Wall Street's Most Accurate Analysts Spotlight On 3 Defensive Stocks Delivering High-Dividend Yields

Wall Street's Most Accurate Analysts Spotlight On 3 Defensive Stocks Delivering High-Dividend Yields

华尔街最准确的分析师聚焦于3只防御性股票,提供高股息收益

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

在市场动荡和不确定性时期,许多投资者都会转向具有股息收益的股票。这些往往是拥有高自由现金流并向股东支付高股息的公司。

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Benzinga的读者可以查看我们的分析师股票评级页面,查看最新的分析师对他们最喜爱的股票的看法。交易员可以浏览Benzinga的广泛分析师评级数据库,包括按分析师准确性排序。

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer staples sector.

以下是消费必需品板块三只高股息股票最准分析师的评级。

Walgreens Boots Alliance, Inc. (NASDAQ:WBA)

股票价格:15.66美元

- Dividend Yield: 9.62%

- UBS analyst Kevin Caliendo maintained a Neutral rating and cut the price target from $17 to $12 on July 3. This analyst has an accuracy rate of 73%.

- RBC Capital analyst Ben Hendrix maintained a Sector Perform rating and slashed the price target from $22 to $13 on July 2. This analyst has an accuracy rate of 73%.

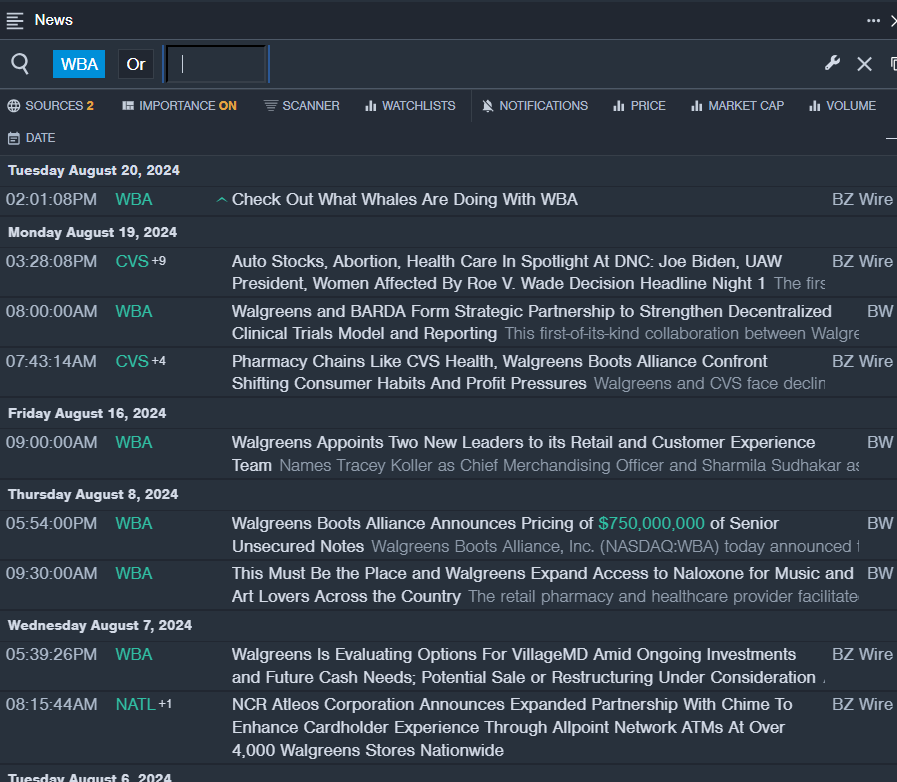

- Recent News: On Aug. 19, Walgreens and BARDA formed a strategic partnership to strengthen decentralized clinical trials model and reporting.

- Benzinga Pro's real-time newsfeed alerted to latest WBA news.

- 股息率:9.62%

- 瑞银分析师凯文·卡连多维持中立评级,并将股价目标从17美元下调至12美元,时间为7月3日。该分析师的准确率为73%。

- RBC资本分析师本·亨德里克斯维持板块表现评级,并将股价目标从22美元下调至13美元,时间为7月2日。该分析师的准确率为73%。

- 最新资讯:8月19日,沃尔格林和BARDA达成战略合作伙伴关系,以加强去中心化临床试验模型和报告。

- Benzinga Pro的实时资讯提醒了关于最新WBA的新闻。

Conagra Brands, Inc. (NYSE:CAG)

康尼格拉(纽交所:CAG)

- Dividend Yield: 4.55%

- Evercore ISI Group analyst David Palmer maintained a Neutral rating and cut the price target from $32 to $31 on July 12. This analyst has an accuracy rate of 65%.

- Wells Fargo analyst Chris Carey maintained an Equal-Weight rating and lowered the price target from $32 to $31 on July 10. This analyst has an accuracy rate of 66%.

- Recent News: On July 11, ConAgra reported worse-than-expected fourth-quarter sales results.

- Benzinga Pro's signals feature notified of a potential breakout in CAG shares.

- 股息收益率:4.55%

- Evercore ISI集团分析师David Palmer于7月12日维持中立评级,并将目标价格从32美元下调至31美元。该分析师的准确率为65%。

- Wells Fargo分析师Chris Carey于7月10日维持等权重评级,并将目标价格从32美元下调至31美元。该分析师的准确率为66%。

- 最新资讯:7月11日,ConAgra报告了不如预期的第四季度销售业绩。

- Benzinga Pro的信号功能提示了CAG股票可能出现突破。

Philip Morris International Inc. (NYSE:PM)

Philip Morris International Inc.(纽交所:PM)

- Dividend Yield: 4.33%

- Barclays analyst Gaurav Jain maintained an Overweight rating and raised the price target from $110 to $130 on Aug. 14. This analyst has an accuracy rate of 66%.

- JP Morgan analyst Jared Dinges maintained an Overweight rating and increased the price target from $110 to $125 on July 25. This analyst has an accuracy rate of 64%.

- Recent News: On July 23, Philip Morris International reported better-than-expected second-quarter FY24 earnings and raised the adjusted EPS outlook.

- Benzinga Pro's earnings calendar was used to track upcoming PM's earnings reports.

- 股息收益率:4.33%

- 巴克莱银行分析师Gaurav Jain维持超配评级,并将目标价从110美元上调至130美元,日期是8月14日。该分析师的准确率为66%。

- JP摩根分析师Jared Dinges维持超配评级,将目标价从110美元上调至125美元,日期是7月25日。该分析师的准确率为64%。

- 最新资讯:7月23日,菲利普莫里斯国际公司公布了超出预期的财年24第二季度盈利,并提高了调整后的每股收益预期。

- Benzinga Pro的财报日历用于跟踪即将出版的PM财报。

Read More:

阅读更多:

- S&P 500, Nasdaq Surge After Fed Minutes Point To Likely Rate Cut In September: Fear & Greed Index Remains In 'Neutral' Zone

- 标准普尔500指数、纳斯达克指数在美联储会议纪要指出9月可能降息后大涨:恐惧与贪婪指数仍处于"中立"区域