Unpacking the Latest Options Trading Trends in Oracle

Unpacking the Latest Options Trading Trends in Oracle

Investors with a lot of money to spend have taken a bullish stance on Oracle (NYSE:ORCL).

有大量资金可用的投资者对Oracle(NYSE:ORCL)采取了看好的态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ORCL, it often means somebody knows something is about to happen.

无论这些机构是还是富人,我们不知道。但当这么大的事情发生在ORCL时,这通常意味着有人知道即将发生的事情。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 14 uncommon options trades for Oracle.

今天,Benzinga的期权扫描器发现了14笔Oracle的非常规期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 57% bullish and 42%, bearish.

这些大笔交易者的总体情绪在57%看好和42%看淡之间分歧。

Out of all of the special options we uncovered, 5 are puts, for a total amount of $639,766, and 9 are calls, for a total amount of $544,283.

在我们发现的所有特殊期权中,有5个是看跌期权,总金额为639,766美元,有9个是看涨期权,总金额为544,283美元。

Predicted Price Range

预测价格区间

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $110.0 to $150.0 for Oracle during the past quarter.

分析这些合约的成交量和持仓量,似乎大户在过去的一个季度里对Oracle的价格区间从110.0美元到150.0美元产生了兴趣。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

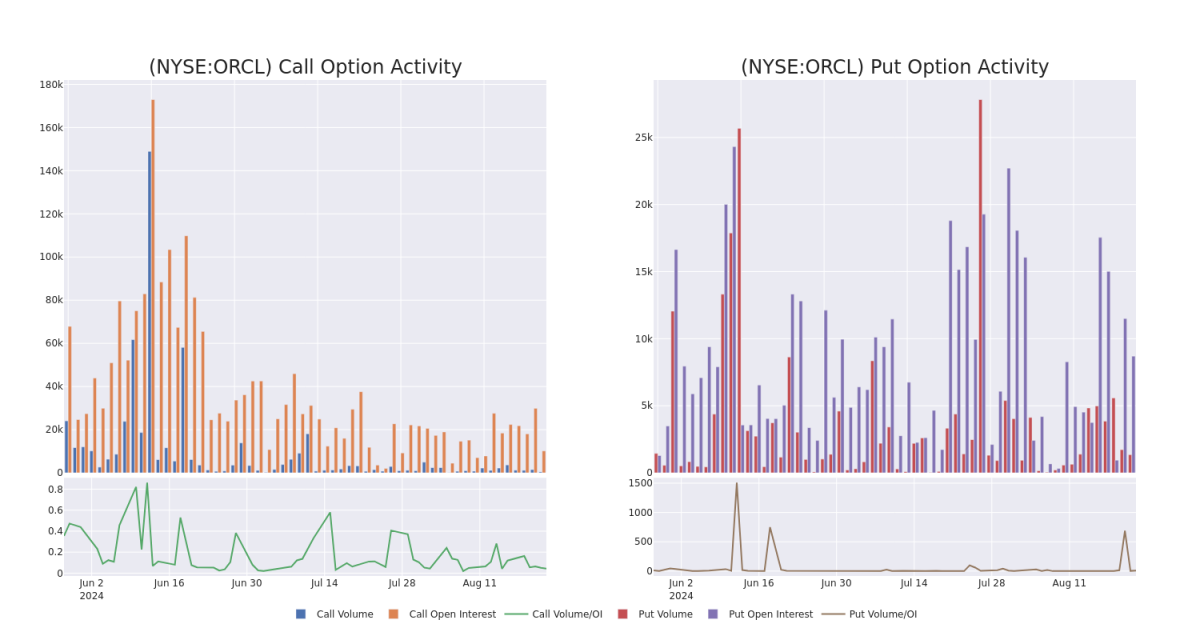

In today's trading context, the average open interest for options of Oracle stands at 1450.38, with a total volume reaching 1,799.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Oracle, situated within the strike price corridor from $110.0 to $150.0, throughout the last 30 days.

在今天的交易背景下,Oracle期权的平均持仓量为1450.38,总成交量达到1,799.00。下图描绘了过去30天内Oracle的高价位交易中,位于110.0美元到150.0美元的行权价格走势图和看涨期权和看跌期权的成交量和持仓量。

Oracle Option Volume And Open Interest Over Last 30 Days

Oracle过去30天的期权成交量和持仓量

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | PUT | TRADE | BULLISH | 11/15/24 | $4.7 | $4.65 | $4.5 | $130.00 | $427.5K | 128 | 961 |

| ORCL | CALL | SWEEP | BULLISH | 12/20/24 | $5.9 | $5.85 | $5.9 | $150.00 | $154.5K | 1.2K | 10 |

| ORCL | CALL | TRADE | BEARISH | 03/21/25 | $11.65 | $11.45 | $11.45 | $145.00 | $114.5K | 679 | 100 |

| ORCL | PUT | SWEEP | BULLISH | 11/15/24 | $6.7 | $6.65 | $6.65 | $135.00 | $77.1K | 282 | 222 |

| ORCL | CALL | SWEEP | BULLISH | 09/20/24 | $8.0 | $7.85 | $7.95 | $135.00 | $71.7K | 6.6K | 108 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | 看跌 | 交易 | 看好 | 11/15/24 | $4.7 | $4.65 | $4.5 | $130.00 | $427.5千 | 128 | 961 |

| ORCL | 看涨 | SWEEP | 看好 | 12/20/24 | $5.9 | $5.85 | $5.9 | $150.00 | $154.5K | 1.2K | 10 |

| ORCL | 看涨 | 交易 | 看淡 | 03/21/25 | $11.65 | $11.45 | $11.45 | $145.00 | $114.5K | 679 | 100 |

| ORCL | 看跌 | SWEEP | 看好 | 11/15/24 | $6.7 | $6.65 | $6.65 | $135.00 | $77.1千美元 | 282 | 222 |

| ORCL | 看涨 | SWEEP | 看好 | 09/20/24 | $8.0 | $7.85 | $7.95 | $135.00 | $71.7K | 6,600份 | 108 |

About Oracle

关于Oracle

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has 430,000 customers in 175 countries, supported by its base of 136,000 employees.

Oracle向全球企业提供数据库技术和企业资源规划(ERP)软件。Oracle成立于1977年,是第一个商用SQL数据库管理系统的创始人。如今,Oracle在175个国家拥有430,000个客户,由136,000名员工支持。

Following our analysis of the options activities associated with Oracle, we pivot to a closer look at the company's own performance.

在对Oracle的期权活动进行分析之后,我们将转向更密切关注公司的表现。

Oracle's Current Market Status

Oracle当前的市场状况

- With a volume of 1,821,243, the price of ORCL is up 0.41% at $138.65.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 17 days.

- RSI指标暗示该标的股票目前处于超买和超卖的中立区间。

- 预计下次财报发布还有17天。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Oracle options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和回报潜力。精明的交易员通过不断学习、调整策略、监控多个指标并密切关注市场动向来管理这些风险。通过Benzinga Pro的实时提醒了解最新的Oracle期权交易情况。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ORCL, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ORCL, it often means somebody knows something is about to happen.