Whales with a lot of money to spend have taken a noticeably bearish stance on GE Aero.

Looking at options history for GE Aero (NYSE:GE) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 37% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $127,165 and 4, calls, for a total amount of $226,900.

From the overall spotted trades, 4 are puts, for a total amount of $127,165 and 4, calls, for a total amount of $226,900.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $185.0 for GE Aero over the recent three months.

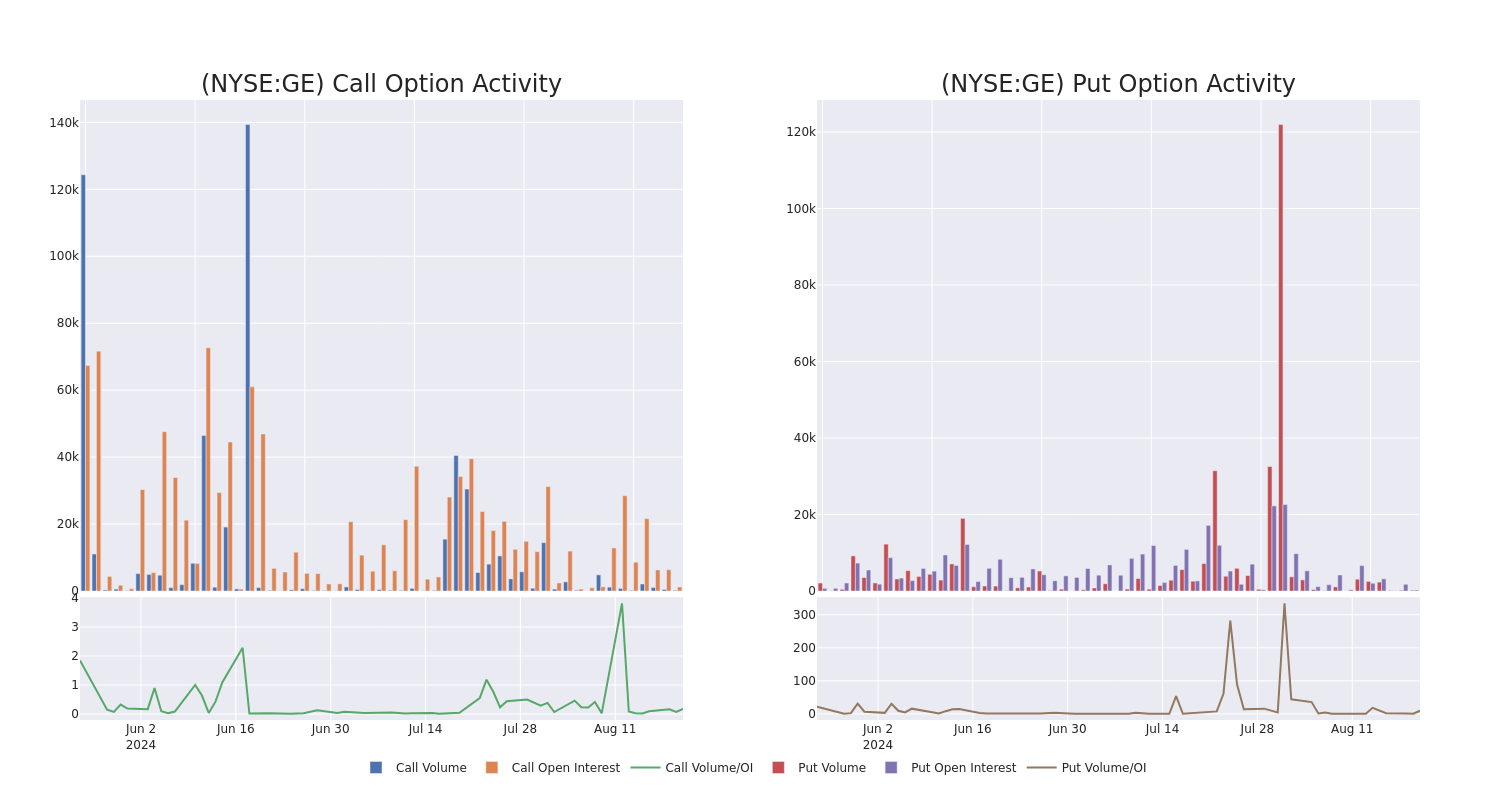

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in GE Aero's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to GE Aero's substantial trades, within a strike price spectrum from $100.0 to $185.0 over the preceding 30 days.

GE Aero Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

GE | CALL | TRADE | NEUTRAL | 01/17/25 | $21.4 | $21.1 | $21.25 | $160.00 | $85.0K | 647 | 48 |

GE | CALL | TRADE | BEARISH | 08/30/24 | $11.85 | $11.4 | $11.58 | $160.00 | $57.9K | 206 | 53 |

GE | CALL | SWEEP | BULLISH | 11/15/24 | $5.3 | $5.2 | $5.3 | $185.00 | $53.0K | 336 | 107 |

GE | PUT | SWEEP | NEUTRAL | 11/15/24 | $14.05 | $13.85 | $13.97 | $180.00 | $37.6K | 15 | 45 |

GE | PUT | TRADE | BEARISH | 11/15/24 | $14.0 | $13.75 | $13.9 | $180.00 | $37.5K | 15 | 72 |

About GE Aero

GE Aerospace is the global leader in designing, manufacturing, and servicing large aircraft engines, along with partner Safran in their CFM joint venture. With its massive global installed base of nearly 70,000 commercial and military engines, GE Aerospace earns most of its profits on recurring service revenue of that equipment, which operates for decades. GE Aerospace is the remaining core business of the company formed in 1892 with historical ties to American inventor Thomas Edison; that company became a storied conglomerate with peak revenue of $130 billion in 2000. GE spun off its appliance, finance, healthcare, and wind and power businesses between 2016 and 2024.

Current Position of GE Aero

With a trading volume of 2,030,572, the price of GE is up by 0.69%, reaching $171.16.

Current RSI values indicate that the stock is may be approaching overbought.

Next earnings report is scheduled for 62 days from now.

What Analysts Are Saying About GE Aero

In the last month, 3 experts released ratings on this stock with an average target price of $198.33333333333334.

An analyst from RBC Capital has decided to maintain their Outperform rating on GE Aero, which currently sits at a price target of $190.

An analyst from Wells Fargo persists with their Overweight rating on GE Aero, maintaining a target price of $205.

An analyst from Barclays persists with their Overweight rating on GE Aero, maintaining a target price of $200.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest GE Aero options trades with real-time alerts from Benzinga Pro.

有很多钱可以花的大户对通用电气航空采取了明显的看跌立场。

查看通用电气航空(纽约证券交易所代码:GE)的期权历史记录,我们发现了8笔交易。

如果我们考虑每笔交易的具体情况,可以准确地说,有25%的投资者以看涨的预期开盘,37%的投资者持看跌预期。

在已发现的全部交易中,有4笔是看跌期权,总额为127,165美元,4笔是看涨期权,总额为226,900美元。

在已发现的全部交易中,有4笔是看跌期权,总额为127,165美元,4笔是看涨期权,总额为226,900美元。

目标价格是多少?

根据交易活动,看来主要投资者的目标是将通用电气航空公司最近三个月的价格区间从100.0美元扩大到185.0美元。

交易量和未平仓合约趋势

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了通用电气航空公司在指定行使价下期权的流动性和投资者兴趣。即将发布的数据可视化了与通用电气航空公司的大量交易相关的看涨期权和未平仓合约的波动,在过去30天内,行使价范围从100.0美元到185.0美元不等。

GE Aero 看涨和看跌交易量:30 天概述

检测到的重要期权交易:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume | Total Trade Price | Open Interest | Volume |

|---|

GE | CALL | TRADE | NEUTRAL | 01/17/25 | $21.4 | $21.1 | $21.25 | $160.00 | $85.0K | 647 | 48 | $85.0K | 647 | 48 |

GE | CALL | TRADE | BEARISH | 08/30/24 | $11.85 | $11.4 | $11.58 | $160.00 | $57.9K | 206 | 53 | $57.9K | 206 | 53 |

GE | CALL | SWEEP | BULLISH | 11/15/24 | $5.3 | $5.2 | $5.3 | $185.00 | $53.0K | 336 | 107 | $53.0K | 336 | 107 |

GE | PUT | SWEEP | NEUTRAL | 11/15/24 | $14.05 | $13.85 | $13.97 | $180.00 | $37.6K | 15 | 45 | $37.6K | 15 | 45 |

GE | PUT | TRADE | BEARISH | 11/15/24 | $14.0 | $13.75 | $13.9 | $180.00 | $37.5K | 15 | 72 | $37.5K | 15 | 72 |

关于 GE Aero

GE Aerospace是设计、制造和维修大型飞机发动机的全球领导者,其CFM合资企业中还有合作伙伴赛峰集团。GE Aerospace在全球拥有近7万台商用和军用发动机的庞大装机群,其大部分利润来自于该设备的经常性服务收入,该设备已运营了数十年。通用电气航空航天是该公司剩下的核心业务,成立于1892年,与美国发明家托马斯·爱迪生有着历史联系;该公司成为传奇的企业集团,2000年的峰值收入为1300亿美元。通用电气在2016年至2024年间分拆了其电器、金融、医疗保健以及风能和电力业务。

通用电气航空目前的立场

分析师对通用电气航空的看法

上个月,3位专家公布了该股的评级,平均目标价为198.33333333333334美元。

加拿大皇家银行资本的一位分析师已决定维持对通用电气航空的跑赢大盘评级,该评级目前的目标股价为190美元。

富国银行的一位分析师坚持对通用电气航空的增持评级,维持205美元的目标价格。

巴克莱银行的一位分析师坚持对通用电气航空的增持评级,维持200美元的目标价格。

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时警报,随时了解最新的通用电气航空期权交易。

在已发现的全部交易中,有4笔是看跌期权,总额为127,165美元,4笔是看涨期权,总额为226,900美元。

在已发现的全部交易中,有4笔是看跌期权,总额为127,165美元,4笔是看涨期权,总额为226,900美元。

From the overall spotted trades, 4 are puts, for a total amount of $127,165 and 4, calls, for a total amount of $226,900.

From the overall spotted trades, 4 are puts, for a total amount of $127,165 and 4, calls, for a total amount of $226,900.