A Look Into Oshkosh Inc's Price Over Earnings

A Look Into Oshkosh Inc's Price Over Earnings

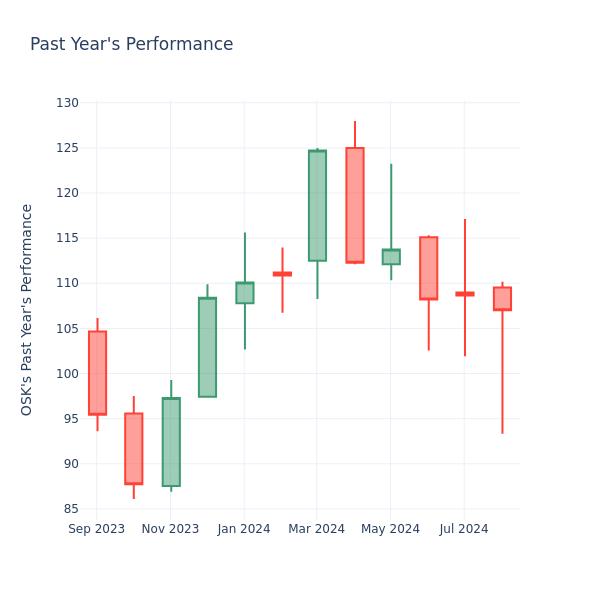

In the current market session, Oshkosh Inc. (NYSE:OSK) share price is at $107.00, after a 1.59% spike. Moreover, over the past month, the stock fell by 7.77%, but in the past year, increased by 7.00%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is performing up to par in the current session.

在当前的交易市场中,Oshkosh Inc. (NYSE:OSK) 的股价为107.00美元,上涨了1.59%。此外,在过去一个月里,该股下跌了7.77%,但在过去一年里增长了7.00%。股东们可能对股票是否被高估感兴趣,即使该公司在当前交易时段表现良好。

How Does Oshkosh P/E Compare to Other Companies?

Oshkosh的市盈率与其他公司相比如何?

The P/E ratio is used by long-term shareholders to assess the company's market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

市盈率是由长期股东用于评估公司市场表现的一项指标,可以和市场数据、历史收益和整个行业进行对比。较低的市盈率可能表明股东不希望股票未来表现更好,或者可能意味着公司被低估。

Compared to the aggregate P/E ratio of the 15.84 in the Machinery industry, Oshkosh Inc. has a lower P/E ratio of 10.19. Shareholders might be inclined to think that the stock might perform worse than it's industry peers. It's also possible that the stock is undervalued.

与机械行业的15.84的总市盈率相比,Oshkosh的市盈率较低,为10.19。股东们可能会倾向于认为该股可能表现不如其行业同行。该股还可能被低估。

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company's market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company's financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

总结一下,虽然市盈率是投资者评估公司市场表现的重要工具,但应谨慎使用。低市盈率可能是被低估的指标,但也可能意味着增长前景疲软或财务不稳定。此外,市盈率只是投资者在做投资决策时应考虑的众多指标之一,它应与其他财务比率、行业趋势和定性因素一起评估。通过综合分析公司的财务健康状况,投资者可以做出更有可能取得成功的明智决策。

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company's market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company's market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry