Unpacking the Latest Options Trading Trends in Vertex Pharmaceuticals

Unpacking the Latest Options Trading Trends in Vertex Pharmaceuticals

High-rolling investors have positioned themselves bearish on Vertex Pharmaceuticals (NASDAQ:VRTX), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in VRTX often signals that someone has privileged information.

重量级投资者已对福泰制药(NASDAQ:VRTX)采取了看淡的立场,这对散户交易者来说非常重要。我们今天通过Benzinga追踪公开期权数据时注意到了这一活动。这些投资者的身份尚不确定,但在VRTX出现如此显著的变动通常意味着某人掌握着内幕信息。

Today, Benzinga's options scanner spotted 12 options trades for Vertex Pharmaceuticals. This is not a typical pattern.

今天,Benzinga的期权扫描器发现了福泰制药的12笔期权交易。这并不是一个典型的模式。

The sentiment among these major traders is split, with 8% bullish and 83% bearish. Among all the options we identified, there was one put, amounting to $55,692, and 11 calls, totaling $435,054.

这些大额交易者中的情绪分化,8%看涨,83%看跌。在我们找到的所有期权中,有一笔看跌,交易额达55,692美元,以及11笔看涨,交易额总计435,054美元。

What's The Price Target?

目标价是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $485.0 to $510.0 for Vertex Pharmaceuticals over the last 3 months.

考虑到这些合约的成交量和未平仓合约数量,看起来大鳄们在过去3个月一直把福泰制药的价格区间锁定在485.0至510.0美元之间。

Volume & Open Interest Trends

成交量和未平仓量趋势

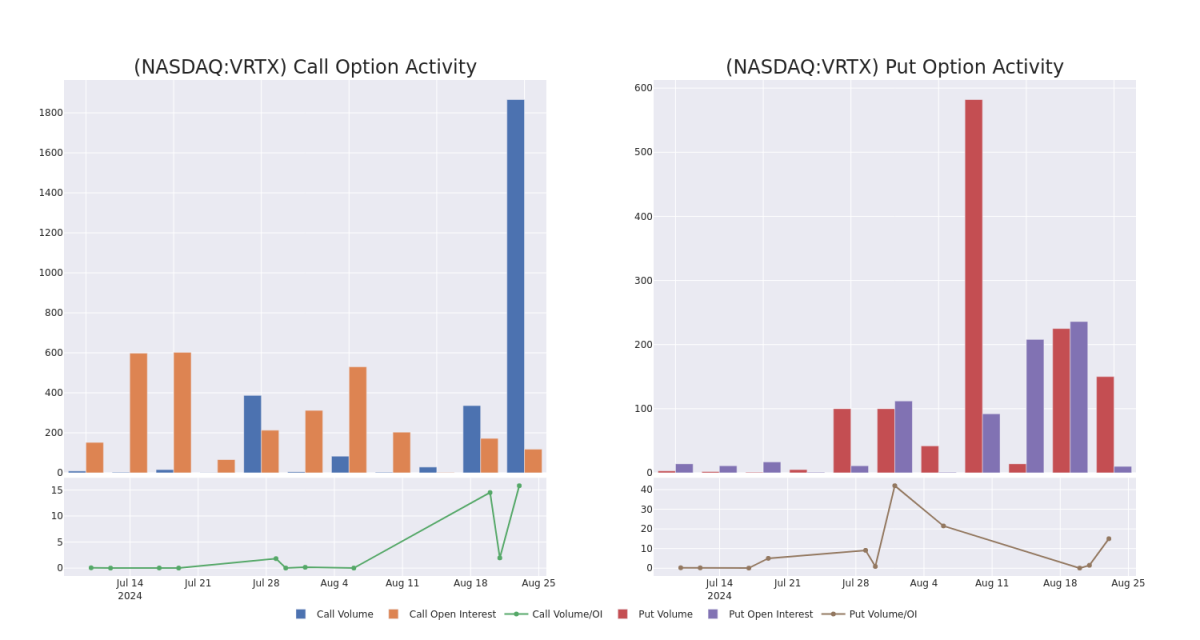

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Vertex Pharmaceuticals's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Vertex Pharmaceuticals's whale trades within a strike price range from $485.0 to $510.0 in the last 30 days.

在交易期权时,查看成交量和未平仓合约是非常有力的举措。这些数据可以帮助您跟踪福泰制药某一行权价格的期权的流动性和兴趣。下面,我们可以观察过去30天内,所有福泰制药大额交易在485.0至510.0美元行权价格区间内看涨期权和看跌期权的成交量和未平仓合约的演变。

Vertex Pharmaceuticals Call and Put Volume: 30-Day Overview

福泰制药看涨期权和看跌期权成交量:30天概况

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRTX | PUT | SWEEP | NEUTRAL | 08/30/24 | $4.4 | $4.3 | $4.4 | $485.00 | $55.6K | 10 | 150 |

| VRTX | CALL | SWEEP | BEARISH | 01/17/25 | $24.8 | $24.0 | $24.0 | $510.00 | $48.0K | 118 | 138 |

| VRTX | CALL | SWEEP | BEARISH | 01/17/25 | $24.4 | $23.7 | $23.8 | $510.00 | $47.4K | 118 | 2 |

| VRTX | CALL | TRADE | BEARISH | 01/17/25 | $25.1 | $24.3 | $24.5 | $510.00 | $44.1K | 118 | 250 |

| VRTX | CALL | TRADE | BEARISH | 01/17/25 | $24.8 | $24.1 | $24.1 | $510.00 | $43.3K | 118 | 156 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 福泰制药 | 看跌 | SWEEP | 中立 | 08/30/2024 | $4.4 | $4.3 | $4.4 | 485.00美元 | $55.6K | 10 | 150 |

| 福泰制药 | 看涨 | SWEEP | 看淡 | 01/17/25 | $24.8 | $24.0 | $24.0 | $510.00 | $48.0千 | 118 | 138 |

| 福泰制药 | 看涨 | SWEEP | 看淡 | 01/17/25 | $24.4 | $23.7 | $23.8 | $510.00 | $47.4K | 118 | 2 |

| 福泰制药 | 看涨 | 交易 | 看淡 | 01/17/25 | $25.1 | $24.3 | $24.5 | $510.00 | $44.1K | 118 | 250 |

| 福泰制药 | 看涨 | 交易 | 看淡 | 01/17/25 | $24.8 | $24.1 | $24.1 | $510.00 | $43.3K | 118 | 156 |

About Vertex Pharmaceuticals

关于Vertex Pharmaceuticals

Vertex Pharmaceuticals is a global biotechnology company that discovers and develops small-molecule drugs for the treatment of serious diseases. Its key drugs are Kalydeco, Orkambi, Symdeko, and Trikafta/Kaftrio for cystic fibrosis, where Vertex therapies remain the standard of care globally. Vertex has diversified its portfolio through Casgevy, a gene-editing therapy for beta thalassemia and sickle-cell disease. Additionally, Vertex is evaluating small-molecule inhibitors targeting acute and chronic pain using nonopioid treatments, and small-molecule inhibitors of APOL1-mediated kidney diseases. Vertex is also investigating cell therapies to deliver a potential functional cure for type 1 diabetes.

Vertex Pharmaceuticals是一家全球性生物技术公司,致力于发现和开发治疗严重疾病的小分子药物。其主要药物是Kalydeco、Orkambi、Symdeko和Trikafta/Kaftrio,用于囊性纤维化,其中Vertex的治疗法在全球范围内仍是标准的护理。Vertex通过Casgevy进行了组合基因编辑治疗β地中海贫血和镰状细胞病。此外,Vertex正在评估使用非阿片类治疗的小分子抑制剂,以及针对APOL1介导的肾脏疾病的小分子抑制剂。Vertex还正在研究细胞疗法,为1型糖尿病提供潜在的功能性治愈。

Following our analysis of the options activities associated with Vertex Pharmaceuticals, we pivot to a closer look at the company's own performance.

在我们分析了与福泰制药相关的期权活动之后,我们转向更仔细地观察公司的表现。

Present Market Standing of Vertex Pharmaceuticals

- With a volume of 284,458, the price of VRTX is up 0.65% at $482.99.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 73 days.

- RSI指标暗示该标的股票目前处于超买和超卖的中立区间。

- 下一个财报将在73天内发布。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $485.0 to $510.0 for Vertex Pharmaceuticals over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $485.0 to $510.0 for Vertex Pharmaceuticals over the last 3 months.