Market Mover | Snowflake Shares Down Over 11% After Announcing Q2 Financial Results

Market Mover | Snowflake Shares Down Over 11% After Announcing Q2 Financial Results

August 22, 2024 - $Snowflake (SNOW.US)$ shares continued to decrease over 12% to $117 in trading on Thursday.

2024年8月22日 - $Snowflake (SNOW.US)$ 股价在周四交易中继续下跌超过12%,跌至117美元。

The company announced exceeded-expectation financial results for the Q2 of fiscal 2025 after the market close on Wednesday but provided lukewarm future guidance that didn't convince investors in a competitive environment.

公司在2025财年Q2的财务业绩超出预期,并在周三收盘后发布了温吞的未来指引,未能说服投资者在竞争激烈的环境中。

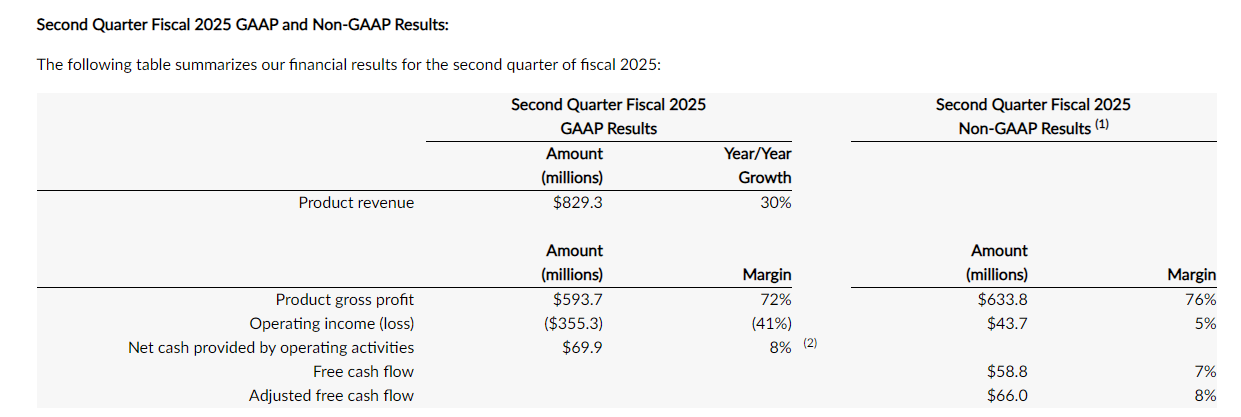

Highlights for the Q2 financial results:

Q2财务业绩亮点:

Product revenue of $829.3 million in the second quarter, representing 30% year-over-year growth;

Stockholders - basic and diluted of ($0.95) in this quarter and ($0.69) in the same period last year;

Net revenue retention rate of 127%;

510 customers with trailing 12-month product revenue greater than $1 million;

736 Forbes Global 2000 customers;

Remaining performance obligations of $5.2 billion, representing 48% year-over-year growth;

Authorized the repurchase of an additional $2.5 billion under our stock repurchase program through March 2027.

第二季度产品营业收入达到82930万美元,同比增长30%;

本季度每股股东基本和稀释收益为(0.95)美元,去年同期为(0.69)美元。

净营业收入留存率达到127%;

有510位客户的过去12个月的产品营业收入超过100万美元;

有736位《福布斯》全球2000强客户;

剩余履约义务为52亿美元,同比增长48%;

通过2027年3月,授权再回购250亿美元股票

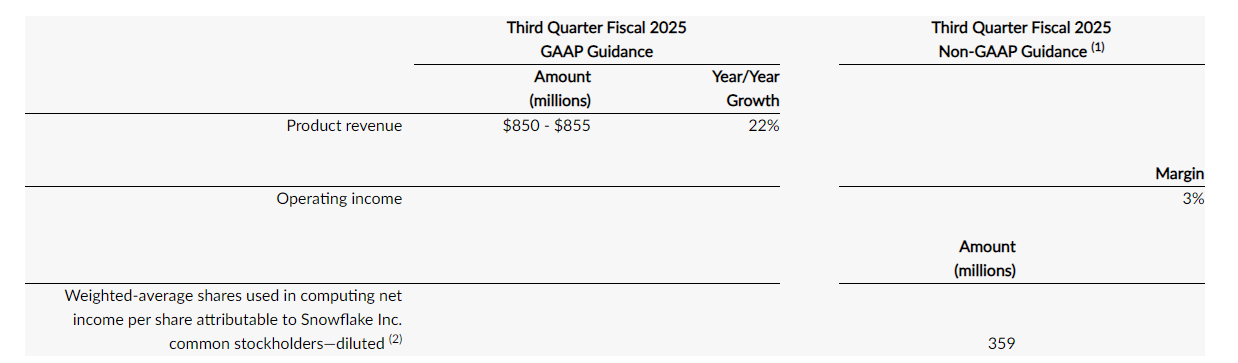

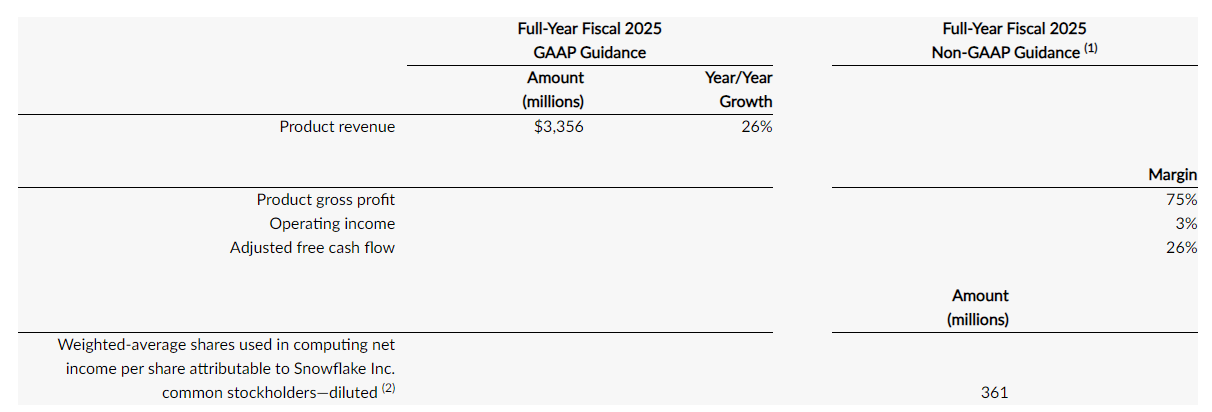

Outlook for the Q3 and the full year:

第三季度和全年展望:

Snowflake expects Q3 product revenue between $850 million and $855 million, a 22% increase year-over-year growth.

Snowflake预计第三季度产品营业收入在8500万至8550万美元之间,同比增长22%。

The company also expects a full-year product revenue of $3.356 billion, a 26% year-over-year increase.

公司还预计全年产品营业收入为33.56亿美元,同比增长26%。

Analyst rating

分析师评级

JMP Securities maintained a market outperform rating and lowered its price target to $190 from $235;

Needham maintained a buy rating and lowered its price target to $160.00 from $210.00.

Needham维持买入评级,并将价格目标从210.00美元下调至160.00美元。