What the Options Market Tells Us About Faraday Future

What the Options Market Tells Us About Faraday Future

High-rolling investors have positioned themselves bullish on Faraday Future (NASDAQ:FFIE), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in FFIE often signals that someone has privileged information.

高位投资者已经看好Faraday Future (纳斯达克:FFIE),对于零售交易者来说这是非常重要的。这一活动是通过Benzinga对公开可获得的期权数据进行追踪后今天引起了我们的注意。这些投资者的身份尚不确定,但在FFIE中的如此重大举措通常意味着某人拥有内幕消息。

Today, Benzinga's options scanner spotted 8 options trades for Faraday Future. This is not a typical pattern.

今天,Benzinga的期权扫描器发现Faraday Future有8次期权交易。这并不是一个典型的模式。

The sentiment among these major traders is split, with 50% bullish and 12% bearish. Among all the options we identified, there was one put, amounting to $26,557, and 7 calls, totaling $302,372.

这些主要交易者中的情绪分歧,有50%是看好的,12%是看淡。在我们确认的所有期权中,有一笔看跌交易,金额为26,557美元,以及7笔看涨交易,总额为302,372美元。

Expected Price Movements

预期价格波动

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $1.0 to $8.0 for Faraday Future over the recent three months.

根据交易活动,看起来这些重要的投资者正在瞄准Faraday Future在最近三个月的价格区间,范围从1.0美元到8.0美元。

Volume & Open Interest Trends

成交量和未平仓量趋势

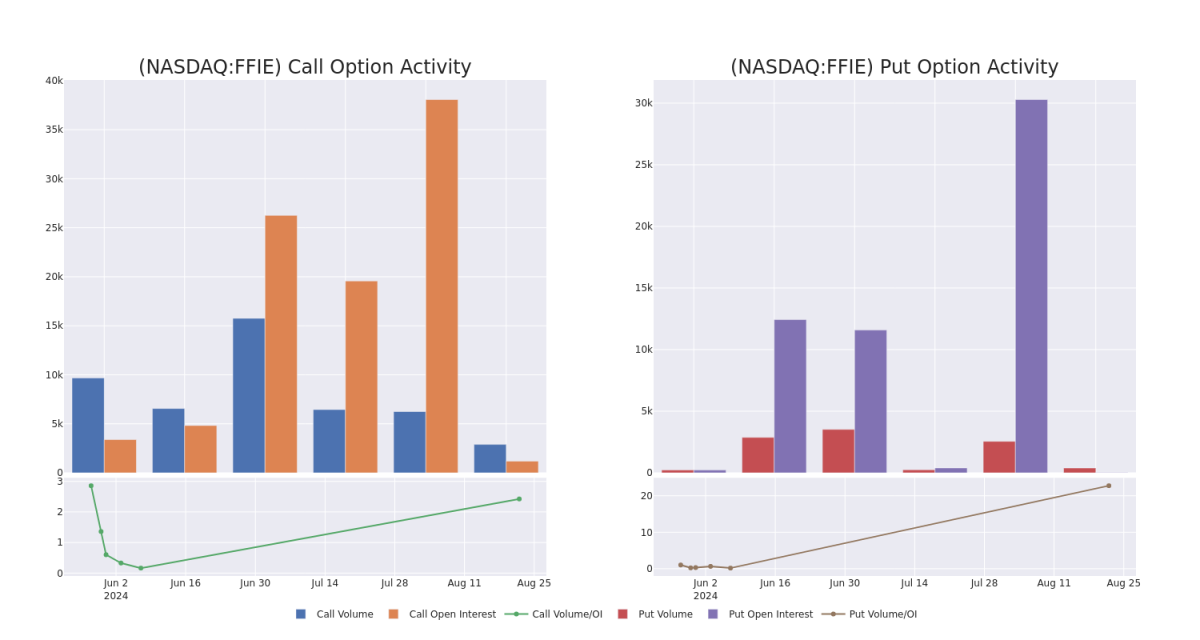

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Faraday Future's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Faraday Future's whale trades within a strike price range from $1.0 to $8.0 in the last 30 days.

观察成交量和未平仓合约在交易期权时是一个重要的举措。这些数据可以帮助您跟踪Faraday Future在特定行权价格的期权的流动性和兴趣。下面,我们可以观察在过去30天内,所有Faraday Future的巨额交易所涉及的看涨期权和看跌期权的成交量和未平仓合约的演变,行权价格范围从1.0美元到8.0美元。

Faraday Future Option Activity Analysis: Last 30 Days

Faraday Future期权活动分析:过去30天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FFIE | CALL | SWEEP | BULLISH | 09/20/24 | $2.2 | $2.11 | $2.2 | $5.00 | $88.0K | 68 | 797 |

| FFIE | CALL | SWEEP | NEUTRAL | 09/20/24 | $1.21 | $1.2 | $1.21 | $6.00 | $45.9K | 175 | 388 |

| FFIE | CALL | TRADE | NEUTRAL | 01/16/26 | $7.0 | $5.25 | $6.0 | $1.00 | $45.0K | 28 | 81 |

| FFIE | CALL | SWEEP | BULLISH | 08/30/24 | $1.92 | $1.69 | $1.8 | $7.00 | $34.0K | 0 | 965 |

| FFIE | CALL | TRADE | NEUTRAL | 08/30/24 | $4.0 | $3.05 | $3.55 | $3.50 | $31.9K | 0 | 416 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FFIE | 看涨 | SWEEP | 看好 | 09/20/24 | $2.2 | $2.11 | $2.2 | $5.00。 | $88.0千美元 | 68 | 797 |

| FFIE | 看涨 | SWEEP | 中立 | 09/20/24 | $1.21 | $1.2 | $1.21 | $6.00 | $45.9K | 175 | 388 |

| FFIE | 看涨 | 交易 | 中立 | 01/16/26 | $7.0 | $5.25 | $6.0 | 1.00美元 | $45.0K | 28 | 81 |

| FFIE | 看涨 | SWEEP | 看好 | 08/30/2024 | $1.92 | $1.69 | $1.8 | $7.00 | $34.0K | 0 | 965 |

| FFIE | 看涨 | 交易 | 中立 | 08/30/2024 | $4.0 | $3.05 | $3.55 | 3.50美元 | $31.9K | 0 | 416 |

About Faraday Future

Faraday Future Intelligent Electric Inc is a global shared intelligent mobility ecosystem. It is poised to break the boundaries between the Internet, IT, creative, and auto industries with product and service offerings that integrate new energy, AI, Internet, and sharing models.

After a thorough review of the options trading surrounding Faraday Future, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Faraday Future Standing Right Now?

- Currently trading with a volume of 50,161,653, the FFIE's price is up by 81.48%, now at $6.51.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 81 days.

- RSI读数表明该股票目前处于中立状态,处于超买和超卖之间。

- 预期收益发布还有81天。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。