Powell's Rate Cut Signal Triggers Small-Cap Rally, Gold Makes Record Highs, Dollar Tumbles: 7 ETFs On The Move

Powell's Rate Cut Signal Triggers Small-Cap Rally, Gold Makes Record Highs, Dollar Tumbles: 7 ETFs On The Move

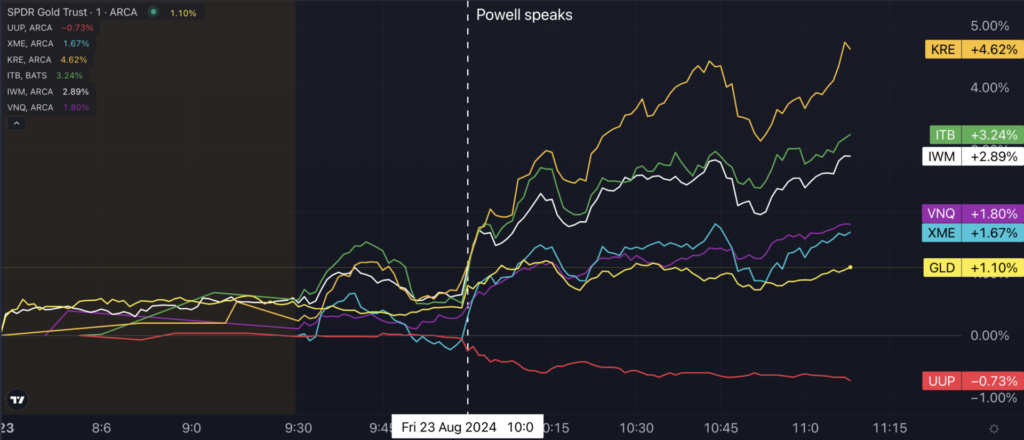

Jerome Powell's interest rate remarks Friday ignited a rally in stocks, bonds, and commodities, while the U.S. dollar plunged as traders solidified their bets on rate cuts.

杰罗姆·鲍威尔周五的利率言论引发了股票、债券和大宗商品的上涨,而由于交易员巩固了对降息的押注,美元暴跌。

Financial markets responded positively to Fed Chair Jerome Powell's remarks at the Jackson Hole symposium, where he said the '"time has come for policy to adjust."

金融市场对美联储主席杰罗姆·鲍威尔在杰克逊霍尔研讨会上的讲话做出了积极回应,他在讲话中说,'“现在是调整政策的时候了”。

The Fed chair said he is more confident the economy is on a sustainable path back to the 2% inflation target, allowing the Fed to finally shift its focus to labor market conditions.

美联储主席表示,他更有信心经济走上可持续的道路,恢复2%的通胀目标,这使美联储最终得以将重点转移到劳动力市场条件上。

"We do not seek or welcome further cooling in labor market conditions," he said, adding the Fed has "ample room to respond" by adjusting its policy should further weakening in labor market conditions occur.

他说:“我们不寻求或欢迎劳动力市场状况的进一步降温,” 他补充说,如果劳动力市场状况进一步疲软,美联储有 “足够的应对空间”,调整政策。

7 Key ETFs React To Powell's Jackson Hole Speech

7只主要ETF对鲍威尔的杰克逊霍尔演讲做出了反应

A greenback gauge, as tracked by the Invesco DB USD Index Bullish Fund ETF (NYSE:UUP), tumbled by 0.7% at 11 a.m. ET., extending its weekly decline to 1.4% — the worst performance it has recorded this year.

景顺Db美元指数看涨基金ETF(纽约证券交易所代码:UUP)追踪的美元指数在美国东部时间上午11点下跌0.7%,延续至1.4%,这是今年以来最差的表现。

Driven by expectations of lower interest rates and a weakening dollar, gold prices surged to a new all-time high of $2,530 per ounce following the speech, with the SPDR Gold Trust (NYSE:GLD) climbing by 1.1%.

在对降低利率和美元疲软的预期的推动下,金价在讲话后飙升至每盎司2530美元的历史新高,SPDR黄金信托基金(纽约证券交易所代码:GLD)上涨了1.1%。

Wall Street initially rallied before paring back some gains as traders assess the economic outlook.

由于交易员评估经济前景,华尔街最初上涨,随后缩减了部分涨幅。

Small caps, instead, substantially outperformed large-cap indices. The iShares Russell 2000 ETF (NYSE:IWM) soared 2.9%, on track for its strongest session since July 16.

相反,小盘股的表现大大超过了大盘股指数。iShares Russell 2000 ETF(纽约证券交易所代码:IWM)飙升2.9%,有望创下7月16日以来最强劲的交易日。

Within sectors, real estate stocks rallied, with the Vanguard Real Estate ETF (NYSE:VNQ) up 1.8%, hitting the highest levels since September 2022.

在板块内,房地产股上涨,Vanguard房地产ETF(纽约证券交易所代码:VNQ)上涨1.8%,触及2022年9月以来的最高水平。

Interest-rate sensitive industries saw significant gains following Powell's remarks, with homebuilders, regional banks and miners leading the market.

鲍威尔发表讲话后,利率敏感行业大幅上涨,房屋建筑商、地区银行和矿业领跑市场。

The SPDR S&P Regional Banking ETF (NYSE:KRE) jumped 4.6%, while the iShares U.S. Home Construction ETF (NYSE:ITB) climbed 3.2%, and the SPDR S&P Metals & Mining ETF (NYSE:XME) advanced 1.7%.

SPDR标普地区银行ETF(纽约证券交易所代码:KRE)上涨4.6%,而iShares美国房屋建筑ETF(纽约证券交易所代码:ITB)上涨3.2%,SPDR标普金属与矿业ETF(纽约证券交易所代码:XME)上涨1.7%。

Don't miss the opportunity to dominate in a volatile market at the Benzinga SmallCAP Conference Oct. 9-10 at the Chicago Marriott Downtown Magnificent Mile.

不要错过10月9日至10日在芝加哥市中心壮丽大道万豪酒店举行的Benzinga SmallCap会议上在动荡的市场中占据主导地位的机会。

- Financial Crime Weekly: Health Care Provider To Pay $3.85M For Medicare Scheme, Co-Conspirators To Pay $70M For Vitol Bribery Scheme

- 《金融犯罪周刊》:医疗保健提供者将为医疗保险计划支付385万美元,同谋将为Vitol贿赂计划支付7000万美元

Jerome Powell and Wall Street illustration. Photo: Federalreserve/Flickr Photo: Bylolo/Unsplash

杰罗姆·鲍威尔和华尔街的插图。照片:美联储/Flickr 照片:Bylolo/Unsplash