What the Options Market Tells Us About Trade Desk

What the Options Market Tells Us About Trade Desk

Financial giants have made a conspicuous bullish move on Trade Desk. Our analysis of options history for Trade Desk (NASDAQ:TTD) revealed 12 unusual trades.

金融巨头在the trade desk上展开了明显的看好行动。我们对the trade desk (纳斯达克:TTD)期权历史进行分析后发现12笔飞凡交易。

Delving into the details, we found 58% of traders were bullish, while 41% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $174,432, and 9 were calls, valued at $442,687.

深入细节后,我们发现58%的交易者持看好态度,而41%显示出看淡倾向。在我们发现的所有交易中,有3笔看跌交易,价值174,432美元,还有9笔看涨交易,价值442,687美元。

What's The Price Target?

目标价是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $75.0 to $115.0 for Trade Desk over the recent three months.

根据交易活动,显然重要投资者瞄准了the trade desk在近三个月内从75.0美元到115.0美元的价格区间。

Insights into Volume & Open Interest

成交量和持仓量分析

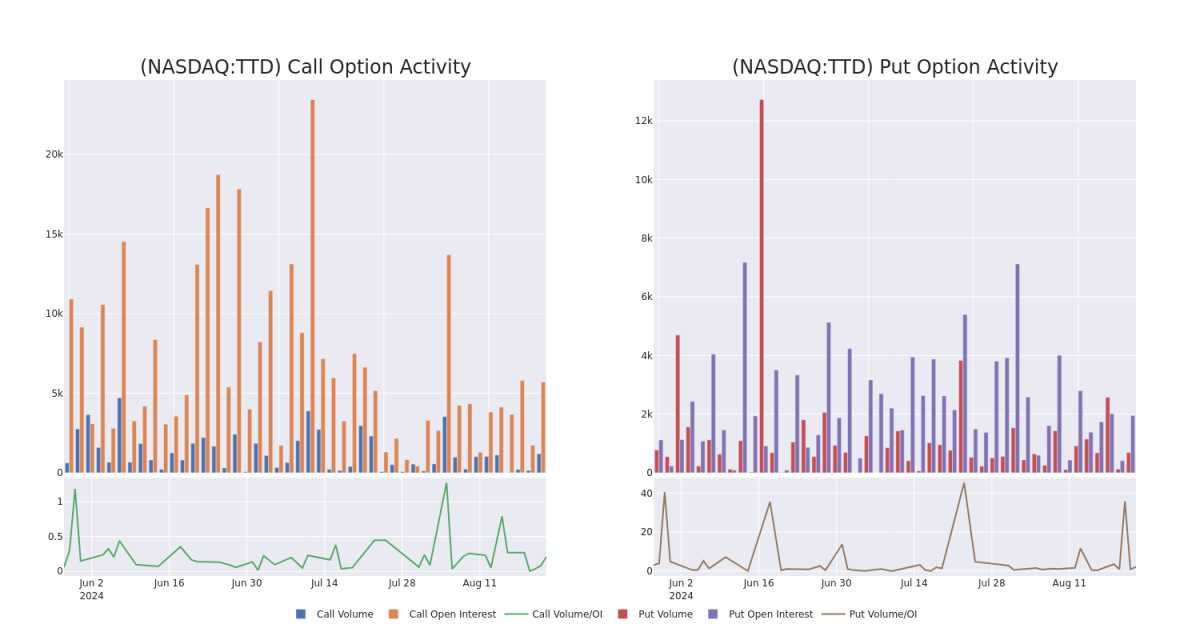

In terms of liquidity and interest, the mean open interest for Trade Desk options trades today is 765.9 with a total volume of 1,887.00.

就流动性和兴趣而言,the trade desk期权交易今日的平均未平仓量为765.9,总成交量为1,887.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Trade Desk's big money trades within a strike price range of $75.0 to $115.0 over the last 30 days.

在下图中,我们可以追踪the trade desk大单交易的成交量和未平仓量发展,涵盖了过去30天内在75.0美元至115.0美元行权价区间内看涨和看跌期权。

Trade Desk Option Activity Analysis: Last 30 Days

交易台期权活动分析:过去30天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TTD | PUT | SWEEP | BULLISH | 10/18/24 | $5.0 | $4.95 | $4.95 | $105.00 | $84.1K | 266 | 200 |

| TTD | CALL | TRADE | BEARISH | 08/23/24 | $24.8 | $24.25 | $24.46 | $80.00 | $66.0K | 152 | 121 |

| TTD | CALL | TRADE | BULLISH | 08/23/24 | $2.68 | $2.31 | $2.68 | $102.00 | $64.8K | 1.2K | 329 |

| TTD | PUT | TRADE | BEARISH | 10/18/24 | $4.95 | $4.9 | $4.95 | $105.00 | $64.8K | 266 | 332 |

| TTD | CALL | SWEEP | BEARISH | 09/06/24 | $2.25 | $2.08 | $2.1 | $105.00 | $55.8K | 216 | 301 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TTD | 看跌 | SWEEP | 看好 | 10/18/24 | $5.0 | $4.95 | $4.95 | $105.00 | $84.1K | 266 | 200 |

| TTD | 看涨 | 交易 | 看淡 | 08/23/24 | $24.8 | $24.25 | $80.00 | $66.0K | 152 | 121 | |

| TTD | 看涨 | 交易 | 看好 | 08/23/24 | $2.68 | $2.31 | $2.68 | $102.00 | $64.8K | 1.2K | 329 |

| TTD | 看跌 | 交易 | 看淡 | 10/18/24 | $4.95 | $4.9 | $4.95 | $105.00 | $64.8K | 266 | 332 |

| TTD | 看涨 | SWEEP | 看淡 | 09/06/24 | 每千立方英尺2.25美元 | $2.08 | $2.1 | $105.00 | $55.8K | 216 | 301 |

About Trade Desk

关于Trade Desk

The Trade Desk provides a self-service platform that helps advertisers and ad agencies programmatically find and purchase digital ad inventory (display, video, audio, and social) on different devices like computers, smartphones, and connected TVs. It utilizes data to optimize the performance of ad impressions purchased. The firm's platform is referred to as a demand-side platform in the digital ad industry. The firm generates its revenue from fees based on a percentage of what its clients spend on advertising.

Trade Desk提供自助服务平台,帮助广告商和广告代理在不同设备上(如计算机、智能手机和连接电视)以程序化方式查找和购买数字广告库存(显示屏、视频、音频和社交)。它利用数据优化购买的广告展示的性能。该公司的平台在数字广告行业中被称为需求方平台。该公司的收入来自基于其客户在广告上花费的百分比的费用。

Following our analysis of the options activities associated with Trade Desk, we pivot to a closer look at the company's own performance.

在分析与Trade Desk相关的期权活动之后,我们转向更仔细地观察该公司的业绩。

Current Position of Trade Desk

- With a volume of 1,103,137, the price of TTD is up 1.66% at $104.88.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 76 days.

- RSI指标暗示该股票可能要超买了。

- 下一次盈利预计将在76天内公布。

Expert Opinions on Trade Desk

关于Trade Desk的专家意见

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $114.0.

- Maintaining their stance, an analyst from Macquarie continues to hold a Outperform rating for Trade Desk, targeting a price of $115.

- An analyst from Citigroup has decided to maintain their Buy rating on Trade Desk, which currently sits at a price target of $115.

- Consistent in their evaluation, an analyst from BTIG keeps a Buy rating on Trade Desk with a target price of $114.

- An analyst from Macquarie has decided to maintain their Outperform rating on Trade Desk, which currently sits at a price target of $115.

- In a cautious move, an analyst from Stifel downgraded its rating to Buy, setting a price target of $111.

- Macquarie的一位分析师决定维持对Trade Desk的跑赢市场评级,目前价格定在115美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

In terms of liquidity and interest, the mean open interest for Trade Desk options trades today is 765.9 with a total volume of 1,887.00.

In terms of liquidity and interest, the mean open interest for Trade Desk options trades today is 765.9 with a total volume of 1,887.00.