.9K | 0 | 434 |

| APP | CALL | SWEEP | BEARISH | 02/21/25 | $14.6 | $14.3 | $14.3 | $90.00 | $607.7K | 78 | 425 |

| APP | CALL | TRADE | BEARISH | 03/21/25 | $7.9 | $7.5 | $7.5 | $110.00 | $562.5K | 0 | 750 |

| APP | CALL | SWEEP | BEARISH | 02/21/25 | $14.4 | $14.1 | $14.1 | $90.00 | $352.5K | 78 | 675 |

| APP | CALL | TRADE | BEARISH | 09/20/24 | $2.15 | $2.0 | $2.02 | $95.00 | $40.4K | 1.3K | 274 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 应用程序 | 看涨 | SWEEP | 看淡 | 03/21/25 | 14.6美元 | $14.1 | $14.1 | 92.50美元 | $611.9K | 0 | 434 |

| 应用程序 | 看涨 | SWEEP | 看淡 | 02/21/25 | 14.6美元 | $14.3 | $14.3 | $90.00 | Wedbush分析师保持既有立场,对AppLovin持有Outperform评级,并设定价格为90美元。 | 78 | 425 |

| 应用程序 | 看涨 | 交易 | 看淡 | 03/21/25 | $7.9 | $7.5 | $7.5 | $110.00 | 0 | 750 | |

| 应用程序 | 看涨 | SWEEP | 看淡 | 02/21/25 | 14.4美元 | $14.1 | $14.1 | $90.00 | 78 | 675 | |

| 应用程序 | 看涨 | 交易 | 看淡 | 09/20/24 | $2.15 | $2.0 | $2.02 | $ 95.00 | $40.4K | 1.3K | 274 |

About AppLovin

关于AppLovin

AppLovin Corp is a mobile app technology company. It focuses on growing the mobile app ecosystem by enabling the success of mobile app developers. The company's software solutions provide tools for mobile app developers to grow their businesses by automating and optimizing the marketing and monetization of their applications.

AppLovin Corp是一家移动应用程序技术公司,专注于通过支持移动应用程序开发人员的成功来增长移动应用程序生态系统。该公司的软件解决方案为移动应用程序开发人员提供工具,通过自动化和优化其应用程序的营销和货币化来增长他们的业务。

Where Is AppLovin Standing Right Now?

AppLovin现在的状态如何?

- Currently trading with a volume of 1,980,608, the APP's price is up by 3.32%, now at $89.45.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 77 days.

- RSI读数表明该股目前可能接近超买水平。

- 预期的收益发布还有77天。

What Analysts Are Saying About AppLovin

3 market experts have recently issued ratings for this stock, with a consensus target price of $98.33333333333333.

3位市场专家最近对这只股票发表了评级,共识目标价为98.33333333333333美元。

- An analyst from Oppenheimer downgraded its action to Outperform with a price target of $105.

- Maintaining their stance, an analyst from Wedbush continues to hold a Outperform rating for AppLovin, targeting a price of $90.

- An analyst from Wedbush has revised its rating downward to Outperform, adjusting the price target to $100.

- Wedbush的一位分析师调低了评级至跑赢大盘,将价格目标设定为$100。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for AppLovin with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但同时也提供了更高的利润潜力。精明的交易者通过持续教育,策略性的交易调整,利用各种因子和关注市场动态来减轻这些风险。通过Benzinga Pro获取AppLovin的最新期权交易,以获得实时警报。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for AppLovin's options at certain strike prices. Below, we present a snapshot of the

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for AppLovin's options at certain strike prices. Below, we present a snapshot of the